13 years since #Bitcoin's inception, #BTC has never seen a secular #bearmarket (Monthly #RSI has never been oversold), eventually this will come.

Though I strongly believe BTC will have at least one more cycle to go before this happens, it is possible this has already began.

Though I strongly believe BTC will have at least one more cycle to go before this happens, it is possible this has already began.

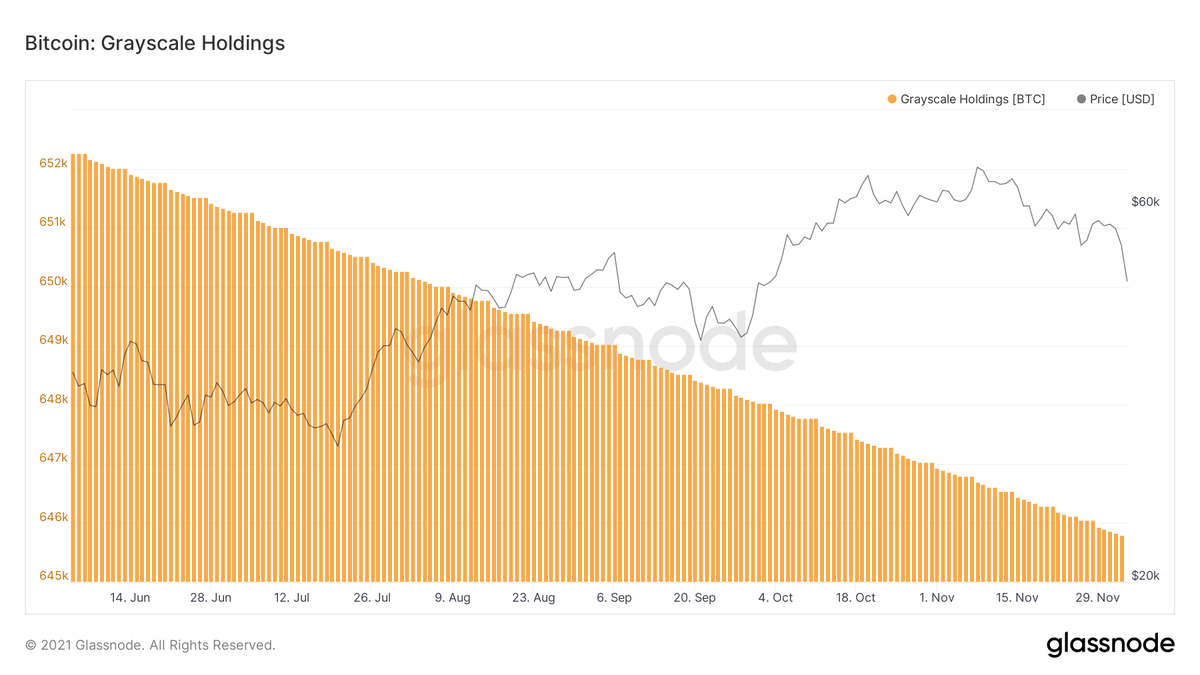

In a secular bearmarket, the "only only" mentality gets tested then shattered. People will ask "how is this possible?", we saw a hint of this when #BTC fell below previous cycle top $20k.

Much alike #NASDAQ in dotcom age, for 14 years, it has always had higher highs...

Much alike #NASDAQ in dotcom age, for 14 years, it has always had higher highs...

then come 2000 a secular #bearmarket shattered all previous expectations (as indicated by monthly oversold RSI).

Imo it is not a question if but when the similar will happen to a rapidly growing asset like #Bitcoin, those who bought the secular top could be in losses for years.

Imo it is not a question if but when the similar will happen to a rapidly growing asset like #Bitcoin, those who bought the secular top could be in losses for years.

Nothing is "up only", investments that seem to be "up only" are either misunderstood or ponzis

The reason I brought this up now is because the beginning of such secular bearmarket will come with many "first" like

- "no one ever lost money investing in #BTC for 4 years (so far)."

The reason I brought this up now is because the beginning of such secular bearmarket will come with many "first" like

- "no one ever lost money investing in #BTC for 4 years (so far)."

• • •

Missing some Tweet in this thread? You can try to

force a refresh