BTC and ETH are less risky than you think

My analysis on ETH/BTC through multiple cycles (risk on/off, inflation regimes, rising/falling interest rates) and vs other major asset classes for @MessariCrypto

messari.io/article/re-eva…

Some cliff notes in the 🧵 below

My analysis on ETH/BTC through multiple cycles (risk on/off, inflation regimes, rising/falling interest rates) and vs other major asset classes for @MessariCrypto

messari.io/article/re-eva…

Some cliff notes in the 🧵 below

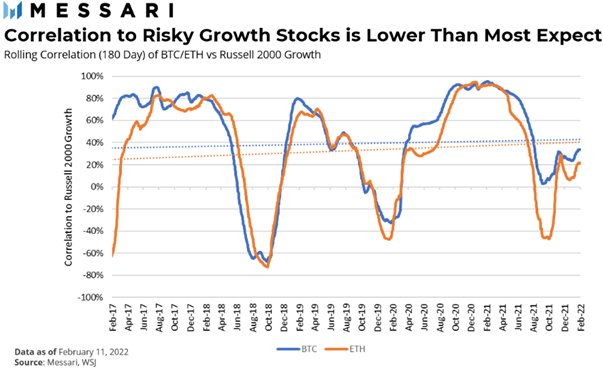

To the riskiest growth stocks BTC averages about a 35% correlation over the last four years while ETH averages about a 30% correlation over the same time period. Notably, Ethereum has been exhibiting a much lower correlation to low/no revenue technology stocks more recently.

As cash flow has increased for ETH the last two years, correlation to the S&P and NASDAQ has increased. As most are aware the top 4 names in both are tech giants $aapl $msft $amzn $goog

What about BTC? Strangely enough it’s been tracking closer and closer to the large cap value index over time. The top names in the Russell 1000 value index are Berkshire Hathaway, J&J, JP Morgan, United Healthcare, P&G, Bank of America, and Exxon.

On Interest Rate Changes--> No surprises during rising or falling IR environments, they perform as expected but notably BTC/ETH are still inversely correlated to real yields

On Inflation--> While BTC and ETH haven’t experienced a high correlation to inflationary pressures in the past, both tokens have popped the minute strong CPI numbers have been released the last few months. They also have tracked inflation expectations very closely

On bear markets--> As expected for price action but notably builders keep building and downturns seem to be getting less severe and less protracted

Correlation between BTC/ETH remains high but I bet this continues to deteriorate as their different use cases cement themselves. We see shades of that already

• • •

Missing some Tweet in this thread? You can try to

force a refresh