Paris Saint-Germain’s 2020/21 accounts cover a season when they were Ligue 1 runners-up, though they won the title again in 2021/22, their 8th in 10 years. Also reached the Champions League semi-final and won the Coupe de France. Some thoughts in the following thread #PSG

#PSG were acquired in 2011 by Qatar Sports Investments (QSI), a subsidiary of Qatar's sovereign wealth fund Qatar Investment Authority (QIA), making the club by far the richest in France and one of the wealthiest in the world. Nasser Al-Khelaifi is the club’s chairman and CEO.

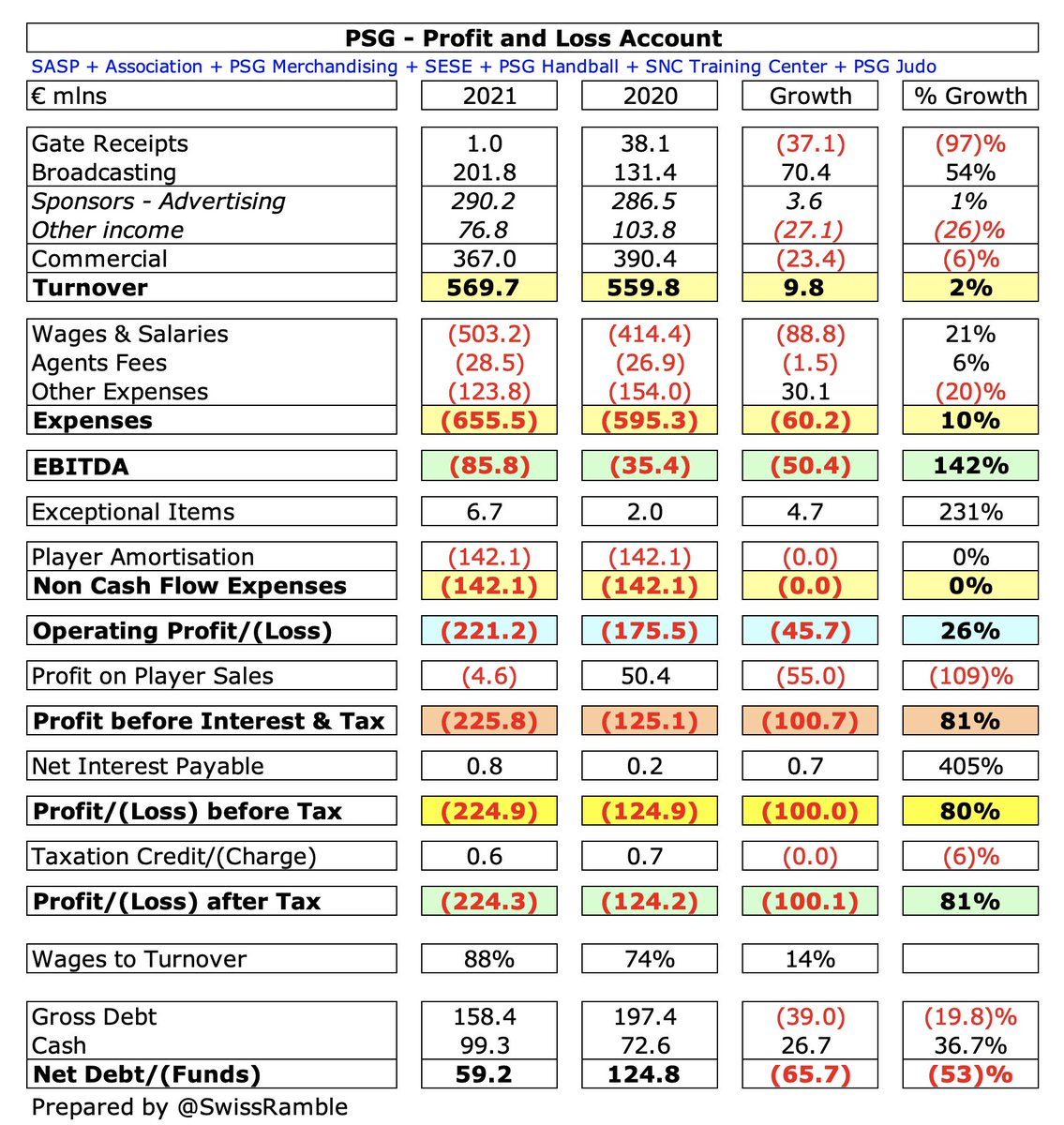

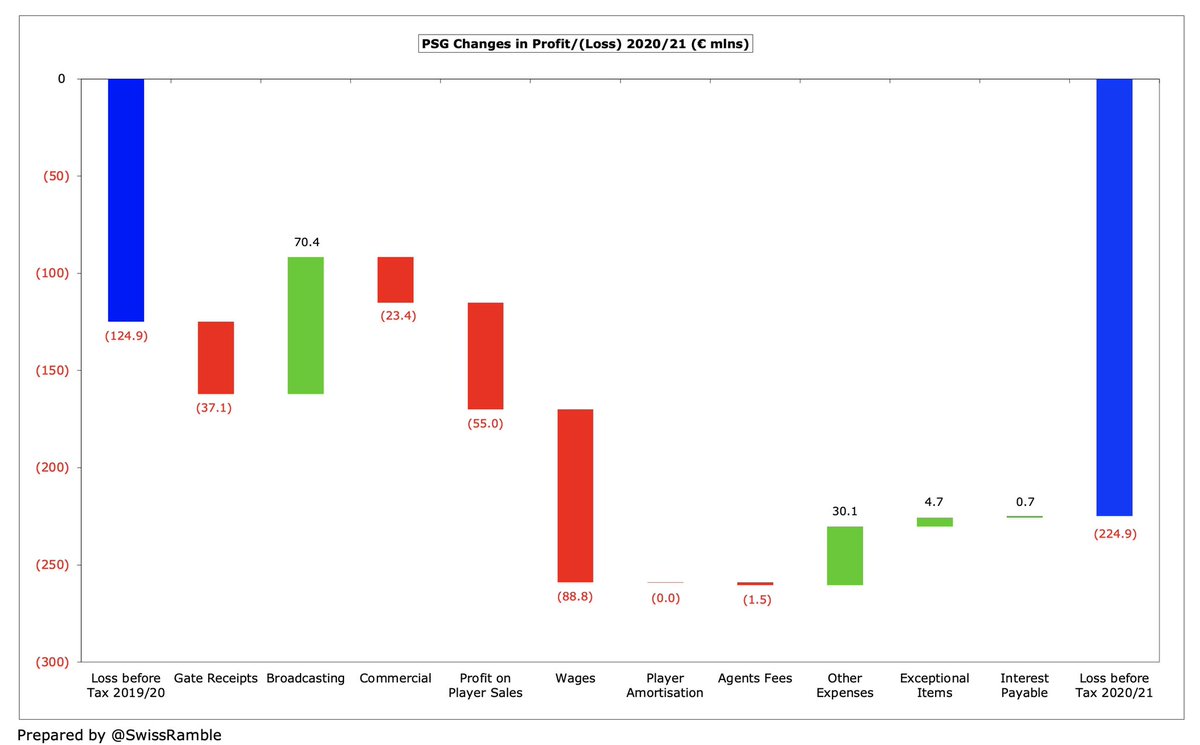

Partially due to COVID, #PSG pre-tax loss increased by €100m from €125m to club record €225m, despite revenue increasing €10m (2%) from €560m to €570m, as €55m profit on player sales turned into a €5m loss, while operating expenses shot up €56m (8%). Post-tax loss €224m

The main driver of #PSG revenue increase was broadcasting, which rose €70m (54%) to €202m, mainly due to revenue deferred from 2019/20 accounts, which offset COVID-driven reductions in gate receipts, down €37m (97%) to just €1m, and commercial, down €23m (6%) to €367m.

However, investment in the squad meant that #PSG wages shot up €89m (21%) from €414m to €503m, though player amortisation was flat at €142m and agent fees only rose €1m (6%) to €28m. Other expenses fell €30m (20%) to €124m, due to lower costs of staging games.

Unsurprisingly #PSG €225m loss was by far the largest in France, more than twice as much as closest challenger, Lyon €109m, followed by Marseille €76m and Bordeaux €67m. Normally most French clubs post small profits or losses, but 2020/21 included a full year of the pandemic.

#PSG have not quantified the COVID impact, but I estimate revenue loss as €103m, mainly stadium-related, such as gate receipts, merchandising and events. Partly offset by €35m revenue deferrals from 2019/20. Total loss over 2 years is €150m, including broadcaster rebate.

Clearly, all football clubs have been significantly hit by the effect of the pandemic, but #PSG €225m pre-tax loss was one of the largest in Europe, only surpassed by Barcelona’s awful €555m and Inter €239m. Indeed, #MCFC, Bayern Munich & Real Madrid all posted small profits.

#PSG made a €5m loss on player sales, as Cavani, Thiago Silva & Meunier were all released. Well down from €50m profit, in contrast to Lille’s €81m gain (mainly Osimhen to Napoli). COVID depressed the transfer market, but some clubs did well: Real Madrid €106m and #MCFC €77m.

Before the COVID-impacted 2020 accounts, #PSG had actually reported pre-tax profits in 4 of the last 5 years, amounting to €75m between 2015 and 2019, and tiny losses in the preceding 3 years. However, their combined loss over the last 2 years is a hefty €350m.

Traditionally #PSG have made very little from player sales, though this had become increasingly important, as they posted gains of €272m between 2018 and 2020 before last season’s slowdown. Of course, could have made a lot more if they had accepted Madrid’s offer for Mbappé.

In contrast, player trading is very important to other French clubs, especially Monaco, who generated over half a billion (€541m) in the last 5 years, Lyon €364m and Lille €328m. This approach offsets large operating losses. #PSG are only 4th highest in Ligue 1 with €281m.

#PSG operating loss (excluding player sales, exceptional items and interest payable) fell from €178m to €228m, continuing the steady decline from €13m operating profit in 2015. Again, this is the worst in France, though losses also very high at Monaco €178m & Lyon €158m.

#PSG also booked €7m exceptional items. These are usually very low in Ligue 1, but Monaco included a significant €196m credit in their 2020/21 accounts. Without this boost they would have also reported a huge loss in 2020/21.

#PSG revenue fell €89m (14%) from €659m peak in 2019 to €570m, partly because of COVID, but also due to the expiry of the lucrative publicity deal with the Qatar Tourist Authority. Still more than 5 times as much as the €101m reported in 2011, i.e. before the QSI acquisition.

#PSG alone generated over a third of total revenue in Ligue 1 – more than the 14 clubs with lowest revenue combined. More tellingly, their €570m was also more than Marseille €146m, Lyon €118m, Lille €84m, Rennes €79m, Nice €68m and Monaco €63m put together. “Mind the gap”.

#PSG are 6th highest in the Deloitte Money League, which ranks clubs globally by revenue, only below #MCFC €645m, Real Madrid €641m, Bayern Munich €611m, Barcelona €582m & #MUFC €558m. England, Spain and Italy boosted by money deferred for games played after 2019/20 accounts

As a technical aside, the Deloitte Money League revenue for #PSG of €556m is different to the €570m used by the DNCG (the organisation responsible for monitoring accounts of football clubs in France), presumably due to the latter’s approach of aggregating different companies.

#PSG commercial revenue (per Money League definition) rose €38m (13%) to €337m. Lower than the club’s €363m peak in 2019, but only surpassed by Bayern Munich €345m. Their year-on-year growth was the highest in Europe, ahead of #MCFC €24m.

#PSG sponsorship & advertising revenue was flat at €290m, though this was by far the highest in Ligue 1, a cool quarter of a billion more than Lyon €34m and Marseille €29m. In fact, #PSG receive nearly twice as much as the other 19 clubs combined.

#PSG have a long-term €80m kit supplier deal with Nike to 2032, while the Accor €60m shirt sponsorship runs to 2022, but with a 3-year option. Sleeve sponsor GOAT pays €17m a year, while also good deals with Ooredoo (training centre) €10m and Visit Rwanda €10m.

#PSG other income fell €27m (26%) to €77m, significantly lower than €257m in 2019, due to the expiry of the Qatar Tourist Authority deal after FFP pressure from UEFA. However, still much more than other Ligue 1 clubs with the next highest being Marseille €25m and Lyon €22m.

Following the signing of Messi, #PSG are looking to further boost commercial income. Club president Nasser Al-Khelaifi said, “The club will increase in every part commercially. We will give you some numbers and you are going to be shocked.”

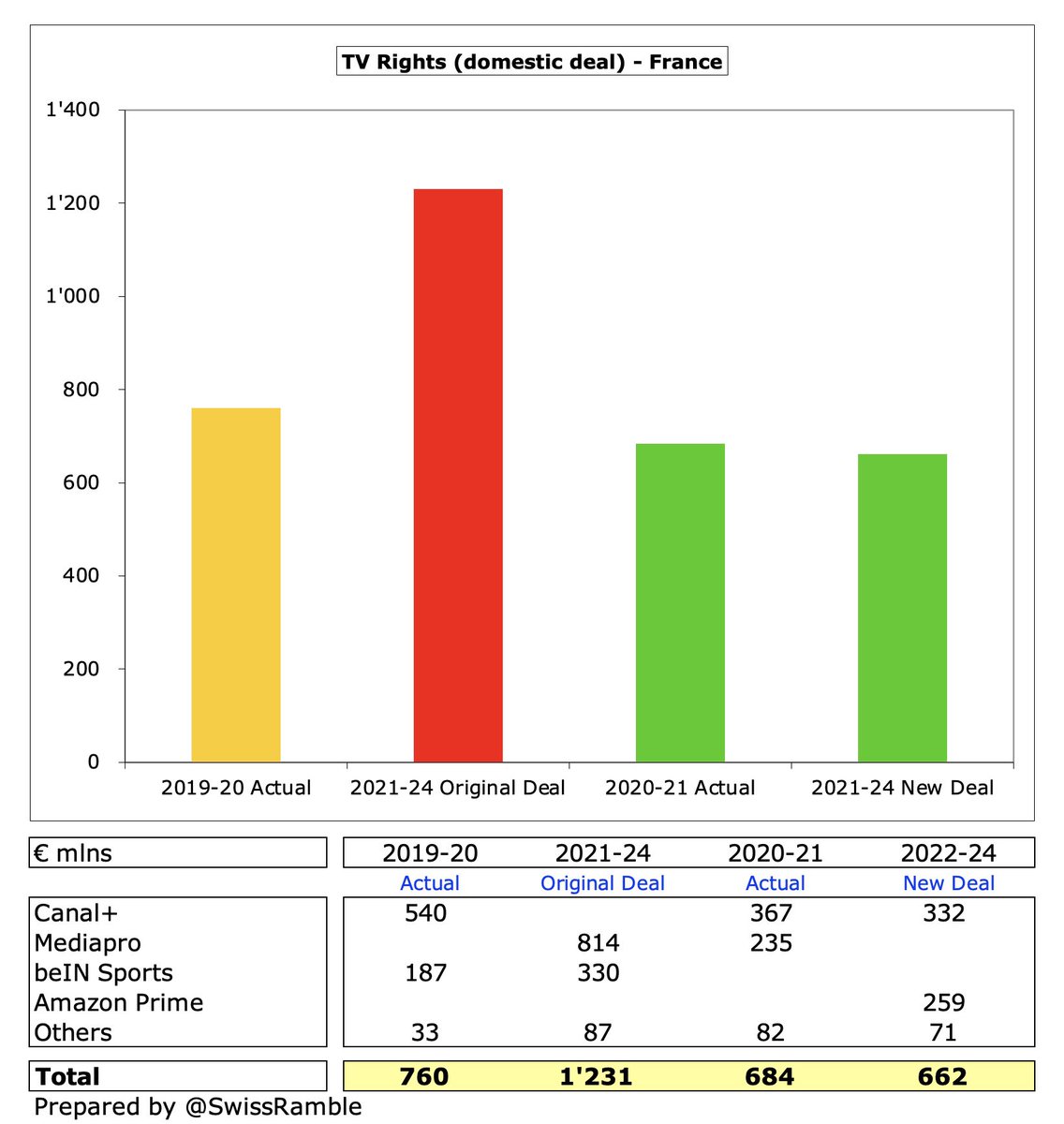

#PSG broadcasting income rose €71m (54%) to €202m, mainly due to revenue deferred from 2019/20, though still on the low side in Europe. This is partly for a fundamental reason (low Ligue 1 TV deal), exacerbated by a technical factor (more deferred revenue in other leagues).

#PSG earned €50m from Ligue 1 TV deal, despite Mediapro default. Money distributed per the 50-30-20 rule: 50% equal share (30% fixed, 20% according to club licences); 30% league standing (25% current season, 5% 5 previous seasons); and 20% media profile.

#PSG had the highest broadcasting revenue in France with €202m, twice as much as Marseille €91m. The influence of European qualification is evident here with €146m of this revenue stream (nearly three-quarters) coming from their Champions League exploits.

French domestic TV rights should have increased by 60% in 2020/21 from €760m to €1.2 bln, but Mediapro could not meet their payments, so new deal was cancelled. Canal+ picked up those rights, leading to revised total of €662m, i.e. less than the previous deal.

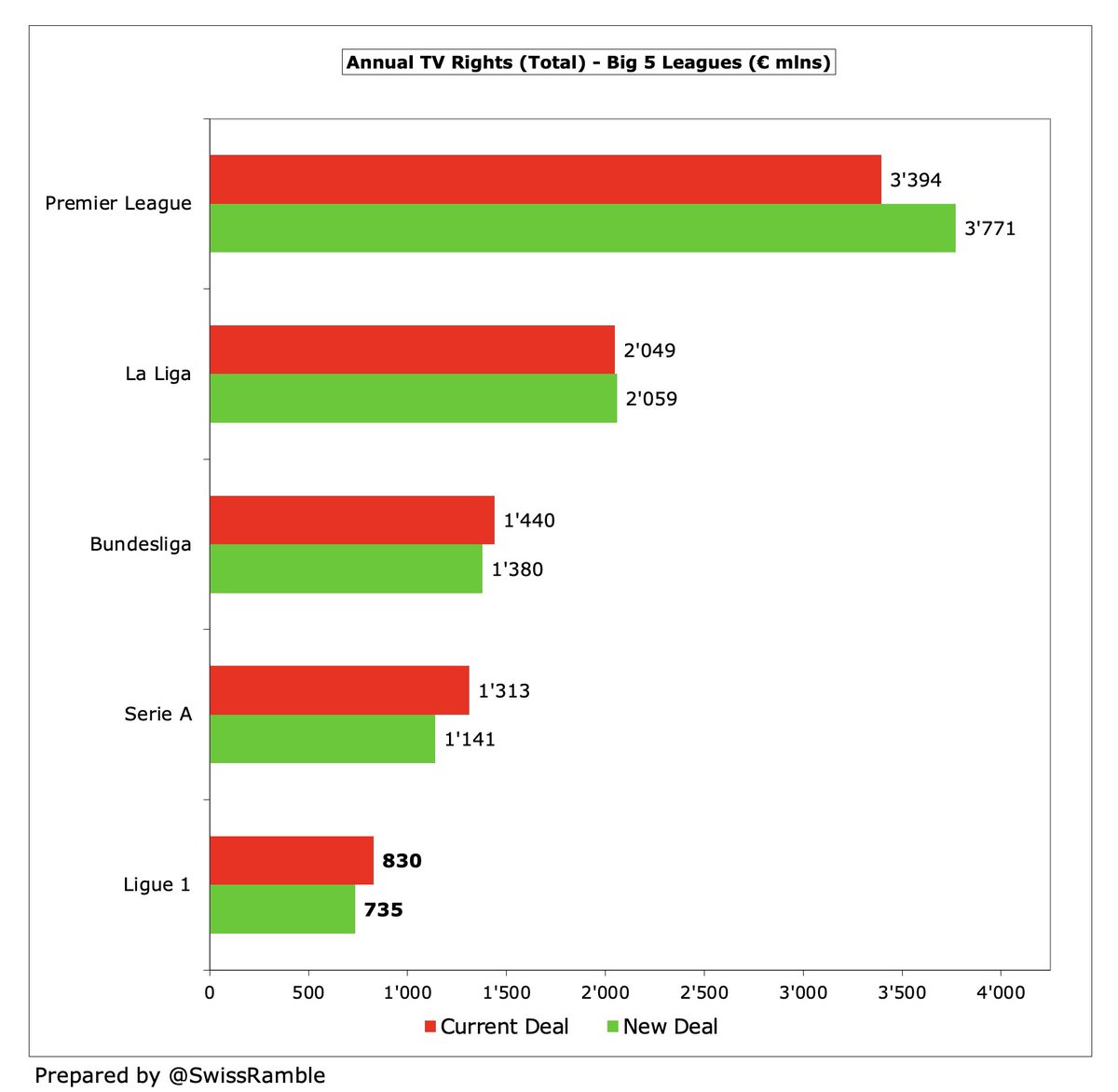

This is a major issue for #PSG, as French TV rights are much lower than other major leagues. Revised €735m for #Ligue1 (including international rights) is only one less than €1 bln, far below Premier League €3.8 bln, La Liga #2.1 bln, Bundesliga €1.4 bln & Serie A €1.1 bln.

#PSG have compensated with progress in the Champions League, where TV money was €111m in 2021, when they were semi-finalists, though also added €35m for games played after 2019/20 accounts to give €146m, much more than Marseille €47m, Rennes €35m, Lille €18m & Nice €12m.

#PSG earned a massive €441m from Europe in 5 years up to 2021, twice as much as Lyon €221m, thus increasing the gap to other French clubs. Will only receive €67m this season after last 16, exit including €30m for UEFA coefficient payment (based on performance over 10 years).

Using the Deloitte Money League definition which includes hospitality, #PSG match day revenue fell €75m (82%) from €92m to €17m, which was actually highest in Europe, as almost all games were played behind closed doors. Some clubs saw even larger reductions.

#PSG 47,554 average attendance in 2019/20 (pre-pandemic) was 2nd highest in France, only below Marseille 52,804. Revenue advantage mainly due to higher prices in Paris, especially corporates. Club plans to add 10,000 new seats to raise Parc des Princes capacity to around 60,000.

#PSG wage bill rose €89m (21%) from €414m to €503m, the club’s highest ever, which means that wages have increased €231m (85%) in the last 4 years. This is before last summer’s recruitment of Messi, Ramos, Donnarumma Wijnaldum, Hakimi and Pereira.

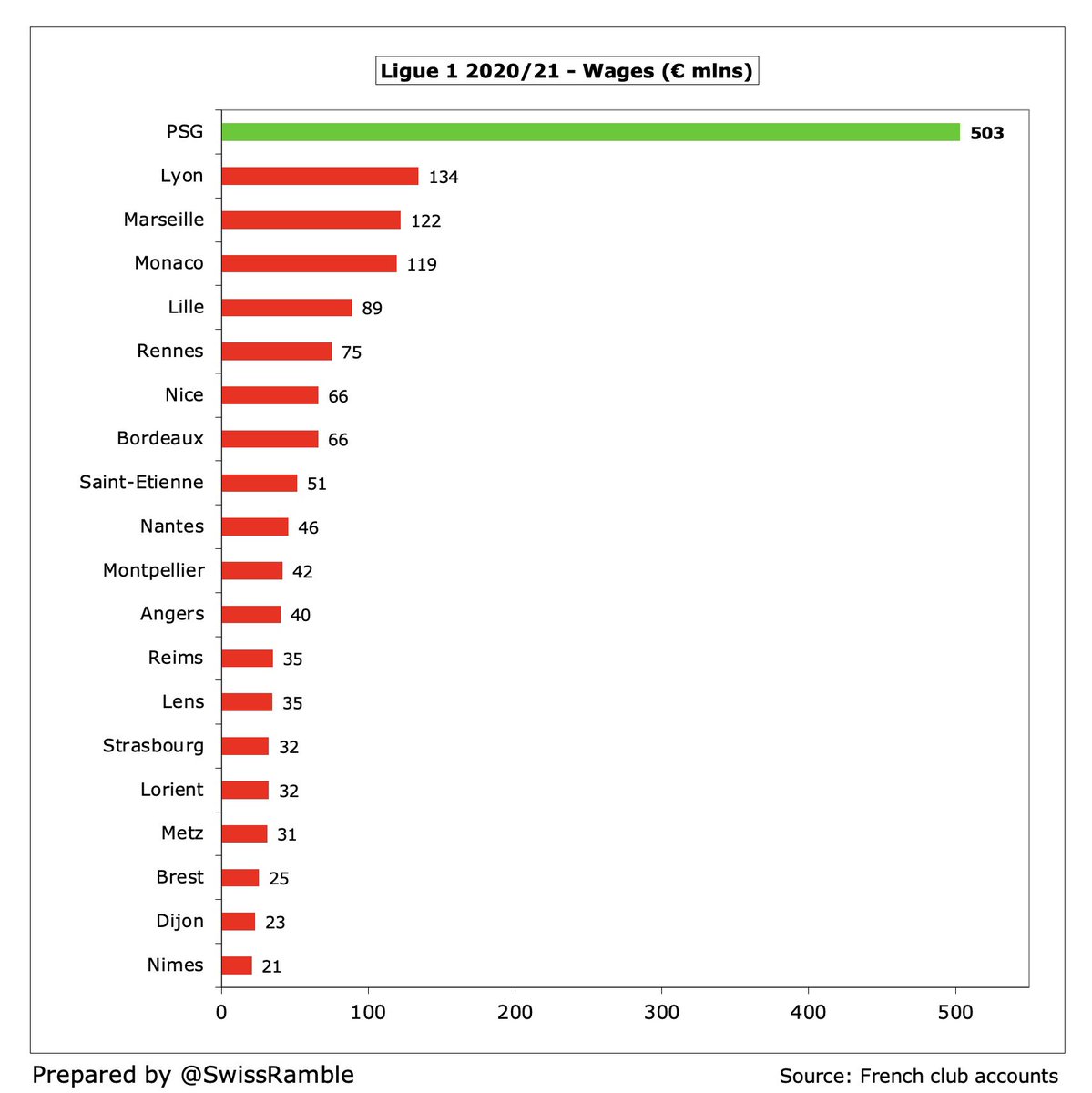

#PSG €503m wage bill is almost 4 times as much as their closest domestic rival, namely Lyon €134m. It’s around a third of total Ligue 1 wages, more than Lyon, Marseille, Monaco and Lille combined. According to L’Equipe, PSG employ 18 of the 20 best paid players in France.

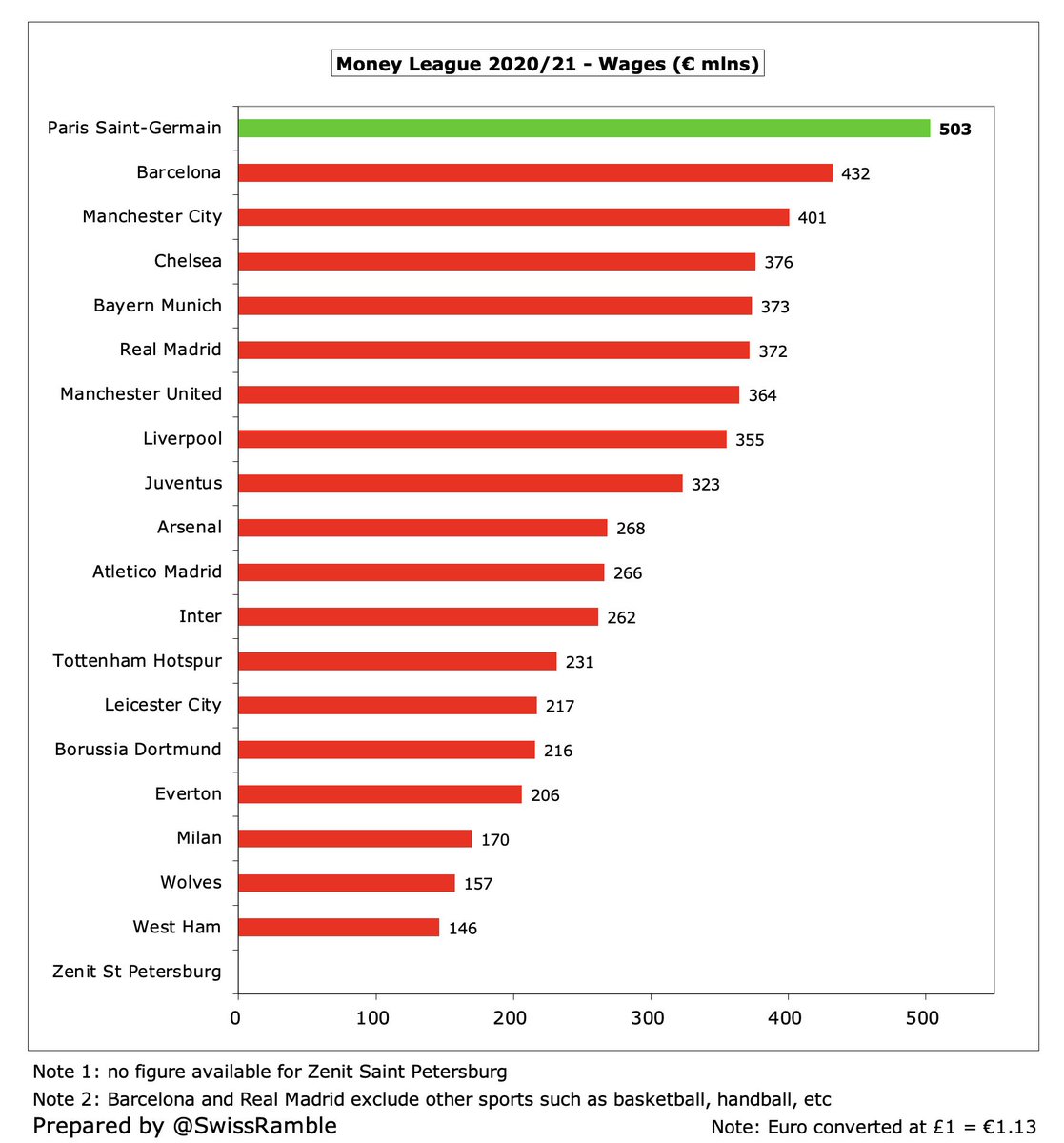

Having surpassed half a billion Euros, it’s not surprising that #PSG €503m wage bill is now the highest in Europe, ahead of Barcelona €432m (before La Liga salary cap applied), #MCFC €401m, #CFC €376m, Bayern Munich €373m, Real Madrid €372m, #MUFC €364m and #LFC €355m.

#PSG wages to turnover ratio increased from 74% to 88%, though this is actually one of the lowest (best) in France. That said, it’s one of the highest (worst) of elite European clubs. DNCG is planning to implement a new measure whereby no club can have a ratio above 70%.

While it is likely that #PSG will offload some players this summer, e.g. the likes of Di Maria, Icardi and Paredes, there is a big question mark over the future of Kylian Mbappé. If he leaves, wage bill would dramatically fall, but if he stays, he is likely to get a big pay rise.

#PSG player amortisation, the annual cost of writing-off transfer fees, was unchanged at €142m, though “the ambitious recruitment policy of Paris Saint-Germain” means that this expense has shot up from just €14m in 2011.

As a result, #PSG €142m player amortisation is by far the highest in France, well ahead of Monaco €86m, followed by Lyon €57m and Marseille €43m. However, this is not the case in Europe, as they are a fair way below #CFC €183m, Juventus €177m and #MCFC €165m.

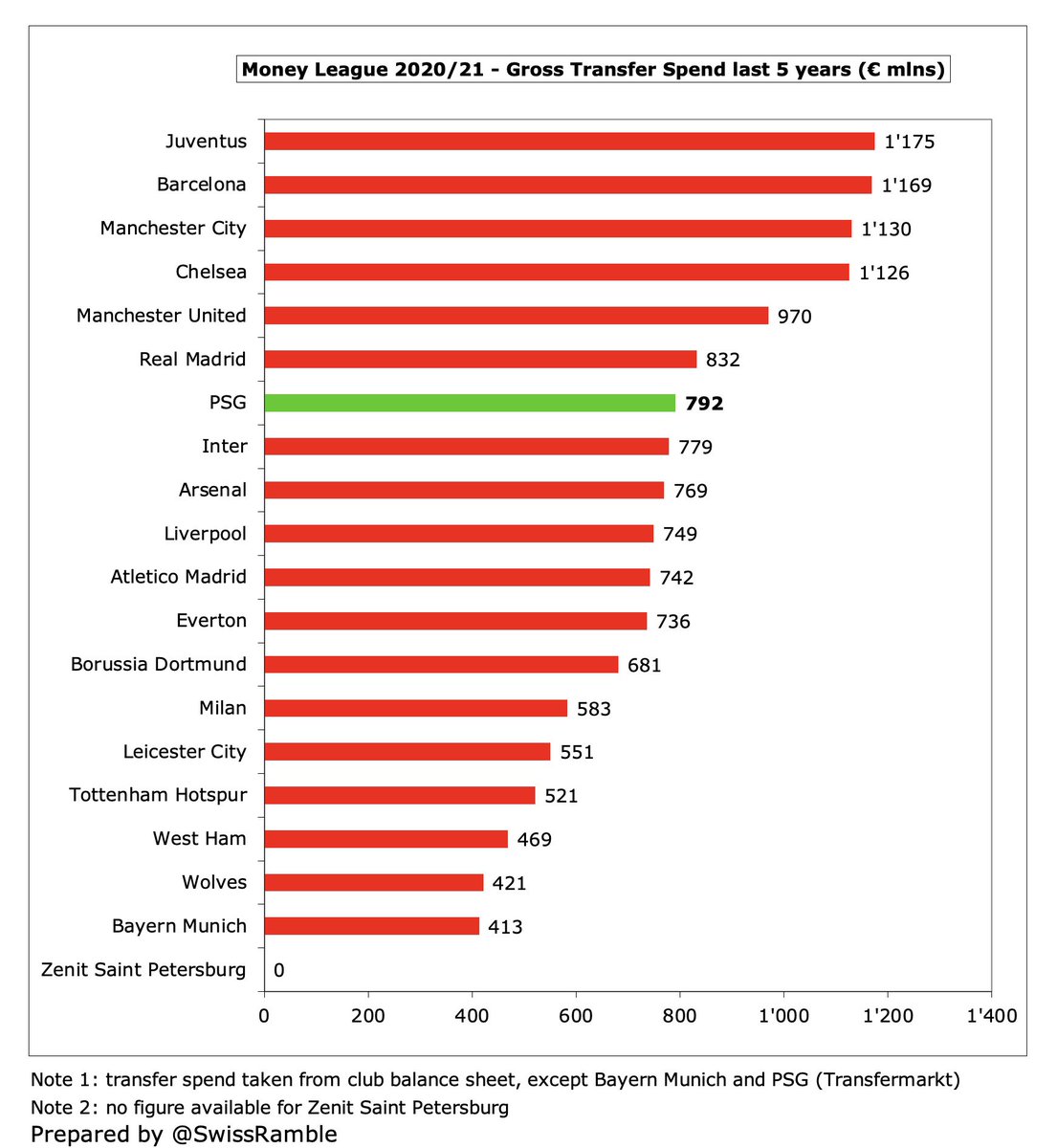

#PSG ramped up transfer spend since QSI investment, amounting to €792m gross outlay in the last 5 years, around 40% more than the preceding 5-year period. Includes huge acquisitions of Neymar from Barcelona €222m and Mbappé from Monaco €145m, but spend has fallen since 2018.

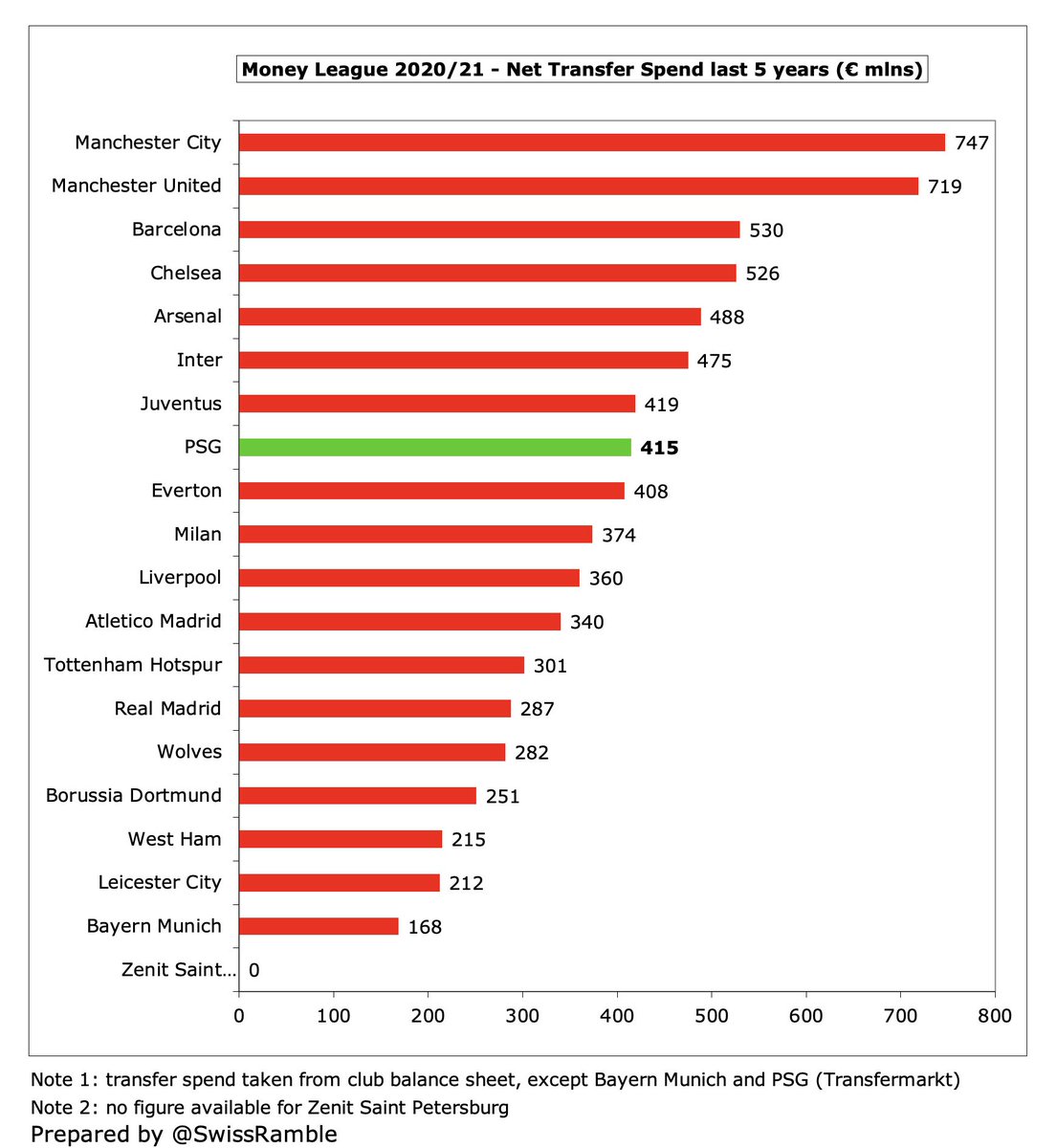

However, #PSG have not spent as much in the transfer market as their European rivals. Their €792m gross spend in last 5 years is comfortably outpaced by Juventus, Barcelona, #MCFC & #CFC – all above a billion. On a net basis, their €415m is far below #MCFC €747m & #MUFC €719m

As a rule #PSG have had no external debt, but added €90m in 2021, though the shareholder loan from QSI decreased by €129m from €197m to €68m, giving total gross debt of €158m. As cash increased by €73m to €99m, the club’s net debt fell from €125m to €59m.

#PSG €158m gross debt is the second highest in France, only below Lyon €330m (new stadium). However, this is one of the lowest of the European elite clubs, miles below the likes of #CFC €1.7 bln (Abramovich funding), #THFC €964m (new stadium) and #MUFC €599m (Glazers LBO).

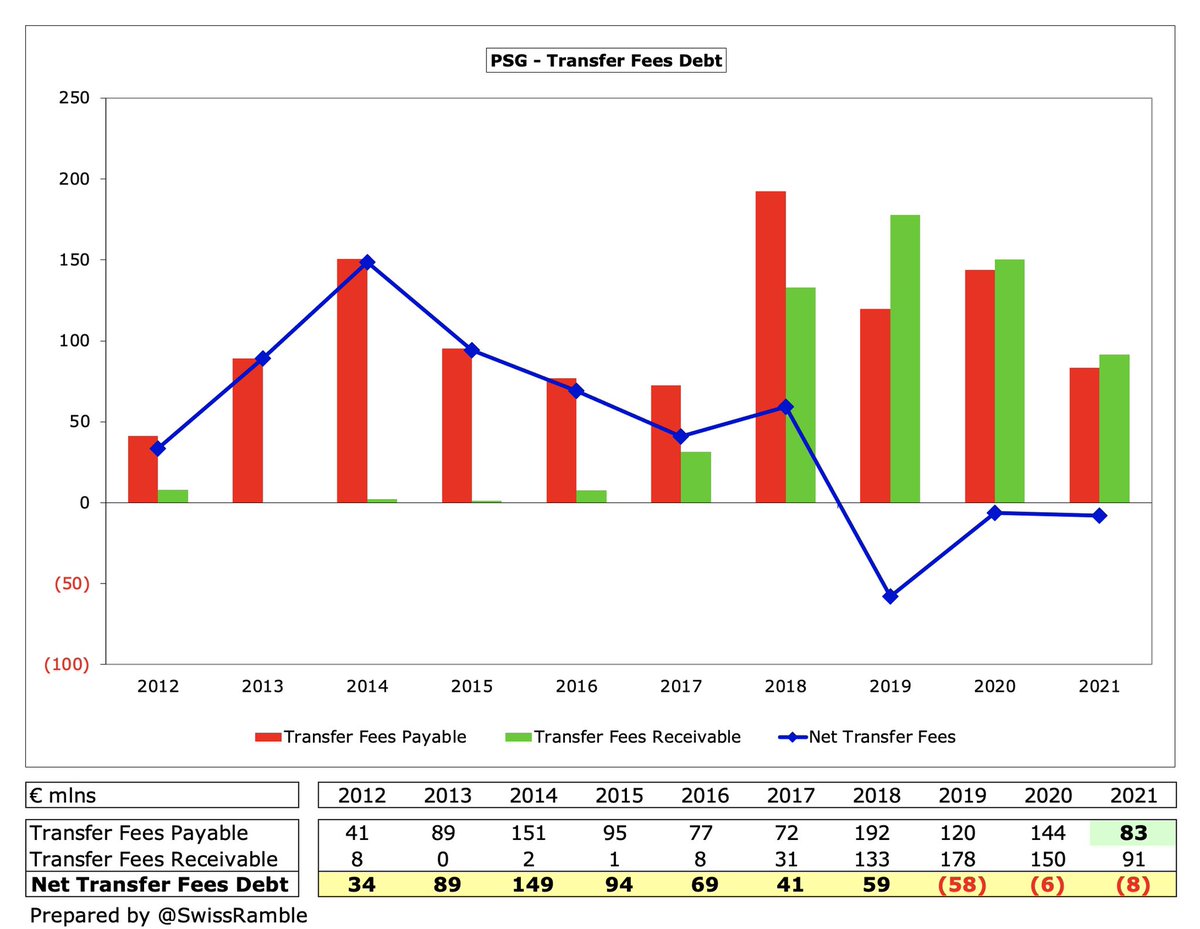

#PSG cut transfer debt from €144m to €83m, way down from €192m in 2018. Second highest in France, just below Lyon €86m, but again low in Europe, i.e. only a third of Juventus €265m and Barcelona €231m. In fact, they have €8m net receivables, as other clubs owe them €91m.

Obviously, #PSG should have no problems paying their debts, especially with a chunky cash balance of €99m. Stop me if you’ve heard this one before, but this is considerably more than other French clubs: Lyon €70m, Lille €33m and Saint-Etienne €27m.

It is also true that #PSG have benefited from significant financial support from their owners, Qatar Sports Investments (QSI), as evidenced by the €171m capital injection last season, which takes the total funding to over half a billion (€511m, including €316m in 2018).

UEFA’s Financial Fair Play regulations have been a thorn in #PSG’s side. They were fined €60m in 2014, after UEFA said their “innovative” QTA deal artificially inflated revenue, though they were ultimately cleared by CAS after the most recent 2017 investigation.

Despite the huge loss, Al-Khelaifi believes that #PSG will comply with FFP over the 3-year monitoring period, taking into consideration previous profits and allowable deductions for infrastructure, academy, women’s football and community.

Furthermore, UEFA have relaxed FFP regulations to “neutralise the adverse impact of the COVID-19 pandemic” by allowing clubs to adjust the break-even calculation by excluding COVID shortfalls and assessing losses posted in 2020 and 2021 as a single (average) period.

#PSG enjoy enormous financial advantages in France, where their revenue and wages are much higher than their domestic challengers, but the true test remains the Champions League, which is proving to be a more difficult nut to crack, leading to much unrest among their fans.

• • •

Missing some Tweet in this thread? You can try to

force a refresh