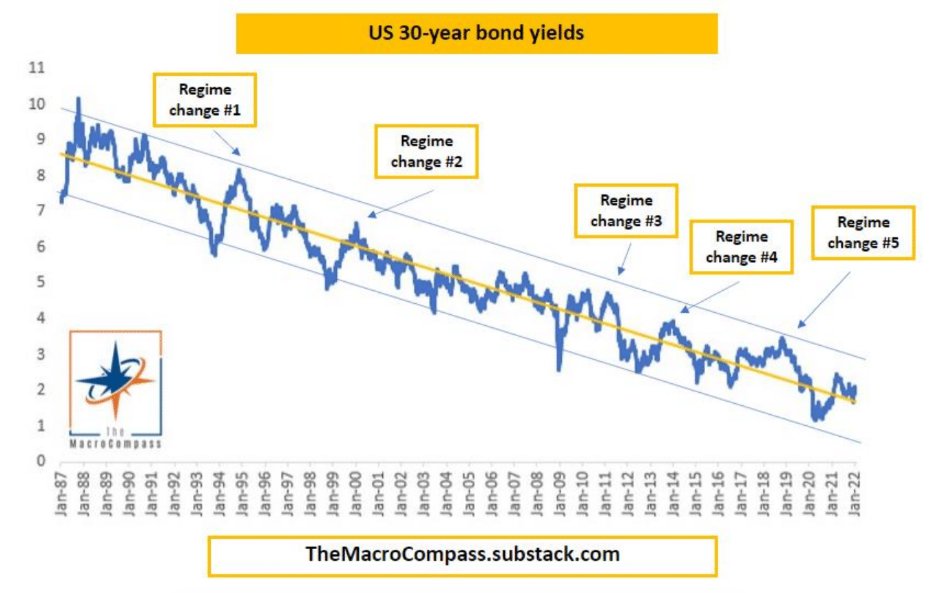

When it gets this volatile, it's important to zoom out

Let's talk about some variables to consider while investing in EMs for the next decade

👇

- Labor supply growth (demographics)

- Private and public debt levels (room to lever up still?)

- Politics & reforms

- Valuations

Let's talk about some variables to consider while investing in EMs for the next decade

👇

- Labor supply growth (demographics)

- Private and public debt levels (room to lever up still?)

- Politics & reforms

- Valuations

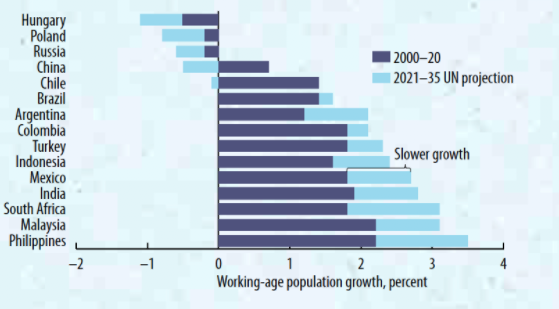

The United Nation prospects for working-age population growth in selected EMs are shown below.

Asia (ex-China) plus Mexico and South Africa are looking good under this metric.

Eastern Europe, Russia, China and Brazil less so.

Asia (ex-China) plus Mexico and South Africa are looking good under this metric.

Eastern Europe, Russia, China and Brazil less so.

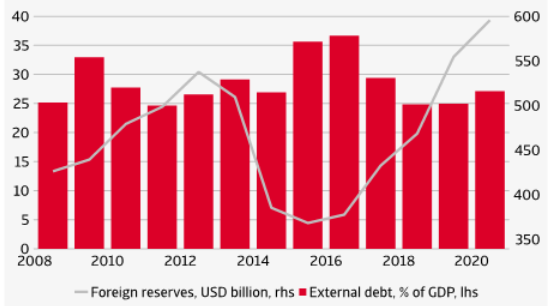

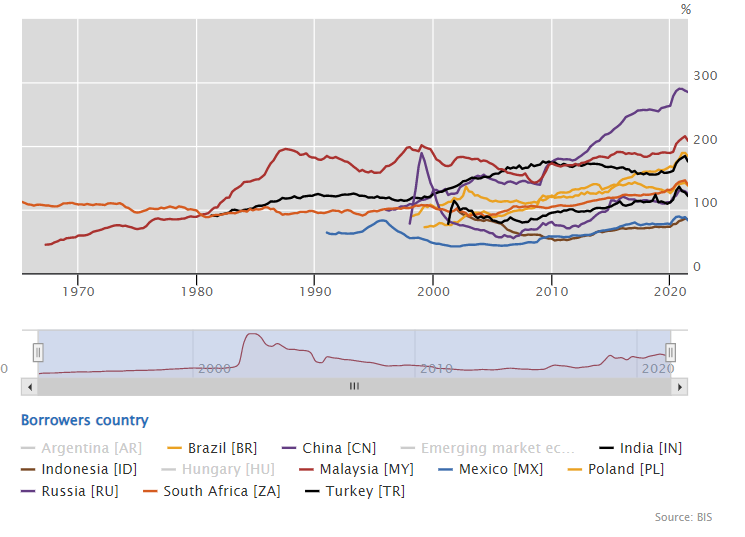

On a private + public debt levels as % of GDP, few countries are still below 150% combined

Mexico: 83%

Indonesia: 85%

Turkey, Russia, Poland and South Africa also below 150%, while China and Brazil already in the 200-300% area

Ok, but not all liabilities are the same.

Mexico: 83%

Indonesia: 85%

Turkey, Russia, Poland and South Africa also below 150%, while China and Brazil already in the 200-300% area

Ok, but not all liabilities are the same.

And assets matter too.

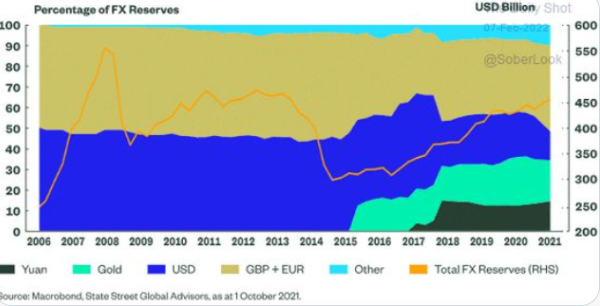

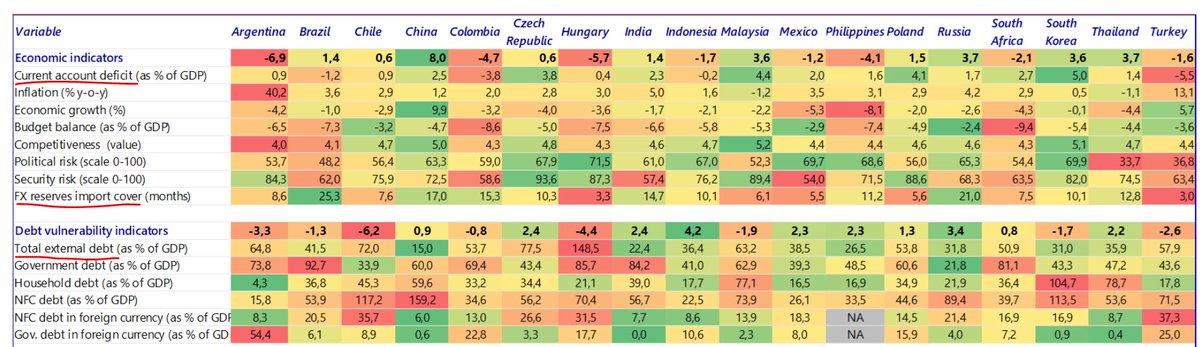

This neat table from Rabobank shows a bunch of interesting indicator: I underlined two metrics for ''liabilities'' (current account deficit and external debt) and one for ''assets'' (# of import months covered by FX reserves).

Have a look!

This neat table from Rabobank shows a bunch of interesting indicator: I underlined two metrics for ''liabilities'' (current account deficit and external debt) and one for ''assets'' (# of import months covered by FX reserves).

Have a look!

Putting it all together on the economics side and considering the political stability side too, some attractive EM countries for the long-term seem to be:

- India & Indonesia

- Mexico

Now, a quick look at valuations.

- India & Indonesia

- Mexico

Now, a quick look at valuations.

12m forward P/Es:

- India: 25 (2y real yield: -1.0%)

- Indonesia: 16 (2y real yield: 2.5%)

- Mexico: 14 (2y real yield: 1.5%)

Turkish and Russian equities have very low fwd P/Es, already discounting sanctions and/or political instability.

- India: 25 (2y real yield: -1.0%)

- Indonesia: 16 (2y real yield: 2.5%)

- Mexico: 14 (2y real yield: 1.5%)

Turkish and Russian equities have very low fwd P/Es, already discounting sanctions and/or political instability.

Obviously, when considering long-term growth potential you need to overlay your macro views on big secular shifts like commodities, for instance.

If you think Copper is here to stay, Chile becomes attractive!

If you think Copper is here to stay, Chile becomes attractive!

Summarizing.

Selected places in Latin America (e.g. Mexico, or ESG commodities producers) and South-East Asia (e.g. Indonesia) in my opinion offer reasonable growth prospects over the next decades at rational entry valuations.

What are the emerging markets you like, and why?

Selected places in Latin America (e.g. Mexico, or ESG commodities producers) and South-East Asia (e.g. Indonesia) in my opinion offer reasonable growth prospects over the next decades at rational entry valuations.

What are the emerging markets you like, and why?

• • •

Missing some Tweet in this thread? You can try to

force a refresh