In 2021, Europe imported ~158 Bcm of Russian #natgas.

By 2027, that figure is (supposedly) going to be 0 Bcm.

How do the Europeans get that done? Time for a 🧵

By 2027, that figure is (supposedly) going to be 0 Bcm.

How do the Europeans get that done? Time for a 🧵

1/n Firstly, how does Europe plan to move away from Russian gas?

1. Moar US #LNG.

2. Increased energy efficiency.

3. More renewable energy deployment.

4. Healthy doses of optimism and idealism.

See @EU_Commission statement below.

ec.europa.eu/commission/pre…

1. Moar US #LNG.

2. Increased energy efficiency.

3. More renewable energy deployment.

4. Healthy doses of optimism and idealism.

See @EU_Commission statement below.

ec.europa.eu/commission/pre…

2/n Specifically, within the EU's statement is the commitment to increase LNG imports from the US by:

15 Bcm in 2022

50 Bcm by [2027]

Seems pretty doable? Until you actually dig into it.

15 Bcm in 2022

50 Bcm by [2027]

Seems pretty doable? Until you actually dig into it.

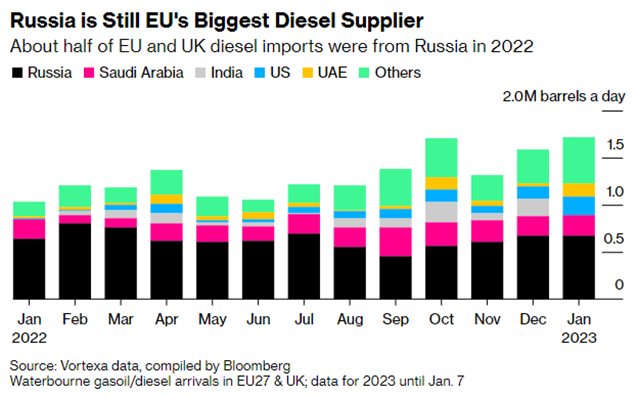

3/n This chart from @politico is old, but it helps paint the picture of just how f*cked Europe is.

Even if 100% of outbound US LNG cargoes flow to Europe, they will still have a supply deficit. Also, that won't happen.

Even if 100% of outbound US LNG cargoes flow to Europe, they will still have a supply deficit. Also, that won't happen.

5/n In February and Marc, 70-80% of outbound US LNG cargoes flowed to Europe. But, that's largely because #TTF (Dutch LNG settlement hub) has priced above #JKM.

That pricing relationship won't last. And, before long, US LNG cargoes will once again be heading to Asia.

That pricing relationship won't last. And, before long, US LNG cargoes will once again be heading to Asia.

6/n Europe doesn't seem to realize this yet, and has been dragging their feet on signing contracts. In the mean time, China has wasted no time snapping up spare #LNG capacity.

H/t @SergioChapa for data.

CC @SusanSakmar.

H/t @SergioChapa for data.

CC @SusanSakmar.

7/n Since early 2010s, thanks to fracking, the US has mostly been insulated from global gas price volatility. But not anymore.

Global natural gas markets are incredibly tight right now. And #HenryHub is riping - thanks to @DoombergT for the exhibit.

Global natural gas markets are incredibly tight right now. And #HenryHub is riping - thanks to @DoombergT for the exhibit.

https://twitter.com/DoombergT/status/1512205618622476295?s=20&t=dRAE876pn9BrASoEaiNURg

8/n Global gas demand continues to rise. And #LNG exports are struggling to keep pace.

This is a long-term problem. And it's not going away anytime soon.

h/t @SStapczynski

This is a long-term problem. And it's not going away anytime soon.

h/t @SStapczynski

9/n Separately, it seems that American investors are taking for granted the likelihood that domestic #LNG projects secure financing. Chariff Soukhi ( $TELL) said something about financing being the easiest thing he's done in his life.

And yet, no financing! 👀

And yet, no financing! 👀

10/10 In summary: it's going to be an interesting decade.

Watch as the #energypolicy pendulum swings back towards security, and away from #decarbonization.

Separately - follow @TwainsMustache for more commentary on energy security.

Watch as the #energypolicy pendulum swings back towards security, and away from #decarbonization.

Separately - follow @TwainsMustache for more commentary on energy security.

• • •

Missing some Tweet in this thread? You can try to

force a refresh