#cryptocurrency

Wrapped #Bitcoin (WBTC) is the third largest token by market cap in the Ethereum Network behind only USDC and #ETH itself. Directionally, this all has disastrous implications for #Ethereum. A thread 🧵

Wrapped #Bitcoin (WBTC) is the third largest token by market cap in the Ethereum Network behind only USDC and #ETH itself. Directionally, this all has disastrous implications for #Ethereum. A thread 🧵

Ask yourself: What's the highest value use case for a coin or token❓

MONEY

Money is not tps, tx cost, or throughput. Those are all features of a blockchain.

MONEY

Money is not tps, tx cost, or throughput. Those are all features of a blockchain.

Nothing in the Ethereum Network has established itself as MONEY except for stablecoins and collateral like bitcoin (wrapped). The problem here is that both of these are CENTRALIZED derivates of the real thing (USD, BTC), and they travel on Ethereum’s base layer.

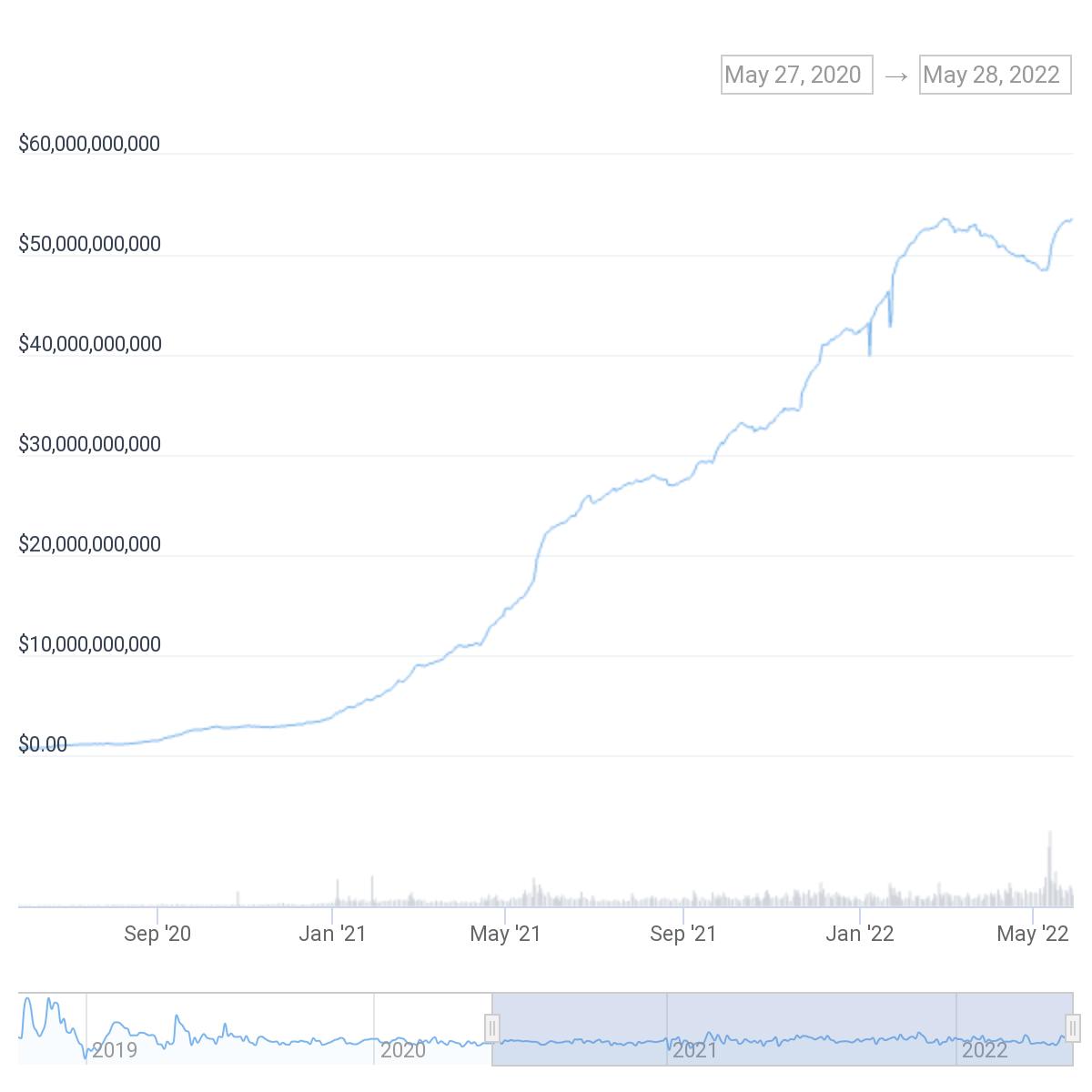

What other reason could there be for 87% of the network’s transaction volume to come from stablecoins and wrapped collateral? Check out USDC’s two-year market cap growth:

Is there any good reason to assume this growth will slow w/out regulations? No. And if it continues growing at this pace, it'll flip ETH’s mkt cap in late 2024, making it perhaps the “Flippening” we should be discussing, quite embarrassing, flipped by your own native stablecoin.

USDC ($54B) is just one stablecoin active on the network. Don’t forget WBTC too, collateralizing $8B, DAI ($7B) or PAX ($1B) or USDT ($20B) in ETH DeFi, etcetera.

So what's Ethereum?

An IOU database.

ETH is a gas token that's required to ferry centralized derivative money around the network, and dapps try catching this money by offering their speculative tokens in xchange for it

Web2: you are the product

Web3: you are the exit liquidity

An IOU database.

ETH is a gas token that's required to ferry centralized derivative money around the network, and dapps try catching this money by offering their speculative tokens in xchange for it

Web2: you are the product

Web3: you are the exit liquidity

Web3 is a tokenized orgy of swaps, wraps, burns, mints, and stakes run by dapps that do nothing but optimize token interactions to keep the orgy going. It’s a VC, Dev, & CEX vaporware scam. And the only reason most of them can exist, is because there are no securities regulations

This means collusion, inside trading, trading against customers, and manipulating liquidity are fair game, without any consumer protection requirements. #Bitcoin is NOT a profitable business for most exchanges. They can’t control it.

A person with 10,000 coins is no different than a person with 0 coins to the network. Can’t vote. Can’t collude. Can’t secure the network by staking. Both can submit a BIP. And mining requires a continuous expenditure of resources, with its own free market and economy of scale.

That easy money is rapidly approaching its end with regulation. We assume the worst case scenario (ETH and dapps getting designated securities) won’t happen, and instead the money (stablecoins, wrapped collateral) do get designated. It doesn’t matter. The effect will be the same:

Small stables will decollateralize, large stablecoins will be handicapped, and wrapped collateral will mostly disappear. The premium cost of the remaining money will make it impractical. You’re left with more and more illiquid vaporware competing for the same money, less money.

This answers the question of why efforts to create algorithmic stables has been so gung-ho, even in the wake of Madoff-esque Ponzi's by @stablekwon and his #LUNA exit scam.

https://twitter.com/VitalikButerin/status/1529850412760674304?s=20&t=0rp99Lw8v5x4vQQzrOfr_A

The myopic folly of these algo ambitions isn’t only that they're a derivative of a derivative of inflationary fiat, but that if the underlying fiat goes hyper, or even close to it, then:

THE ENTIRE SYSTEM IMPLODES.

Boldest tweet of 2021🔜2024

THE ENTIRE SYSTEM IMPLODES.

Boldest tweet of 2021🔜2024

In a hyper event, there’s only ☝️ release valve for capital flight in the space: #BTC. It’ll mop up and squeeze the bloody mess of red ink into one bucket.

The Merge makes all of this worse…we were assuming the status quo in this thread. I didn’t make it to staking derivatives

The Merge makes all of this worse…we were assuming the status quo in this thread. I didn’t make it to staking derivatives

The Ethereum Network is a Rube Goldberg Machine with a mega-lottery structure that recreates the current financial system hellbent on outdoing 2008. It’s beholden to derivative collateralization, counter-party risk, weakening settlement assurances, solves no real word problems,

makes problems it tries solving pricier, and hides behind VC buzzwords. S-curve adoption shakeout of the space inbound. I'm short ETH. Cover targets $800 to $96 over next 24 months. This is a pair trade I’ve combined with $10 calls purchased on @RiotBlockchain expiring Jan 2024

• • •

Missing some Tweet in this thread? You can try to

force a refresh