1 / If by any reason you are not familiar with Convex and @CurveFinance then here is a little recap:

2/

- Curve is a DEX designed for stablecoin trading with $8.9b in TVL

- $CRV is the gov token of Curve Finance

- $CRV holders get 50% of trading fees and can vote on the emission of $CRV for the liq pools

- The longer you lock $CRV for $veCRV the higher voting power you get

- Curve is a DEX designed for stablecoin trading with $8.9b in TVL

- $CRV is the gov token of Curve Finance

- $CRV holders get 50% of trading fees and can vote on the emission of $CRV for the liq pools

- The longer you lock $CRV for $veCRV the higher voting power you get

3/

- Convex is a DeFi protocol built to get as much as possible $CRV

- Users can irreversibly convert $CRV into $cvxCRV - the liquid version of stacked $CRV.

- $CRV will be forever locked in Curve, so Convex can influence the allocation of further issued CRV.

- Convex is a DeFi protocol built to get as much as possible $CRV

- Users can irreversibly convert $CRV into $cvxCRV - the liquid version of stacked $CRV.

- $CRV will be forever locked in Curve, so Convex can influence the allocation of further issued CRV.

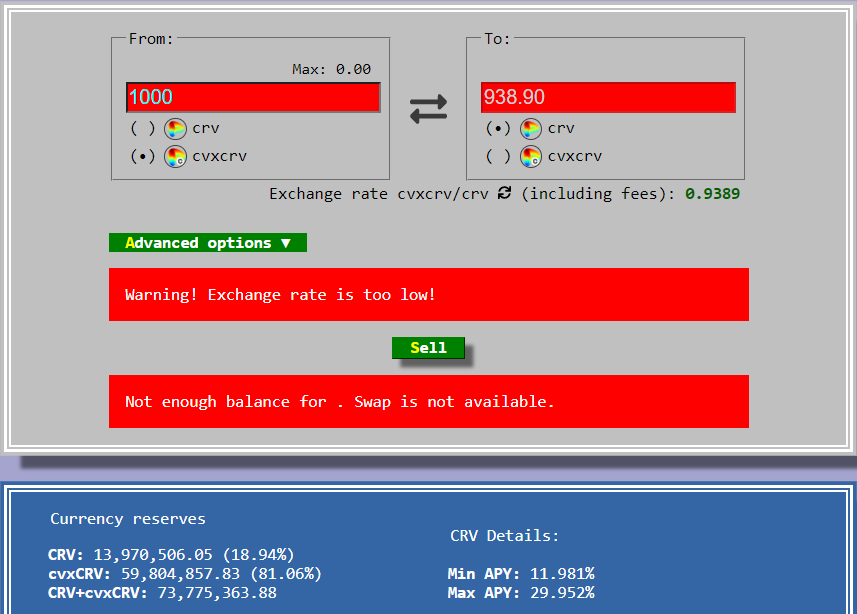

4/ $cvxcrv can NOT be redeemed for $CRV but can be exchanged for it at a market rate (considered to be at 1:1 rate). How is the situation at the moment?

~$14m of exit liquidity left in cvxcrv-crv pool

~$14m of exit liquidity left in cvxcrv-crv pool

5/ What does it mean for the industry if $cvxcrv loses the peg?

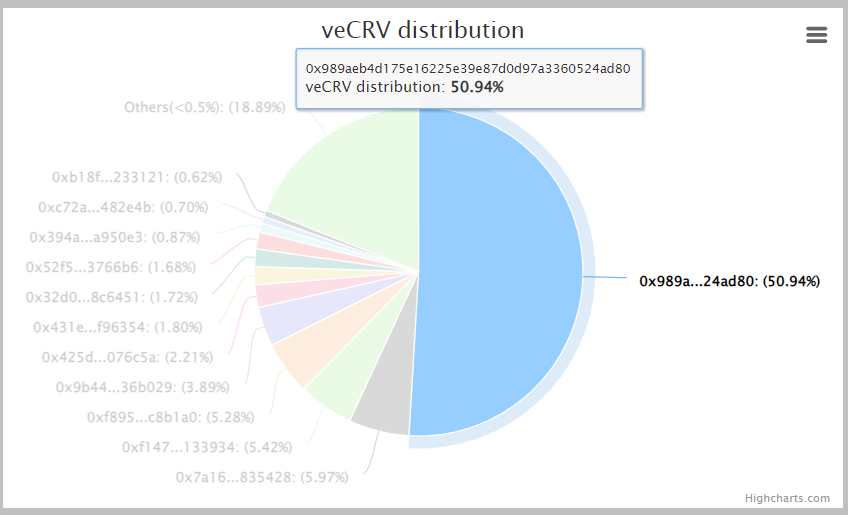

Convex will still have 51% share of all veCRV locked, they don't lose much. Except new $crv will stop coming to the platform.

Convex will still have 51% share of all veCRV locked, they don't lose much. Except new $crv will stop coming to the platform.

7/ Curve wars were very profitable during UST/FRAX narratives. With $Luna collapse and $frax marketing company based on screenshots from @samkazemian in TG - welcome to -85% on $crv.

8/ @CryptoHayes stated in his recent article "The crypto capital markets now must determine who is overexposed to anything Terra-related. Any service offering above average yields that is believed to have any exposure to this melodrama will experience swift outflows...

9/ ...And given that most people never read how any of these protocols actually work in distress scenarios, it will be a sell first, read later exercise...

10/ ...This will continue to weigh on all crypto assets as all investors lose confidence and would rather suck their thumb, clutch their safety blanket, and hold fiat cash."

11/ In other words the market will remove all the participants who didn't take profits in time or are trying to outplay the market. All the pegged assets must be prepared for a bad scenario, especially its holders.

12/ As @LFG_org was forced to sell all the #bitcoin the same all the overexposed market players will be forced to give up with their position. Probably it is too late to say, but it is better to take profits voluntarily, then to be forced to take losses.

• • •

Missing some Tweet in this thread? You can try to

force a refresh