The truth about Liquidity Pool APRs 🧵

i.e - No, you're not really getting 420% APR and here's why👇

[1/x]

i.e - No, you're not really getting 420% APR and here's why👇

[1/x]

2/

Yield farms can be quite misleading in how they show APR numbers.

The truth is the APR you actually get when farming is a lot less than the displayed APR.

So why are the advertised APRs so much higher? What are some common traps / sneaky tricks?

Yield farms can be quite misleading in how they show APR numbers.

The truth is the APR you actually get when farming is a lot less than the displayed APR.

So why are the advertised APRs so much higher? What are some common traps / sneaky tricks?

3/

If the concept of a Liquidity Pool / AMM is unclear to you, then check out this thread:

If the concept of a Liquidity Pool / AMM is unclear to you, then check out this thread:

https://twitter.com/shivsakhuja/status/1473794498081689601?s=21

4/

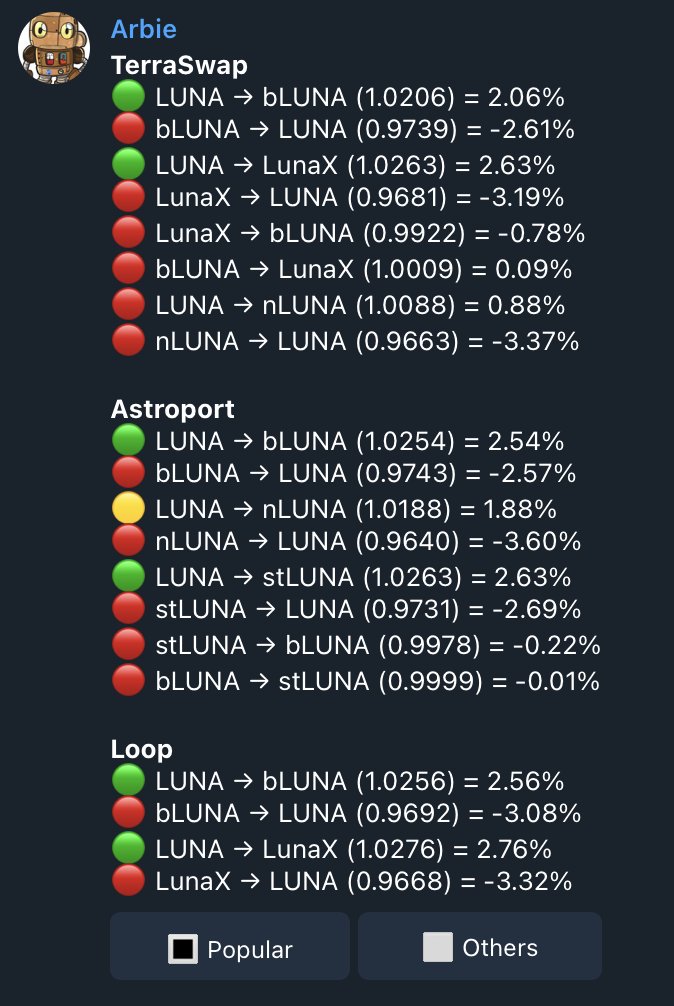

Liquidity Providers earn rewards in 2 forms:

1. Swap Fees (trading fees)

2. Farm Incentives

Most of the time, the bulk of the APR is coming from the farm incentives, and not from swap fees.

Liquidity Providers earn rewards in 2 forms:

1. Swap Fees (trading fees)

2. Farm Incentives

Most of the time, the bulk of the APR is coming from the farm incentives, and not from swap fees.

5/

Let's understand how the APR number is calculated.

Most #DeFi yield farms will pay a fixed number of tokens per pool per day (emissions).

These are new tokens that are printed and proportionally distributed to farmers staking their LP tokens.

Let's understand how the APR number is calculated.

Most #DeFi yield farms will pay a fixed number of tokens per pool per day (emissions).

These are new tokens that are printed and proportionally distributed to farmers staking their LP tokens.

6/

Consider this example.

Farm XYZ wants to incentivize liquidity providers for the $ETH / $BTC pool and will reward LPs with 1,000 XYZ tokens per day.

Suppose there is $100,000 of liquidity in the pool, and you provide $1,000 of liquidity.

You now own 1% of the pool.

Consider this example.

Farm XYZ wants to incentivize liquidity providers for the $ETH / $BTC pool and will reward LPs with 1,000 XYZ tokens per day.

Suppose there is $100,000 of liquidity in the pool, and you provide $1,000 of liquidity.

You now own 1% of the pool.

7/

So you receive 1% of rewards (10 XYZ tokens per day)

Currently, 1 XYZ token = $1, so you are receiving $10 per day.

Annualized, this would be 365% APR.

Meaning you should earn $3,650 per year (you won't tho.. 😞).

So you receive 1% of rewards (10 XYZ tokens per day)

Currently, 1 XYZ token = $1, so you are receiving $10 per day.

Annualized, this would be 365% APR.

Meaning you should earn $3,650 per year (you won't tho.. 😞).

8/

The actual APR depends on:

1. How many farm tokens are emitted daily

2. Price of the farm token being emitted

3. How much $ in the pool (TVL).

4. How much $ is the pool generating in swap fees. (trading volume)

The actual APR depends on:

1. How many farm tokens are emitted daily

2. Price of the farm token being emitted

3. How much $ in the pool (TVL).

4. How much $ is the pool generating in swap fees. (trading volume)

9/

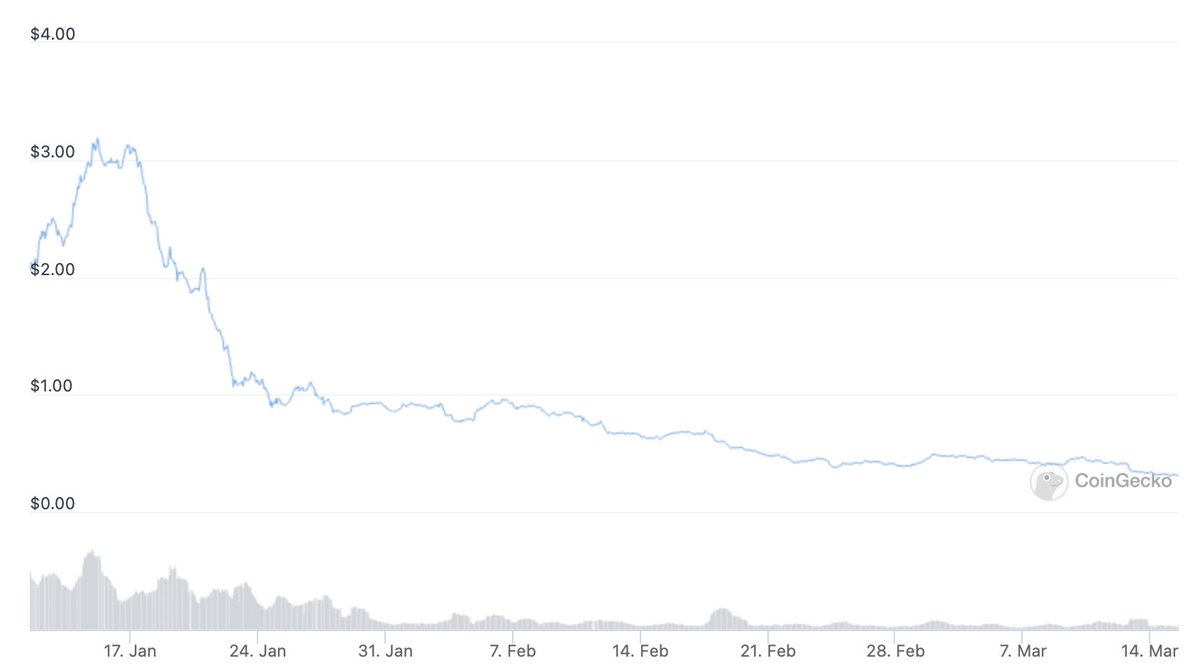

And here's why you wouldn't actually get 365% APR:

1. Emissions will decrease over time: Farms tend to incentivize pools more heavily earlier on.

2. Price of XYZ coin will decrease over time: Most farm tokens have no utility and are constantly dumping.

Example chart 👇

And here's why you wouldn't actually get 365% APR:

1. Emissions will decrease over time: Farms tend to incentivize pools more heavily earlier on.

2. Price of XYZ coin will decrease over time: Most farm tokens have no utility and are constantly dumping.

Example chart 👇

10/

3. If it's a popular farm or rewards are high for a while, then TVL may increase, diluting your share of the pool.

3. If it's a popular farm or rewards are high for a while, then TVL may increase, diluting your share of the pool.

11/

Obviously, there are exceptions to all of this.

Some farms have more cleverly designed tokenomics that prevent or reduce the constant dumpage.

But even then, it's quite difficult to keep price from falling unless the farm token has some real utility.

Obviously, there are exceptions to all of this.

Some farms have more cleverly designed tokenomics that prevent or reduce the constant dumpage.

But even then, it's quite difficult to keep price from falling unless the farm token has some real utility.

12/

If there's no strong demand driver for an inflationary token, the price is bound to fall.

The only question is how fast.

So what can you do with this information? 👇

If there's no strong demand driver for an inflationary token, the price is bound to fall.

The only question is how fast.

So what can you do with this information? 👇

13/

Here are some practical tips for farming:

1. Understand the tokenomics. If you're getting paid in shitty farm tokens, then sell for stables as frequently as possible.

2. Or use Autocompounders like @beefyfinance to sell rewards automagically.

Here are some practical tips for farming:

1. Understand the tokenomics. If you're getting paid in shitty farm tokens, then sell for stables as frequently as possible.

2. Or use Autocompounders like @beefyfinance to sell rewards automagically.

https://twitter.com/shivsakhuja/status/1475421236477849601?s=20

14/

3. Don't get roped in by attractive yields against farming tokens:

Most farms will pay much higher APR for providing liquidity against the farm token.

(ex: ETH/XYZ on farm XYZ)

In my experience, the APR will almost never be enough to compensate for the price going down.

3. Don't get roped in by attractive yields against farming tokens:

Most farms will pay much higher APR for providing liquidity against the farm token.

(ex: ETH/XYZ on farm XYZ)

In my experience, the APR will almost never be enough to compensate for the price going down.

15/

4. Another sneaky thing I've seen some farms doing is showing a 7-day average instead of current APR (without being transparent about it).

Check how much you earned after 24 hours and how it matches up against your expected daily earnings.

It's usually lower.

4. Another sneaky thing I've seen some farms doing is showing a 7-day average instead of current APR (without being transparent about it).

Check how much you earned after 24 hours and how it matches up against your expected daily earnings.

It's usually lower.

16/

5. Another sneaky thing: they may advertise APY instead of APR.

Since the rates are transient, the APY number is very misleading.

The delta between APR & APY is especially significant for higher numbers.

1% daily = 365% APR = 3,678% APY.

5. Another sneaky thing: they may advertise APY instead of APR.

Since the rates are transient, the APY number is very misleading.

The delta between APR & APY is especially significant for higher numbers.

1% daily = 365% APR = 3,678% APY.

https://twitter.com/shivsakhuja/status/1469870056561590277?s=20

17/

6. Finally, don't forget about Impermanent Loss (IL) when selecting a pool.

Be careful when pairing 2 coins that have low correlation or have a big difference in market caps.

6. Finally, don't forget about Impermanent Loss (IL) when selecting a pool.

Be careful when pairing 2 coins that have low correlation or have a big difference in market caps.

https://twitter.com/shivsakhuja/status/1482188295488430086?s=20

19/

Hope you found these tips helpful.

I've seen so many people fall for these traps (as I have), and I haven't seen it explained very clearly, so I gave it a shot.

If you found it useful, I'd really appreciate a ❤️ / ♻️ on the original tweet.

Hope you found these tips helpful.

I've seen so many people fall for these traps (as I have), and I haven't seen it explained very clearly, so I gave it a shot.

If you found it useful, I'd really appreciate a ❤️ / ♻️ on the original tweet.

https://twitter.com/shivsakhuja/status/1503662894960967682?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh