Some soothing advice for Investors in tough times

We know lot of investors are getting tensed about market fall.

But trust..! Don't look at stock prices daily..

#investing

#StockMarket

#sharemarket

#stockmarketcrash

We know lot of investors are getting tensed about market fall.

But trust..! Don't look at stock prices daily..

#investing

#StockMarket

#sharemarket

#stockmarketcrash

https://twitter.com/BeatTheStreet10/status/1517906417469976578

Investing should bring peace and wealth. Peace of mind is very much imp for better thinking n avoiding bad decisions

Even if you are swing trader markets won't show any opportunity before 16800.

Even if you are swing trader markets won't show any opportunity before 16800.

So lets focus on learning and mistakes. What went wrong ? How exposure you should take to a particular sector /stock ? Do some more analysis on your own. Don't do bottom fishing. Wait for revival and hold your existing positions

Read what management is guiding since they are giving their FY23 guidance

In terms of changes in portfolio, exit very poor companies and buy some tracking position with strong financials and business model.

Don't go for IPO/ High PE/ High Debt/ Low FCF/ High Valuation stocks

In terms of changes in portfolio, exit very poor companies and buy some tracking position with strong financials and business model.

Don't go for IPO/ High PE/ High Debt/ Low FCF/ High Valuation stocks

Read about sector / macros. There would be lot of changes in many industries in rate hike phase

Look for Why rather than What ...

Look for Why rather than What ...

So last but not least

"Read Business Not Stock Prices"

"Read Business Not Stock Prices"

Are we at bottom ? Here are charts & data points

https://twitter.com/BeatTheStreet10/status/1522840270018007040?t=1__O4ApgsFfWTLB0l1oSzg&s=19

Where to deploy funds if you are thinking of doing some bottom fishing

https://twitter.com/BeatTheStreet10/status/1439564492497580034?t=1__O4ApgsFfWTLB0l1oSzg&s=19

What Warren Buffet says about falling stock prices / markets

https://twitter.com/TD_Investor/status/1525484632057294848?t=G86mWUMg-yJjkfZijpoZvg&s=19

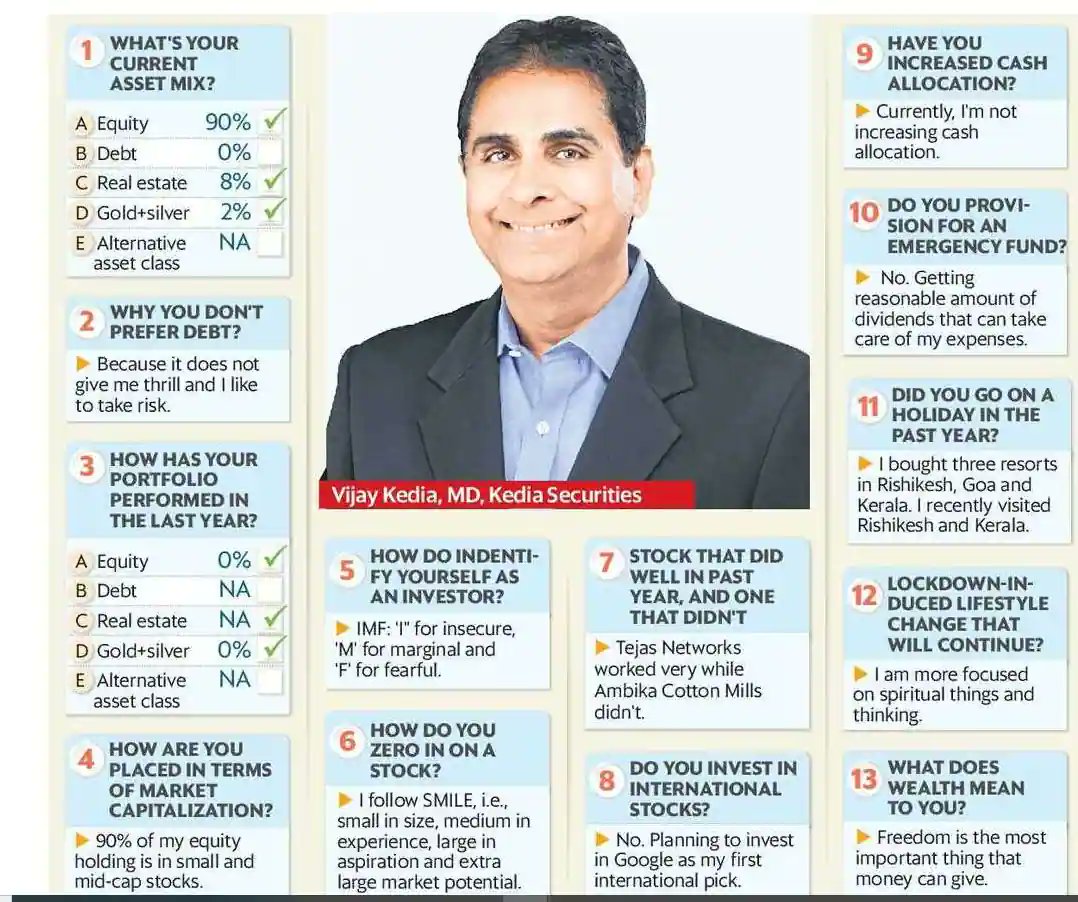

@VijayKedia1 made 0 returns in last 1 yr.

livemint.com/money/personal…

Conviction & Patience = Profit (@unseenvalue)

Tatas are not going to stop their business expansion seeing daily price fluctuations, one Vijay Ji said

livemint.com/money/personal…

Conviction & Patience = Profit (@unseenvalue)

Tatas are not going to stop their business expansion seeing daily price fluctuations, one Vijay Ji said

@AnilSinghvi_ on @ZeeBusiness has very simple advice (similar to our tagline) Read Business not stock prices, don't watch news, don't watch markets for few months

There will be time when Indian investors will become FII

There will be time when Indian investors will become FII

Want to do bottom fishing ?

Invest in ETFs

Invest in tax saving mutual funds if you are in taxable bracket

This way you can invest for both long term via ELSS & short term via ETFs

Invest in ETFs

Invest in tax saving mutual funds if you are in taxable bracket

This way you can invest for both long term via ELSS & short term via ETFs

Some charts & data which prefers investing over trading & think long-term

https://twitter.com/BeatTheStreet10/status/1494270768099717120?t=RrKkdP07XdgEcinZRPr4bQ&s=19

Most Simple Way to create wealth

Monthly SIP of ₹1000 for 25 yrs can create wealth of ₹30L+ with investment of just ₹3L

Best Mutual Funds :

Monthly SIP of ₹1000 for 25 yrs can create wealth of ₹30L+ with investment of just ₹3L

Best Mutual Funds :

Investment Theme for the Next 5 Year

Macro View on Investing

Timeline Analysis of different Sectors

Top 5 Sectors that will fire in the Upcoming 5 Year & Why?

#StockMarketIndia

#ShareMarket

#StocksToBuy

Macro View on Investing

Timeline Analysis of different Sectors

Top 5 Sectors that will fire in the Upcoming 5 Year & Why?

#StockMarketIndia

#ShareMarket

#StocksToBuy

Always remember we don't have any trader who became billionaire out of trading. They became billionaires because they invest.

We are not against trading we are against uniformed & emotion based trading without any proper trade setup

We are not against trading we are against uniformed & emotion based trading without any proper trade setup

Retail investors attracted to falling stocks rather than rising ones and accumulate more of these as prices fall. This can cause them to do badly, even in a bull market.

Don't catch falling knifes and always have limited exposure to a particular stock

livemint.com/money/personal…

Don't catch falling knifes and always have limited exposure to a particular stock

livemint.com/money/personal…

new investors making the same mistakes again and again

New investors should focus on avoiding big mistakes, NOT on being brilliant

Here are 10 common mistakes of new investors:

@BrianFeroldi

New investors should focus on avoiding big mistakes, NOT on being brilliant

Here are 10 common mistakes of new investors:

https://twitter.com/BrianFeroldi/status/1555902033726668800?t=jIZQeDOhVpsVrRzLk9Nhmg&s=19

@BrianFeroldi

• • •

Missing some Tweet in this thread? You can try to

force a refresh