Can the European Union ban Russian gas imports?

Answer: Faster than you might expect, but it comes down to great leadership & setting the right priorities!

Let's go - Part 1 of a total of 25

1/n 🧵

#UkraineRussiaWar #EuropeanUnion

Answer: Faster than you might expect, but it comes down to great leadership & setting the right priorities!

Let's go - Part 1 of a total of 25

1/n 🧵

#UkraineRussiaWar #EuropeanUnion

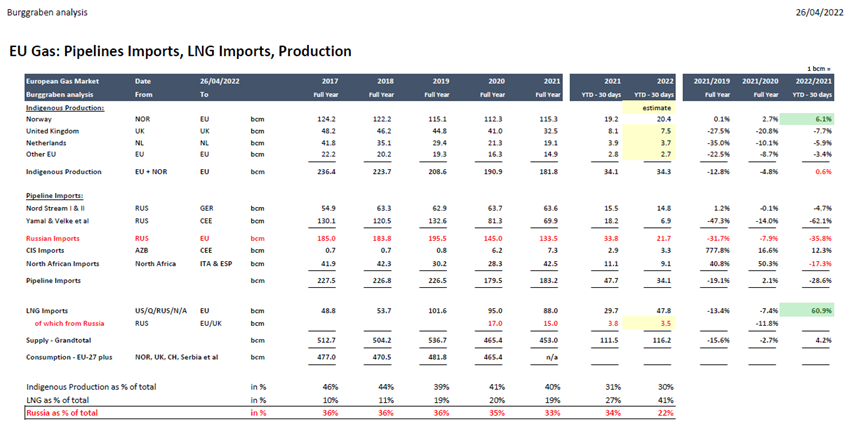

Basics first: How much gas does Europe need to replace (not just the EU, UK et al too)?

Answer: Europe purchased 150 billion cubic meters (bcm) of gas from Russia, imported from 3 pipelines & 15bcm in the form of Liquified Natural Gas (LNG) by sea.

2/n Source: Burggraben

Answer: Europe purchased 150 billion cubic meters (bcm) of gas from Russia, imported from 3 pipelines & 15bcm in the form of Liquified Natural Gas (LNG) by sea.

2/n Source: Burggraben

Why is it important to cut Russian gas?

Because it finances Putin's genocide in Ukraine which in turn pushes gas prices up. That destroys businesses and - for heaven's sake - creates food shortages with a subsequent refugees crisis.

3/n #foodshortage

Because it finances Putin's genocide in Ukraine which in turn pushes gas prices up. That destroys businesses and - for heaven's sake - creates food shortages with a subsequent refugees crisis.

3/n #foodshortage

https://twitter.com/BurggrabenH/status/1518624787270184960?s=20&t=FnlGZv_AGCpfsRf841vf2Q

How much money does the EU send to Gazprom at today's gas prices (Title Transfer Facility = EU Gas Hub in NL)?

Price x Volume = Revenues to Russia

Price = US$28/Mcf (= Thousand Cubic Feet)

150bcm = 5,297 Bcf = 5,297,205,000 Mcf

Revenues = US$ 148.3 billion per annum

4/n

Price x Volume = Revenues to Russia

Price = US$28/Mcf (= Thousand Cubic Feet)

150bcm = 5,297 Bcf = 5,297,205,000 Mcf

Revenues = US$ 148.3 billion per annum

4/n

More basics: Which European country consumes how much?

Answer: 75% was consumed only by GER, UK, ITA, FRA, Iberia & NL .

5/n Source: Energy Aspects (pre-Covid 2019)

Answer: 75% was consumed only by GER, UK, ITA, FRA, Iberia & NL .

5/n Source: Energy Aspects (pre-Covid 2019)

Basics: Which sector consumes how much gas?

Answer: Let's take Germany in 2021

- Industry (incl. local power generation): 36%;

- Households: 29%;

- Retail/Service Industry: 13%;

- Power Generation: 14%;

- Heating: 8%;

6/n Note: similar for most EU (& UK) countries

Answer: Let's take Germany in 2021

- Industry (incl. local power generation): 36%;

- Households: 29%;

- Retail/Service Industry: 13%;

- Power Generation: 14%;

- Heating: 8%;

6/n Note: similar for most EU (& UK) countries

Before I get going, note that I will illustrate solutions (AND policy shortcomings) to cut RUS gas.

Ironically however, the liberalisation of the EU gas market remains a huge success story & were it not for its one shortcoming - RUS gas dependence.

7/n

Ironically however, the liberalisation of the EU gas market remains a huge success story & were it not for its one shortcoming - RUS gas dependence.

7/n

https://twitter.com/BurggrabenH/status/1480309727468953607?s=20&t=FnlGZv_AGCpfsRf841vf2Q

Let's start with LNG. Did you note on tweet 2/n that LNG imports increased by 60% in 2022 year-to-date (YTD)? That is impressive & the result of a wide open arbitrage vs Asia. Futures prices support EU imports (higher netbacks) into October.

8/n Follow @OKalleklev to learn more.

8/n Follow @OKalleklev to learn more.

Were the EU to continue to import LNG at this pace it would take full year 2022 imports to 141bcm (88bcm in 2021). Therefore, the EU is on track to replace 53bcm (141-88) or 33% of the 150bcm of Russian imports in 2021. #LNG works..!

9/n This one is for Finnish ex PM @alexstubb

9/n This one is for Finnish ex PM @alexstubb

So where can the remaining 100bcm come from?

Answer: From (1) better infrastructure use, from storage (2), from existing & new gas fields (3), from substitution as well as curtailments. On the latter, @IEA made a proposals below.

10/n

Answer: From (1) better infrastructure use, from storage (2), from existing & new gas fields (3), from substitution as well as curtailments. On the latter, @IEA made a proposals below.

10/n

https://twitter.com/IEA/status/1517129795661975552?s=20&t=FnlGZv_AGCpfsRf841vf2Q

(1) Let us now look at LNG.

One bottleneck is the EU regasification infra. Iberia possesses the largest capacity but its full utilisation requires linking Spain's to France's pipeline system.

A 12-18 months fix? 40bcm or 27% possible?

11/n #Fixitnow

One bottleneck is the EU regasification infra. Iberia possesses the largest capacity but its full utilisation requires linking Spain's to France's pipeline system.

A 12-18 months fix? 40bcm or 27% possible?

11/n #Fixitnow

https://twitter.com/BurggrabenH/status/1508202191462535174?s=20&t=8eEYcl0R438jsp5KkHsltw

But is there even enough LNG export capacity for even more EU LNG imports?

For 2022 @flexlngltd expects additional 25 million tonnes (=34bcm) of capacity to come online.

12/n #LNG @Cheniere @TellurianLNG

For 2022 @flexlngltd expects additional 25 million tonnes (=34bcm) of capacity to come online.

12/n #LNG @Cheniere @TellurianLNG

Meanwhile & according to the EU Commission, the EU LNG regasification network continues to have capacity room even at current higher LNG imports, if de-bottlenecked soon (tweet 11/n).

Can we build 277km of pipe by year-end? Yes we can. Allez les bleus!

13/n @EmmanuelMacron

Can we build 277km of pipe by year-end? Yes we can. Allez les bleus!

13/n @EmmanuelMacron

For good order sake, below the latest policy declaration between the US and Europe on the topic from February 2022. But can the US even sell more capacity to the EU and as discussed below?

14/n

14/n

LNG terminals require billions of upfront investment which is why e.g. Cheniere locked-in long-term sales contracts.

But US contracts do NOT restrict spot sales as cargoes can be sold in the market by the original buyer at any time. So yes it can!

15/n

spglobal.com/commodityinsig…

But US contracts do NOT restrict spot sales as cargoes can be sold in the market by the original buyer at any time. So yes it can!

15/n

spglobal.com/commodityinsig…

But it is important for EU policy makers to keep prices floating!

Both Asia & Europe are net importers of gas & compete for LNG imports. Which is why their prices have converged. Higher EU gas prices pulled global LNG into Europe.

16/n @vonderleyen

Both Asia & Europe are net importers of gas & compete for LNG imports. Which is why their prices have converged. Higher EU gas prices pulled global LNG into Europe.

16/n @vonderleyen

https://twitter.com/BurggrabenH/status/1456712823673737220?s=20&t=8eEYcl0R438jsp5KkHsltw

(2) Storage:

The EU possesses little-discussed “cushion gas”. For technical reasons, regulators insist that storage units maintain a big gas amounts that is not normally available. The article below argues 1/10 of it could be used without problems.

17/n

economist.com/europe/2022/01…

The EU possesses little-discussed “cushion gas”. For technical reasons, regulators insist that storage units maintain a big gas amounts that is not normally available. The article below argues 1/10 of it could be used without problems.

17/n

economist.com/europe/2022/01…

Italy (and perhaps other EU countries too) also have strategic gas reserves. They are by any stretch of the imagination NOT impressive (think policy failure) but the below quoted 5bcm will certainly carry Italy through one winter & until...

18/n

argusmedia.com/en/news/227519…

18/n

argusmedia.com/en/news/227519…

ENI, Italy's major, managed to bring more gas online. Options are in Libya (which urgently needs a long-term peace agreement), in Morocco (think Chariot) or Algeria but also LNG exports out of West Africa.

19/n @AzizSapphire

reuters.com/business/energ…

19/n @AzizSapphire

reuters.com/business/energ…

(3) Let's now look at existing & new gas fields.

1. Groningen in the NL - a giant but aging field which runs on a Dutch gov quota well below its production capacity.

Potential within weeks: 20bcm or 13% of Russian gas.

20/n

1. Groningen in the NL - a giant but aging field which runs on a Dutch gov quota well below its production capacity.

Potential within weeks: 20bcm or 13% of Russian gas.

20/n

https://twitter.com/BurggrabenH/status/1505922765706211334?s=20&t=E-7UjHNGMJVL2PWyFGiDpw

Why does Groningen not produce at full capacity?

Answer: Because its geology produces local earthquakes, subject to production. The quakes are real and caused damages to buildings, but are not life-threatening with only 2 quakes >3.5 Richter scale in 30 years.

21/n

Answer: Because its geology produces local earthquakes, subject to production. The quakes are real and caused damages to buildings, but are not life-threatening with only 2 quakes >3.5 Richter scale in 30 years.

21/n

For a full study by the University of Groningen see the link below & then perhaps reflect on Putin's war in Ukraine for a brief moment.

Perhaps the people of Groningen & Dutch government can find an amicable solution for timely claims' refunding?

22/n

rug.nl/feb/news/2018/…

Perhaps the people of Groningen & Dutch government can find an amicable solution for timely claims' refunding?

22/n

rug.nl/feb/news/2018/…

2. Have you noticed that Norway's gas production is +6% YTD on tweet 2/n? Awesome!

Were NOR to continue this trend it would replace 7bcm of Russian gas or 5%. Of course, it requires other EU producers to keep production stable too.

23/n @Equinor @akerbpasa @Ian_H_Lundin

Were NOR to continue this trend it would replace 7bcm of Russian gas or 5%. Of course, it requires other EU producers to keep production stable too.

23/n @Equinor @akerbpasa @Ian_H_Lundin

How can regulators & govs support the industry "battle" base declines (a term describing a field's output decline over time as reserves deplete)?

Among others, by promoting investment through lower tax rates, maximising allowances & faster project approvals.

24/n Here is how:

Among others, by promoting investment through lower tax rates, maximising allowances & faster project approvals.

24/n Here is how:

The industry will do the rest. E&Ps of all sizes have promising local projects which must be fast-tracked with the support of competent authorities such as the UK OGA - renamed the "Transition Authority". We get back on that.

25/n (End of part I)

nstauthority.co.uk

25/n (End of part I)

nstauthority.co.uk

• • •

Missing some Tweet in this thread? You can try to

force a refresh