London has been beautiful for this week’s @WorldNuclear Working Group meetings - learned a lot as always.

World #Nuclear Fuel Cycle meeting kicking off now with Treva from @U3O8TradeTech discussing #uranium fundamentals with @cameconews @Oranogroup @NAC_Kazatomprom

World #Nuclear Fuel Cycle meeting kicking off now with Treva from @U3O8TradeTech discussing #uranium fundamentals with @cameconews @Oranogroup @NAC_Kazatomprom

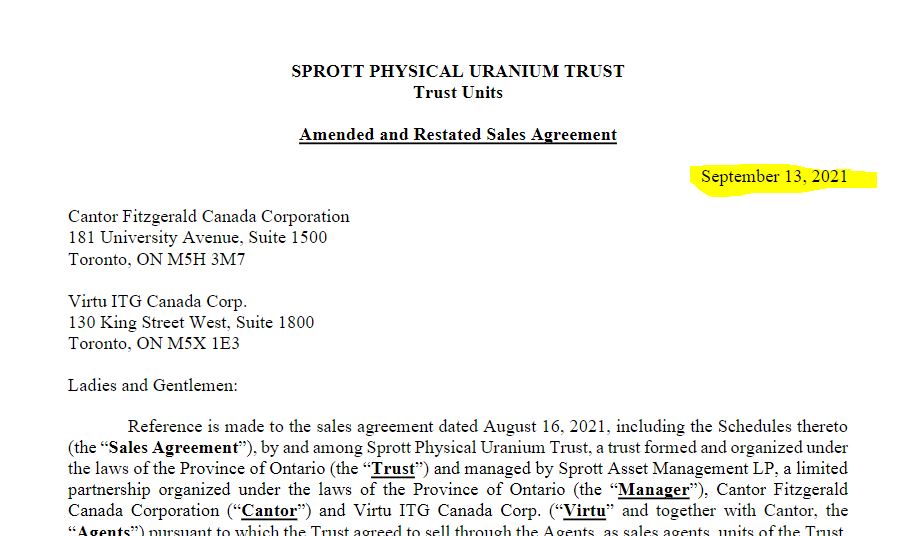

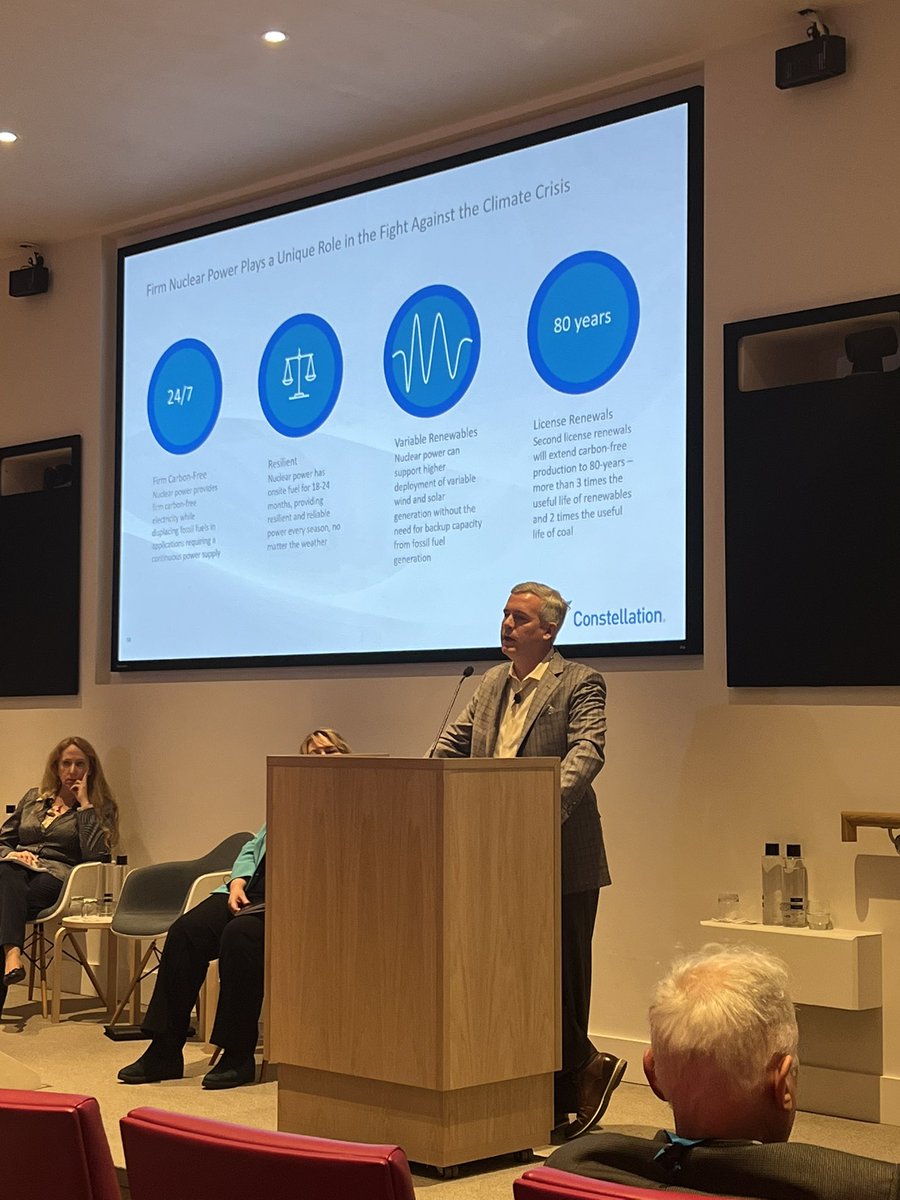

Jason Murphy from @ConstellationEG giving a great talk on the company’s #nuclear fleet - very impressive stats all around. Emphasized that the company intends to pursue life extensions to 80 years for the whole fleet. Also- contracting strategy starts 6 years before any reload!

Favorite quote of the day so far: “we don’t live in the spot market like some others do. I’m not sure how those guys sleep at night”… long term contracts with reliable partners is the name of the game. Also strategic inventories are clearly important for a fleet of their size.

Adrienne Hanly, Uranium Production Specialist from the @iaeaorg discussing U.S. inventory levels. Her study shows 16 months on average vs. their recommendation of 2Y+. This is an issue from her perspective and something governments may need to address (Europe just above 2Y now).

Security of Supply panel starting now - Fredrik Leijonhufvud from @VattenfallGroup opens by highlighting how quickly things have changed. After years of low energy prices, tight budgeting and oversupplied mkts we have now refocused on security of supply & fuel cycle uncertainty.

John-Paul Jones from @urencoglobal discussing S/D in enrichment and conversion. Great slides explaining why Russia’s exclusion from global markets is a big problem. Also addressing Advanced #nuclear / #HALEU demand - Urenco’s dance card is clearly full at the conference…

That’s a wrap folks. Night flight back to NYC. Thanks to @NEI and @WorldNuclear for a wonderful event. Look forward to seeing everyone in person again soon. Next conference for me is @Reuters SMR & Advanced Reactor Forum in Atlanta next month. Reach out if attending!

• • •

Missing some Tweet in this thread? You can try to

force a refresh