#Consumer spending +0.2% in Feb but fell 0.4% in real terms.

🟡Disposable income +0.4%

🟡Inflation-adj -0.2%

⤴️Savings +0.2pt to 6.3%: near 2013 low

PCE prices +0.6%

🔥#Inflation 6.4% (+0.4pt) high since '82

Core prices +0.4%

🔥Core inflation 5.4% (+0.2pt) high since '82

🟡Disposable income +0.4%

🟡Inflation-adj -0.2%

⤴️Savings +0.2pt to 6.3%: near 2013 low

PCE prices +0.6%

🔥#Inflation 6.4% (+0.4pt) high since '82

Core prices +0.4%

🔥Core inflation 5.4% (+0.2pt) high since '82

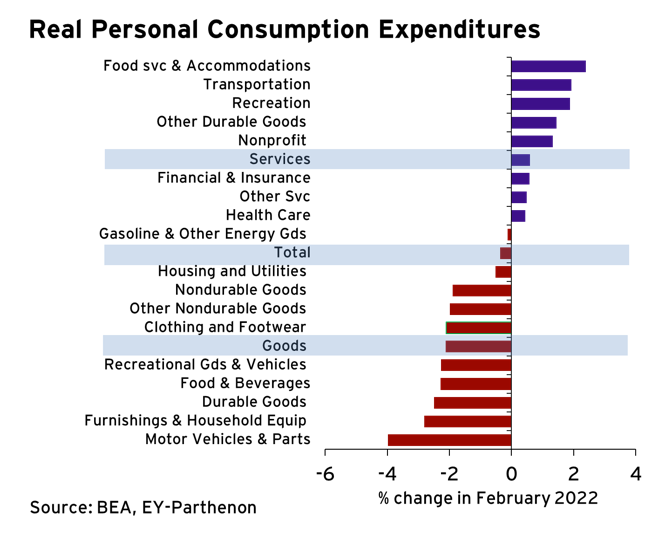

US consumer spending expenditures adjusted for inflation slipped 0.4% in February

🟡Consumers pulled back their outlays on goods (-2.1%) led by a 2.5% plunge in durable goods and a 1.9% contraction in nondurable goods.

🟢Spending on services posted a healthy 0.6% jump

🟡Consumers pulled back their outlays on goods (-2.1%) led by a 2.5% plunge in durable goods and a 1.9% contraction in nondurable goods.

🟢Spending on services posted a healthy 0.6% jump

Consumer spending in Feb

🟢Drivers:

- better health conditions

- Desire/Ability to spend

🟡Constraints (mostly on goods):

- Supply chain constraints

- Higher prices

- Spending mix rotation

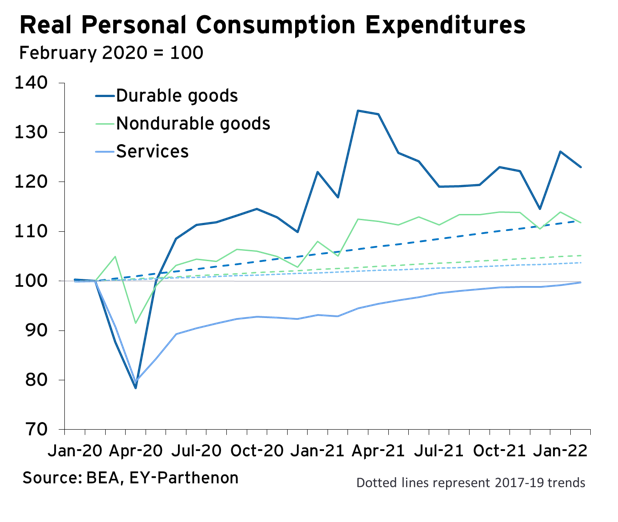

▶️Spending on goods +16% 🆚pre-Covid

▶️Spending on services -0.3% 🆚pre-Covid

🟢Drivers:

- better health conditions

- Desire/Ability to spend

🟡Constraints (mostly on goods):

- Supply chain constraints

- Higher prices

- Spending mix rotation

▶️Spending on goods +16% 🆚pre-Covid

▶️Spending on services -0.3% 🆚pre-Covid

🟢Consumer outlays on goods are 7.7% higher🆚pre Covid trend

🟡Consumer outlays on services are 3.9% lower 🆚pre Covid trend

🟡Consumer outlays on services are 3.9% lower 🆚pre Covid trend

US consumer outlays are now in line with their pre-#Covid trend while real personal income has fallen below its trend on account of reduced fiscal support and higher inflation

via @EY_Parthenon

via @EY_Parthenon

As a result, the personal saving rate is now below its pre-Covid level (6.3% in Feb) and near its lowest level since 2013 – indicating households have started to dip into their excess savings

• • •

Missing some Tweet in this thread? You can try to

force a refresh