Chief Economist @EYnews, @EY_US, @EY_Parthenon. Previously Chief Economist @OxfordEconomics, @IHSMarkit. Father of 3. Husband of 1. 🇺🇸 & 🇧🇪. Views are mine

How to get URL link on X (Twitter) App

💡My key takeaways

💡My key takeaways

📊 Nonfarm business sector labor #productivity posted another solid advance in Q4 2023, +3.2%, as economic output +3.5% and hours worked increased a more modest +0.3%.

📊 Nonfarm business sector labor #productivity posted another solid advance in Q4 2023, +3.2%, as economic output +3.5% and hours worked increased a more modest +0.3%.

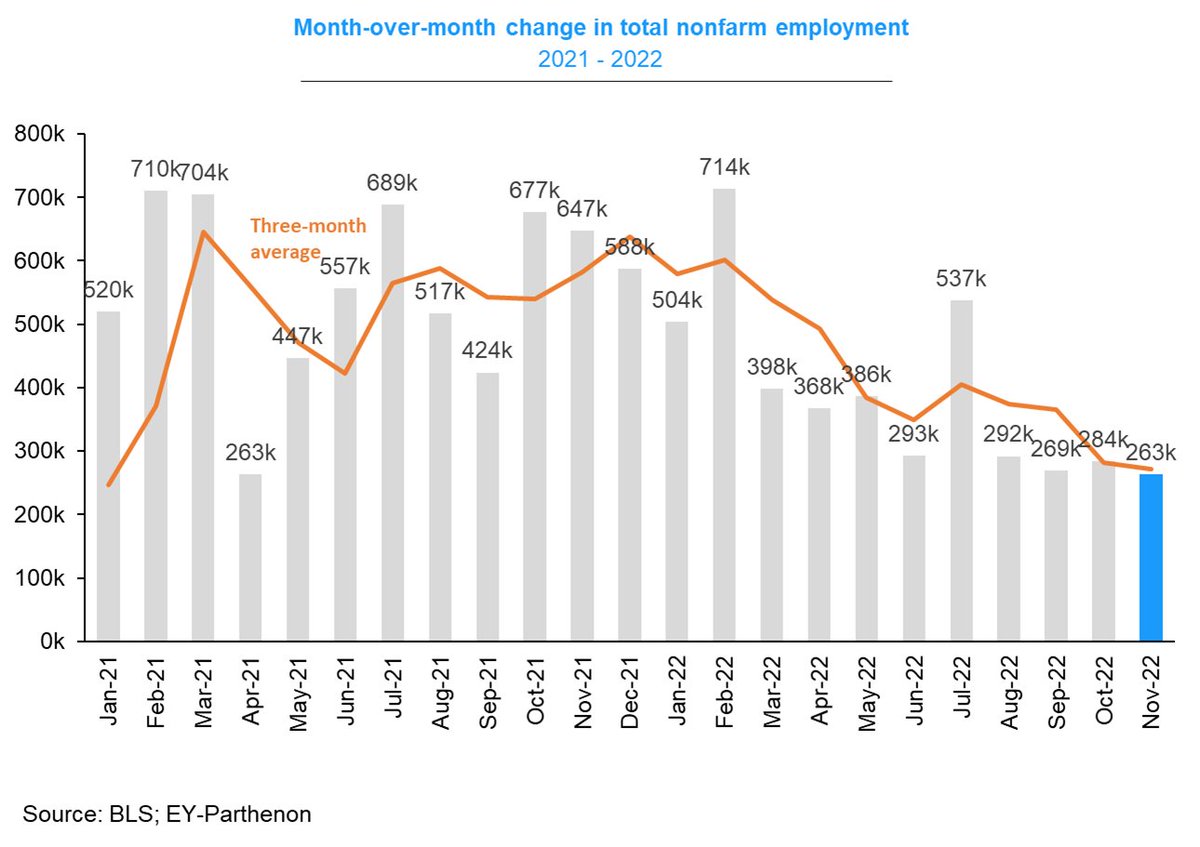

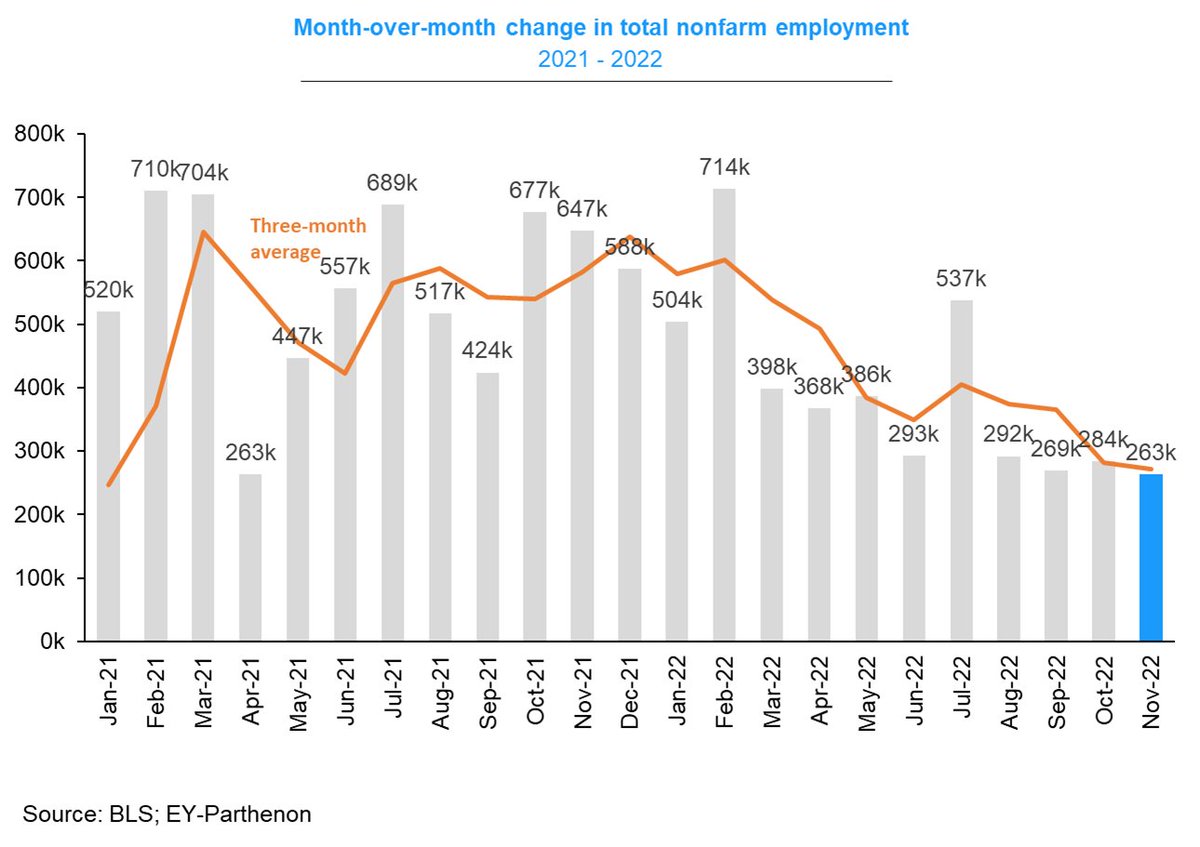

⚠️This isn't a retrenchment, but a slowdown for now

⚠️This isn't a retrenchment, but a slowdown for now

While the consensus has swung much more optimistic, we believe cooler days are on the horizon.

While the consensus has swung much more optimistic, we believe cooler days are on the horizon.

"Committed learning the right lessons from this episode and we will work to prevent these events from happening again. VC Barr's review underscores need to address our rules & supervisory practices to make for stronger & + resilient banking system & I'm confident we will do so"

"Committed learning the right lessons from this episode and we will work to prevent these events from happening again. VC Barr's review underscores need to address our rules & supervisory practices to make for stronger & + resilient banking system & I'm confident we will do so"

"We seem to be in a season of contradictions. Business is slowing, but in some ways, it isn’t. Prices for some commodities are stabilizing, but not for others. Some product shortages are over, others aren’t. Trucking is more plentiful, except when it isn’t..."

"We seem to be in a season of contradictions. Business is slowing, but in some ways, it isn’t. Prices for some commodities are stabilizing, but not for others. Some product shortages are over, others aren’t. Trucking is more plentiful, except when it isn’t..."

“All depositors of First Republic Bank will become depositors of JPMorgan Chase Bank, National Association, and will have full access to all of their deposits.”

“All depositors of First Republic Bank will become depositors of JPMorgan Chase Bank, National Association, and will have full access to all of their deposits.”

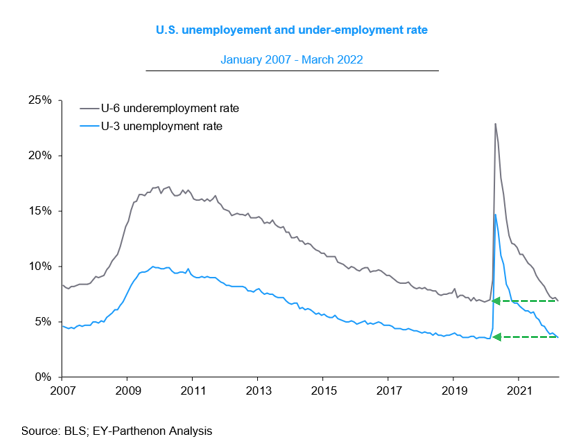

While jobs growth moderated in April, this report continues to show a very robust and historically tight labor market.

While jobs growth moderated in April, this report continues to show a very robust and historically tight labor market.

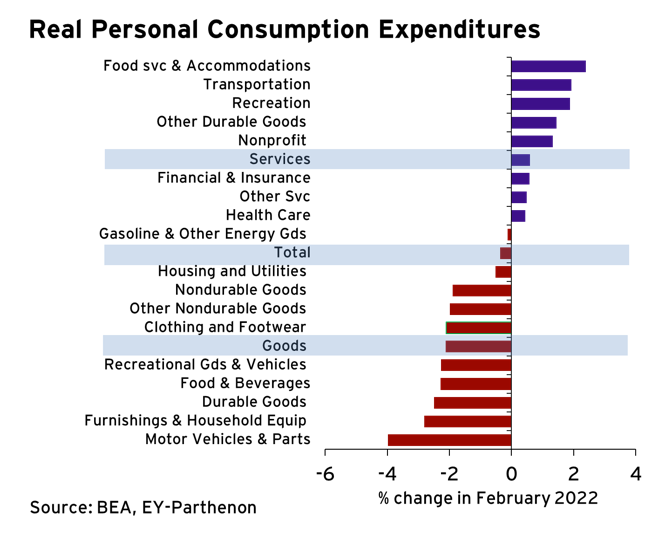

US consumer spending expenditures adjusted for inflation slipped 0.4% in February

US consumer spending expenditures adjusted for inflation slipped 0.4% in February

While the LFPR recovery is expected to undershoot the pre-pandemic rate (over 63%), the shortfall mostly reflects an aging population.

While the LFPR recovery is expected to undershoot the pre-pandemic rate (over 63%), the shortfall mostly reflects an aging population.

The $1.2tn #Infrastructure and Investment Jobs Act (IIJA) provides $550bn in new spending over the next 10 years.

The $1.2tn #Infrastructure and Investment Jobs Act (IIJA) provides $550bn in new spending over the next 10 years.

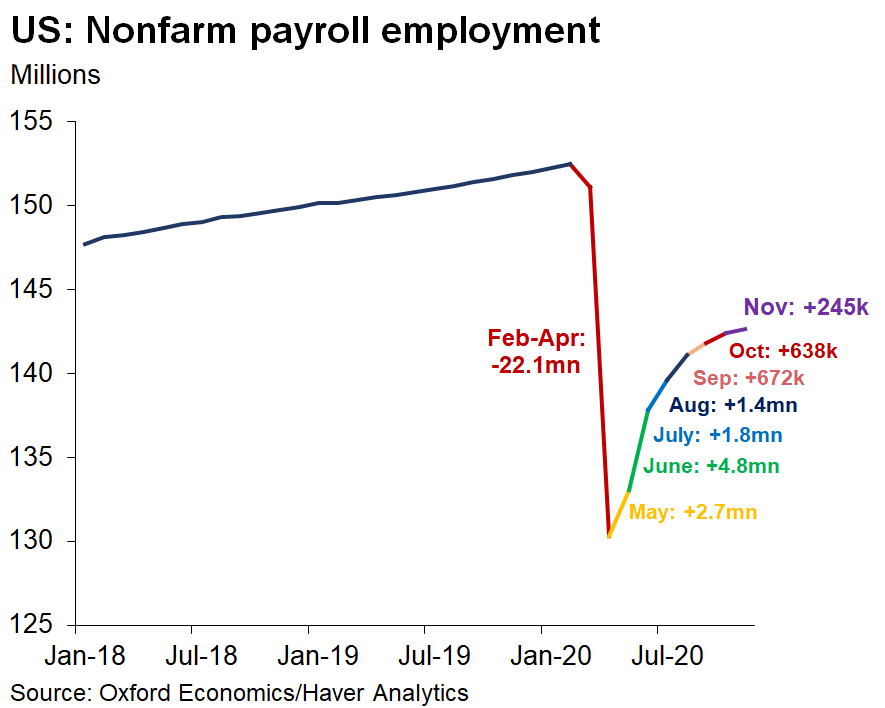

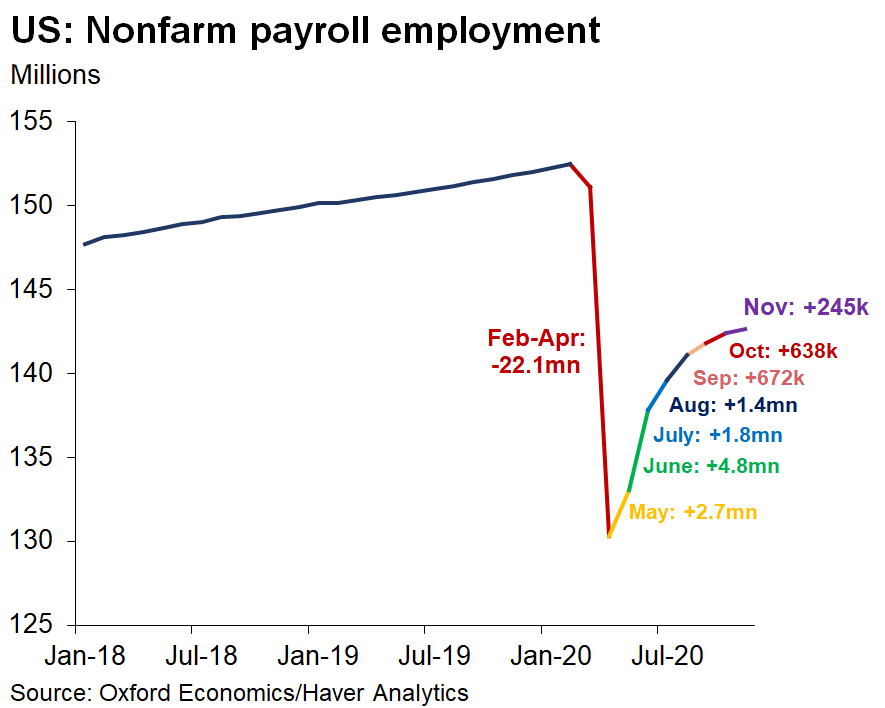

The US labor market is exiting the summer with much less momentum then when it entered with only a 235k advance in August

The US labor market is exiting the summer with much less momentum then when it entered with only a 235k advance in August

Many elements of positive news:

Many elements of positive news:

The strong Q3 #GDP performance gives a false impression of the economy’s true health.

The strong Q3 #GDP performance gives a false impression of the economy’s true health.

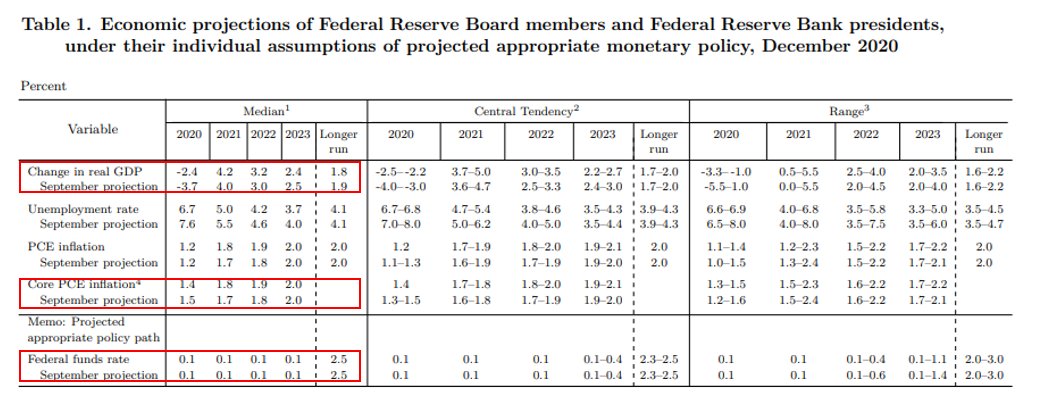

The latest economic projections:

The latest economic projections:

The "ok" news was that private payrolls +344k

The "ok" news was that private payrolls +344k

Initial signs of financial sector stress and expectations of rising delinquencies:

Initial signs of financial sector stress and expectations of rising delinquencies:

The strong #GDP performance gives a false impression of the economy’s true health.

The strong #GDP performance gives a false impression of the economy’s true health.

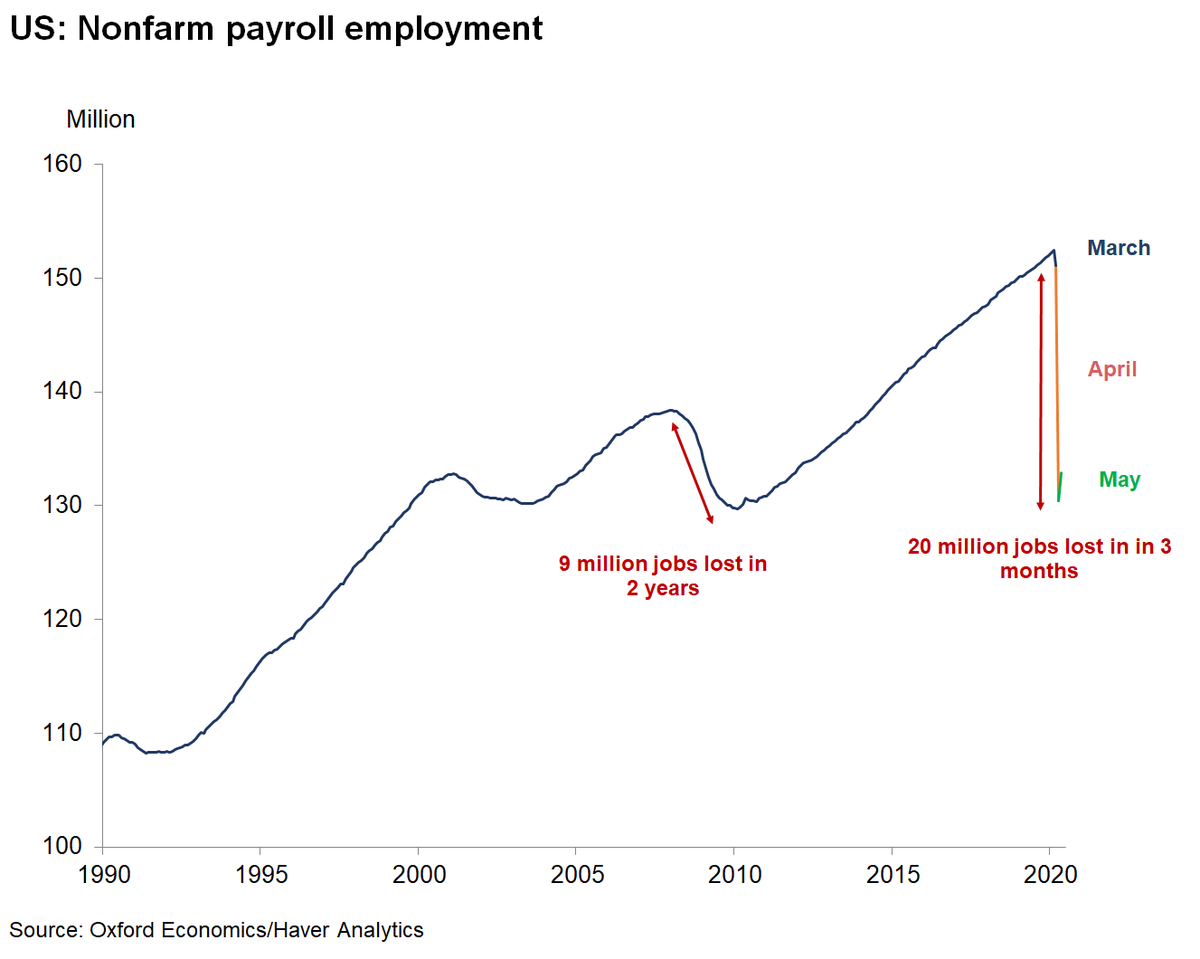

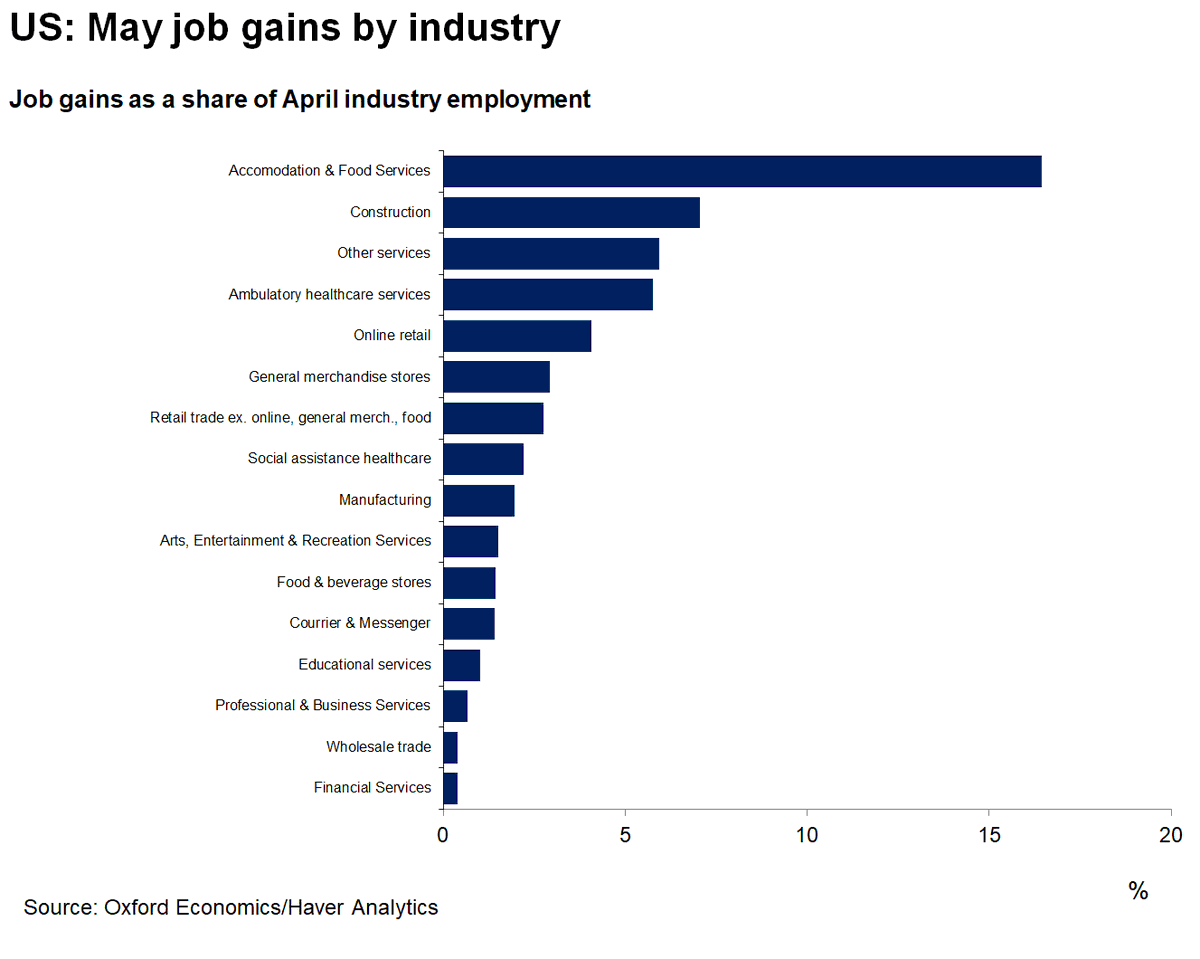

Encouraging 2.5mn job gains concentrated in:

Encouraging 2.5mn job gains concentrated in:

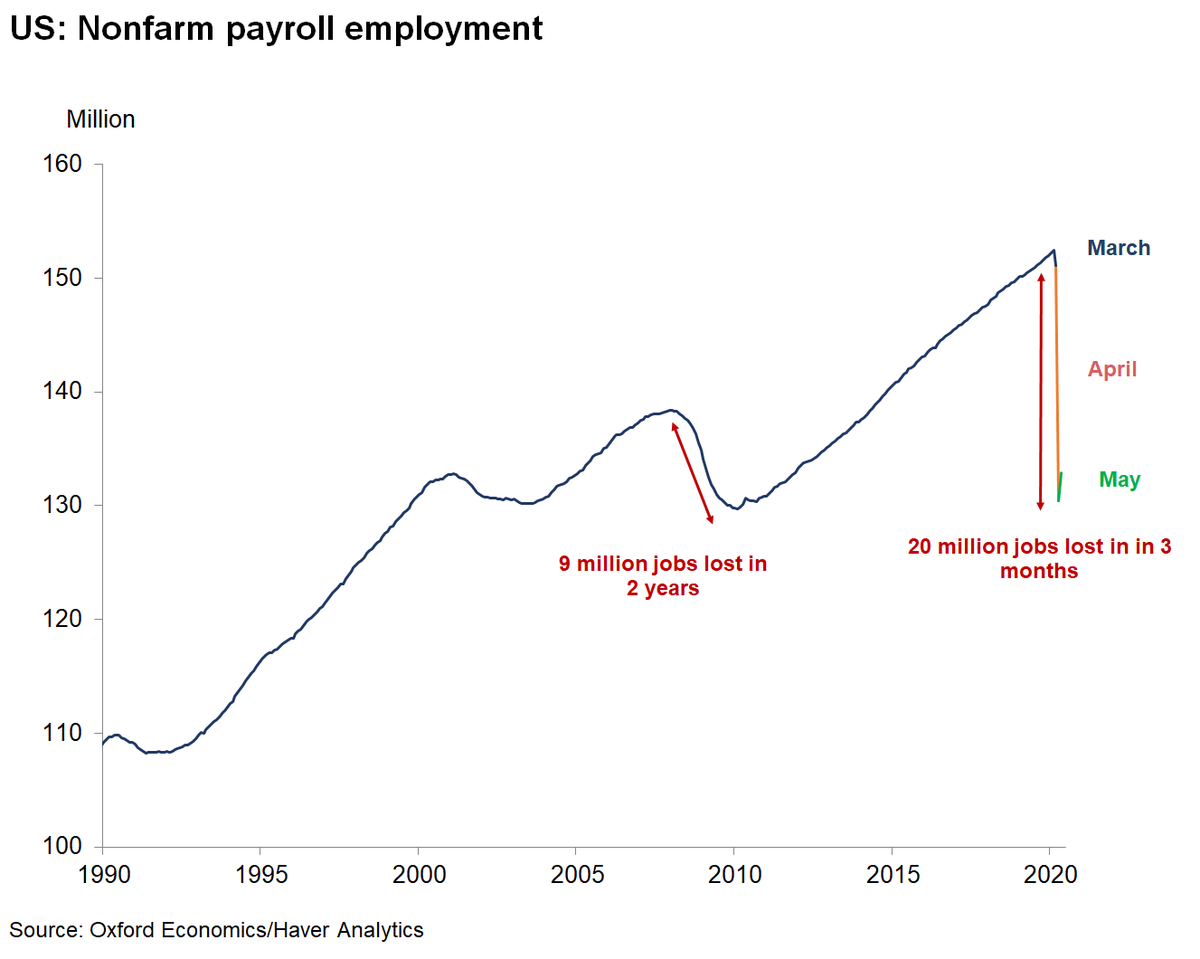

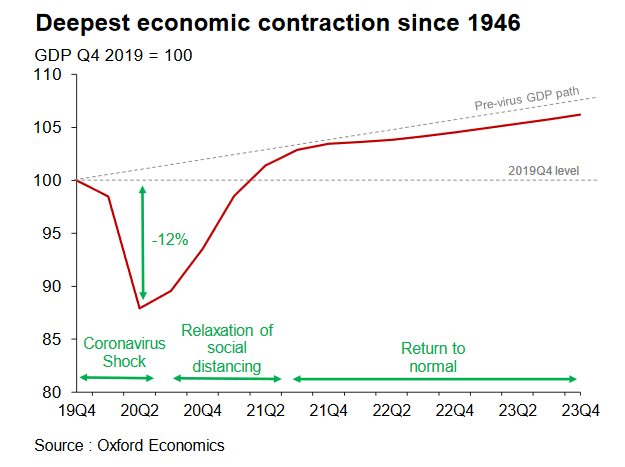

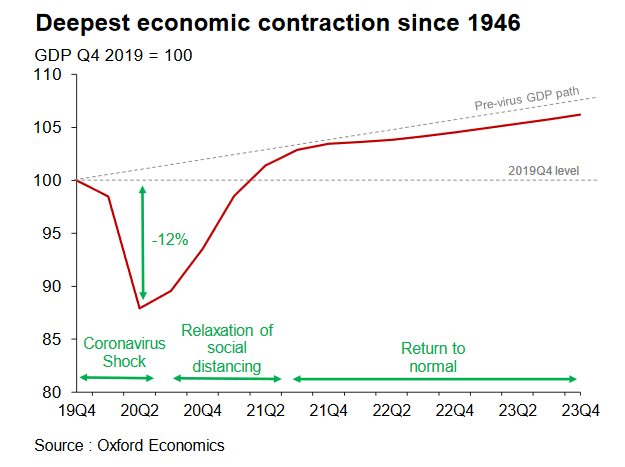

Putting the #COVID19 shock in the context of US #recessions of the last 100 years

Putting the #COVID19 shock in the context of US #recessions of the last 100 years