How to develop yourself in High-Frequency Trading. First topics, books and good practices.

#HFT #trading #cryptocurrency #algotrading

#HFT #trading #cryptocurrency #algotrading

First of all, I would like to tell you that it is only my opinion about how to develop yourself in HFT and I based it on my experience and background. The most important thing is to be critical and think for yourself.

I think that a great HF Trader should be good in a lot of things. Do not concentrate only on one thing - it will not be good, because a good HF Trader has to be also a leader, not only for algo traders but also for developers and other people. You have to have a lot of skills.

Today I am going to talk about how to develop more technical skills, but do not underestimate other things if you want to be the best.

#1 Probability → you have to have a good knowledge related to the logic behind probability. You don’t have to know a lot about some advanced concepts, but good understanding of random variables, conditional expectation and probability and stochastic processes would be great.

#2 Stats and Time-Series → Intuition behind statistical tests and understanding how basic processes (MA, AR, ARMA, ARIMA) are created will be a good start for further exploration of topics that will be interesting for you.

#2 Do not underestimate value of linear algebra because if you will be interested in Machine Learning, it will be really important skill.

#3 Python → Fluency in manipulating DataFrames and NumPy arrays, list and set comprehension, good skills related to the data visualization, basic understanding of object-oriented programming, and debugging skills will be a good start. Fluent Python is a book that can help you.

-

- #4 One other programming language → It will be good for you to be quite fluent in one of the other programming languages like C++, Java etc. It will bring your skills to the next level that will be also helpful in Python, but also bridge the gap between you and developers.

- #4 One other programming language → It will be good for you to be quite fluent in one of the other programming languages like C++, Java etc. It will bring your skills to the next level that will be also helpful in Python, but also bridge the gap between you and developers.

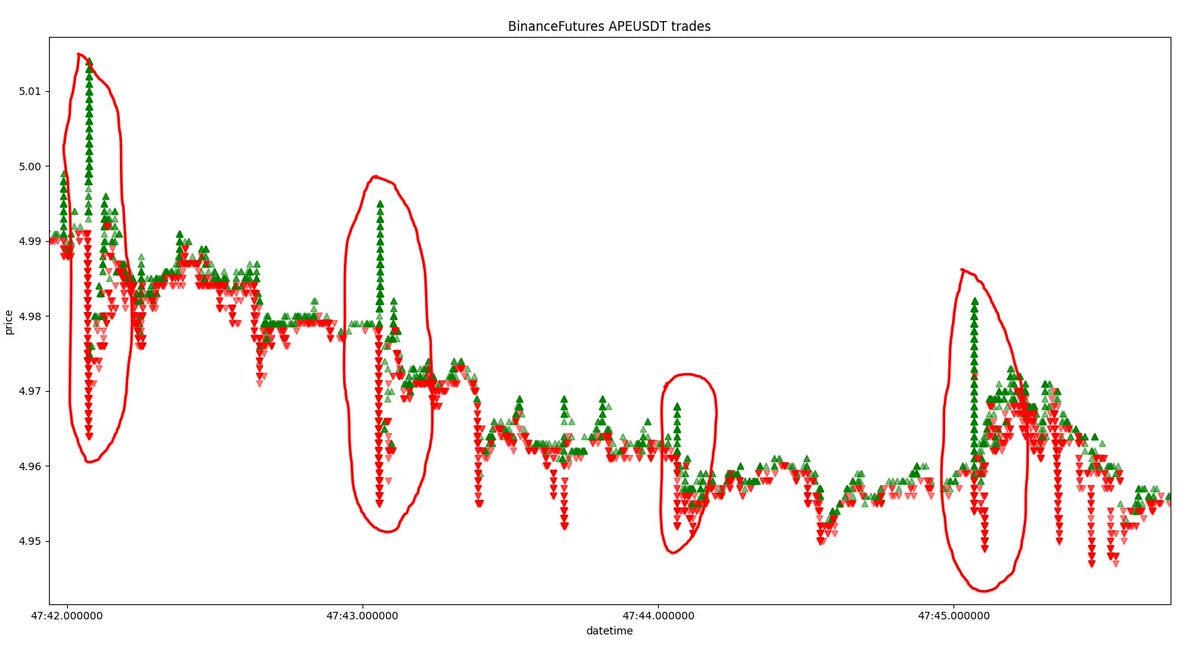

#5 Screen Time → Maybe the most important thing that you can do during the start of your journey. Look at the orderbooks, look at the trades. What is the frequency of the trades, what is the volume imbalance, and do you see patterns in placing orders. It will be really fruitful

#5 Consider buying programs like BookMap for better screen-time.

#6 Theoretical HFT → It will be enough for you to read one or two books related to the HFT and market microstructure. A good start will be Market Microstructure Theory by O’Hara and then go to the more advanced book like Algorithmic and High-Frequency Trading.

#6 Read it carefully but do not read too much books like those, because it will not give you a lot more.

#7 Read HFT papers → Stoikov, Bouchaud, and Gueant are one of the guys that can be helpful in terms of going in-depth with HFT.

#8 Implement some paper/book chapter → it will be fruitful for you if you will be able to implement some paper or some chapter from Market Microstructure Theory and use real data from Binance (for example) to fit it to models.

#8 Try to learn how those people thought when they had found new ideas. You will have to be really creative as well in HFT.

#9 Just do it → I cannot do it for you. Just do it, do not think too much if something will be really important for you, and do not jump from topic to topic without going in-depth. You do not have to be great to start, but you have to start to be great.

#10 Do not treat me as a mentor or guru and do not treat other guys from Twitter like that. You have to be down to earth and believe that you can be greater that all of the tweeter traders. It is only my opinion, I do not have to be right. There are a lot of way to make it.

@phamtuan2k1 thank you for the incentive to write it. Wish you good luck on the journey with HFT.

• • •

Missing some Tweet in this thread? You can try to

force a refresh