The most important question now on the mind of all analysts and traders. Is this a bear market rally or is this the start of a bull move. Retweeting this as I will need a few tweets to explain my view

https://twitter.com/ap_pune/status/1505235416475058177

Everyone knows the HH-HL or LH-LL as per Dow theory. This can be a bit confusing on how one marks the Highs and Lows. Long back, I picked up this trick from one of the neo-Dow theorists on what to do in scenarios like this

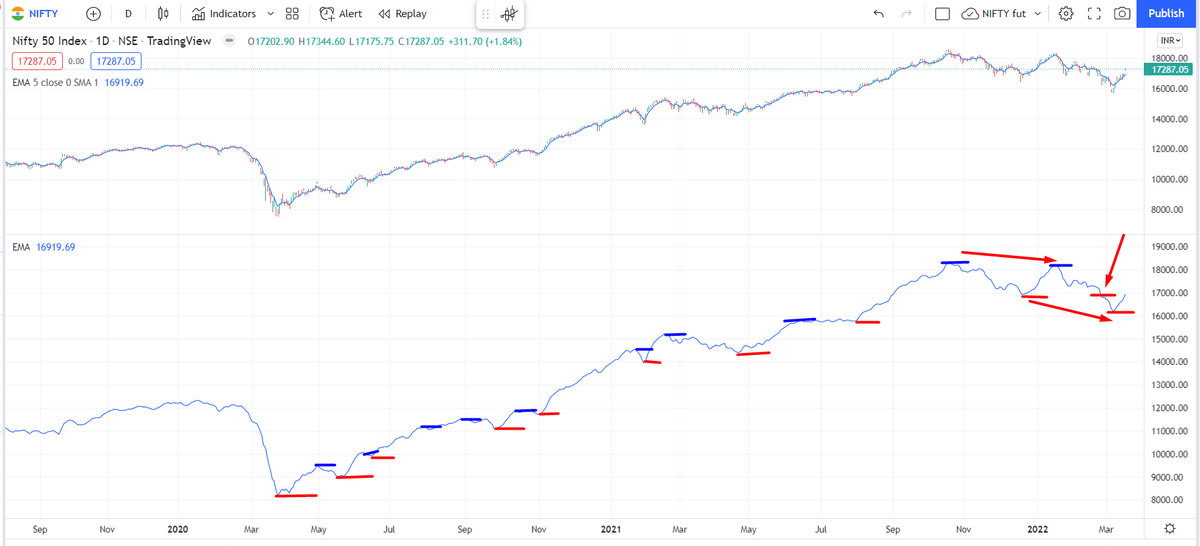

Simply plot a 5 period exponential moving average on a different panel. A 5-EMA simply shows you a running weekly perspective and kind of smoothens the price where a single spike high/low is not of that much importance

You will see this 5-ema also making HH.HL.LH.LL. So now, rather than focusing on the highs/lows on the charts, focusing on highs/lows on the 5-ema gives a cleaner perspective

As per this charts, unless the 5-ema now closes above 17540 ( the ema, not Nifty price) I will not play this as a bull market. I will deal with this market as a counter move against the major bear trend

More about Dow theory here :

In a strong bull market, the 5-ema moves in tandem with price. The tops are broken almost at same time, max a few days apart and sometimes in advance. See the marked examples.

That is not the case now, which holds me back from calling this a clean bull market

That is not the case now, which holds me back from calling this a clean bull market

Since end March 2020, we have had the first clean breakdown of lows and a Lower High - Lower Low scenario

The common consensus is that moving averages, whether simple or exponential are lagging indicators. So explain this, the 5-ema crosses previous high even before the price crosses the previous high. This is a massively bullish signal

#ITC

#ITC

• • •

Missing some Tweet in this thread? You can try to

force a refresh