Arsenal’s 2020/21 financial results covered a season when they finished 8th in the Premier League and reached the Europa League semi-finals under head coach Mikel Arteta, but their finances were adversely impacted by COVID-19. Some thoughts follow #AFC

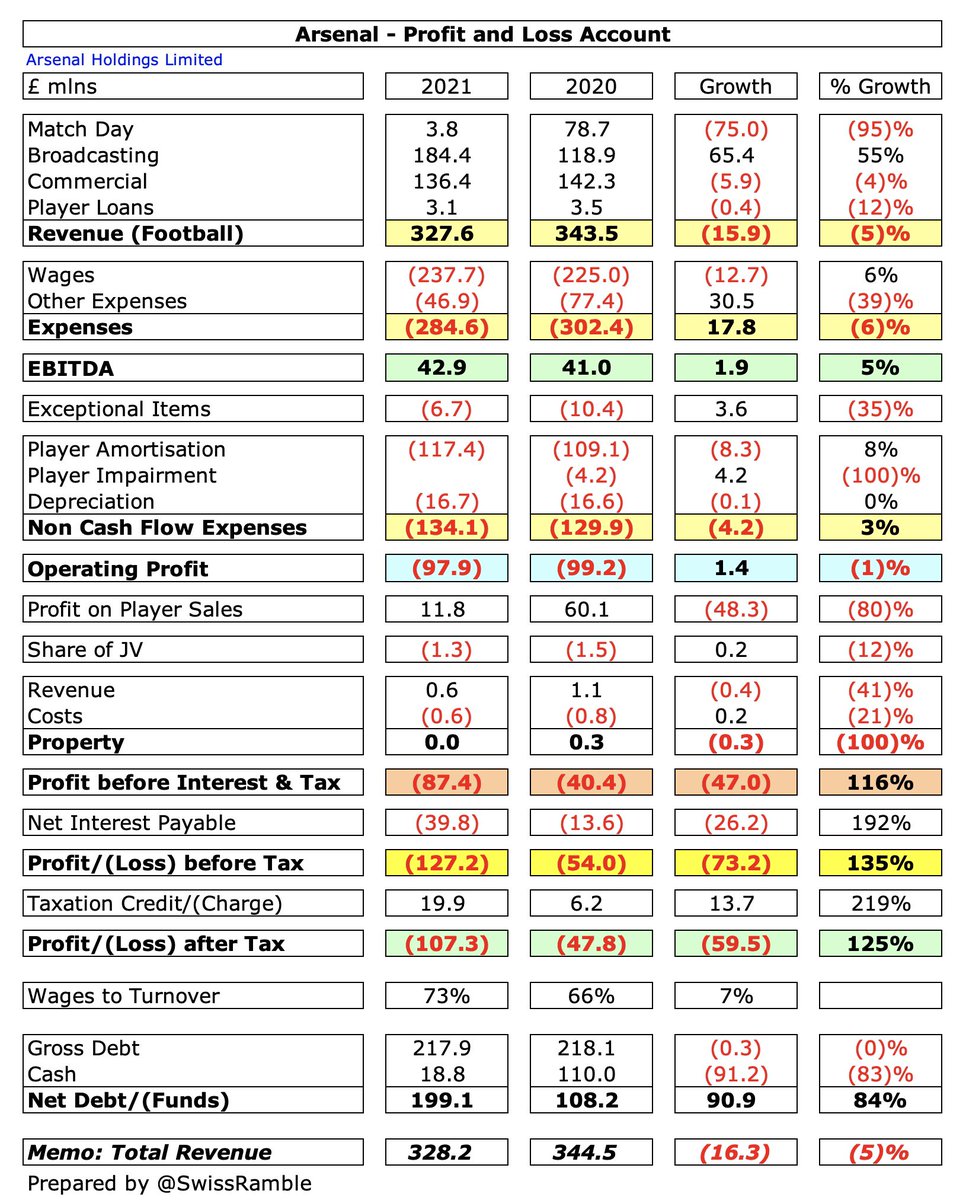

#AFC pre-tax loss shot up from £54m to £127m (after tax £107m), as revenue dropped £16m (5%) from £344m to £328m and profit on player sales fell £48m from £60m to £12m. Operating expenses were cut £17m (4%), but bond finance break costs increased interest payable by £26m to £40m.

#AFC broadcasting revenue rose £65m (55%) from £119m to £184m, mainly due to deferred money from 2019/20, which offset COVID driven reductions in match day, down £75m (95%) to just £4m, and commercial, down £6m (4%) from £142m to £136m. Player loans slightly down at £3m.

#AFC wage bill rose £13m (6%) to £238m (excluding restructuring) while player amortisation increased £8m (8%) to £117m. Other expenses cut £30m (39%) due to reduced cost of staging games, while staff restructuring down from £10m to £7m. No repeat of prior year £4m impairment.

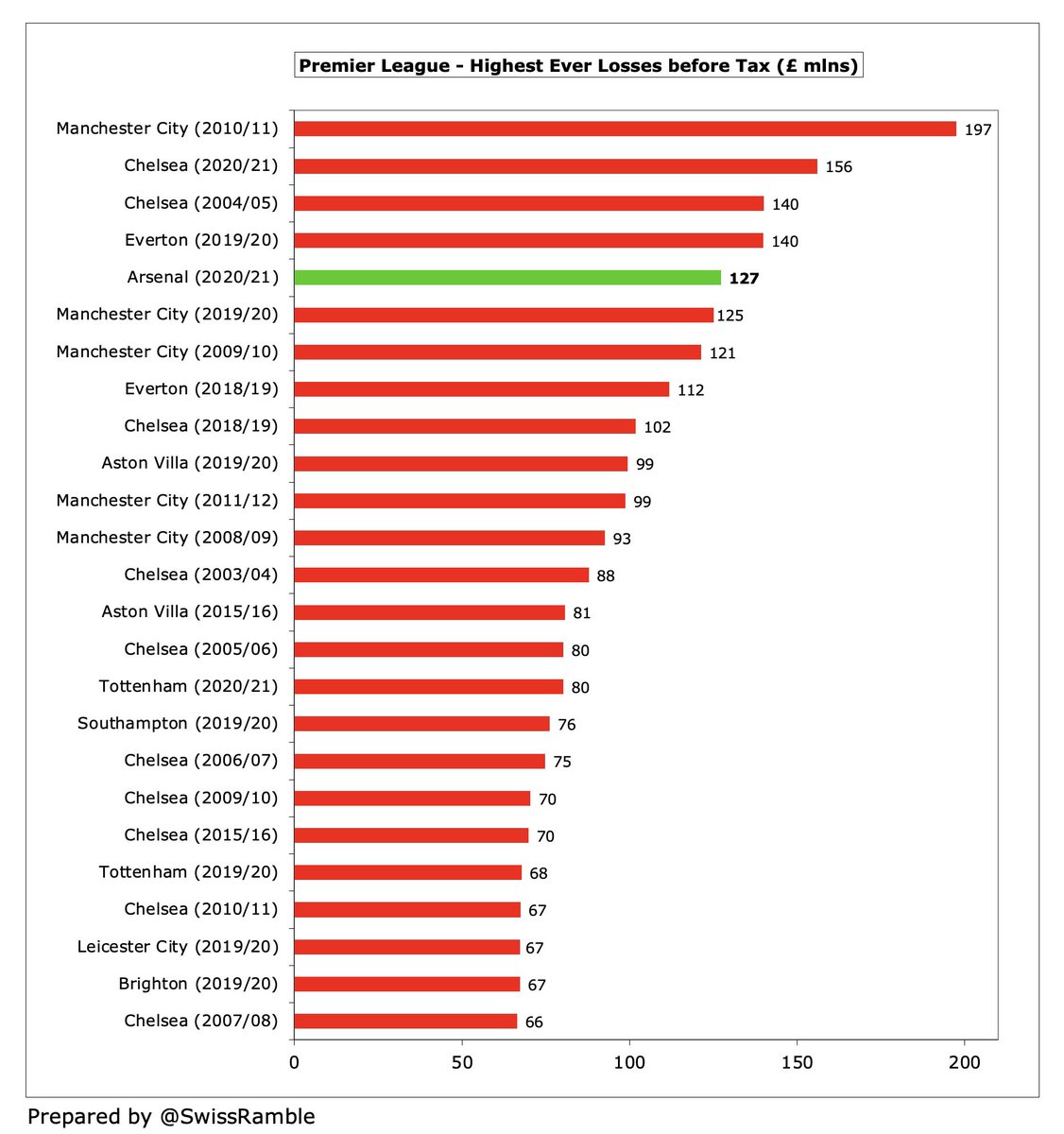

#AFC £127m loss before tax is the second worst reported to date in the 2020/21 Premier League, only surpassed by #CFC £156m, and much more than #THFC £80m. Others also likely to post poor results, due to the pandemic, though both #MCFC and #LFC managed to generate £5m profit.

#AFC results were hit by £85m COVID impact, mainly due to playing games behind closed doors, reduced commercial income and cost of refinancing stadium debt (partly offset by deferred revenue from 2019/20 season and lower costs). Nevertheless, loss would still have been £42m.

Of course, all football clubs have been significantly hit by the effects of the pandemic, so #AFC post-tax £107m loss is by no means the largest in Europe. In fact, it has been “beaten” by 3 Italian clubs (Inter £215m, Juventus £184m, Roma £163m) and especially Barcelona £422m.

#AFC profit from player sales fell £48m from £60m to £12m, mainly Martinez to #AVFC. Club attributed lower profits to the depressed transfer market (COVID), but it did not help that Ozil, Mustafi, Sokratis and Mkhitaryan were all released for nothing. In contrast #MCFC made £69m.

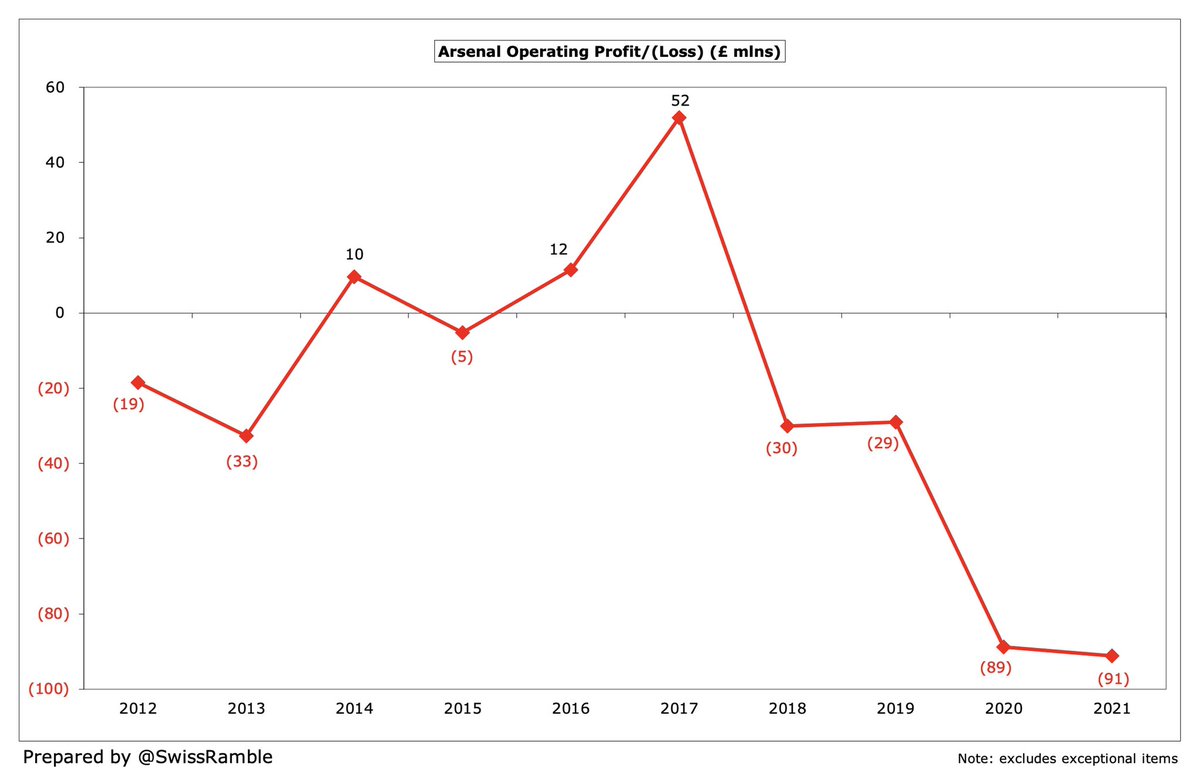

#AFC have now lost money 3 years in a row for a combined £213m loss, each year worse than the one before. This followed 16 consecutive profitable seasons, during which they had a £393m surplus. The 2020/21 £127m loss is actually the 5th highest ever loss in the Premier League.

In fairness, #AFC loss included £39m exceptional expenses: £32m break fees to refinance debt and £7m staff restructuring. The latter was not explained, but possibly due to over 50 redundancies and departure of “Rolodex” Raul Sanllehi. Spent £38m on staff changes in last 4 years.

AFC noted, “player trading has a significant impact on overall profitability”, e.g. £120m in 2018 and £60m in 2020, so the low £12m in 2021 has really hurt. This year will include Joe Willock to #NUFC, but again many have left for free, most notably Aubameyang to Barcelona.

Despite offloading many for free, #AFC still made an impressive £213m from player sales in the last 6 years, which was third highest in the Premier League, only behind #CFC £462m and #LFC £276m (not including 2021). The club has to find a way to make money from player trading.

#AFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales & exceptional items, rose slightly from £41m to £43m, though much lower than 2017 £144m. Still 4th highest to date in Premier League, but less than half #MCFC, #MUFC & #THFC.

#AFC operating loss (excluding player sales and interest) widened from £89m to £91m, the second worst to date in the 2020/21 Premier League. To misquote Josh Kroenke, this is what happens when you pay Champions League wages, but don’t qualify for Europe.

Following the decrease in 2020/21, #AFC revenue has now fallen £95m (23%) from the £423m peak in 2017 to £328m in 2020, though this is almost entirely due to the COVID-driven £96m reduction in match day. Will largely bounce back with fans in the stadium.

That said, while #AFC have seen their revenue fall £23m since 2016, their rivals have powered ahead, despite the impact of the pandemic, with significant growth at #LFC £185m, #MCFC £178m, #THFC £151m and #CFC £106m. Only #MUFC have performed as badly as Arsenal (down £21m).

#AFC £328m revenue remains the 6th highest in the Premier League, comfortably ahead of the closest challenger #LCFC £226m. However, they are at least £150m below the top three clubs: #MCFC £570m, #MUFC £494m and #LFC £487m.

#AFC remained 11th in the 2019/20 Deloitte Money League, which ranks clubs globally by revenue, though they are only £9m behind 10th placed Juventus. Former chief executive Ivan Gazidis will have maybe noticed that Bayer Munich £556m are over £200m more than the Gunners.

The extent of #AFC revenue under-performance compared to other elite clubs is underlined by looking at their Money League trend over the last decade. Their ranking fell from 5th in 2011 to 11th in 2020, while their revenue was £95m higher than 10th placed club in 2016.

It will also not have escaped #AFC fans’ attention that North London rivals #THFC have overtaken them in terms of revenue. The gap in 2020/21 is £33m, mainly due to Tottenham being ahead in both broadcasting £22m and commercial £16m.

#AFC broadcasting income rose £65m (55%) from £119m to £184m, mainly due to revenue from games deferred from 2019/20 season (including FA Cup win) plus more Europa League money, partly offset by PL reductions (contributions to EFL clubs, cost of COVID tests, lost Chinese TV deal)

As 2019/20 season was extended, £34m revenue was booked in 2020/21 accounts. driving £68m year-on-year growth (reduction in 1st year plus increase in 2nd year). Clubs like #AFC with May year-end had largest revenue deferrals, while those with a July close had nothing deferred.

#AFC earned €29m for reaching the Europa League semi-final, more than prior season’s €18m (last 32). though significantly lower than the Champions League representatives, e.g. #CFC and #MCFC received €120m for reaching the final (around four times as much as Arsenal).

#AFC have earned €189m from Europe in the last five years, the lowest by far of the Big Six, e.g. #MCFC €422m, #LFC €361m and #CFC €311m. A clear reduction in the last 4 years after dropping out of the Champions League, while they did not even qualify for Europe this season.

#AFC match day revenue fell £75m (95%) to just £4m, as all home games were played behind closed doors (except a couple with severely restricted capacity). In a normal season, Arsenal would expect around £100m, though club has been overtaken by #THFC, due to their new stadium.

As matches were played without fans, #AFC lost a key revenue stream, putting them at a big disadvantage compared to others. To illustrate the importance of match day revenue, it accounted for 23% of the club’s revenue in 2019/20, the second highest in the Premier League.

#AFC 2019/20 average attendance of 59,254 (for games played with fans), was 4th highest in the Premier League. The club will increase ticket prices by 4% next season. This might be the first rise since 2014, but it still feels misguided, given the relatively small revenue gain.

#AFC commercial revenue fell £6m (4%) to £136m, though has still grown by £26m in the last 2 years, thanks to the renewal of the Emirates sponsorship deal and a new kit deal with Adidas, while others have seen decreases, e.g. #MUFC and #CFC down £43m and £26m respectively.

That’s obviously good news, but even after this growth, #AFC commercial income is still 6th highest in England, around half of #MCFC £272m. Also a long way behind #MUFC £232m and #LFC £218m, though within striking distance of #CFC £154m and #THFC £152m.

#AFC main commercial deals improved in 2019/20: Emirates sponsorship was extended at £40m (up £10m), while Adidas kit supplier £60m is twice the previous Puma partnership £30m. Worth noting that Emirates includes naming rights and does not allow separate training kit deal.

#AFC wage bill rose £13m (7%) from £225m to £238m (excluding £7m restructuring), as underlying growth offset COVID measures, including cut in first team wages. However, increases at other top clubs have been much higher, e.g. all more than twice as much as Arsenal in last 5 years

#AFC £238m wage bill is 5th highest in England, but far below the top four clubs, who are all above £300m. #MCFC lead the way with £355m, followed by #CFC £333m, #MUFC £323m and #LFC £314m. Arsenal are still £33m ahead of #THFC £205m, but the gap has narrowed from £95m in 2016.

#AFC wages to turnover ratio increased from 66% to 73%, the highest for many years. Worse than most other leading clubs, e.g. #THFC only 57%, with the exception of #CFC 77%. Wages should fall following the departure of many highly paid players from the squad.

#AFC highest paid director’s remuneration increased from £435k to £491k, while total doubled from £529k to £1.1m. However, far below Ed Woodward’s £2.9m at #MUFC and Daniel Levy’s £2.7m at #THFC. Also a lot less than Ivan Gazidis, who trousered £2.7m in his last full season.

#AFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £8m (8%) to £117m, so this has doubled in the last 5 years. Now 4th highest in the Premier League, though a long way below big-spending #CFC £162m and #MCFC £146m.

#AFC depreciation was flat at £17m. This non-cash expense is often overlooked, but worth noting that Arsenal have the second highest in the Premier League, due to Emirates stadium, only surpassed by #THFC £72m (new stadium and training ground).

#AFC other expenses fell £30m (39%) from £77m to £47m, mainly due to reduced match day costs, as games were played behind closed doors. These were as high as £87m in 2018. Club said that costs associated with European Super League have been fully charged to KSE.

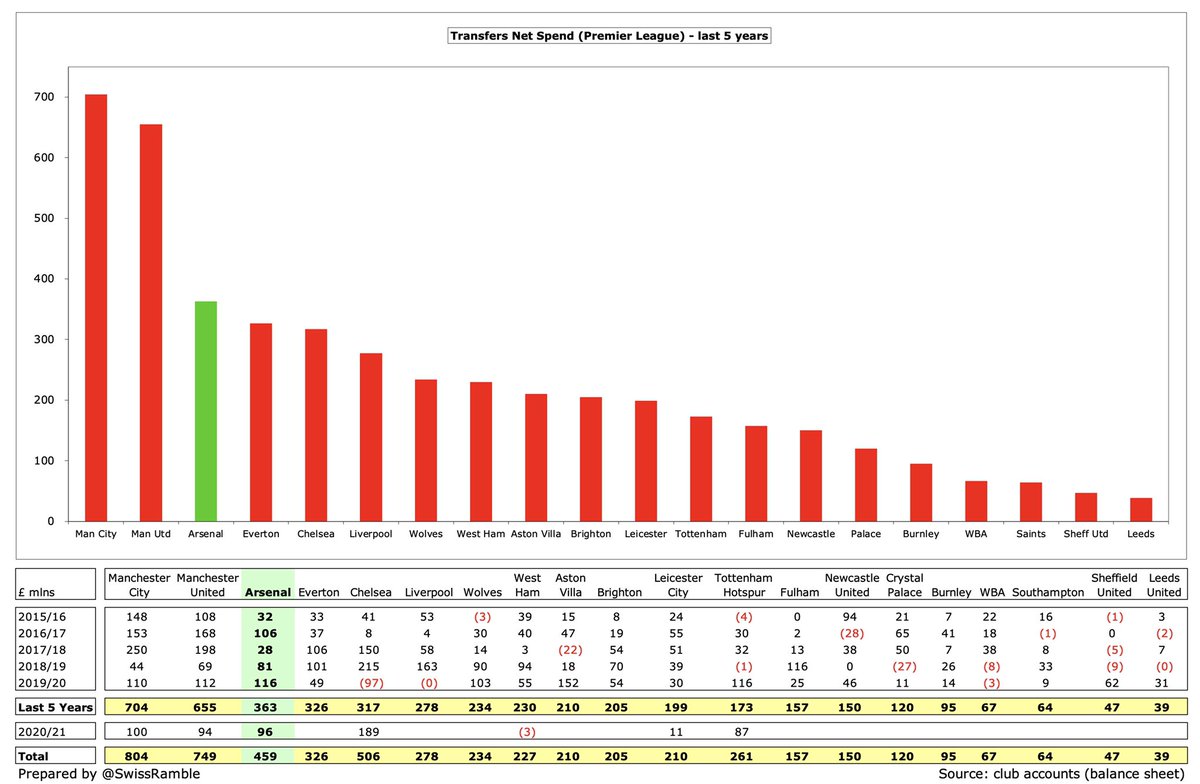

#AFC made £115m player purchases, mainly Partey from Atletico Madrid and Gabriel from Lille plus agents’ fees for Willian and Cedric. Have splashed out an incredible £676m in last 5 years. This year will be another £150m (White, Odegaard, Ramsdale, Tomiyasu, Lokonga & Tavares).

In fact, #AFC £363m net transfer spend in the 5 years up to 2020 was more than #LFC £278m, who won the Premier League and Champions League in this period, though a lot less than #MCFC £704m and #MUFC £655m. Sixth highest for gross spend.

#AFC gross debt was unchanged at £218m, though the bonds were redeemed and replaced by a £202m loan from owner Stan Kroenke (repayable on 2 years notice). Cash decreased by £91m from £110m to £19m, so net debt increased from £108m to £199m.

#AFC £218m gross debt is 7th highest in the Premier League, a long way behind #THFC £854m (new stadium) and #MUFC £530m (Glazer’s leveraged buyout). Club had taken out a cheap £120m COVID Bank of England loan, but this has been repaid, presumably using the £70m Barclays facility.

#AFC interest payment increased from £11m to £34m, mainly £32m refinancing break fee. This will fall next year, as KSE loan is interest-free (per the club’s interest rate profile), while the bonds cost 5.8% and 7%. Highest in the PL in 2021, ahead of #MUFC £21m and #THFC £18m.

Like most clubs, #AFC player purchases are largely funded by higher transfer debt, though this was reduced from £154m to £133m, around the same as #MUFC. The highest in the Premier League is #THFC with £170m. Arsenal are owed £33m by other clubs, so net transfer payable is £100m.

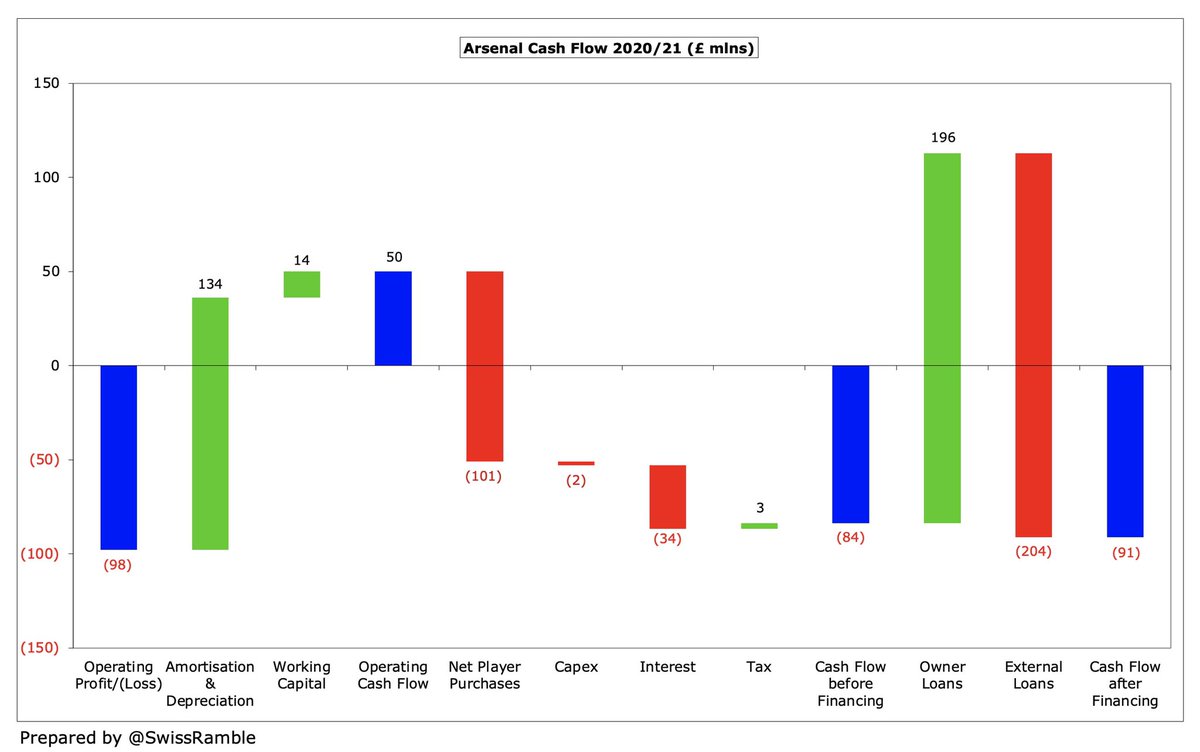

#AFC £98m operating loss became £50m cash flow after adding back amortisation and working capital moves, but then spent £101m on players (purchases £133m, sales £32m), £34m interest and £2m capex. Around £200m was provided by Kroenke, though a similar amount used to redeem bonds.

As a result, #AFC cash balance fell from £110m to £19m, the lowest since 2003, significantly impacted by COVID and delayed season ticket renewals. A lot lower than #THFC £148m and #MUFC £111m, having fallen from £231m peak 3 years ago. No longer have to hold debt service reserve.

In the last 10 years #AFC had over £1 bln available cash: £708m from operations, £211m owner funding and £142m decrease in cash balance. Around half (£491m) was spent on players (net), but also repaid £274m loans and made £139m interest payments, plus £119m capex and £38m tax.

In the 10 years up until 2020 Kroenke had only put £15m funding into #AFC (apart from buying the club), but has now provided £211m loans. Other owners have been more generous, albeit with mixed results: #MCFC £837m, #CFC £559m, #AVFC £434m and #EFC £348m.

Notwithstanding the large loss, #AFC are fine in terms of Financial Fair Play, as financial results are adjusted for allowable deductions and COVID impact. In addition, 2019/20 and 2020/21 seasons are averaged for 3-year monitoring period.

#AFC huge £127m loss is not great, but there are some positive signs. Match day income should return to pre-pandemic levels, the wage bill will fall after many high profile departures and there will be no repeat of once-off debt refinancing (which will lower interest payments).

#AFC 2021 loss was clearly driven by COVID, but significant investment in the squad also played a part. A return to the sustainable model is very dependent on European qualification, preferably the lucrative Champions League, and profitable player trading.

• • •

Missing some Tweet in this thread? You can try to

force a refresh