This is my ULTIMATE guide to managing a #crypto portfolio.

Here I show you EXACTLY how I manage my portfolio. Including how I manage my #alts, my #hodl bags and what I do when I want to go full degen and ape into shitcoins.

Like n retweet if you found this useful!

🧵👇

Here I show you EXACTLY how I manage my portfolio. Including how I manage my #alts, my #hodl bags and what I do when I want to go full degen and ape into shitcoins.

Like n retweet if you found this useful!

🧵👇

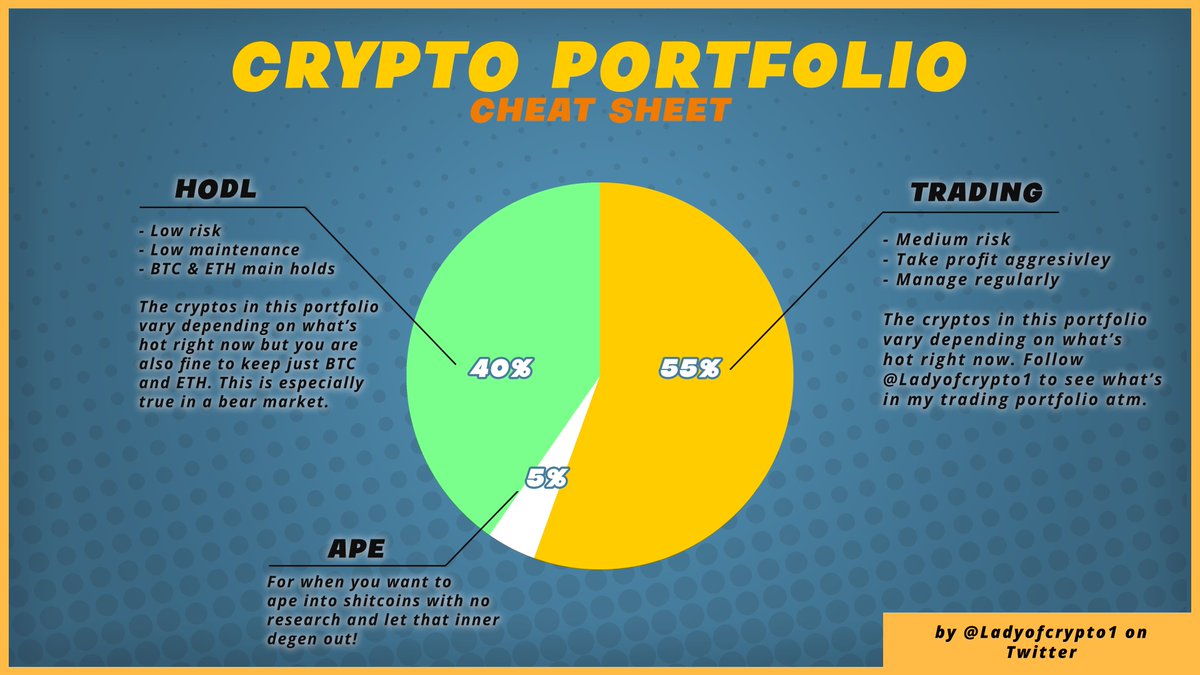

1/ -- PORTFOLIO SPLIT ---

I split my portfolio into three sub-portfolios

HODL (40%) - I don't touch this much other than to DCA.

Trading (55%) - Where I take most positions I share on CT.

Ape (5%) - More on this later.

I split my portfolio into three sub-portfolios

HODL (40%) - I don't touch this much other than to DCA.

Trading (55%) - Where I take most positions I share on CT.

Ape (5%) - More on this later.

2/ -- HODL ---

My HODL portfolio is simple. It currently holds $BTC, $ETH, $SOL, $LUNA n $LTC.

I've taken profit aggressively on SOL and LUNA though.

Even though this is a HODL portfolio I occasionally TP everything that isn't BTC or ETH.

My HODL portfolio is simple. It currently holds $BTC, $ETH, $SOL, $LUNA n $LTC.

I've taken profit aggressively on SOL and LUNA though.

Even though this is a HODL portfolio I occasionally TP everything that isn't BTC or ETH.

3/ -- Trading ---

This is my day-to-day portfolio that I use to invest in medium/low risk projects.

I manage these trades regularly by taking profit and resistance and buying back at support. Some of my biggest bags in this portfolio atm are $GMT and $PYR. I'll share more below.

This is my day-to-day portfolio that I use to invest in medium/low risk projects.

I manage these trades regularly by taking profit and resistance and buying back at support. Some of my biggest bags in this portfolio atm are $GMT and $PYR. I'll share more below.

4/ -- Ape ---

We all have a little bit of degen inside us. That's why we trade crypto and not stocks.

My ape portfolio is for letting the degen out and apeing into unresearched, high risk, shitcoins when I just want to burn some money.

We all have a little bit of degen inside us. That's why we trade crypto and not stocks.

My ape portfolio is for letting the degen out and apeing into unresearched, high risk, shitcoins when I just want to burn some money.

5/ -- Cheat Sheet --

Here is a handy little cheat sheet that breaks down the above. Keep reading for a more in-depth breakdown 👇

Here is a handy little cheat sheet that breaks down the above. Keep reading for a more in-depth breakdown 👇

6/ -- Stable --

Keeping stable sidelined is vital for buying dips.

In a bull market I keep min 20% stable on my Trading portfolio and 10% in my HODL.

In a bear market I keep min 60% stable on my Trading portfolio and 40% in my HODL. I aim for more stable though!

Keeping stable sidelined is vital for buying dips.

In a bull market I keep min 20% stable on my Trading portfolio and 10% in my HODL.

In a bear market I keep min 60% stable on my Trading portfolio and 40% in my HODL. I aim for more stable though!

7/ -- Stable cont --

My Ape portfolio is 100% stable unless I'm apeing at which point I risk at most half of it per trade.

My Ape portfolio is 100% stable unless I'm apeing at which point I risk at most half of it per trade.

8/ -- Why Ape? --

Sometimes taking dumb undisciplined trades is fun, which is why I allocate 5% of my portfolio to apeing.

This way I can satiate that thirst for degen trades without it impacting me too badly if I lose.

Sometimes taking dumb undisciplined trades is fun, which is why I allocate 5% of my portfolio to apeing.

This way I can satiate that thirst for degen trades without it impacting me too badly if I lose.

9/ -- Ape Losses --

The 5% of my capital allocated to my Ape portfolio isn't counted towards my total capital on my tracking spreadsheet.

Psychologically this helps because I consider the capital already lost. So if I ape into a trade and get rugged I don't care.

The 5% of my capital allocated to my Ape portfolio isn't counted towards my total capital on my tracking spreadsheet.

Psychologically this helps because I consider the capital already lost. So if I ape into a trade and get rugged I don't care.

10/ -- HODL & DCA --

I move gains made in my Ape and Trading portfolios over to my HODL weekly which allows me to DCA into $BTC and $ETH.

In a proper bear market, I'll narrow my HODL portfolio down to BTC n ETH and hodl just those two. They are the only safe bets.

I move gains made in my Ape and Trading portfolios over to my HODL weekly which allows me to DCA into $BTC and $ETH.

In a proper bear market, I'll narrow my HODL portfolio down to BTC n ETH and hodl just those two. They are the only safe bets.

11/ -- Staking --

I put my stable to work for me by staking it for high APY. 4% to 19% depending on where it's staked.

I stake different stables in different places to spread my risk. $UST $USDT $USDC $DAI and I'll do $USN soon too.

I put my stable to work for me by staking it for high APY. 4% to 19% depending on where it's staked.

I stake different stables in different places to spread my risk. $UST $USDT $USDC $DAI and I'll do $USN soon too.

12/ -- Current Holdings --

HODL - Mostly $BTC and $ETH n little $LTC n $METIS. Sold most $SOL n $LUNA.

Trading - Biggest holds are $GMT, $PYR, $UOS, $NEAR & $ILV. I've taken enough profit on all of these to be way up even if they dump!

Ape - Nothing atm.

HODL - Mostly $BTC and $ETH n little $LTC n $METIS. Sold most $SOL n $LUNA.

Trading - Biggest holds are $GMT, $PYR, $UOS, $NEAR & $ILV. I've taken enough profit on all of these to be way up even if they dump!

Ape - Nothing atm.

13/ -- Vesting --

I am an early investor in several projects which I am vested into for up to 2 years.

I do not calculate vested amounts as crypto holdings.

If I did then 95% of my capital would be in crypto but I couldn't take profit 👀

I am an early investor in several projects which I am vested into for up to 2 years.

I do not calculate vested amounts as crypto holdings.

If I did then 95% of my capital would be in crypto but I couldn't take profit 👀

If you found this thread useful, please like and retweet the first tweet below 👇

https://twitter.com/LadyofCrypto1/status/1521161371324452865

• • •

Missing some Tweet in this thread? You can try to

force a refresh