What #Ethereum applications have the highest demand? To find out, we followed where users spent the most gas.

In our latest research piece, we explore the dynamic and ever changing usage profile of #Ethereum, from #ERC20 tokens, to #DeFi, to #NFTs

1/5🧵

glassno.de/etherverse

In our latest research piece, we explore the dynamic and ever changing usage profile of #Ethereum, from #ERC20 tokens, to #DeFi, to #NFTs

1/5🧵

glassno.de/etherverse

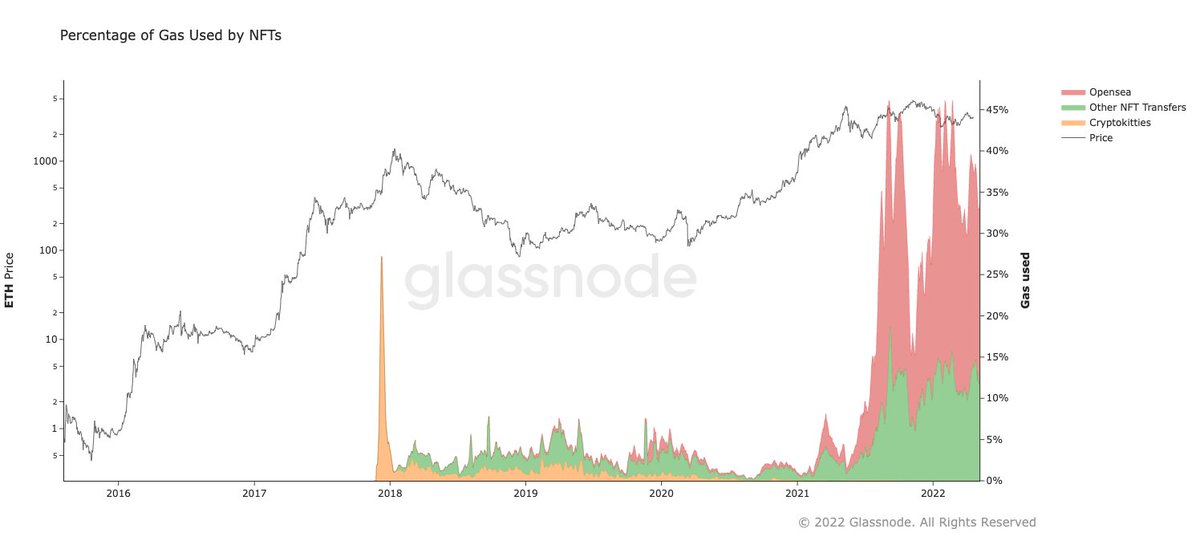

Over time, #Ethereum has been many things, and we can clearly see these trends emerge within Gas consumption dominance.

Notable #Ethereum usage dominance today:

- 30% NFTs

- 13% DeFi

- 8% $ETH transfers

- 5% Stablecoins

- 5% Bridges

2/5

Live Chart: glassno.de/39Uw5Xx

Notable #Ethereum usage dominance today:

- 30% NFTs

- 13% DeFi

- 8% $ETH transfers

- 5% Stablecoins

- 5% Bridges

2/5

Live Chart: glassno.de/39Uw5Xx

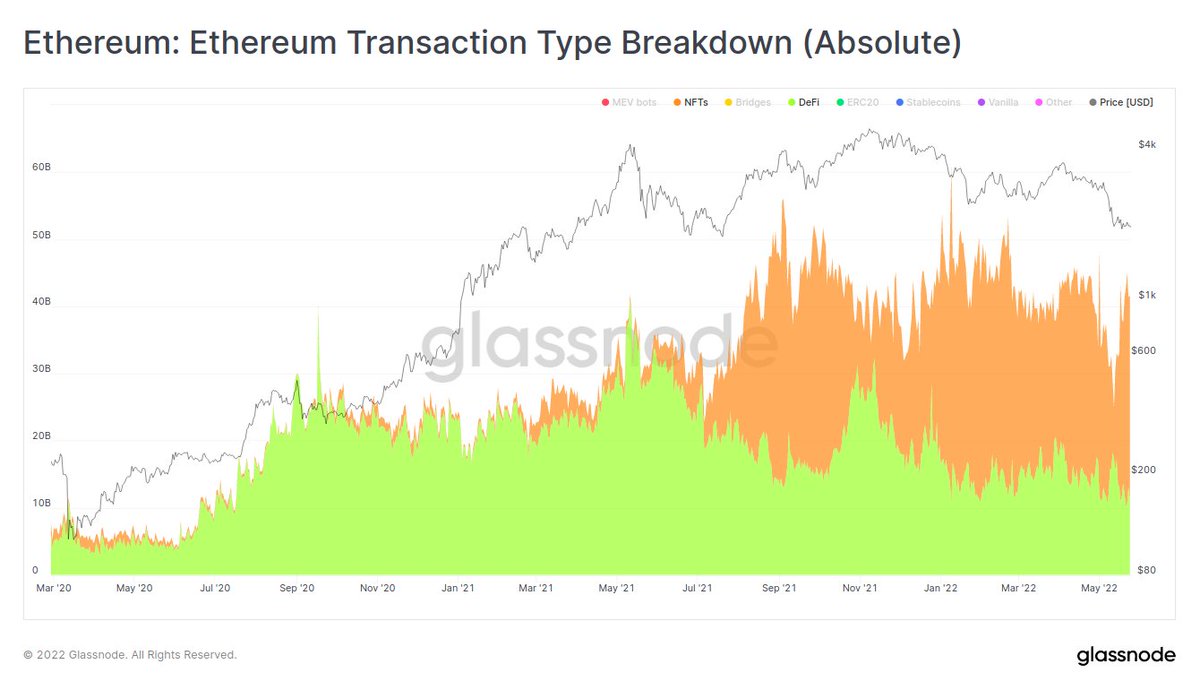

Through observation of #Ethereum network usage, we can identify shifting market preferences.

The chart below clearly demonstrates the expansion of the #NFT trend 🟧, taking off in mid-2021, and absorbed market share relative to DeFi 🟩

3/5

Live Chart: glassno.de/39SRYqu

The chart below clearly demonstrates the expansion of the #NFT trend 🟧, taking off in mid-2021, and absorbed market share relative to DeFi 🟩

3/5

Live Chart: glassno.de/39SRYqu

#NFTs currently command 30% to 45% of daily #Ethereum gas consumption, and transaction counts on-chain.

@opensea remains one of the largest NFT trading platforms, capturing a large share of user demand in 2022.

4/5

@opensea remains one of the largest NFT trading platforms, capturing a large share of user demand in 2022.

4/5

As #Ethereum continues to evolve as a platform, new use cases will be discovered, and user demand can shift.

Our analysis explores the history of the Etherverse, told through the lens of gas consumption, usage trends, and transaction dominance👇

glassno.de/etherverse

5/5

Our analysis explores the history of the Etherverse, told through the lens of gas consumption, usage trends, and transaction dominance👇

glassno.de/etherverse

5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh