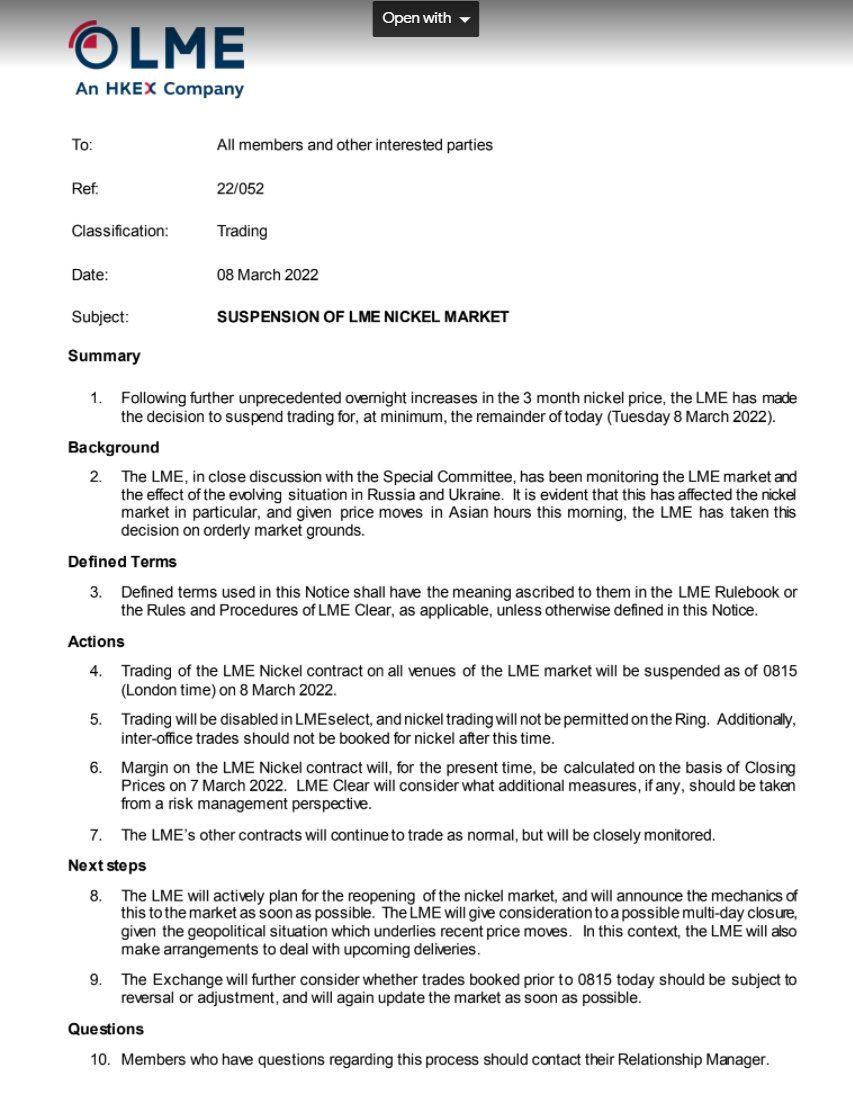

The #commodity markets are breaking… it’s like “you money is no good here”

The significance of this can’t be understated. This may well continue to other commodities. It can’t hold up and will just end up creating two markets. A real market cash market and a phoney one

The significance of this can’t be understated. This may well continue to other commodities. It can’t hold up and will just end up creating two markets. A real market cash market and a phoney one

In my opinion this has long been the case with markets like the #silver market where due to goverments/central banks influence the major exchanges do not reflect real world prices or availability. Even major silver etfs have been complicit in this by creating shares…

…for silver they don’t have but simply are contracts to get in the future.

It would appear to me that governments are likely to step in and ‘controls’ on commodity trading now. Determine who’s allowed to even purchase some contracts and who isn’t. Force ‘speculators’ to out

It would appear to me that governments are likely to step in and ‘controls’ on commodity trading now. Determine who’s allowed to even purchase some contracts and who isn’t. Force ‘speculators’ to out

Just know that there will be printing and money creation at unparalleled levels over the next year due to the complete mess that’s been made in the energy sector and the necessity to stop trading with Russia. We may be heading to governments forcing rationing via finance

I think it’s likely that some commodities will see controls put in place as to who can buy them especially in the futures market. These maniacs have ruined sound money and continue to do so. The average person will be forced to suffer inflationary effects.

The opportunity to invest and protect your hard earned capital by purchasing commodities can and likely will be taking from you.

I would strongly recommend purchasing gold and silver as an inflation hedge while you’re still able to get products.

I would strongly recommend purchasing gold and silver as an inflation hedge while you’re still able to get products.

When I was at Sprott during the last commodity bull we had contracts with major banking institutions promising 5 day deliver for silver. When we actually decided to call that #silver and take delivery on behalf of our clients we found out that the 5 day promise was bullshit

It took us more than half a year. To get our silver. It was first said that it would take month or so due to logistics. The 2 months in it was said that there was a problem getting it from Chicago and they would be getting from new York. And they had to rebook the shipping

Then they said that silver was not available for export from NY and they said it was coming from London on a boat. Finally after more than 6 months they said it was coming from China and would arrive on the west coast and would be shipped across the country.

I made requests for Bar Numbers at that time and shipping tracking information not was not provided them. Finally the bars began trickling in and imho they did not come from china. It was all a delay tactic.

For those asking I trust that Sprott’s physical etf’s

For those asking I trust that Sprott’s physical etf’s

In the early days I saw the silver and gold with my own eyes and I worked along side the team of people that would audit the bars.

I still think it’s worth considering a safety deposit box and purchasing your own physical. It’s a great store of value

I still think it’s worth considering a safety deposit box and purchasing your own physical. It’s a great store of value

These metals always will have used and the uses for silver only keep growing. The energy cost (and labour cost which is also energy based) will only keep rising. That’s why it’s a store of value. (Unlike crypto which destroys energy to make worthless tokens)

I have been predicting the ‘failure’ of major commodity exchanges. Today it’s nickel, tomorrow or next week it might be tin, or silver etc.

I expect that this cycle precious metals futures contracts will break. Owners will not be able to get good delivery bars from exchanges

I expect that this cycle precious metals futures contracts will break. Owners will not be able to get good delivery bars from exchanges

Governments will allow contracts to be settled with cash and it will break the market. Once cashed out of their contracts, would be owners of physical gold or silver will find they have to pay up 30-50% to get the physical they thought they owned

Government mints will stop minting coins to try to slow the publics purchase of them. It’s coming.. and it’s been a long time coming.

The world is going to lose faith in many faith based currencies.

Know what you own

The world is going to lose faith in many faith based currencies.

Know what you own

Imagine your a business that hedged your nickel purchasing needs (long nickel cause you need it) what’s likely to happen is the government is going to allow the true speculators (banks and commodity brokers) to settle in cash rather than delivery of metal

The business that gets cashed out will then find that they have to try to source actual nickel in the real world and it’s not immediately available. Could be 6-12 months and possibly cost much more. Manufacturing options may have to stop and huge losses incurred

The game is rigged to always protect the banks and the bankers. It’s disgusting to see they are always the first to get bailed out, they proportionately get more bail out money than anyone else and then a few years later return to record profits and record bonuses

It’s going to be very difficult for those with real world needs to hedge or protect themselves against inflation. Because the system is designed and to protect the banks who are complicit with the governments in selling the public bullshit inflation protection and empty promises

It ain’t fucking transitory. There’s a 100+ year trend of governments destroying +99% of their currencies purchasing power and screwing the poor and continually squeezing the shit out of the middle class.

That’s why when commodity bull markets start up you best get invested in unhedged producers. Unhedged or contracted with out fixed prices or price caps. That’s the only way to properly get the insurance you need in your portfolio during run away commodity/energy inflation

Resource companies that engage in hedging or capped long term contracts typically screw themselves because their financial teams aren’t nearly as smart as the bankers or those on the other side of their contracts. Some end up bankrupt cause they get the market so very wrong

Rumour is that a major nickel producer ‘hedged’ a huge amount of nickel production and has a mark to market ~$12b loss that they can’t financially settle so that the exchange is concerned about counter liability risk.

So the question is, will they screw the buyers or will someone print and bail to fund the contract obligations and keep the market functioning. Free markets? Legitimate commodity exchanges? Can’t see governments letting commodity exchanges fail.. so I think it will be…

“socialization of losses” the new mainstream term for 2023-2023

• • •

Missing some Tweet in this thread? You can try to

force a refresh