Should listed IT companies cheer the lay offs in the start up eco system?

A quick 🧵 on the same.

Do ‘re-tweet’ and help us educated more investors (1/14)

#Investing

A quick 🧵 on the same.

Do ‘re-tweet’ and help us educated more investors (1/14)

#Investing

There are 2 most talked about reasons for the current IT sector under performance,

(A) Increasing interest rates & hence reset of valuations

(B) Operating margins shrinking because of the ‘Great Resignation’ (2/14)

(A) Increasing interest rates & hence reset of valuations

(B) Operating margins shrinking because of the ‘Great Resignation’ (2/14)

(A) Lets talk about valuation reset first,

One way of valuing stock is using the DCF method.

(a) You project the future cash flows of the business for the coming 3-5 years & discount it at a particular rate to arrive at today’s value of the business (3/14)

One way of valuing stock is using the DCF method.

(a) You project the future cash flows of the business for the coming 3-5 years & discount it at a particular rate to arrive at today’s value of the business (3/14)

(b) Lets say for example,

Expected Cash Flow of the business,

Year 1 – 1000

Year 2 – 1400

Year 3 – 2000

If I discount it at 6%, today’s value of the business is 3,868 but if rates increases & I discount it at 8% the value drops to 3713 (4/14)

Expected Cash Flow of the business,

Year 1 – 1000

Year 2 – 1400

Year 3 – 2000

If I discount it at 6%, today’s value of the business is 3,868 but if rates increases & I discount it at 8% the value drops to 3713 (4/14)

Valuation drops in a rising rate market if the company is not able to out perform on the expected earnings

Which is why you see NASDAQ (reference for IT) falling more than the S&P (5/14)

Which is why you see NASDAQ (reference for IT) falling more than the S&P (5/14)

(B) Lets talk about the Great Resignation now,

Below are the reported attrition rates amongst the top IT companies,

Cognizant - 31%

Infosys - 27.7%

Tech Mahindra - 24%

TCS - 17.4% (6/14)

Below are the reported attrition rates amongst the top IT companies,

Cognizant - 31%

Infosys - 27.7%

Tech Mahindra - 24%

TCS - 17.4% (6/14)

Attrition leads to reducing margins for the IT companies,

- Salaries increase in retaining or hiring new talent

- Utilization falls, Infosys utilization fell from 88.5% to 87% in Q4 FY22 (7/14)

- Salaries increase in retaining or hiring new talent

- Utilization falls, Infosys utilization fell from 88.5% to 87% in Q4 FY22 (7/14)

(Q) Where is the talent going you may ask?

Since the last 2 years, a lot of new age tech start ups were offering 2-3x salaries, ESOP’s etc., attracting talent from the old IT services companies (8/14)

Since the last 2 years, a lot of new age tech start ups were offering 2-3x salaries, ESOP’s etc., attracting talent from the old IT services companies (8/14)

(Q) What’s happening to the start up eco system?

(a) Valuation reset because of rising rates is hurting publicly listed tech stocks & VC’s / PE’s are losing big time on their listed portfolios (9/14)

(a) Valuation reset because of rising rates is hurting publicly listed tech stocks & VC’s / PE’s are losing big time on their listed portfolios (9/14)

(b) Bcoz the peer tech stock is losing valuation in the listed world, it is putting pressure on the valuation of the unlisted companies

(c) Tiger Global is expected to be losing $17B, almost 2/3 of the cumulative gains it made in the start up investing since it was formed in 2001

(c) Tiger Global is expected to be losing $17B, almost 2/3 of the cumulative gains it made in the start up investing since it was formed in 2001

(d) Softbank is estimated to lose $18.6B on its public portfolio upto March 22.

The above is leading to drying liquidity in the start up eco system (11/14)

The above is leading to drying liquidity in the start up eco system (11/14)

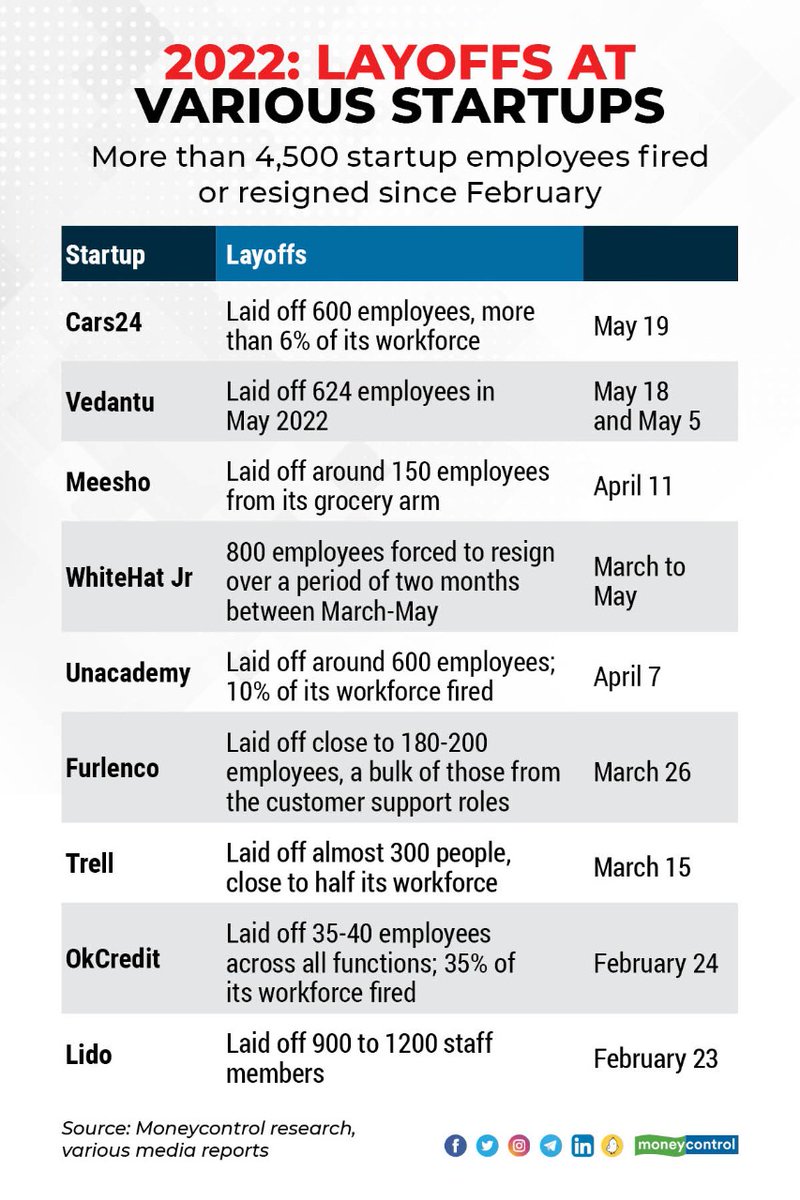

(Q) What is the second order effect of mounting losses, drying liquidity & lowering valuations?

LAYOFF's (12/14)

LAYOFF's (12/14)

(Q) Is this an advantage to the IT sector?

- Startup's may be ditched for stability

- Along with depreciating rupee, this can probably improve the operating margins for the IT sector going forward

This is definitely not an investment advice but an educational thread ☺ (13/14)

- Startup's may be ditched for stability

- Along with depreciating rupee, this can probably improve the operating margins for the IT sector going forward

This is definitely not an investment advice but an educational thread ☺ (13/14)

This is my 54th thread, you can follow me at @KirtanShahCFP for some interesting content around investing.

Have earlier written on,

-Sector Analysis

-Macro

-Debt Markets

-Equity

-Gold

-Personal Finance etc.

You can find them all in the link below

Have earlier written on,

-Sector Analysis

-Macro

-Debt Markets

-Equity

-Gold

-Personal Finance etc.

You can find them all in the link below

https://twitter.com/KirtanShahCFP/status/1337953717274832896?s=20&t=IpXfaMap2Ssb1NTvQm9Ikw(END)

• • •

Missing some Tweet in this thread? You can try to

force a refresh