If ever leave Twitter, will be proud of 2 things

1. Contribution during covid in apr'21

2. Continuous rant on overvaluation amplified from Oct'21

Here is master thread on each of those rants. Rarely asked but show some love if it made any +ve difference to your investing. journey

1. Contribution during covid in apr'21

2. Continuous rant on overvaluation amplified from Oct'21

Here is master thread on each of those rants. Rarely asked but show some love if it made any +ve difference to your investing. journey

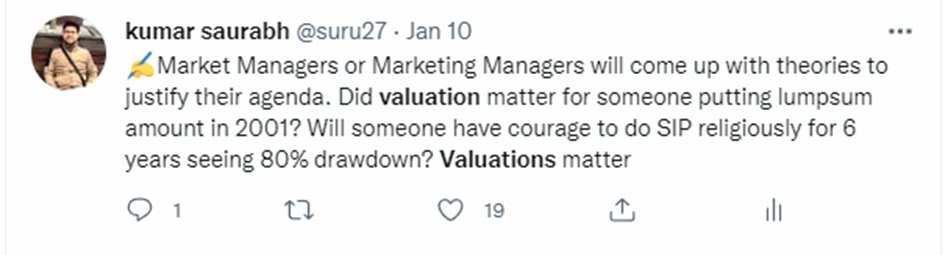

Market Overvaluation

https://twitter.com/suru27/status/1443216175891038212?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

Market Overvaluation

https://twitter.com/suru27/status/1443604929168379909?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

Market overvaluation

https://twitter.com/suru27/status/1451497332965445640?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

IPO Overvaluation

https://twitter.com/suru27/status/1453247460466384898?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

Market Overvaluation

https://twitter.com/suru27/status/1454131888822517761?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

Stock overvaluation

https://twitter.com/suru27/status/1454133841195462659?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

Market Overvaluation

https://twitter.com/suru27/status/1456934674333192193?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

Market Overvaluation

https://twitter.com/suru27/status/1459784680794836994?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

Market Overvaluation

https://twitter.com/suru27/status/1465705476755124236?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

Market Overvaluation

https://twitter.com/suru27/status/1466493443996205057?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

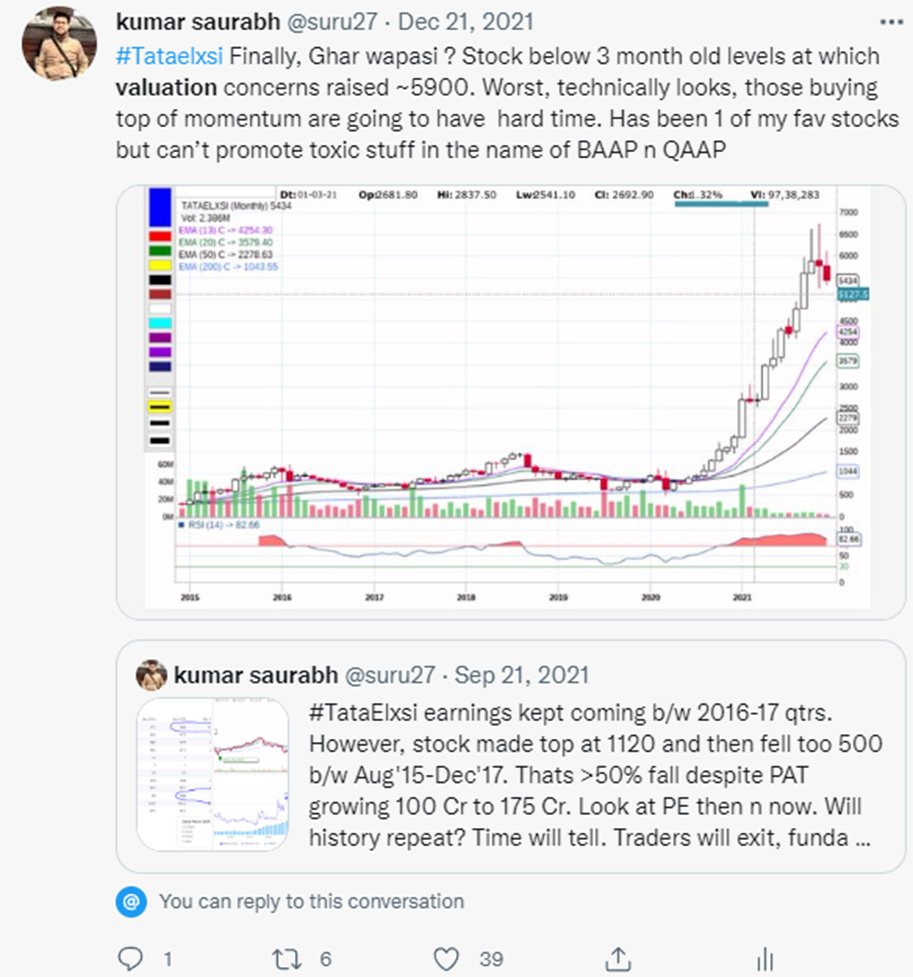

#TATAELXSI Gone wrong

https://twitter.com/suru27/status/1473067586262683650?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

Market Overvaluation

https://twitter.com/suru27/status/1480500744172105732?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

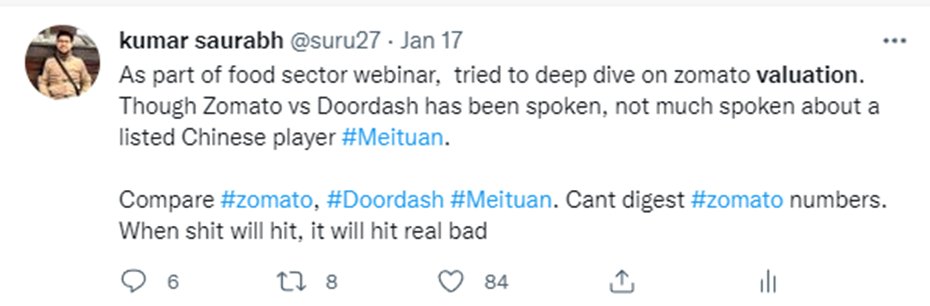

#zomato overvaluation

https://twitter.com/suru27/status/1483027039687180289?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

#lalpath #metropolis

https://twitter.com/suru27/status/1485617461194072072?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

#nextgen loss tech overvaluation

https://twitter.com/suru27/status/1489303933332103168?s=20&t=jwWAYvBxGr_jG3F5h6rhlw

There were 2 more on IPO and textiles but this is the last tweet a twitter thread can take. So, ending here.

Let another bull run come. Let another valuation madness come.

HUM PHIR AYENGE 🙂

Let another bull run come. Let another valuation madness come.

HUM PHIR AYENGE 🙂

Will always be there for those who care, this platform or that platform , does not matter. I will ensure it , I promise

• • •

Missing some Tweet in this thread? You can try to

force a refresh