🧵On A Small Cap Textile Co.

M.cap- 827crs

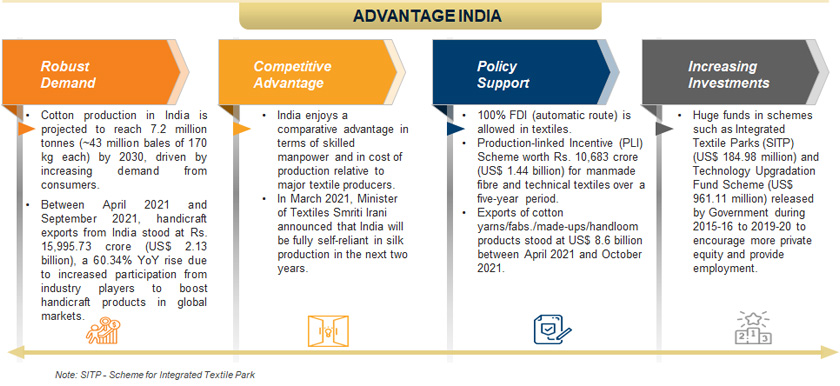

#Textiles sector has been in the news for quite a while now, as this sector is seeing many tailwinds one after the another, be it –

-Trade wars

-Scouting for sourcing from more than one

-country due to pandemic

M.cap- 827crs

#Textiles sector has been in the news for quite a while now, as this sector is seeing many tailwinds one after the another, be it –

-Trade wars

-Scouting for sourcing from more than one

-country due to pandemic

-Ban on imports from China's Xinjiang region

-Various reforms & push from the local Govt. to reach aspirational target of $100bn of textile exports within 5 years from current $44bn.

-Several incentives such as RoSCTL,MITRA, PLI and signing of new FTAs hv added fuel to d fire

-Various reforms & push from the local Govt. to reach aspirational target of $100bn of textile exports within 5 years from current $44bn.

-Several incentives such as RoSCTL,MITRA, PLI and signing of new FTAs hv added fuel to d fire

-Various player in this industry hv already seen a massive rerating in their valns.

-From yarn mfgs🧵 to garments 🎽mfg co., every player has seen a tremendous improvement in their profitability due to⬆️ cotton yarn spreads,⬆️realization for the end product & China+1 Strategy.

-From yarn mfgs🧵 to garments 🎽mfg co., every player has seen a tremendous improvement in their profitability due to⬆️ cotton yarn spreads,⬆️realization for the end product & China+1 Strategy.

-Among all this one co. which came to my radar, after a Renowned Investor Sir @LuckyInvest_AK bought stake in it & further topped it up later at a higher price.

The interesting thing is that,Sir bought it,after it was already 8x from its Mar'20 lows

Stake- 4.63% as of 31.12.21

The interesting thing is that,Sir bought it,after it was already 8x from its Mar'20 lows

Stake- 4.63% as of 31.12.21

#FAZE THREE LTD.

Promoted by Mr. Ajay Anand in 1985, is a mfg & exporter of home furnishing textile products mainly floor coverings.

CMP: Rs.343

M.cap- 827crs

P.E.-18.9

@pd_log @AnishA_Moonka @nid_rockz @caswapnilkabra @StocksAndStoics

Promoted by Mr. Ajay Anand in 1985, is a mfg & exporter of home furnishing textile products mainly floor coverings.

CMP: Rs.343

M.cap- 827crs

P.E.-18.9

@pd_log @AnishA_Moonka @nid_rockz @caswapnilkabra @StocksAndStoics

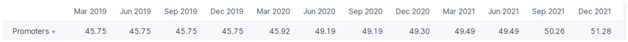

-Along with Mr.Kacholia, Promoters of the co. hv been openly buying from the markets every qtr.

- In last 2 years they hv increased their stake by almost 6% & they are buying since 2017.

- In last 2 years they hv increased their stake by almost 6% & they are buying since 2017.

So, What does the co. do❓

-They mfg. bathmats, rugs and top of the bed i.e. blankets and throws along with cushions (apart from bed sheets & towels that currently other listed players specialize in)

-Bath mats & rugs contribute 80% of the revenue

-They mfg. bathmats, rugs and top of the bed i.e. blankets and throws along with cushions (apart from bed sheets & towels that currently other listed players specialize in)

-Bath mats & rugs contribute 80% of the revenue

History📖

-Founded in 1985 with operations out of Panipat, Haryana, FTL came out with a public issue during the year 1995.

-FTL has 6 manufacturing facilities at Panipat, Silvassa and Vapi.

-More than 90% of its turnover is from exports (US-60%, UK/EU – 30%,ROW-10%)

-Founded in 1985 with operations out of Panipat, Haryana, FTL came out with a public issue during the year 1995.

-FTL has 6 manufacturing facilities at Panipat, Silvassa and Vapi.

-More than 90% of its turnover is from exports (US-60%, UK/EU – 30%,ROW-10%)

Client base 🤝

-Comprises of very large retail chains in USA, UK, EUR etc.

-Top 15 customers contribute around 80% of the revenue and no single customer contribute more than 15% of Rev.

-Their relationship with top 15 customers is almost 2 decades old.

-Comprises of very large retail chains in USA, UK, EUR etc.

-Top 15 customers contribute around 80% of the revenue and no single customer contribute more than 15% of Rev.

-Their relationship with top 15 customers is almost 2 decades old.

Me too co.❓

What’s unique about FTL is that d space in which it operates,is not crowded by Indian Textile Giants like Welspun ,Trident etc.

Although Welspun is present in some of its product basket but the market itself is so large that every player can get its own share.

What’s unique about FTL is that d space in which it operates,is not crowded by Indian Textile Giants like Welspun ,Trident etc.

Although Welspun is present in some of its product basket but the market itself is so large that every player can get its own share.

-FAZE 3 mfg those products which are clear beneficiary of CHINA+1 theme.

-China is d major exporter of Rugs and bathmats to US and as per the mgt there is huge unfulfilled demand from existing customers due to shift in sourcing from China to India.👍

-China is d major exporter of Rugs and bathmats to US and as per the mgt there is huge unfulfilled demand from existing customers due to shift in sourcing from China to India.👍

Management Quality 👨💼

-In every small cap co. major risk/concern is about the mgt quality or any corp. governance issue.

-After going through its past 10 Annual reports, nothing have come to light which highlights any corp. gov issue.

-In every small cap co. major risk/concern is about the mgt quality or any corp. governance issue.

-After going through its past 10 Annual reports, nothing have come to light which highlights any corp. gov issue.

Management quality can also be accessed from the 👇 points:

1.Salaries Drawn:

-In 2010-11 Salary drawn by Mr.Ajay Anand=34.56lacs ,Mr.Sanjay Anand=17.64lacs

Salary Drawn in 2020-21 Ajay Anand =68.61lacs Sanjay Anand=38.40lacs

-Total =1.07crs (4.28% of N.P)

1.Salaries Drawn:

-In 2010-11 Salary drawn by Mr.Ajay Anand=34.56lacs ,Mr.Sanjay Anand=17.64lacs

Salary Drawn in 2020-21 Ajay Anand =68.61lacs Sanjay Anand=38.40lacs

-Total =1.07crs (4.28% of N.P)

-Although Mr.Ajay Anand hv already got the shareholder’s approval to inc his salary to 98lacs in 2018 but still he drawing salary lower than d approved limit

2.Dividends: After turning around the co. & paying of its major liabilities in 2017-18, the first thing that co. did was

2.Dividends: After turning around the co. & paying of its major liabilities in 2017-18, the first thing that co. did was

to declare a dividend of Rs.0.50/share after a gap of 10 years & another dividend in 2020.

-Dividends seems to be on the lower🔽 side but not to forget co. hv been on investment spree after 2017 turnaround and preparing itself for higher growth in coming years.

-Dividends seems to be on the lower🔽 side but not to forget co. hv been on investment spree after 2017 turnaround and preparing itself for higher growth in coming years.

3. Next gen promoter- Mr.Ajay Anand is nearing 68yrs old now & his son Mr.Vishnu Anand is preparing himself to take the control.

-Here’s an interview of Mr.Vishnu Anand in which he talks a lot about the ethics & Culture in the co.

-Here’s an interview of Mr.Vishnu Anand in which he talks a lot about the ethics & Culture in the co.

Why Growth was slow till now?

Lets go back to 2010 to understand this.

-In 2010 world economies were still struggling with the after effects of GFC 2008,as a result of that d demand for home textile was subdued.

-They had a subsidiary in Germany which suffered heavy losses.

Lets go back to 2010 to understand this.

-In 2010 world economies were still struggling with the after effects of GFC 2008,as a result of that d demand for home textile was subdued.

-They had a subsidiary in Germany which suffered heavy losses.

- After analyzing the European market conditions and to mitigate the further losses, the Board of Directors decided to file an insolvency petition in the German court.

-As a result various write-off were done which effected the profitability.

-As a result various write-off were done which effected the profitability.

-The corporate guarantee of Rs.29crs was invoked by the Canara Bank London.

-Along with the Corporate guaranteeit there were FCCB bonds which were due to be redeemed but co. could not redeem them because of financial stress.

-Along with the Corporate guaranteeit there were FCCB bonds which were due to be redeemed but co. could not redeem them because of financial stress.

-Inspite of that co. was able to grow its topline but the bottomline was affected due to various write-off and provisions.

-The turning point for the co. came in 2017 when promoters raised funds by issuing Preference shares & warrants to promoters & non- promoters entities.

-The turning point for the co. came in 2017 when promoters raised funds by issuing Preference shares & warrants to promoters & non- promoters entities.

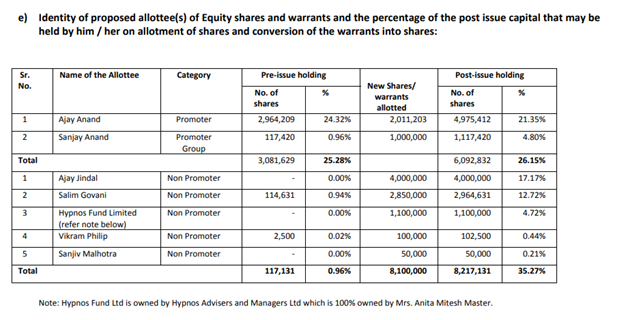

-FTL made a Preferential Issue and Allotment of 81,00,000 Equity Shares and 30,11,203 Convertible Equity Warrants (Rs.20/share)on October 15

💵Total funds raised 22.22crs (Promoters infused – 6crs)

Details👇

💵Total funds raised 22.22crs (Promoters infused – 6crs)

Details👇

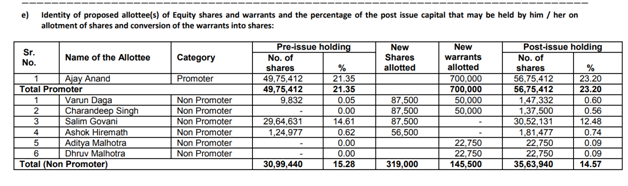

-Then Again in March 2017

They did Preferential Issue of 319000 equity shares and 845500 Convertible Equity Warrants @Rs.110/share⬆️

Mr.Ajay Anand Infused – 7.7crs

Details👇

They did Preferential Issue of 319000 equity shares and 845500 Convertible Equity Warrants @Rs.110/share⬆️

Mr.Ajay Anand Infused – 7.7crs

Details👇

-These funds were used to settle all the prev. liab. like corp.Guarantee ,FCCB bonds & all the impending long term liab. were settled.

💪Another shot in the arm for them was d start of US-China Trade war due to which they started gaining more attention from their global clients.

💪Another shot in the arm for them was d start of US-China Trade war due to which they started gaining more attention from their global clients.

-Mgt focused aggressively to capture the market share vacated by China.

-They started developing outdoor performance textile products for some of their large customers , which were earlier sourced out of China

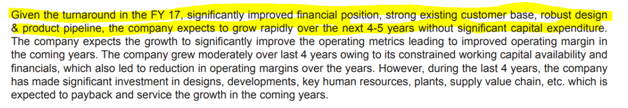

Even the guidance Trajectory changed dramatically after 2017👇

-They started developing outdoor performance textile products for some of their large customers , which were earlier sourced out of China

Even the guidance Trajectory changed dramatically after 2017👇

Along with warrants Promoters cont. inc. their stake in the co. from d open market (Skin in the game)

-They realigned their product and customer mix which lead to improvement in margins & at one time they were struggling to pay off their liabilities

-They realigned their product and customer mix which lead to improvement in margins & at one time they were struggling to pay off their liabilities

but now they were undergoing capex & that too funded by internal accruals.

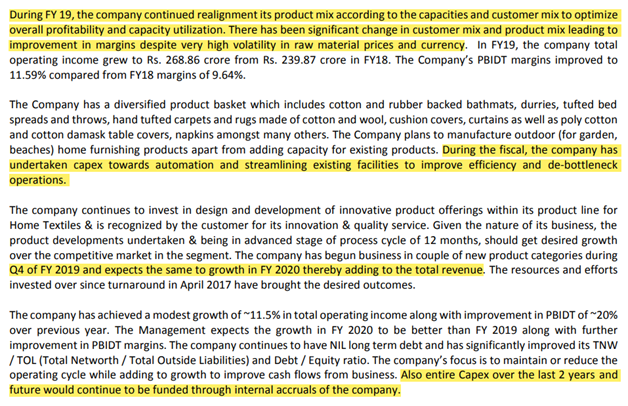

-Mgt guided for even better results for FY20 & despite the COVID they were able to achieve it.

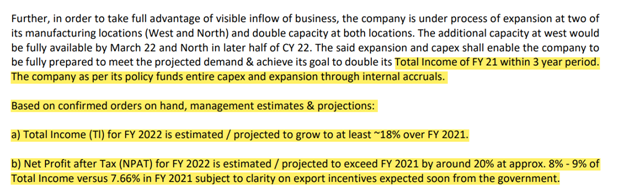

Fast forward to FY21 – Mgt reiterated their guidance to 2X their turnover of FY21 within 3 years🚀🚀

-Mgt guided for even better results for FY20 & despite the COVID they were able to achieve it.

Fast forward to FY21 – Mgt reiterated their guidance to 2X their turnover of FY21 within 3 years🚀🚀

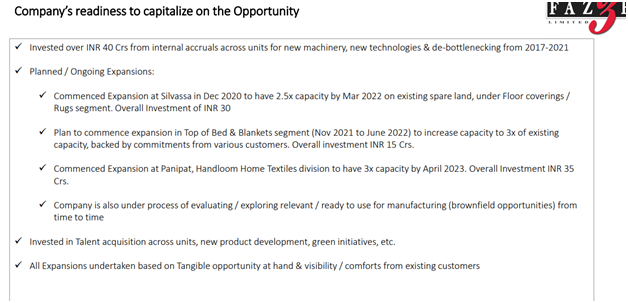

CAPEX PLANS🏗️

So until now it was all about past, now lets look what is going to happen in the future.

-Their capex plans-Looking at the size of the opportunity co. has decided to invest 80crs from internal accruals in order to inc. their capacity by almost 3x by April 2023.🚀🚀

So until now it was all about past, now lets look what is going to happen in the future.

-Their capex plans-Looking at the size of the opportunity co. has decided to invest 80crs from internal accruals in order to inc. their capacity by almost 3x by April 2023.🚀🚀

-With a targeted asset turnover of ~8-10x of new capex,the company has chalked out a plan to build FTL’s revenue to 1500 crore in the next five to six years (from current- 480crore).🚀🚀

👉3x Current Rev.

👉3x Current Rev.

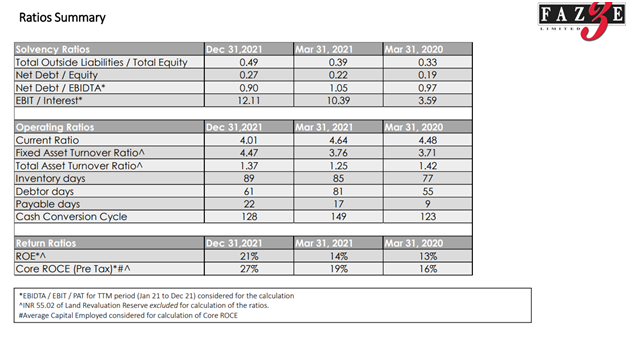

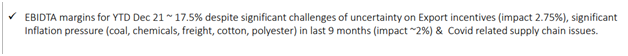

FINANCIALS💹

Now coming to the financials

-Co. is long term debt free & the short term liabilities comprises of Packing credit facilities only.

-Ebitda margins are expected to sustain around current levels despite higher RM and other costs.

Now coming to the financials

-Co. is long term debt free & the short term liabilities comprises of Packing credit facilities only.

-Ebitda margins are expected to sustain around current levels despite higher RM and other costs.

Valuations

👉At CMP Rs.344 the co. is currently trading at 14.7x FY23 EPS est.

👉Topline is expected to grow exponentially over the next few years along with decent profitability.

👉At CMP Rs.344 the co. is currently trading at 14.7x FY23 EPS est.

👉Topline is expected to grow exponentially over the next few years along with decent profitability.

RISK*⃣

-Foreign currency risk – since 90% of its turnover is from exports, there could be risk associated with currency fluctuations

-Slowdown in demand from US and European markets

- Significant increase in RM prices

-Foreign currency risk – since 90% of its turnover is from exports, there could be risk associated with currency fluctuations

-Slowdown in demand from US and European markets

- Significant increase in RM prices

- Execution risk – Inability to utilize expanded capacity successfully could impact the financials of the co.

Thread is quite long, but tried my best to include all the major info required.

This is not a Reco. So kindly consult with your advisor before investing.

Thread is quite long, but tried my best to include all the major info required.

This is not a Reco. So kindly consult with your advisor before investing.

Disclosure: Invested and Biased

• • •

Missing some Tweet in this thread? You can try to

force a refresh