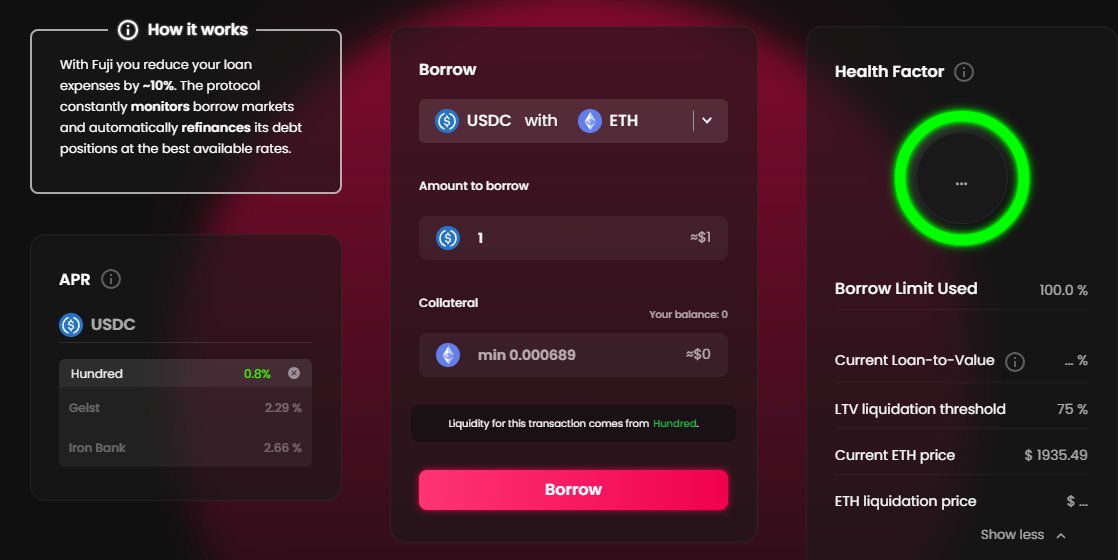

1/ Fuji is a DeFi Borrowing Aggregator. It is searching for the best borrowing rates and what is the most important it is also refinancing your debt position.

2/ Forgot to mention that @FujiFinance is live on #ethereum and #fantom but we will stick to the fantom chain as there is an #airdrop coming. I will explain about it further.

3/ Back to the functionality. Fuji allows you to borrow $DAI or $USDC against $FTM / $ETH / $BTC through the different lending protocols. It is searching for the lowest borrowing rate on the market and routes your loan to the best provider, you get the optimal market conditions.

4/ When the borrowing rate changes (there is a minimum threshold required to trigger refinancing), the protocol will transfer your collateral and debt to the protocol with a better rate. It is done in an efficient way via flashloans.

5/ Same when the user wants to repay debt and exit the borrowing position it can be done with a flashloan, so you do not need to seek for the funds to repay the debt. For me this is a very important feature as I do not have knowledge of how to do flashloans myself.

6/ If the lending protocol incentivises users with a reward token, Fuji is selling them for the collateral asset of a specific vault, increasing its overall health. Unfortunately it is not represented on the UI.

7/ So if you use Fuji for borrowing it will:

- Automatically search for the best borrowing rates on the market;

- Refinance your position when there are better rates on the market;

- Compound rewards (if any) and lending APY;

- Use flashloans for in and out.

- Automatically search for the best borrowing rates on the market;

- Refinance your position when there are better rates on the market;

- Compound rewards (if any) and lending APY;

- Use flashloans for in and out.

8/ Things you need to consider before using Fuji:

- FujiDAO is charging 0.2% on top of the lowest borrowing rate;

- There is a limited amount of lending protocols in use at the moment;

- Fuji sets each vault's LTV limit to the most conservative provider.

- FujiDAO is charging 0.2% on top of the lowest borrowing rate;

- There is a limited amount of lending protocols in use at the moment;

- Fuji sets each vault's LTV limit to the most conservative provider.

9/ Last point from the message above means that if provider A has 80% of LTV and provider B has 70%, you will be able to borrow at maximum 70% LTV.

10/ Personally for me this is a very useful protocol, especially when they add more pairs and enable borrowing non-stable assets. It is quite complicated to manage all your debt positions, especially when the rates spike and you need to restructure your positions.

11/ And I will add a few words about the coming #airdrop.

https://twitter.com/FujiFinance/status/1531311978320482304?s=20&t=hYgEpDn9i9yVnvjCnNFIHw

12/ Basically you need to deposit collateral and borrow stablecoins using Fuji on #fantom. You will be accumulating meter points which you can later exchange for $fuji token.

13/ You will be getting 1 meter point per day for every 1$ debt you have and Fuji has also added a little gamification to the campaign, where you can get special NFTs to get a boost, etc. Rules and mechanics are explained in the Fuji docs.

docs.fujidao.org/climbing-fanto…

docs.fujidao.org/climbing-fanto…

14/ If you liked this thread, I would love it if you could share it by retweeting the first tweet:

Thank you and stay safe!

https://twitter.com/DeFi_Made_Here/status/1532366592880910337?s=20&t=pvCb5ONtsIXh6gsquHmKWg

Thank you and stay safe!

• • •

Missing some Tweet in this thread? You can try to

force a refresh