Recently #commodities are reflecting a knee-jerk reaction to the conflict b/w Russia and Ukraine, but it's the longer-term neglect that's created the foundation for profoundly higher prices for longer.

Let's look at exploration and capex for industrial metals.

Short thread.

1/4

Let's look at exploration and capex for industrial metals.

Short thread.

1/4

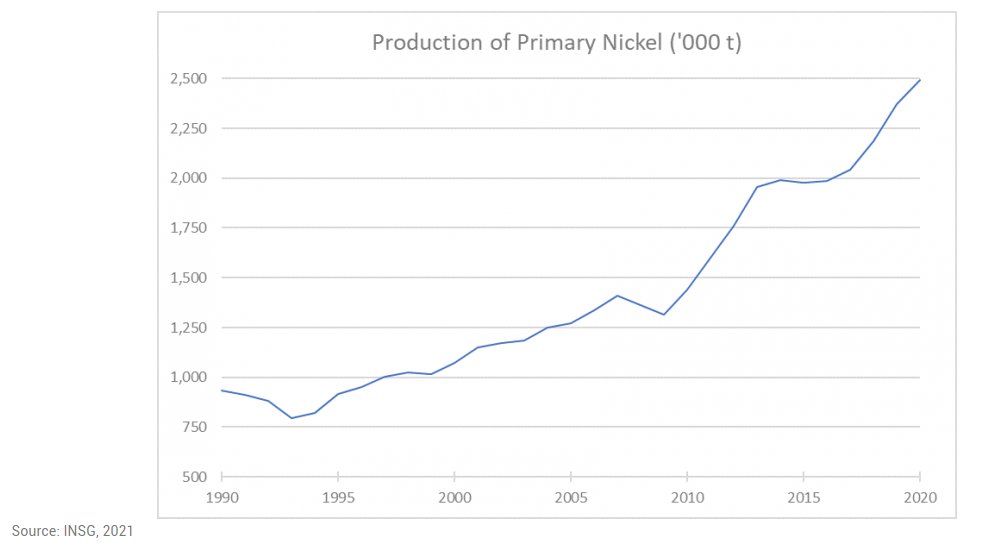

Global exploration budgets for #copper, #nickel and #zinc peaked in 2012 at $6.4B after a run in commodity prices, surpassing 2008 high of $5.2B. As prices fell from the high in 2011, exploration spending cooled to an avg. of $2.7B/yr since 2015.

2006-2015: $40B

2016-2020: $13B

2006-2015: $40B

2016-2020: $13B

Capex spend is similar. Aggregating capex for select major to mid-cap producers shows a clear lack of investment vs. prev. yrs, despite increasing sales in recent yrs. Notable is cons. estimates this trend to continue through 2023.

Capex/Sales

2006-2015: 13.4%

2016-2023E: 8.6%

Capex/Sales

2006-2015: 13.4%

2016-2023E: 8.6%

Despite the run-up in copper prices since 2020 we have not seen a material increase in pdn as old existing mega mines deal w/ grade declines, water issues, geopolitical challenges, etc. New projects (KK, QB2, Quellaveco) help, but supply likely to remain challenged for longer.

• • •

Missing some Tweet in this thread? You can try to

force a refresh