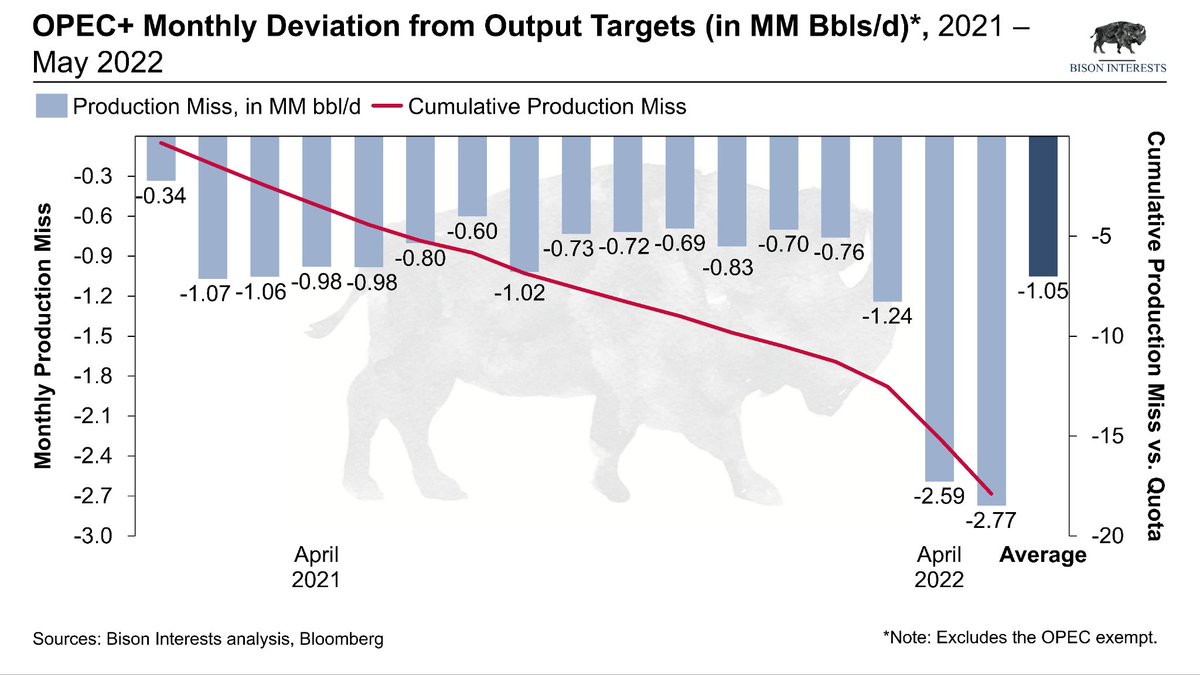

OPEC+ missed their #oil output target even more in May. Short thread with charts. 🧵

This was the worst month for OPEC+ since we started sharing comments on this. Highlights (all in MM bbl/d):

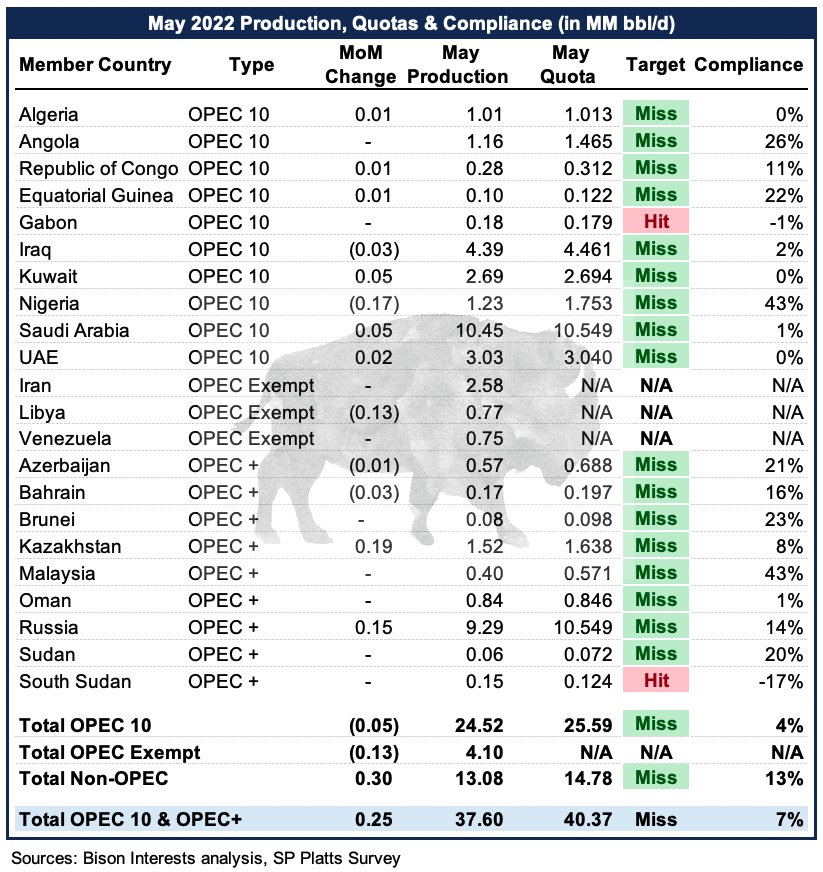

Total production for OPEC+ countries (excluding the OPEC exempt) was 37.60, falling short of the 40.37 quota by 2.77 MM bbl/d.

OPEC 13 production increased by 0.25, 0.15 short of their target increase

OPEC 13 production increased by 0.25, 0.15 short of their target increase

17/19 OPEC+ countries (excluding the exempt) missed their production quotas, the highest number of misses ever since we started sharing comments on this.

Our original white paper on "The Myth of OPEC+ Spare Capacity" bisoninterests.com/content/f/the-…

And the updated and more in depth "OPEC+ Spare Capacity is Insufficient Amid Global Energy Crisis"

bisoninterests.com/content/f/opec…

bisoninterests.com/content/f/opec…

• • •

Missing some Tweet in this thread? You can try to

force a refresh