Understanding Lifestyle Creep - A Thread 🧵

Lifestyle inflation, is overspending after your income increases.

It can occur over years and difficult to spot unless

you are on top of your budget

#personalfinance #FinancialFreedom #financialplanning #lifestyle

Lifestyle inflation, is overspending after your income increases.

It can occur over years and difficult to spot unless

you are on top of your budget

#personalfinance #FinancialFreedom #financialplanning #lifestyle

Basically increase in spending after receiving a raise instead of saving the additional income.

Or if monthly loan payment got over & extra cash now not saved but spent on non essential items

Once this takes over, new cash gets spent as fast as — or faster than — it comes in.

Or if monthly loan payment got over & extra cash now not saved but spent on non essential items

Once this takes over, new cash gets spent as fast as — or faster than — it comes in.

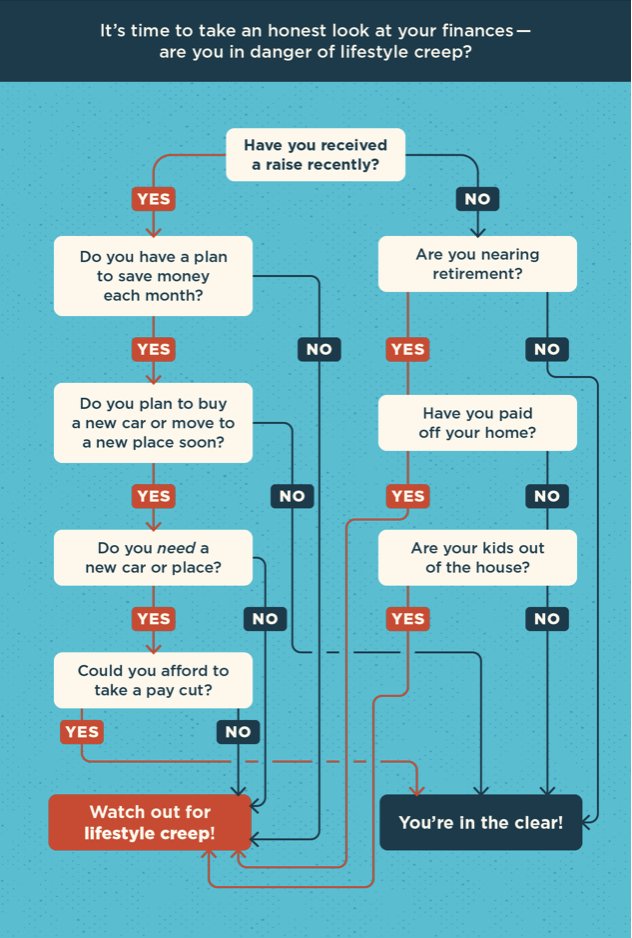

It's normal for lifestyle spending to increase when we get a better income. We want to treat yourself after working hard to make that money. Where it becomes problematic is when the increase in lifestyle outpaces the increase in income.

Lifestyle creep can affect everyday earners as much as more affluent households.

Anyone can be convinced that they need to eat out most nights because they can't find the time to cook or that their new job requires them to buy new clothes every now & then.

Anyone can be convinced that they need to eat out most nights because they can't find the time to cook or that their new job requires them to buy new clothes every now & then.

Signs of lifestyle creep

1. Stagnant Savings.

2. Spending increased in many areas of life - costlier vacations, costlier cars, costlier gadgets

3. No Budgeting

4. You do not feel in control of finances. Living pay cheque to pay cheque

1. Stagnant Savings.

2. Spending increased in many areas of life - costlier vacations, costlier cars, costlier gadgets

3. No Budgeting

4. You do not feel in control of finances. Living pay cheque to pay cheque

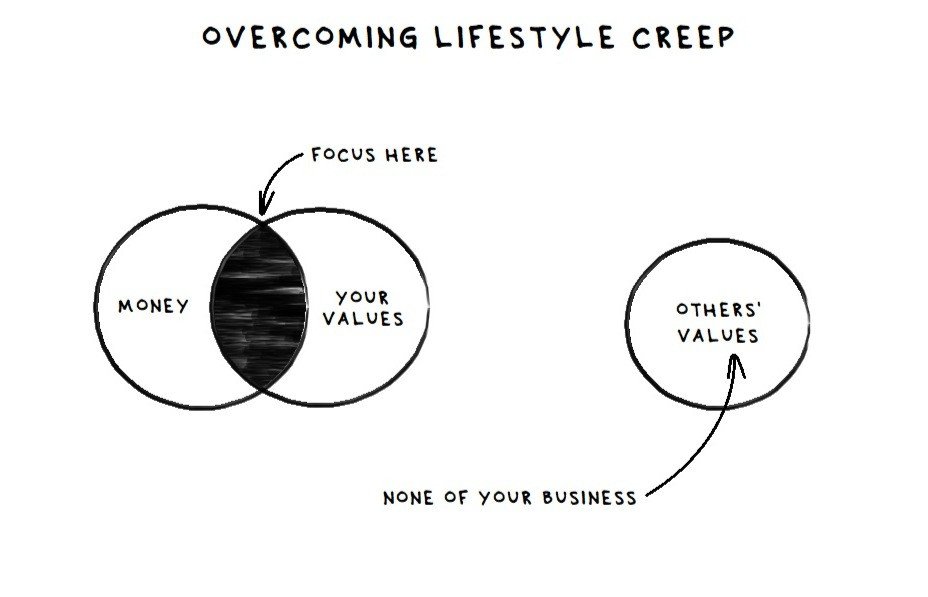

Prevention

1. Make a Budget.

2. Ear Mark money for saving. Not an absolute number, but % of income, which should gradually increase.

3. Lock in Emergency Funds

4. Curtial Consumer Debt

1. Make a Budget.

2. Ear Mark money for saving. Not an absolute number, but % of income, which should gradually increase.

3. Lock in Emergency Funds

4. Curtial Consumer Debt

DO NOT STRESS OVER SMALL INDULGENCES AND INFREQUENT SMALL SPLURGES. Y

OU ARE EARNING FOR NOW ALSO. BUT NEED TO SECURE YOUR FUTURE TOO

RT if you like the thread.

OU ARE EARNING FOR NOW ALSO. BUT NEED TO SECURE YOUR FUTURE TOO

RT if you like the thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh