#WatfordFC 2020/21 financial results covered a season when they finished 2nd in the Championship, securing immediate promotion back to the Premier League. Head coach Vladimir Ivic was replaced by Xisco, since succeeded by Claudio Ranieri and Roy Hodgson. Some thoughts follow.

Despite impact of relegation and COVID, #WatfordFC pre-tax loss reduced from £36m to £22m, even though revenue fell £63m (52%) from £120m to £57m, as profit on player sales shot up from £18m to £56m and expenses were cut £35m (21%). Other income included £2.5m insurance claim.

Main driver of #WatfordFC revenue decrease was broadcasting, down £45m (48%) from £95m to £50m, as TV deal is much more lucrative in the Premier League, though also big falls in commercial, down £13m (76%) from £17m to £4m, and match day, down £5.7m (78%) to £1.6m.

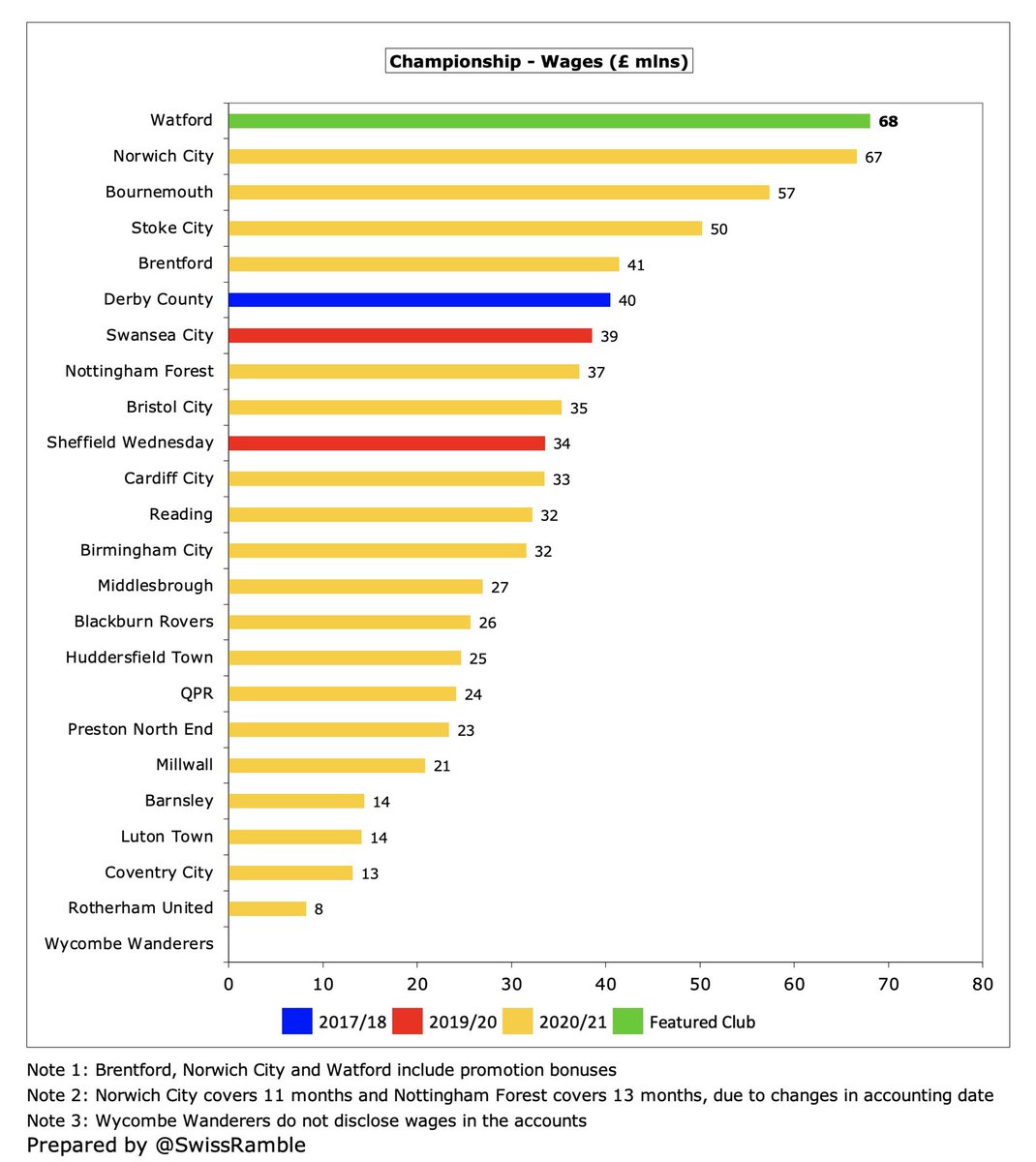

Following relegation, #WatfordFC cut costs: wages fell £28m (29%) from £96m to £68m, despite including hefty promotion bonuses, while player amortisation & impairment decreased £4m (10%) to £36m and other expenses were £5m (18%) lower. Net interest payable down £0.9m to £5.4m.

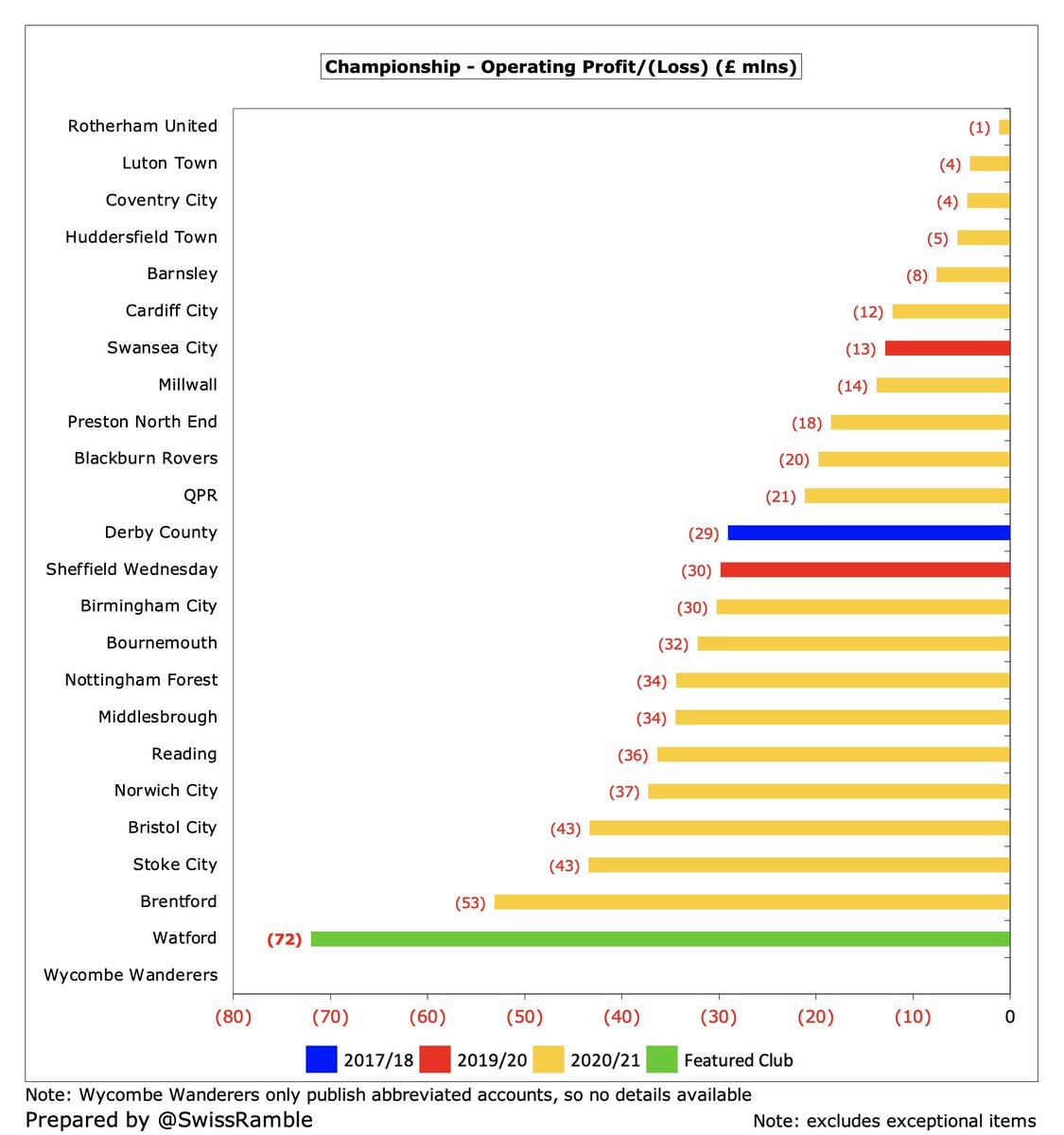

Even though #WatfordFC narrowed their loss to £22m, it was still one of the worst in the Championship, only “beaten” in 2021 by Bristol City £38m, Reading £36m & #Boro £31m. Also worth noting that the other clubs relegated from PL in 2020 posted profits: #NCFC £21m & #AFCB £17m.

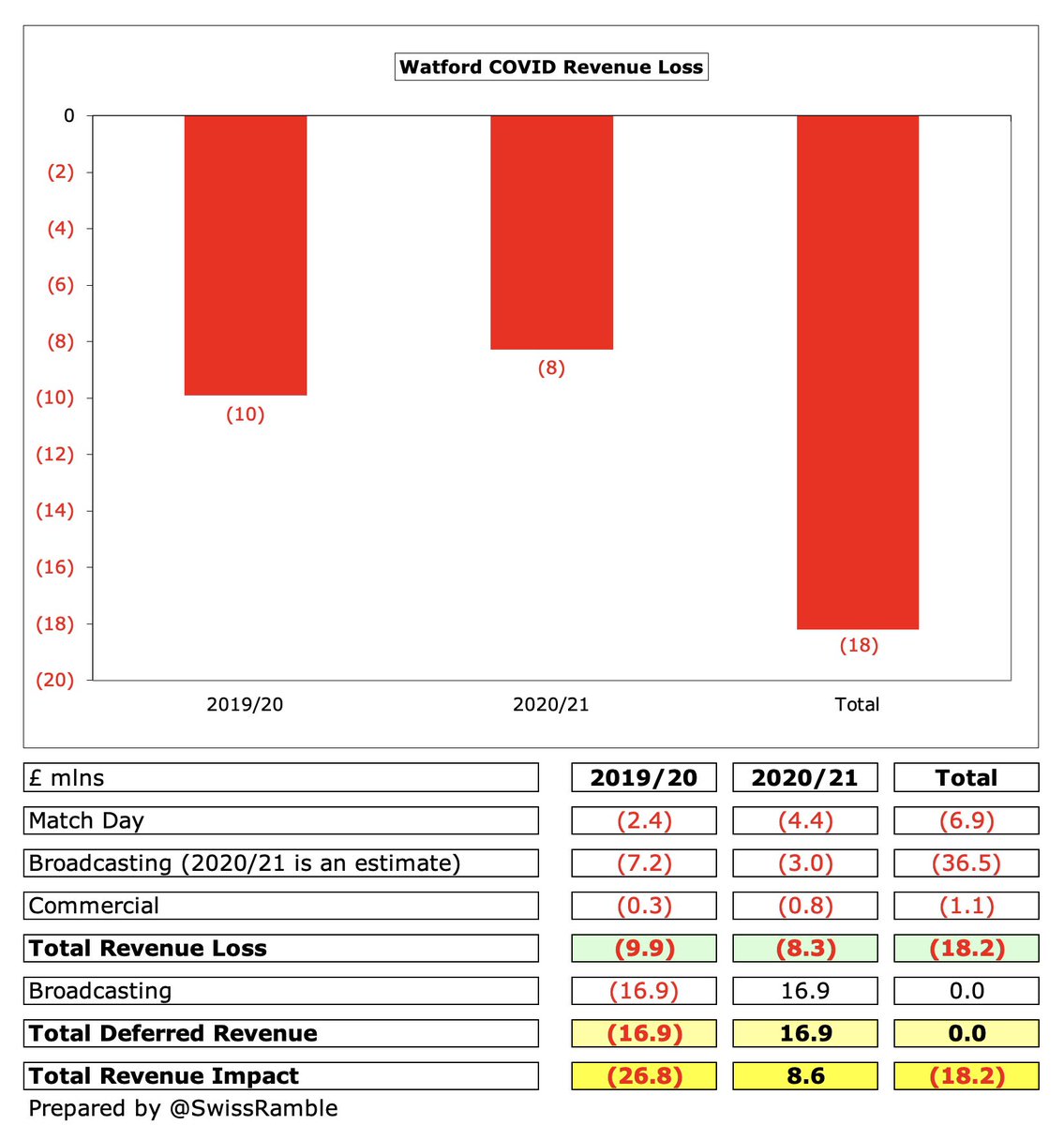

#WatfordFC figures were hit by COVID, though 2021 revenue loss only £8.3m (club: match day £4.4m, commercial £0.8m; estimate: TV rebate £3m), which makes £18m in last 2 years. Furthermore, 2021 boosted by £17m of deferred TV revenue for games played after 2020 accounting close.

#WatfordFC significantly benefited from £56m profit on player sales, up from £18m in 2020, mainly from Doucouré to #EFC, Deulofeu & Pereyra to sister club Udinese, Estupinan to Villarreal & Suarez to Granada. Around the same as the other relegated clubs, #NCFC £60m & #AFCB £56m.

#WatfordFC have now reported losses in three out of the last four seasons, even though they spent all but the last one in the Premier League. Their total loss over this period amounted to £79m. Overall, they had broken-even in the preceding 6-year period.

One reason for #WatfordFC 2021 lower loss was a reduction in termination payments for sacked managers, as they only paid out £2.2m to Nigel Pearson and Vladimir Ivic, compared to £6.7m for Javi Gracia and Quique Sanchez Flores. This season will include pay-off to Claudio Ranieri.

#WatfordFC have become more reliant on player sales, making £121m profit in last 5 years, compared to only £23m in preceding 5-year period. This season is much lower with only £9m after year-end, mainly Hughes to #CPFC, though the likes of Sarr & Dennis would generate good money.

#WatfordFC operating loss (i.e. excluding player sales and interest) increased from £47m to £72m, down from just £6m two years ago. Very few clubs manage to make operating profits, but this is not only Watford’s worst ever performance, but is the highest in the 2021 Championship.

#WatfordFC figures should be better this season after promotion to the Premier League, as was the case with #SUFC, #NCFC and #LUFC, but this is not guaranteed, as revenue increase is sometimes wiped out by higher expenses – see #FFC and #AVFC in 2019/20.

#WatfordFC £57m revenue is £91m (61%) lower than their £148m peak in 2019, i.e. pre-pandemic in the Premier League. Even with the benefit of parachute payments, broadcasting has dropped £69m, while commercial and match day are down £14m and £8m respectively.

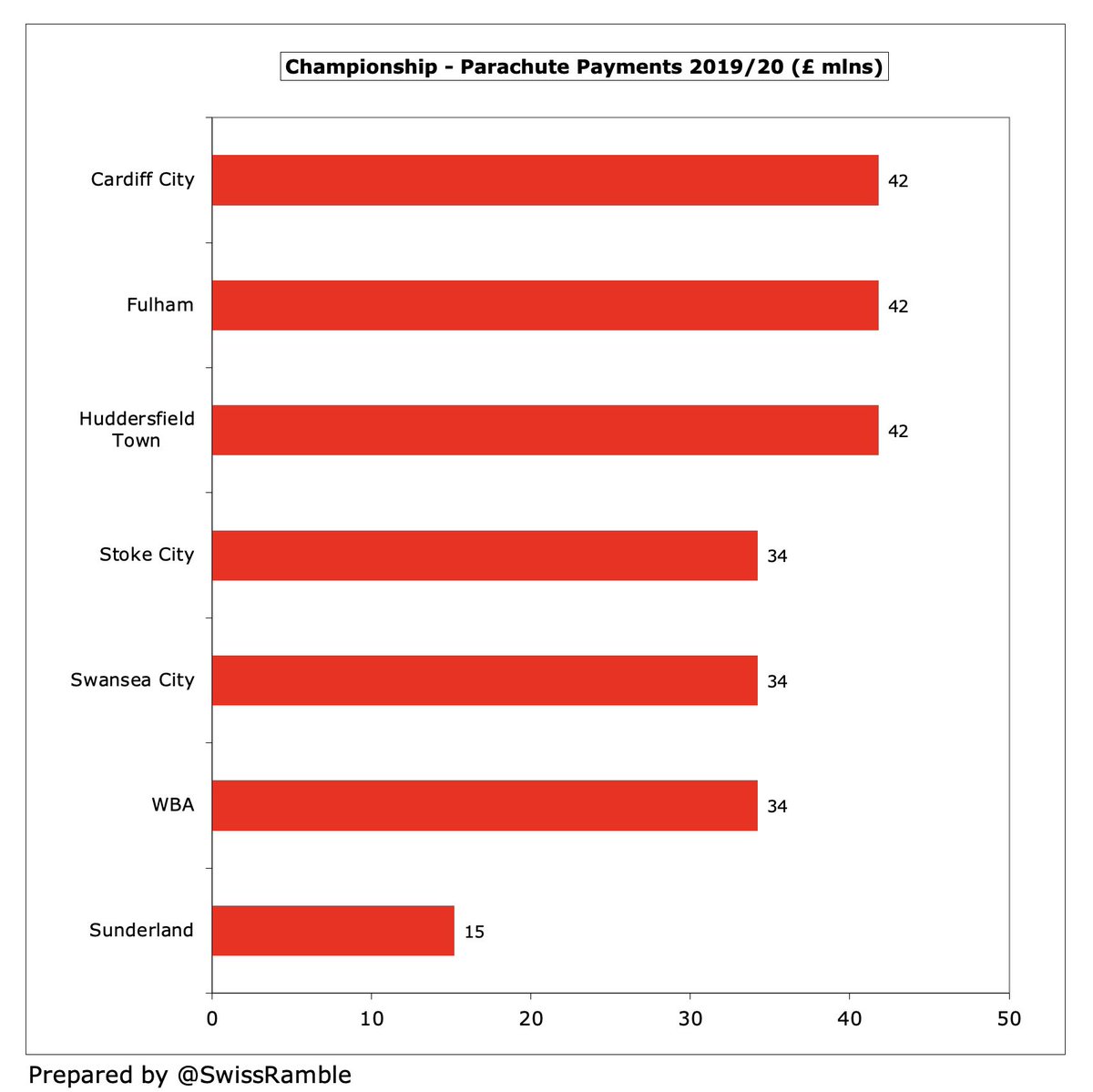

Despite the fall, #WatfordFC £57m revenue was 3rd highest in the Championship, only below the other clubs relegated with them in 2019/20: #AFCB £72m and #NCFC £57m. Clubs with parachute payments from the Premier League have a clear financial advantage.

Parachute payments are so significant that they make it difficult for other clubs to compete. Unfortunately, the Premier League has not published details of 2020/21 payments, but in 2019/20 a relegated club received £42m in year one, £34m in year two and £15m in year three.

Following relegation, #WatfordFC broadcasting income fell £45m (48%) from £95m to £50m, though damage limited by deferred revenue from 6 games played after June 2020 accounting close. Most Championship clubs earn £8-10m, but there is a massive gap to clubs with parachutes.

If #WatfordFC end up being relegated this season after just one campaign in the top flight, they would only get 2 years of parachutes (instead of the usual 3 years). Clearly, they would still hold an advantage over most others, but the pressure would be on.

#WatfordFC match day income fell £5.7m (78%) from £7.3m to £1.6m, as all home games were played behind closed doors except two with restricted capacity (less than 2,000 fans), though many fans still renewed their season tickets. Down from £9.2m two years ago.

#WatfordFC average attendance in 2019/20 in the Premier League (for games played with fans) was 20,836, which was around 4,000 (25%) higher than the last time they were in the Championship in 2014/15. The club is reviewing options to develop the stadium to increase capacity.

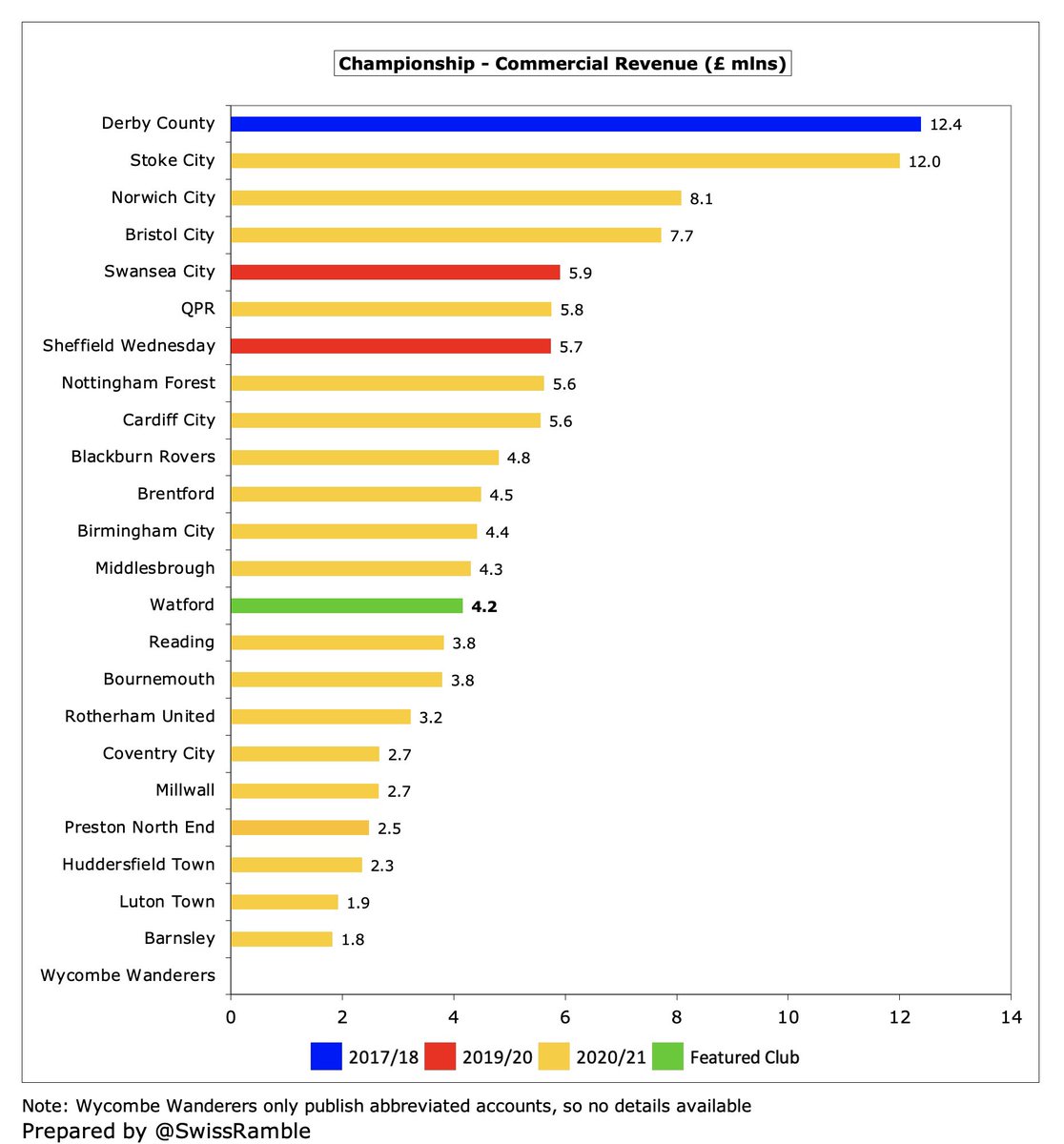

#WatfordFC commercial revenue dropped a considerable £13.2m (76%) from £17.4m to £4.2m, as relegation and the pandemic took their toll. This was in the bottom half of the Championship, only around a third of Stoke City’s £12m.

#WatfordFC shirt sponsor Sportbet.io has been replaced by online betting company Stake from the 2021/22 season in a deal reportedly worth £5m a year, including Dogecoin as sleeve sponsor. In 2020/21 Kelme replaced Adidas as kit supplier in 4-year deal worth £2.5m.

#WatfordFC booked £2.9m other operating income, including £2.5m business interruption insurance claim. Unlike the Hornets, some clubs also report player loans here, e.g. #AFCB included £1.8m in their £5.0m.

#WatfordFC wage bill decreased £28m (29%) from £96m to £68m, despite including hefty promotion bonuses, the club’s lowest since 2016. Termination payments to former coaches fell from £6.7m to £2.2m, so underlying wages dropped £24m (26%) from £90m to £66m.

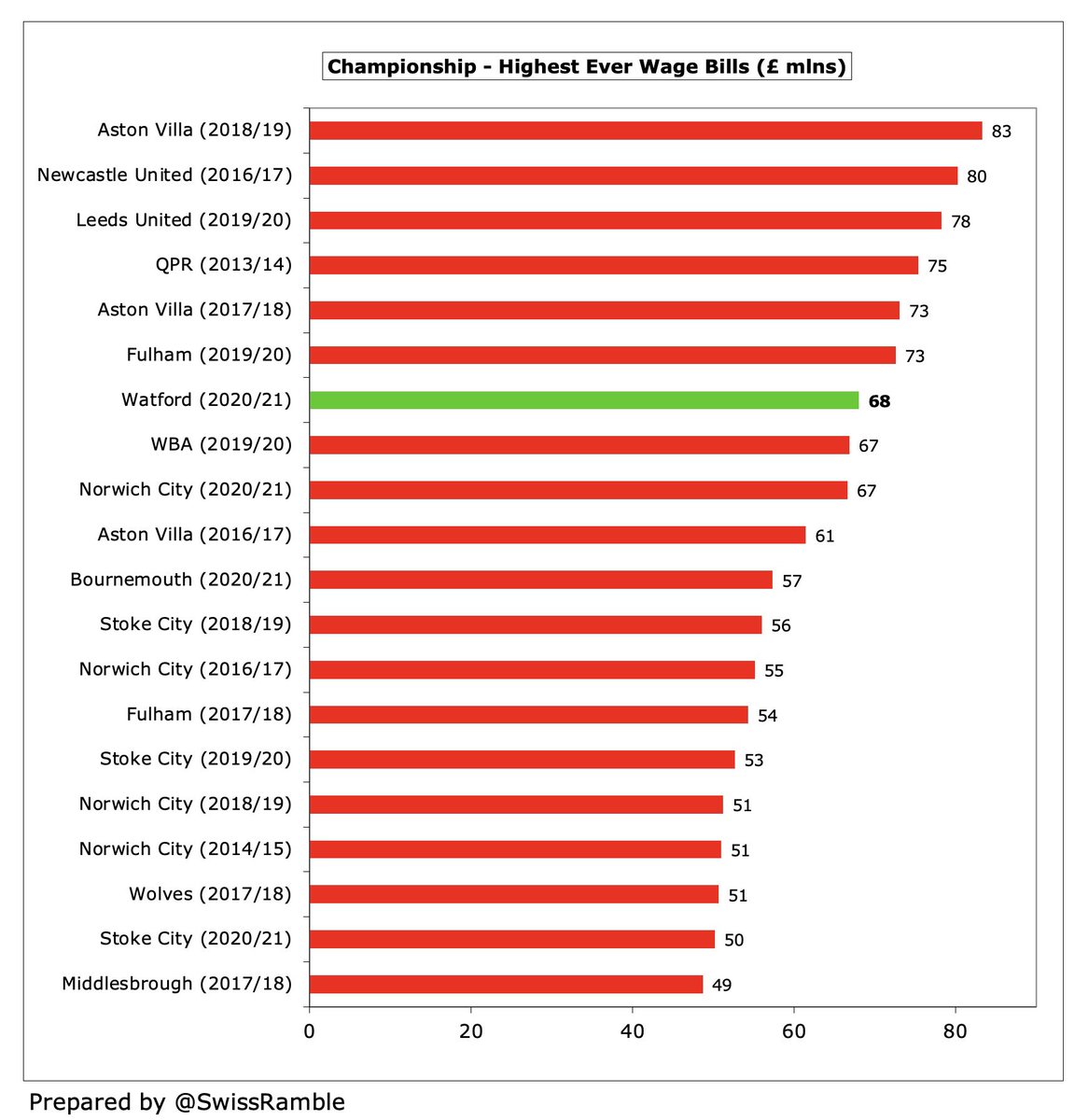

#WatfordFC £68m wage bill was the highest in the Championship in 2020/21, ahead of #NCFC £67m, #AFCB £57m and Stoke City £50m. In fact, this was the 7th highest ever in this division, though a fair way below #AVFC £83m in 2018/19.

As a result of the revenue decrease, #WatfordFC wages to turnover ratio increased (worsened) from 80% to 119%, though this was not too bad in the Championship, where most clubs have ratios above 100% (with no fewer than 5 above 200% in 2020/21).

#WatfordFC total directors remuneration fell slightly from £953k to £934k, but this was still 3rd highest in the Championship. Payment to the highest paid director, presumably chairman and CEO Scott Duxbury, was basically unchanged at £931k, i.e. no relegation clause here.

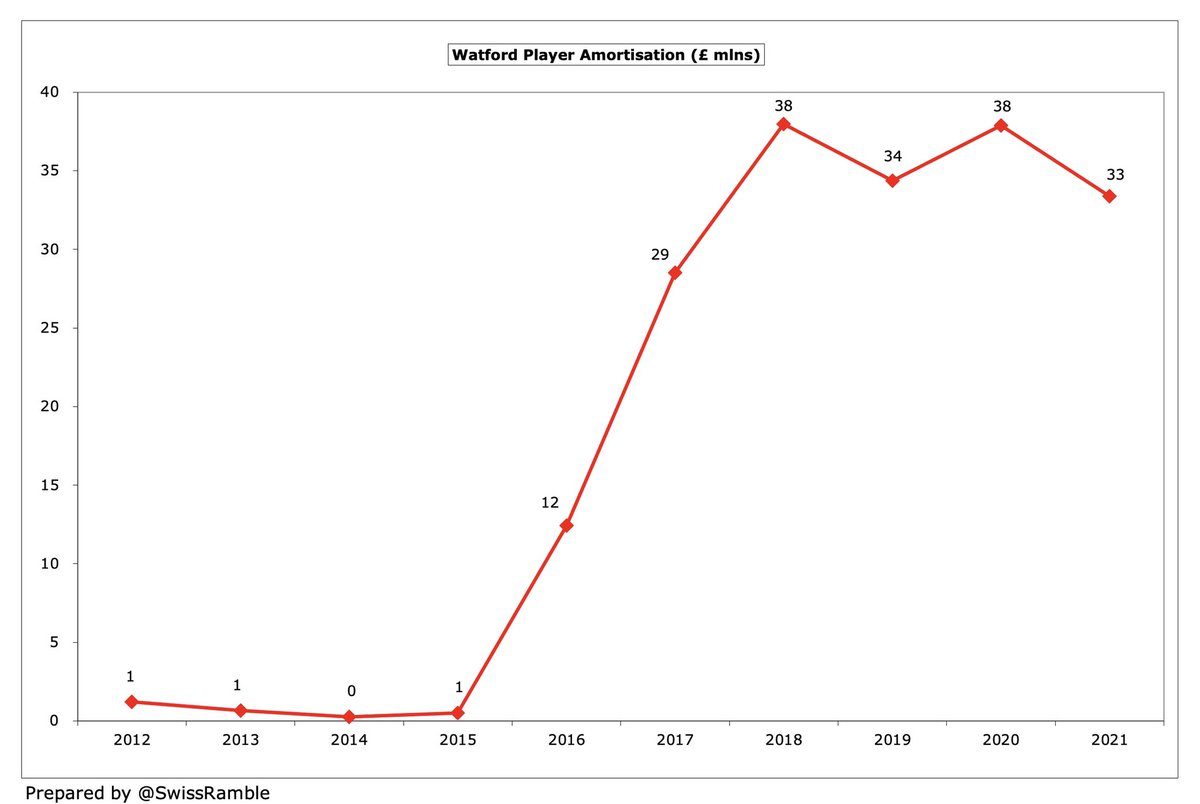

#WatfordFC player amortisation, the annual charge to expense transfer fees over a player’s contract, fell £5m (12%) from £38m to £33m, the second highest in the Championship, only below #AFCB £36m. Also booked £2.5m player impairment to reduce player values.

#WatfordFC other expenses were cut £5m (18%) from £27m to £22m, partly due to the reduced cost of staging games without fans. Club said this was due to “finding efficiencies in our operations without any job losses.”

#WatfordFC spent £21m on player purchases, including Imran Louza from Nantes and Emmanuel Dennis from Club Brugge. Although this was a large reduction from prior year’s £66m in the Premier League, this was actually 3rd highest in the Championship, just behind Brentford and #NCFC.

#WatfordFC had £324m gross spend in the transfer market in the last 6 years (net spend £145m), though most of that (£216m) came in the 3 years between 2016 and 2018. However, per the accounts, the outlay since year-end is only £11m.

#WatfordFC have spent a lot on agent fees. An FA report for the 12 months to January 2022 revealed their £13m expenditure was the highest in the Premier League outside the Big Six, mainly on Arnaud “Mogi” Bayat, named by Belgian authorities as a suspect in a fraud investigation.

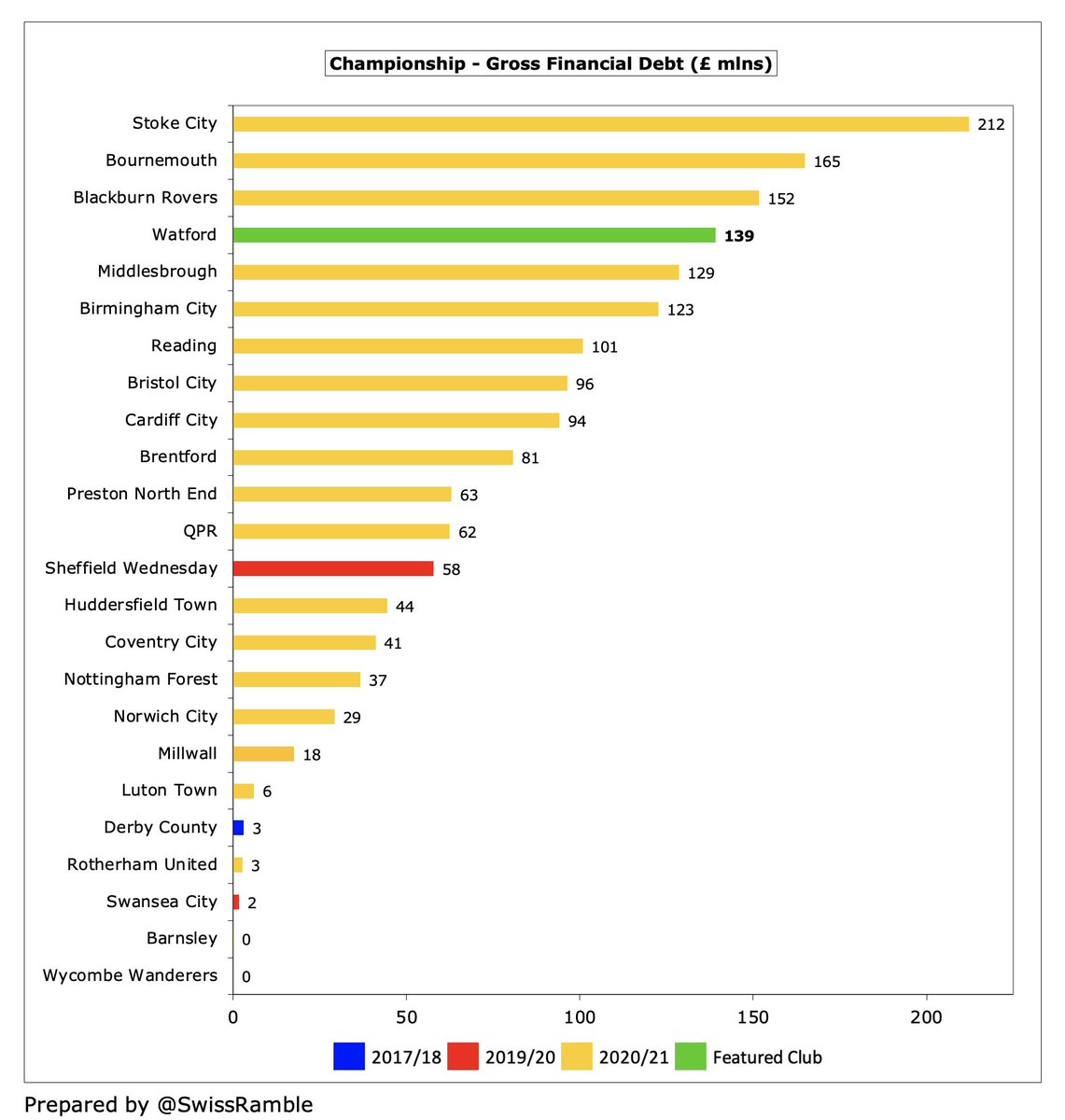

#WatfordFC gross debt rose £36m from £103m to £139m, including £72m from the parent company and £65m external loans (Close Leasing £41m and Macquarie Bank £24m). Debt is more than ten times as much as it was in 2015, when it was only £13m.

Following the increase, #WatfordFC £139m gross debt was the 4th largest in the Championship, only below Stoke City £212m, #AFCB £165m and Blackburn Rovers £152m. Since year-end, media are reporting a new £50m Macquarie Bank loan has replaced the £65m external loans.

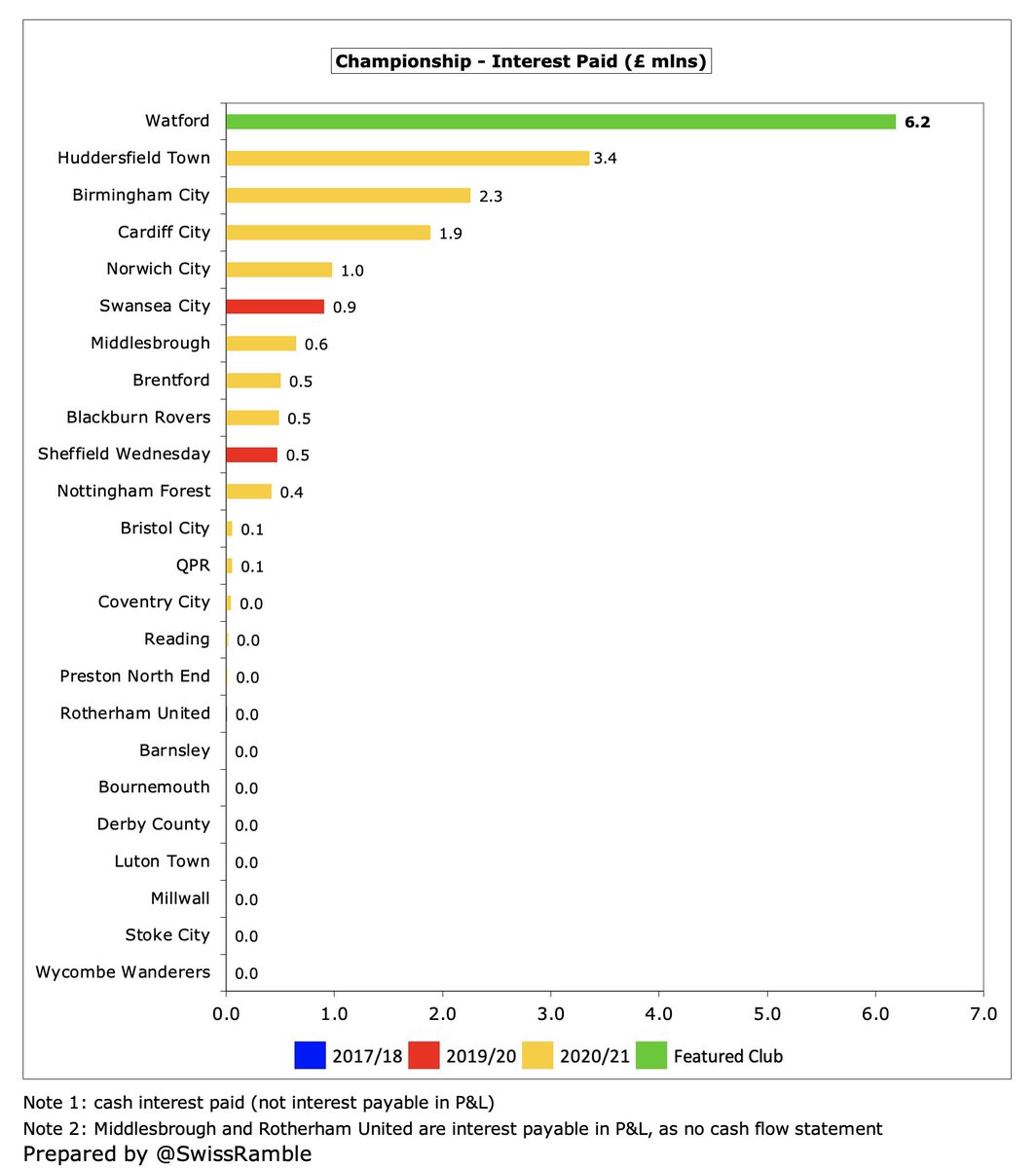

#WatfordFC interest paid fell from £9.2m to £6.2m, though this was easily the most in the Championship, around twice as much as the next highest, #HTAFC £3.4m. The new bank loan is apparently at LIBOR + 5.35%, which is better than the previous loans.

#WatfordFC cut transfer debt from £79m to £62m, the club’s lowest since 2016, but still comfortably the highest in the Championship, ahead of #AFCB £45m and #NCFC £23m. Receivables increased from £15m to £40m, so net payables fell from £64m to £23m.

Interestingly, Pozzo’s Udinese owe #WatfordFC £24m in transfer fees, while the Hornets owe the Italian club £8m, meaning a net receivable of £16m. There have been quite a few transactions between the two clubs over the past few years.

A legal case relating to a late payment to Rennes for Ismaila Sarr‘s transfer caused consternation among fans, as #WatfordFC said the delay was due to “significant disruption and financial difficulties”, though they would argue that these have since been resolved by promotion.

#WatfordFC had £44m negative cash flow after adding back non-cash movements to £72m operating loss. Boosted by £20m from player trading (sales £49m, purchases £29m), they spent £6m on interest payments, £5m owner loan repayments and £1m capex. Funded by £56m new bank loans.

As a result, #WatfordFC net cash inflow was £19m, which reduced the overdraft by £14m and increased the cash balance to £5m. This was pretty good for the Championship, where 14 clubs had less than £3m in the bank account.

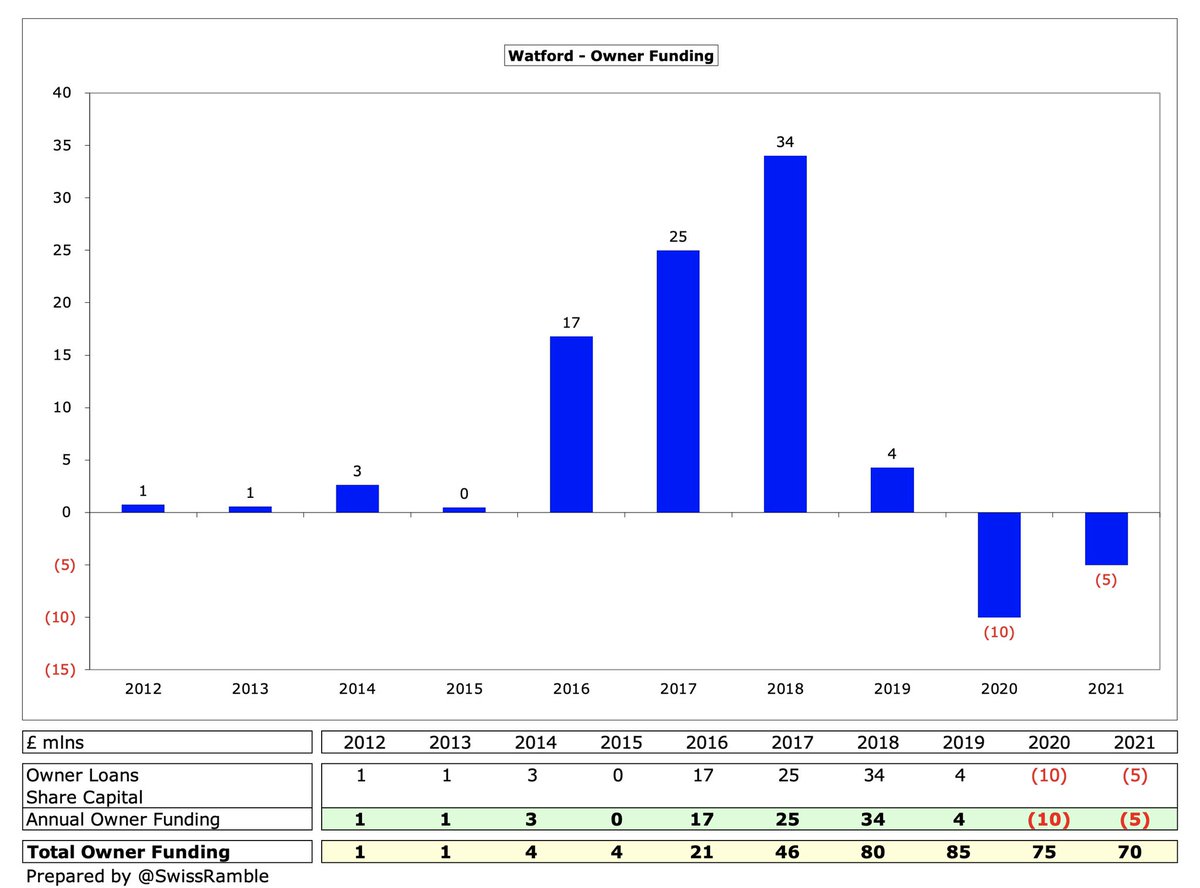

In the last decade #WatfordFC had £196m available cash: £70m owner loans, £65m from operations and £62m bank loans. They spent £113m on new players (net) and £48m on infrastructure with £30m going on interest payments.

#WatfordFC owners have provided £70m funding in the last decade, though in the last two years they were repaid £15m. This was fairly low for the Championship, far below the likes of QPR £283m, Stoke City £195m, Cardiff City £176m and Bristol City £175m.

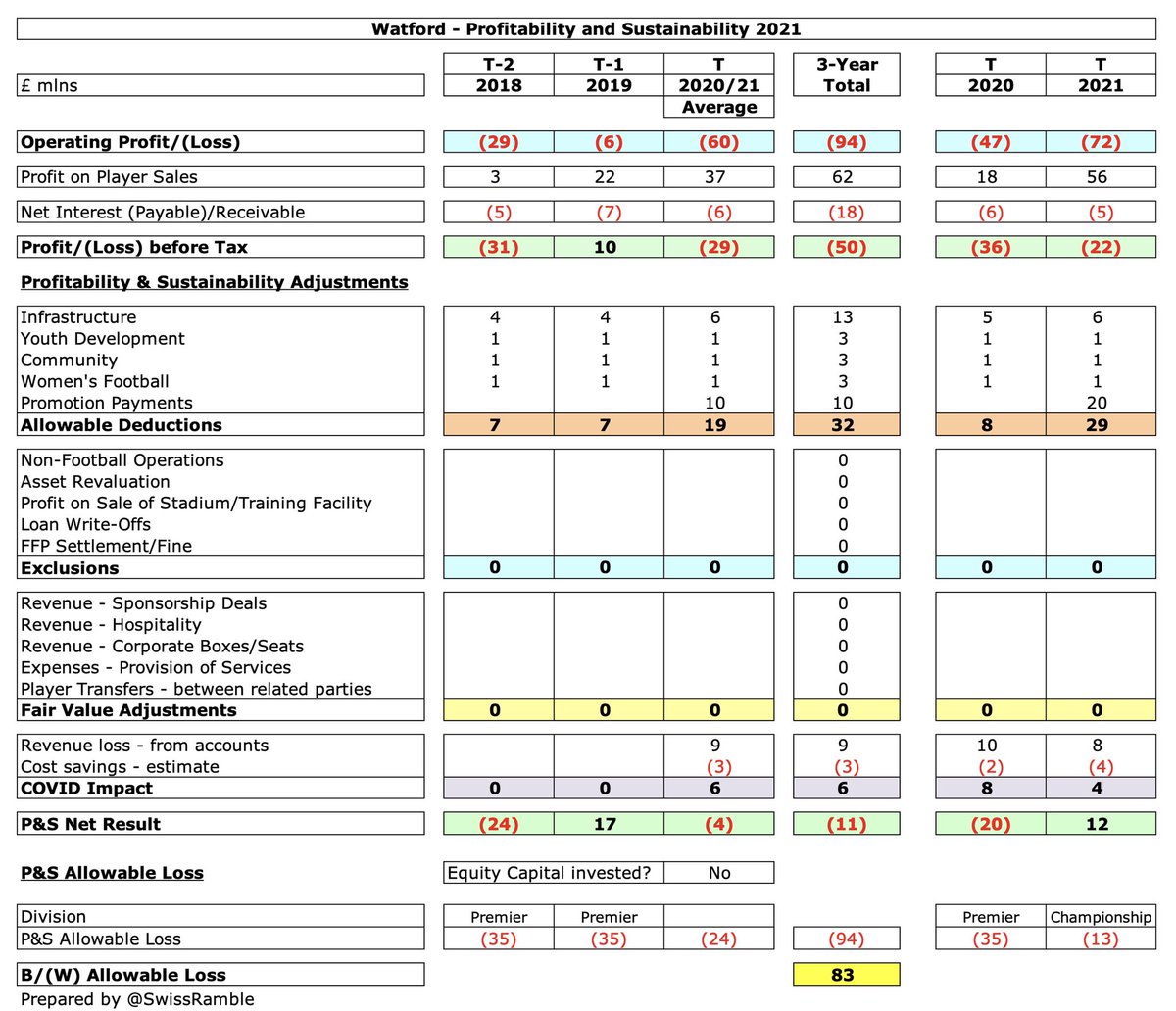

Despite the large losses in the last two years, #WatfordFC are fine in terms of Profitability and Sustainability rules, as they are well within the limit over the 3-year monitoring period after taking into consideration allowable deductions, promotion bonus and COVID impact.

#WatfordFC did well to immediately bounce back to the Premier League in 2020/21, though it looks like they are now facing relegation to the Championship. Some questions about their debt (and interest payments), transfer debt and agent fees, which are all on the high side.

• • •

Missing some Tweet in this thread? You can try to

force a refresh