1/ An update of a thread posted last month... 😉

2/ I’m staring at a list of stocks in the S&P 500 Index. The results are sorted by their weighting in the index from largest to smallest. At a 6.97% weight, $AAPL is at the top.

3/ The top 10 stocks in the S&P 500 represent 29.7% of the index. Nearly a third of every dollar you invest in that index is going into just ten stocks. The value-weighted average price-to-sales ratio is 7.3x.[i] Madness.

4/ $TSLA stock price to sales ratio is the number one contributor to that offensive valuation metric. The vaunted maker of electric vehicles sported a 14.5x multiple with a 2.44% weight in the index.

6/ For any advisor or FA who has bought into the dogma of "only indexes" we ask you: do you think having dot com levels of painfully inappropriate valuations in your clients’ portfolios is a good idea? If so, why?

7/ As most investors have noticed, markets have begun to fall. After what some have suggested are 40 years of ever-larger policy mistakes, the bill is coming due.

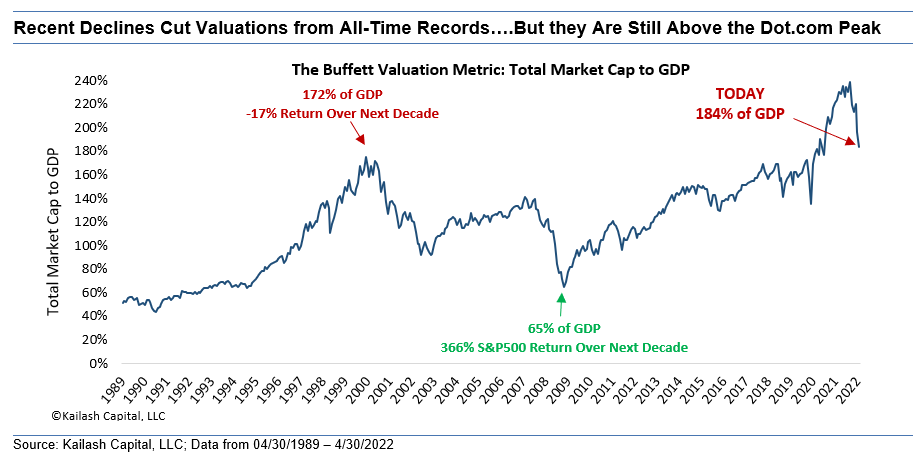

8/ Valuation is a horrible timing tool but, as we have shown, it has been a remarkably effective forecaster of realized 10 year forward returns.

9/ As the chart below shows, the sell-off to date has cut valuations to 184% of GDP. That is still a level well above the peak of the dot com mania.

#Buffett

#Buffett

10/ Get the full Quick Take - Tesla Price to Sales Ratio & The Coming “Tax” on Index Fund Owners 👇🏼

#stocks #investing #etf #spy

kailashconcepts.com/tesla-price-to…

#stocks #investing #etf #spy

kailashconcepts.com/tesla-price-to…

• • •

Missing some Tweet in this thread? You can try to

force a refresh