According to Coinbase: Users *could* lose their #crypto holdings on the exchange if it files for bankruptcy.

Source: businessinsider.com/coinbase-warni…

But it’s more nuanced than that.

Now is the time to explain a *CRITICAL* difference between #exchanges & #crypto wallets

🧵1/7

Source: businessinsider.com/coinbase-warni…

But it’s more nuanced than that.

Now is the time to explain a *CRITICAL* difference between #exchanges & #crypto wallets

🧵1/7

2/7 #Crypto exchanges operate similar to traditional banks.

Exchanges hold your assets for you, and make it easy to swap between the traditional fiat financial system (like $USD) and the world of crypto (like #Bitcoin).

Exchanges hold your assets for you, and make it easy to swap between the traditional fiat financial system (like $USD) and the world of crypto (like #Bitcoin).

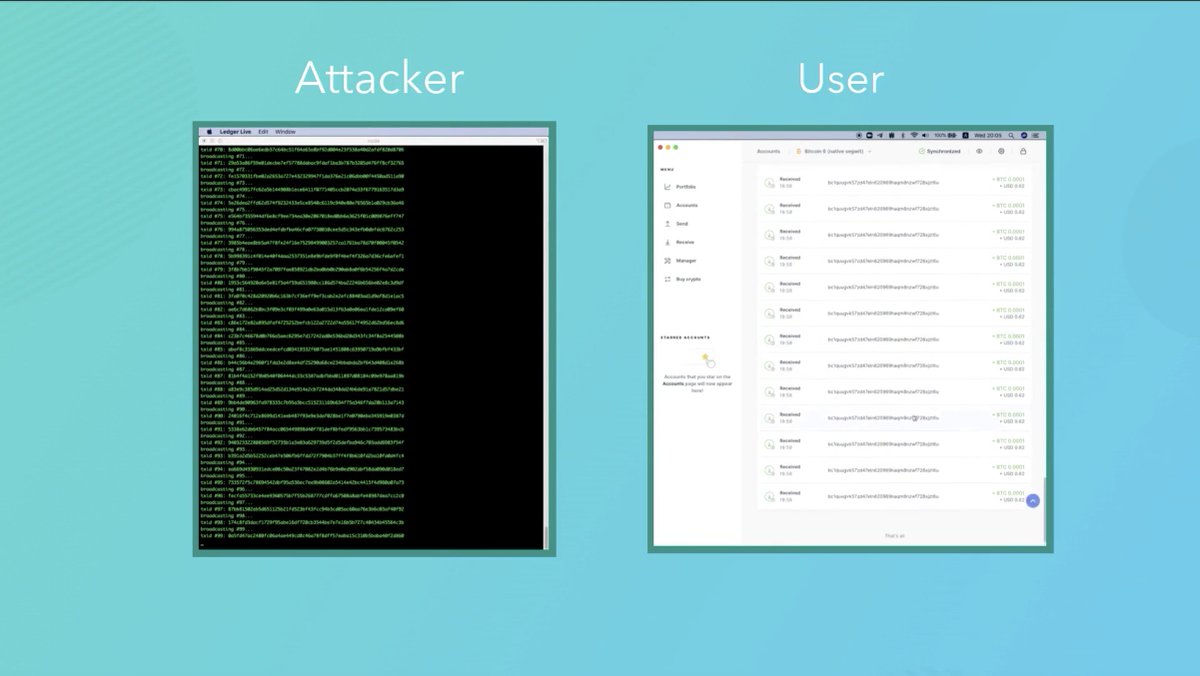

3/7 Because of the way they are structured, #crypto exchanges have custody of your funds, and transactions with them are off-chain, controlled & recorded by them.

If they are “closed” (downed servers or closed on weekends/holidays), they can limit access to your funds.

If they are “closed” (downed servers or closed on weekends/holidays), they can limit access to your funds.

4/7 Because they control your #crypto, in the event of a bankruptcy, exchanges *could be legally mandated* to seize your funds, as @brian_armstrong explains ⬇️

https://twitter.com/brian_armstrong/status/1524233480040710144?s=20&t=2lGapEZ1UwdREIGHqrp2Hw

5/7 On the other hand, traditional #crypto wallets are controlled by you: The user! No 3rd party can access your funds.

Many have embraced crypto specifically for these

property assurances.

This has tradeoffs. You have more control, but you also have endless responsibility.

Many have embraced crypto specifically for these

property assurances.

This has tradeoffs. You have more control, but you also have endless responsibility.

6/7 If you self-custody #crypto in a wallet, most are backed up through a secret recovery phrase.

You *must* keep that phrase secure: No entity will help you recover your $ or #NFTs if lost/stolen. (Unless you use a wallet like ZenGo, where we’ve removed that vulnerability.)

You *must* keep that phrase secure: No entity will help you recover your $ or #NFTs if lost/stolen. (Unless you use a wallet like ZenGo, where we’ve removed that vulnerability.)

7/7 There are benefits and drawbacks to each type of custody option. Always make sure to do your own research and decide what works best for you.

Want to learn more? Listen to this great Zen Crypto Show Podcast episode about #crypto wallets ⬇️

open.spotify.com/episode/3A5QSG…

Want to learn more? Listen to this great Zen Crypto Show Podcast episode about #crypto wallets ⬇️

open.spotify.com/episode/3A5QSG…

• • •

Missing some Tweet in this thread? You can try to

force a refresh