EU gas experts: how long into the spring before EU can afford to cut off all Russian imports of gas? I imagine in winter on short notice that is problematic, but as weather warms, can EU go entirely without Russian imports?

@JasonBordoff @AmyJaffeenergy @DxGordon

@JasonBordoff @AmyJaffeenergy @DxGordon

As Europe enters Spring, and with surge of US LNG and bunkering for next winter, plus a conservation push similar to Japan after Fukushima, could Europe prepare for next winter without Russia?

Should America launch a natural gas conservation effort in solidarity, to free up exports? A "Lend-Lease Act moment" for the 21st century?

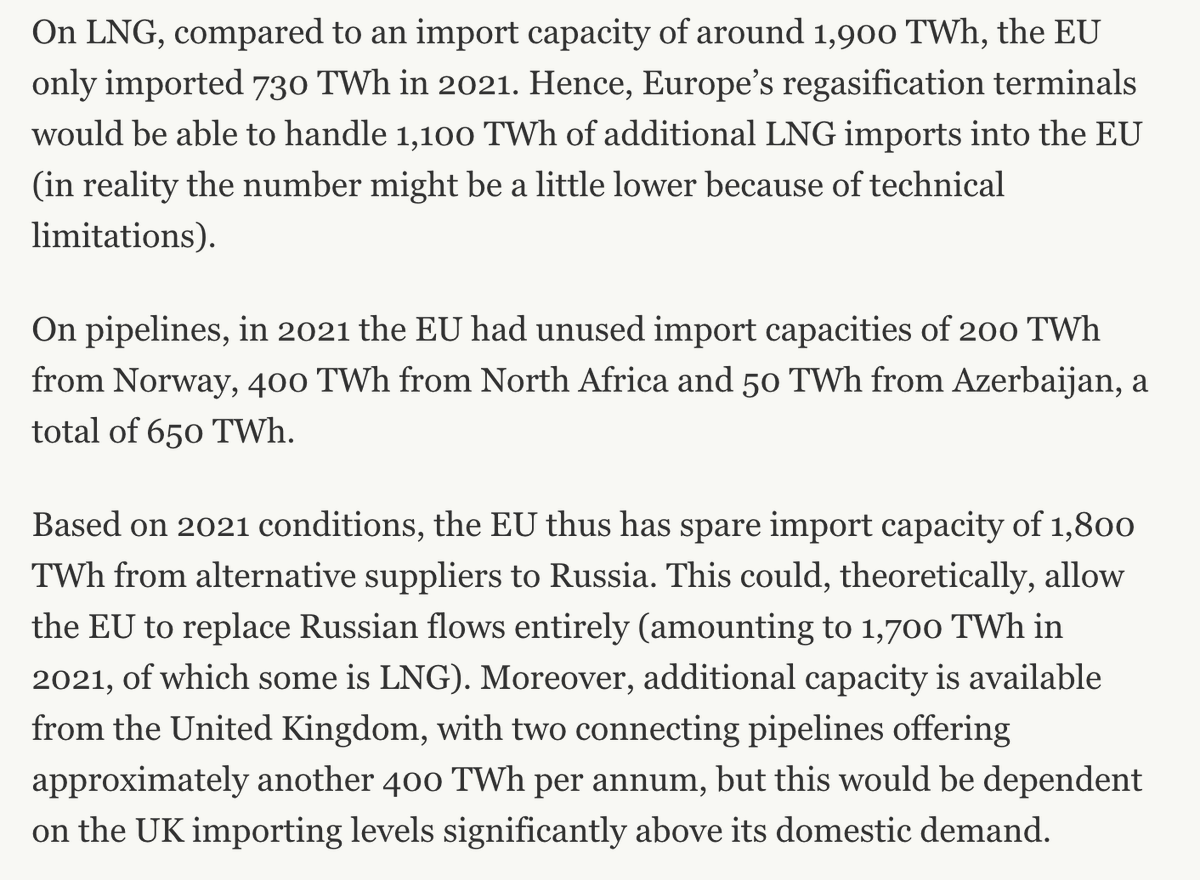

A great piece here with lots of the key data and context to answer these questions. bruegel.org/2022/01/can-eu…

Seems that technically, EU has spare import capacity to displace Russia if supplies could be kept up through off-peak periods, but lots of technical & political challenges

Seems that technically, EU has spare import capacity to displace Russia if supplies could be kept up through off-peak periods, but lots of technical & political challenges

Seems though that a lot could be done to insulate Europe from Russian gas dependence and cut off Russia's most valuable export.

Oil is another key dimension I haven't looked at yet...

Oil is another key dimension I haven't looked at yet...

• • •

Missing some Tweet in this thread? You can try to

force a refresh