Bitcoin Thread W/B 13th March

1/ There’s no point in trying to trade PA like this weekend. It’s designed to chop you up. We’re in the middle of a range. MM is deliberately trying to get retail traders into bad positions

My personal areas of interest are: $36800, $44.5k and $47k

1/ There’s no point in trying to trade PA like this weekend. It’s designed to chop you up. We’re in the middle of a range. MM is deliberately trying to get retail traders into bad positions

My personal areas of interest are: $36800, $44.5k and $47k

https://twitter.com/Crypto_MM_/status/1502288528176263175

2/ Looking for a 3 tap bounce for a long position around the Fair Value Gap at 36800 and possible shorts at mid-high 40s where a manipulation tap of the highs/false breakout could occur #bitcoin $btc

3/ A key thing I’ve noticed over the weekend is how the influencers are shilling the narrative that this coming week is going to be a big week for Bitcoin and that it’s going to be “exciting”. Ie watch out for some heavy manipulation.

4/ No one wants to miss out on a big week, right? Right?

What does a big week suggest? It suggests we go upwards.

What do most retail traders prefer, longing or shorting? Going long.

Therefore what’s most likely to happen first? Price go up or down?

Think about it.

What does a big week suggest? It suggests we go upwards.

What do most retail traders prefer, longing or shorting? Going long.

Therefore what’s most likely to happen first? Price go up or down?

Think about it.

5/ Thanks to @qasim7889 for this spot.

With this happening tomorrow and FOMC on the 15th/16th it looks like we’ll be in for a volatile week

With this happening tomorrow and FOMC on the 15th/16th it looks like we’ll be in for a volatile week

https://twitter.com/Pierr_Person/status/1502356083175735307

6/ A reminder of the key areas I’m looking for longs and shorts. Not interested in where we’re at right now. It’s no man’s land and either side could get screwed

https://twitter.com/Crypto_MM_/status/1502801906174992391

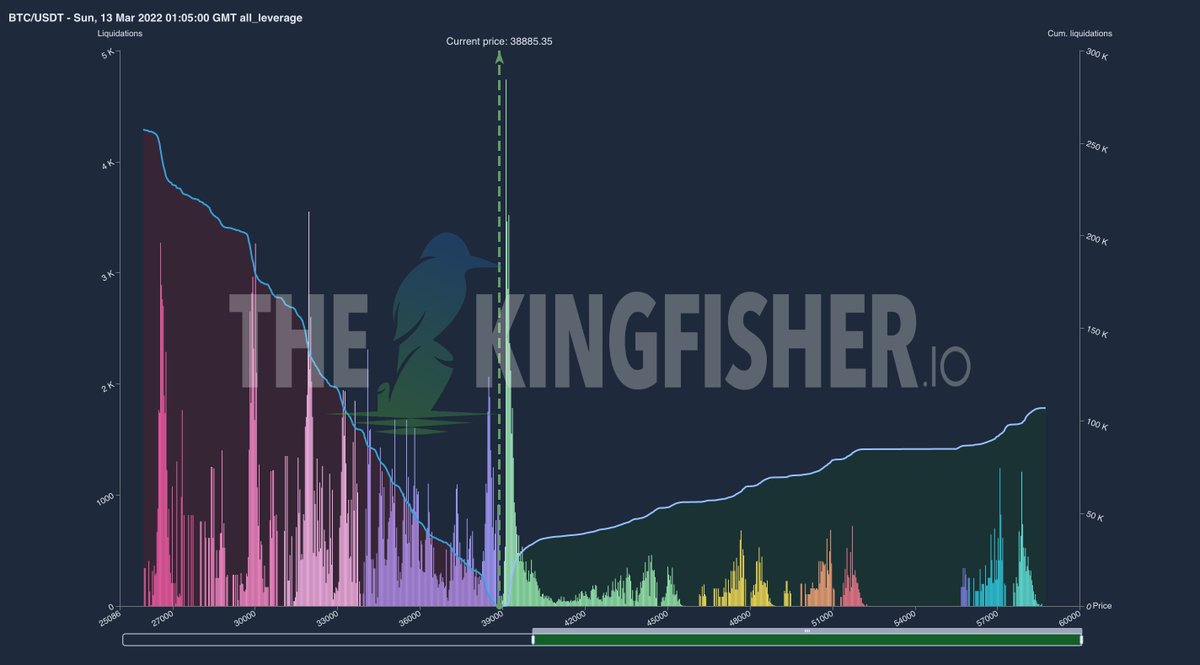

8/ Updated BTC liquidations map for 14th of March. Wouldn't be surprised if they whipsaw on Monday and take out that big green spike to the upside.

10/ Wednesday is FOMC day and can be a volatile day so would be careful and make sure you're aware of when the announcement is going to be made in your timezone. DYOR. Here's an updated liquidations map which atm favours downside #btc #bitcoin $btc

11/ Well well well. I look away from the charts for 1 hour and Asia have done a huge stop hunt.

Hope people didn’t get screwed. Tokyo pumps are 90% of the time the MM getting their shorts filled. Said it many times.

Potentially setting up an M on the 4hr here.

Hope people didn’t get screwed. Tokyo pumps are 90% of the time the MM getting their shorts filled. Said it many times.

Potentially setting up an M on the 4hr here.

14/ Market Maker got busy today. The daily is a blue vector meaning they’re picking up steam. This looks like a W for me. The last time we had a blue vector on the daily was at 36k.

I’ll be watching 44.3k for any rejection/manipulation #bitcoin

I’ll be watching 44.3k for any rejection/manipulation #bitcoin

17/ There’s a reason (other than having been sick with COVID) why I’ve been quiet on Bitcoin lately. It’s a difficult read this month as this range gets tightened. I’ve just been focusing on Alts and getting in and out of them.

(I’m over COVID finally btw 🥳)

(I’m over COVID finally btw 🥳)

20/ Got a partial dump but then stopping volume appeared. Unsure whether Tokyo are going to continue to dump or just hold yet. Either way I’m not longing it #bitcoin

21/ Personally, as shown above, I’m looking for 39k to be the potential bounce area. Not here

https://twitter.com/Crypto_MM_/status/1504579002165571597

22/ Just be careful. The influencoooors are getting really bullish and spreading “Big move coming on Bitcoin within ## hours 🚀🚀🚀🚀🚀”

23/ Key moment here as the NYC session is fully open in less than 15mins.

Technically still in a lower high and there’s a green vector at it that high. Wonder if there’ll be a bear VCR on the 15m in this area?

Technically still in a lower high and there’s a green vector at it that high. Wonder if there’ll be a bear VCR on the 15m in this area?

24/ NYC opened nearly an hour ago. Clocks changed last weekend that i didn’t know about. Still, interesting that we’ve ended up in this area with a green vector within their opening hour

25/ We have a bear VCR on the #Bitcoin 15m chart plus $Eth has a green vector on the 1hr that isn’t pushing up much further than the previous high (however hasnt closed yet)

26/ Gone short but going to be careful here with my stops because if they do decide to go up they’ll likely blast up as it’ll be a break of a trend line/descending channel that retail traders use

Eth 1hr could be the key here if it turns into a bearish vcr

Eth 1hr could be the key here if it turns into a bearish vcr

27/ Also because they are close to liquidations that go up to 41.5k they could fakeout to the upside first. There is more money for them to take below at 39.3k

28/ Eth has also just tapped a 4hr Fair Value Gap which can often be a point of rejection. So Eth 1hr and 4hr could be the key to watch here

29/ They may do a false breakout here on this trend line/channel on bitcoin

False move, get some extra longs trapped up, catch those liquidations to the upside then bring it down

False move, get some extra longs trapped up, catch those liquidations to the upside then bring it down

30/ Aligns with my take on this

https://twitter.com/InspoCrypto/status/1504843689213968422

35/ Funnily enough been 42800 and 43300 is where I’m looking for signs Bitcoin is going to break down. So influencers saying this sort of shit is making me looking even closer at that area.

Looking for a trap breakout of the previous high and then drop.

Looking for a trap breakout of the previous high and then drop.

https://twitter.com/rovercrc/status/1505283501968531456

37/ Alright, seems there’s no good marketing/fundamental reasons as to why. These guys know.

There’s always an outlier in an alts pump that gives a clue the MM is going to dump Bitcoin soon - this time it’s Ether Classic. It’s up 20% out of nowhere and for no reason $etc

There’s always an outlier in an alts pump that gives a clue the MM is going to dump Bitcoin soon - this time it’s Ether Classic. It’s up 20% out of nowhere and for no reason $etc

38/ The daily on Eth Classic is a green vector as well, go figure.

Market Maker is building their shorts on this coin. Going long on it would be suicidal. I’ll be looking for signs to sort it around $34 #etc $etc $eth #Ethereum #EthereumClassic

Market Maker is building their shorts on this coin. Going long on it would be suicidal. I’ll be looking for signs to sort it around $34 #etc $etc $eth #Ethereum #EthereumClassic

39/ Important weekly close coming up for #Bitcoin.

Close where we are now below 43k and it’s a another bad sign

For now, I’m just speculating, but the bad signs are growing ever greater.

Close where we are now below 43k and it’s a another bad sign

For now, I’m just speculating, but the bad signs are growing ever greater.

40/ My feeling is that anyone shorting Bitcoin right now is getting in too early. It's a Saturday night and they aren't moving Bitcoin (typical for a weekend). I believe they're waiting for the new weekly candle to take out the highs

Alts should be the focus on the weekends

Alts should be the focus on the weekends

41/ Between $42.8k and $43.4 is where i'm looking at for signs to go short (orange box above on this chart)

42/ For $Eth the key levels i'm looking for shorts are around $3043 (red box above) and $3111 (full recovery of red vector candle to the left).

43/ People looking for big moves on Bitcoin at the weekend when the probability is low. It’s been very like what I describe in my VCR guide

- The alts with W patterns have ran hard

- Bitcoin has chopped up traders as usual

- The alts with W patterns have ran hard

- Bitcoin has chopped up traders as usual

https://twitter.com/crypto_mm_/status/1504864194541281286

44/ The influencers are getting even more bullish as price goes up. They are calling for 48-49k

They are spreading a narrative as MM are selling into this right now

They are spreading a narrative as MM are selling into this right now

46/ Going to continue with this thread this week.

Nothing has changed. They didn’t break the structure with that mini-dump last night. The CME Gap is at 41920, so would expect that to get filled.

Maybe today we get False Move Monday up to the potential short areas - 43000 $btc

Nothing has changed. They didn’t break the structure with that mini-dump last night. The CME Gap is at 41920, so would expect that to get filled.

Maybe today we get False Move Monday up to the potential short areas - 43000 $btc

47/ Oh, and the update on the weekly close - that wasn’t a good weekly close. They brought it right up for people anticipating a breakout and then dumped right on the new weekly open.

https://twitter.com/crypto_mm_/status/1505317786964398099

48/ Must read.

Also make sure to follow @InspoCrypto if you haven’t already

Also make sure to follow @InspoCrypto if you haven’t already

https://twitter.com/inspocrypto/status/1506000917841289218

49/ Tokyo pumping. 1hr is a green vector after only 5mins!

50/ Remember that most of the time that Tokyo pumps it's them setting up for a dump.

Hit a 15m Fair Value Gap and then pulled away (second chart, red line)

Hit a 15m Fair Value Gap and then pulled away (second chart, red line)

51/ Aite, now we're here and it's the Asian session that's brought us up to this level and filled the FVG, so now I wait and see if any signs come to go short.

https://twitter.com/Crypto_MM_/status/1505356428768391172?s=20&t=9DH4TNPvwWlx-ZIG-P_1Hg

53/ The last 5 times Tokyo has pumped $BTC, including today

There is a recurring theme. On pump 4 they pumped and then retrace the whole move within minutes before we moved on up.

There is a recurring theme. On pump 4 they pumped and then retrace the whole move within minutes before we moved on up.

54/ They are selling their coins whilst pushing price up using futures

https://twitter.com/InspoCrypto/status/1506279242048360469

55/ Binance got thick sell walls at 44 and 45k. Always possible they get rugged but for now they stand

Live stream:

Live stream:

56/ Key liquidations level is 39k on #Bitcoin

This is my main target providing we get a breakdown here

This is my main target providing we get a breakdown here

57/ Possible M forming on the Bitcoin daily if it closes under $42500.

On the 12hr chart there have been 9 green vectors between 34k and 44k. 7 out of 9 have been fully recovered with 1 of the two that haven't being a VCR

On the 12hr chart there have been 9 green vectors between 34k and 44k. 7 out of 9 have been fully recovered with 1 of the two that haven't being a VCR

60/ Tokyo dumping their own pump again. 1hr was a vector after only 7 mins #bitcoin

https://twitter.com/Crypto_MM_/status/1506257322796064769?s=20&t=mrXlIGWykjwow42JLzmb6g

64/ Alright, having processed the information I’m looking for signs of this scenario to play out:

- Fakeout up to $43500-43700 to liquidate the early shorts and trap some more breakout longs

- Down to 39900 to liquidate the longs and sweep Monday’s low

- Unsure after that

- Fakeout up to $43500-43700 to liquidate the early shorts and trap some more breakout longs

- Down to 39900 to liquidate the longs and sweep Monday’s low

- Unsure after that

65/ Why? Liquidity is there both ways, but also:

- Too many random shitcoin/dinocoins pumping this week. Ada and Doge the latest

- Influencers getting heavily bullish

- At HTF resistance and all of the closest Fair Value gaps to the upside have been taken out

- Too many random shitcoin/dinocoins pumping this week. Ada and Doge the latest

- Influencers getting heavily bullish

- At HTF resistance and all of the closest Fair Value gaps to the upside have been taken out

66/ For Eth:

- Looking at 3110 and 3300 as potential fakeout up and rejection points

- Around 2650 is the biggest long liquidation points

Unsure about Eth, have more confidence in the Bitcoin scenario

- Looking at 3110 and 3300 as potential fakeout up and rejection points

- Around 2650 is the biggest long liquidation points

Unsure about Eth, have more confidence in the Bitcoin scenario

67/ Eth longs have been closing like there’s no tomorrow too

Most of the higher timeframe VCRs alert yesterday and today have been bearish too.

My bias is for shorts.

Most of the higher timeframe VCRs alert yesterday and today have been bearish too.

My bias is for shorts.

68/ They are teasing a bear vcr on the 15m timeframe for BTC, candle hasnt closed yet

69/ No bear vcr yet.

Order book shows they are deliberately suppressing price at these levels

Watching to see if it gets rugged or not though

Order book shows they are deliberately suppressing price at these levels

Watching to see if it gets rugged or not though

70/ Bitcoin Dominance is creating a triple bottom at a FVG whilst a lot of Alts have barely moved since the Bitcoin pump started the the beginning of the NYC session

71/ 44k and 45k sell walls have been pulled

44k and 44.5k*

• • •

Missing some Tweet in this thread? You can try to

force a refresh