[THREAD] 🧵 An introduction to #tokenomics

This last bull run we have seen everything pumping, from #L1's and #DeFi to Gaming, #Metaverse & #NFT's.

All of these projects evolve around launching a token - and while crucial, many don't know much about this..

This last bull run we have seen everything pumping, from #L1's and #DeFi to Gaming, #Metaverse & #NFT's.

All of these projects evolve around launching a token - and while crucial, many don't know much about this..

We will cover the following:

1. WHAT

2. FINANCING & DISTRIBUTION

3. KEY CONCEPTS

4. CONCLUSION

1. WHAT

2. FINANCING & DISTRIBUTION

3. KEY CONCEPTS

4. CONCLUSION

1/ WHAT?

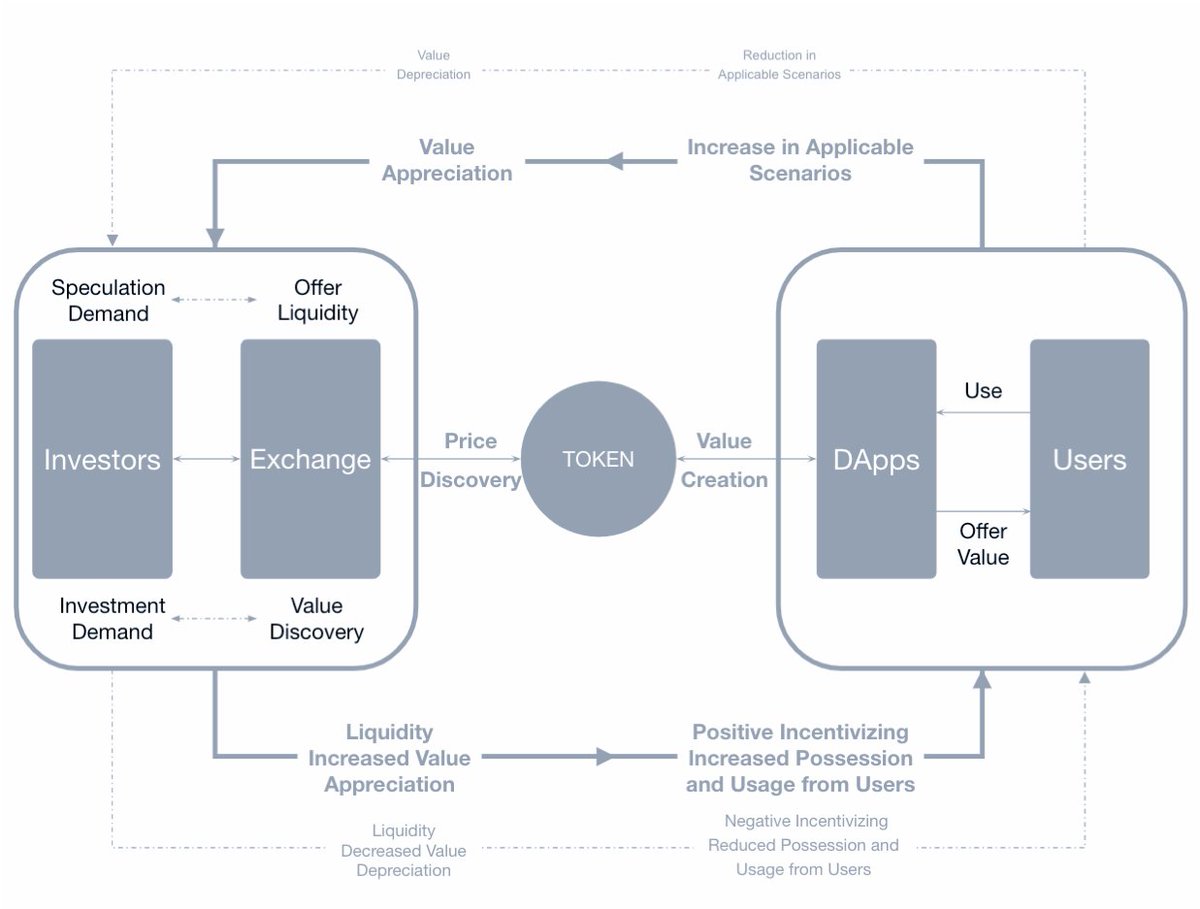

Tokenomics is a combination of “token” and “economics,” - a catch-all for the elements that make a particular cryptocurrency valuable and interesting to investors.

That includes everything from a token's supply and how it's issued to things like what utility it has.

Tokenomics is a combination of “token” and “economics,” - a catch-all for the elements that make a particular cryptocurrency valuable and interesting to investors.

That includes everything from a token's supply and how it's issued to things like what utility it has.

1/ WHAT?

Understanding tokenomics is extremely important - it allows you to understand & filter through good/bad projects.

Understanding key things such as FDV, token-unlocks, sell pressure and so on will impact the way you make investment decisions.

Understanding tokenomics is extremely important - it allows you to understand & filter through good/bad projects.

Understanding key things such as FDV, token-unlocks, sell pressure and so on will impact the way you make investment decisions.

2/ FINANCING & DISTRIBUTION

When a project finally launches/lists, many retail investors can finally buy a token of a project they have been following.

However, before blindly buying any token be aware of the possible drawbacks of buying at listing:

When a project finally launches/lists, many retail investors can finally buy a token of a project they have been following.

However, before blindly buying any token be aware of the possible drawbacks of buying at listing:

2/ FINANCING & DISTRIBUTION

Many projects will have token unlocks at the moment of listing. Most of them will have a vesting period in which the tokens can be unlocked.

Many projects will have token unlocks at the moment of listing. Most of them will have a vesting period in which the tokens can be unlocked.

2/ FINANCING & DISTRIBUTION

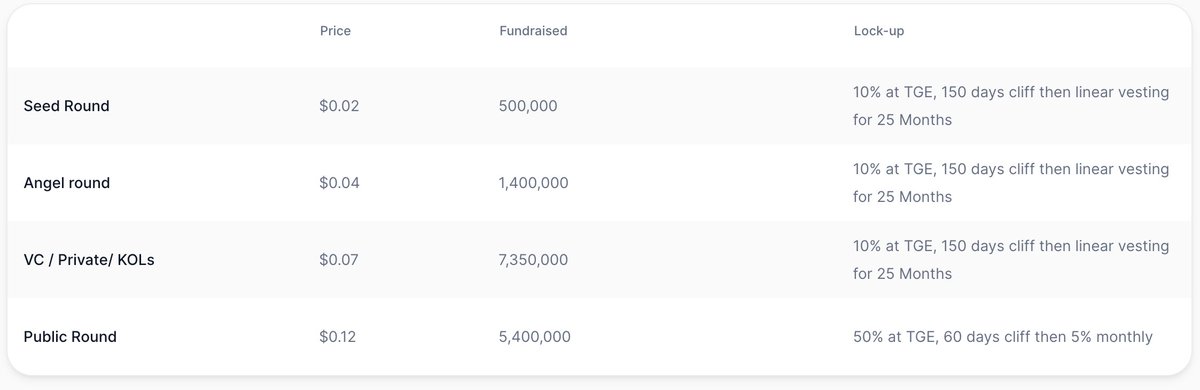

When & how depends on the funding round:

- Seed round

- Private round

- Public round

The specifics vary for each project of course, so the information below discusses the general trend we see across most projects today.

When & how depends on the funding round:

- Seed round

- Private round

- Public round

The specifics vary for each project of course, so the information below discusses the general trend we see across most projects today.

2/ FINANCING & DISTRIBUTION

1️⃣ SEED ROUND - Primary objective is to bring in funds/cash into the company. It allows the project to launch by compensating for the costs related to the development.

This round is done at the beginning & the price is generally very attractive.

1️⃣ SEED ROUND - Primary objective is to bring in funds/cash into the company. It allows the project to launch by compensating for the costs related to the development.

This round is done at the beginning & the price is generally very attractive.

2/ FINANCING & DISTRIBUTION

1️⃣ SEED ROUND - In return for the attractive price (which can create selling pressure on listing), tokens are vested.

What does this mean? The seed round does not touch its tokens at the listing, there is a cliff of a few months/years

1️⃣ SEED ROUND - In return for the attractive price (which can create selling pressure on listing), tokens are vested.

What does this mean? The seed round does not touch its tokens at the listing, there is a cliff of a few months/years

2/ FINANCING & DISTRIBUTION

2️⃣ PRIVATE ROUND - Influencers, smaller investors, and marketing departments are onboarded.

The goal here is more hybrid - besides financing, the important thing is to find partners who can bring added value (such as awareness).

2️⃣ PRIVATE ROUND - Influencers, smaller investors, and marketing departments are onboarded.

The goal here is more hybrid - besides financing, the important thing is to find partners who can bring added value (such as awareness).

2/ FINANCING & DISTRIBUTION

2️⃣ PRIVATE ROUND - The investors here get a preferential price too, though less preferential than in the seed round.

On the other hand, the vesting period is less strict.

2️⃣ PRIVATE ROUND - The investors here get a preferential price too, though less preferential than in the seed round.

On the other hand, the vesting period is less strict.

2/ FINANCING & DISTRIBUTION

3️⃣ PUBLIC ROUND - The average retail investor gets a chance to invest - by knowing the right people or participating in launchpads.

The price here is usually the listing price, in return, you have a very advantageous vesting schedule.

3️⃣ PUBLIC ROUND - The average retail investor gets a chance to invest - by knowing the right people or participating in launchpads.

The price here is usually the listing price, in return, you have a very advantageous vesting schedule.

2/ FINANCING & DISTRIBUTION

As rounds progress, selling pressure on listing weakens as a result of higher purchase prices.

It is also very important to verify that team & advisors have the most drastic vesting schedule to show good faith.

No vesting for team = RED FLAG ❌

As rounds progress, selling pressure on listing weakens as a result of higher purchase prices.

It is also very important to verify that team & advisors have the most drastic vesting schedule to show good faith.

No vesting for team = RED FLAG ❌

3/ KEY CONCEPTS

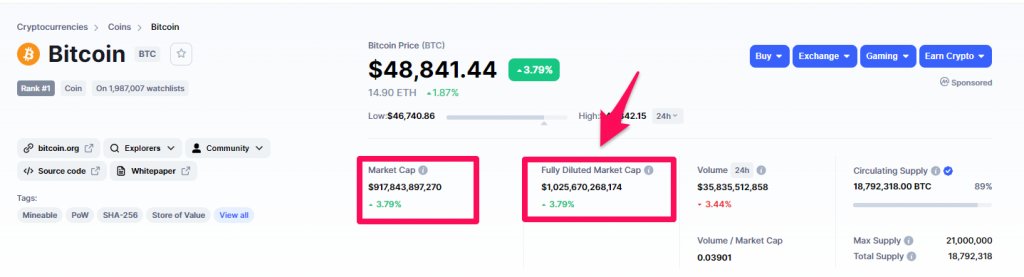

Most #crypto-projects will not release/unlock all of their tokens at launch. Supply is released slowly over time.

#Bitcoin, for example, has a total supply of 21M and a circulating supply of 19M.

Most #crypto-projects will not release/unlock all of their tokens at launch. Supply is released slowly over time.

#Bitcoin, for example, has a total supply of 21M and a circulating supply of 19M.

3/ KEY CONCEPTS

- CIRCULATING SUPPLY: number of tokens currently on the market

- TOTAL SUPPLY: maximum number of tokens that will ever be on the market

- MARKET CAP (MC): current price * circulating supply

- FULLY DILUTED VALUE (FDV): current price * total supply

- CIRCULATING SUPPLY: number of tokens currently on the market

- TOTAL SUPPLY: maximum number of tokens that will ever be on the market

- MARKET CAP (MC): current price * circulating supply

- FULLY DILUTED VALUE (FDV): current price * total supply

3/ KEY CONCEPTS

Important to verify that FDV is not too high - that would imply that a large number of tokens are currently locked and waiting to be released.

This inflates current holders and creates large price pressure to the downside.

Important to verify that FDV is not too high - that would imply that a large number of tokens are currently locked and waiting to be released.

This inflates current holders and creates large price pressure to the downside.

3/ KEY CONCEPTS

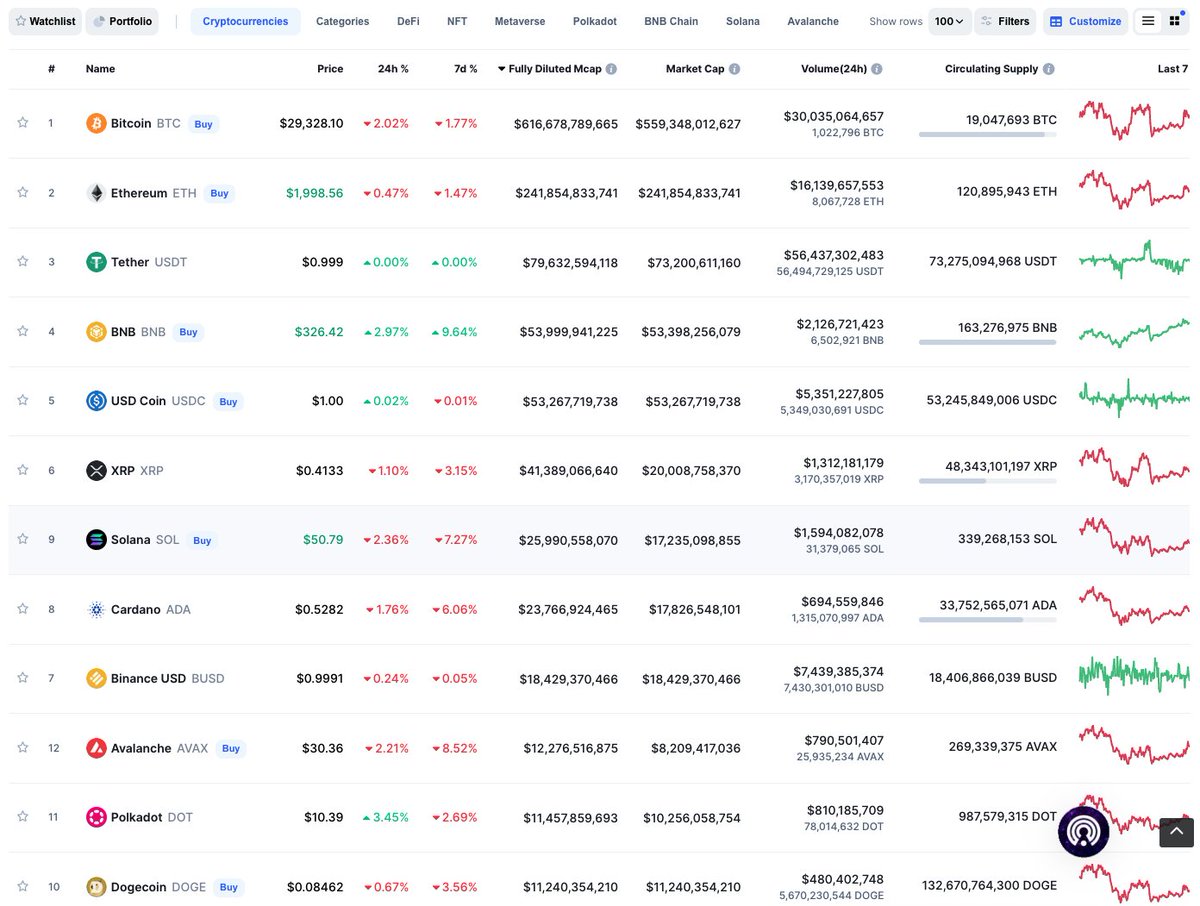

Might be interesting to sort projects based on FDV on @CoinMarketCap

A project with a low MC but a FDV that places it in the top 50, implies there are too many tokens to be released, and thus a strong selling pressure to come

Might be interesting to sort projects based on FDV on @CoinMarketCap

A project with a low MC but a FDV that places it in the top 50, implies there are too many tokens to be released, and thus a strong selling pressure to come

3/ KEY CONCEPTS

A project with MC = FDV means that all previously locked tokens are circulating. You can assume that price is fully correlated with demand.

A project with MC = FDV means that all previously locked tokens are circulating. You can assume that price is fully correlated with demand.

3/ KEY CONCEPTS

Meanwhile, a project with only 10% of tokens in circulation suggests that selling pressure will arrive.

To maintain current prices, token utility must be high enough for the released tokens to find takers at these prices.

Meanwhile, a project with only 10% of tokens in circulation suggests that selling pressure will arrive.

To maintain current prices, token utility must be high enough for the released tokens to find takers at these prices.

4/ CONCLUSION

When evaluating a project to invest in, make sure to consider MC vs. FDV, token unlocks to come, vesting periods & expected selling pressure.

Don't become exit liquidity for a VC who got in at a price 100 times lower than you!

When evaluating a project to invest in, make sure to consider MC vs. FDV, token unlocks to come, vesting periods & expected selling pressure.

Don't become exit liquidity for a VC who got in at a price 100 times lower than you!

That's it!

If you liked this, don't forget to subscribe and share the first tweet. Thank you!

If you liked this, don't forget to subscribe and share the first tweet. Thank you!

https://twitter.com/cryptodraris/status/1528846898752368643

• • •

Missing some Tweet in this thread? You can try to

force a refresh