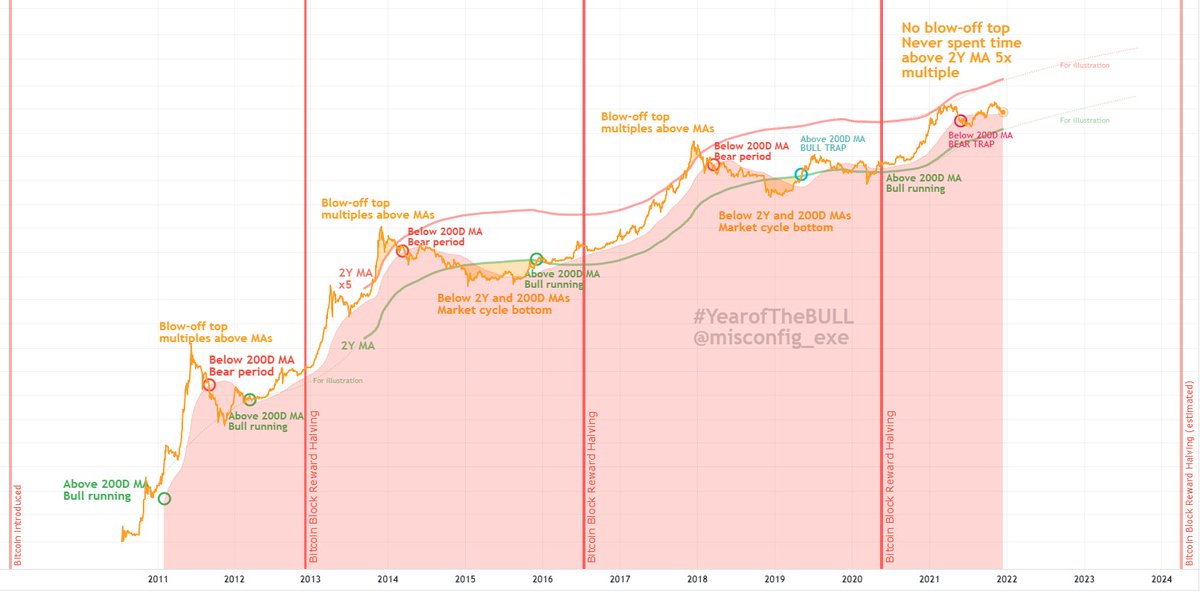

#Bitcoin and TOTAL #crypto market 1Q charts -- each candlestick is 3 Months

What does this tell us about the market? Let's dive in - following tweets.

1/9

What does this tell us about the market? Let's dive in - following tweets.

1/9

The current 3M candle (1 day until close) is in the form of a BULLish "Long Lower Shadow".

Long shadows (wicks) especially without a wick on the opposite end (I'll touch on that) often mean trend reversal.

2/9

Long shadows (wicks) especially without a wick on the opposite end (I'll touch on that) often mean trend reversal.

2/9

Taking a look at the prior candle, it also formed a long-shadow, but in the opposite direction. While the close was higher than the open, it still formed a BEARish Long Upper Shadow.

3/9

3/9

Considering that the price rose +57% during this candle then fell nearly -29% in the following candle, I'd say this reversal pattern played out.

4/9

4/9

Context: This is occurring within a 1.25Y-long rising consolidation channel with higher highs and higher lows, during a time of rising volume on the 3M chart too.

5/9

5/9

Another way to look at the current candlestick is that it is nearly a Dragonfly Doji, which is "T"-shaped.

A +1.37% rise to tomorrow's close would put this as a firm Dragonfly.

A dragonfly doji that appears after a downtrend is bullish, like a hammer candle.

6/9

A +1.37% rise to tomorrow's close would put this as a firm Dragonfly.

A dragonfly doji that appears after a downtrend is bullish, like a hammer candle.

6/9

Meanwhile, the TOTAL market cap chart is also putting in a Long Lower Shadow candle after a Long Upper Shadow inside of a rising consolidation channel; though volume is down compared to prior quarter here.

7/9

7/9

Hard to make a firm conclusion. This type of pattern (especially back-to-back reversal Long-Shadow candles) hasn't occurred before on BTC or TOTAL.

But ...

8/9

But ...

8/9

Overall I think these are long-term bullish signals, and while anything is possible, I expect new highs on #Bitcoin over the course of the next quarters.

9/9 Fin.

9/9 Fin.

¿Necesita traducción al #español de este #Bitcoin análisis?

Gracias a @tucriptotime por traducir.

Gracias a @tucriptotime por traducir.

https://twitter.com/misconfig_exe/status/1509243059237576709/retweets/with_comments

@threadreaderapp unroll please :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh