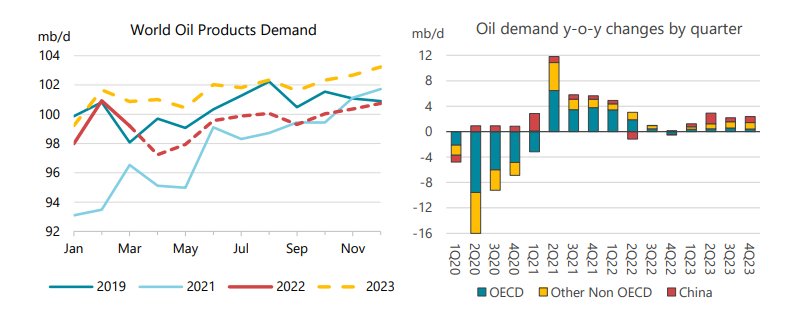

BREAKING: Global oil demand growth will **accelerate** to 2.2m b/d in 2023, up from 1.8m b/d in 2022, the @IEA said on its first look into next year's S/D balances.

"Global oil supply may struggle to keep pace with demand next year," the IEA said | #OOTT #ButTheRecession

"Global oil supply may struggle to keep pace with demand next year," the IEA said | #OOTT #ButTheRecession

As as last month, the @IEA report is full of dire warnings. Global energy policymakers can not say they weren't warned: the second half of 2022, and the full of 2023 look very, very difficult. The IEA doesn't send this warnings that often - pay attention | #OOTT

And ICYMI, this is my @opinion from Monday, warning that the 2022 oil shock was going to roll over into 2023 (as the IEA confirmed today) | #OOTT bloomberg.com/opinion/articl…

A final thought on the IEA 2023 S/D: the global economy may weaken a lot, and soon, as central banks hike interest rates. But with a starting point of 2.2m b/d in 2023 y-on-y oil demand growth, we will need a *really bad recession* to see a *contraction* in consumption next year

• • •

Missing some Tweet in this thread? You can try to

force a refresh