As a follow-up to yesterday’s thread on how the “Big Six” in the Premier League fared during the COVID era, here is an alternative view for each club. I’ve also added a few other clubs which needed more financial support over the two years of the pandemic (2019/20 and 2020/21).

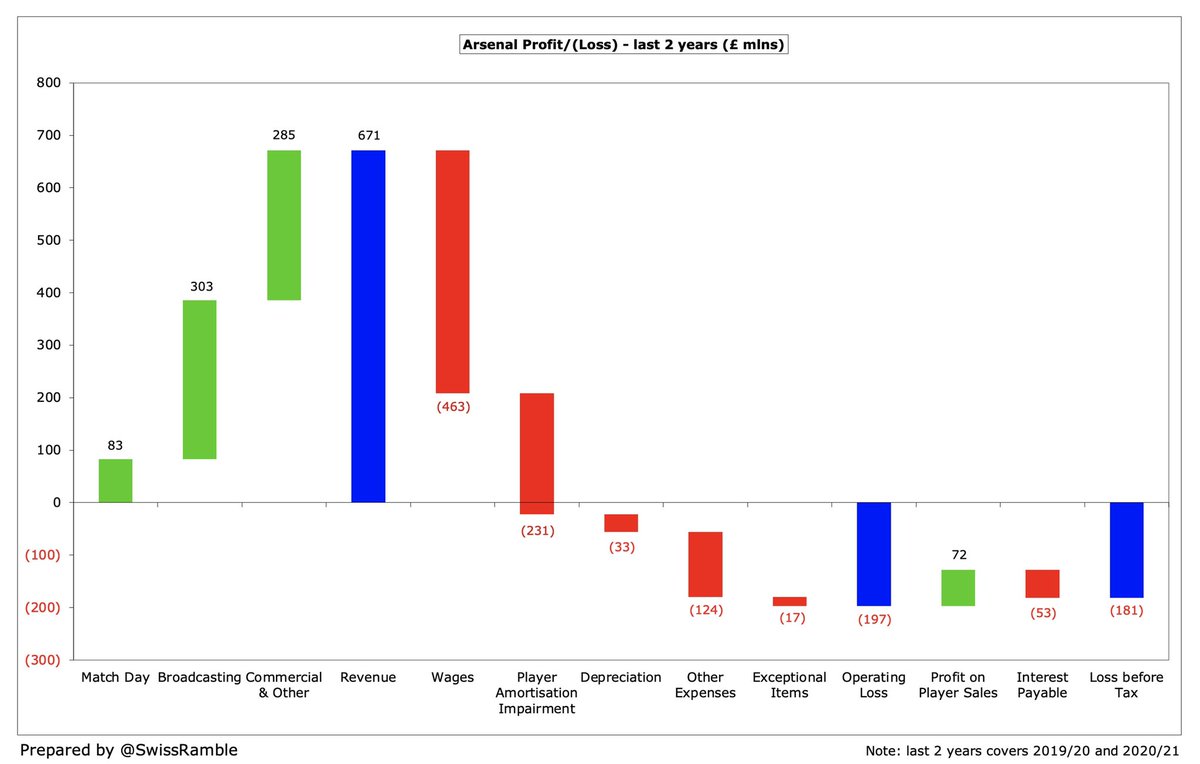

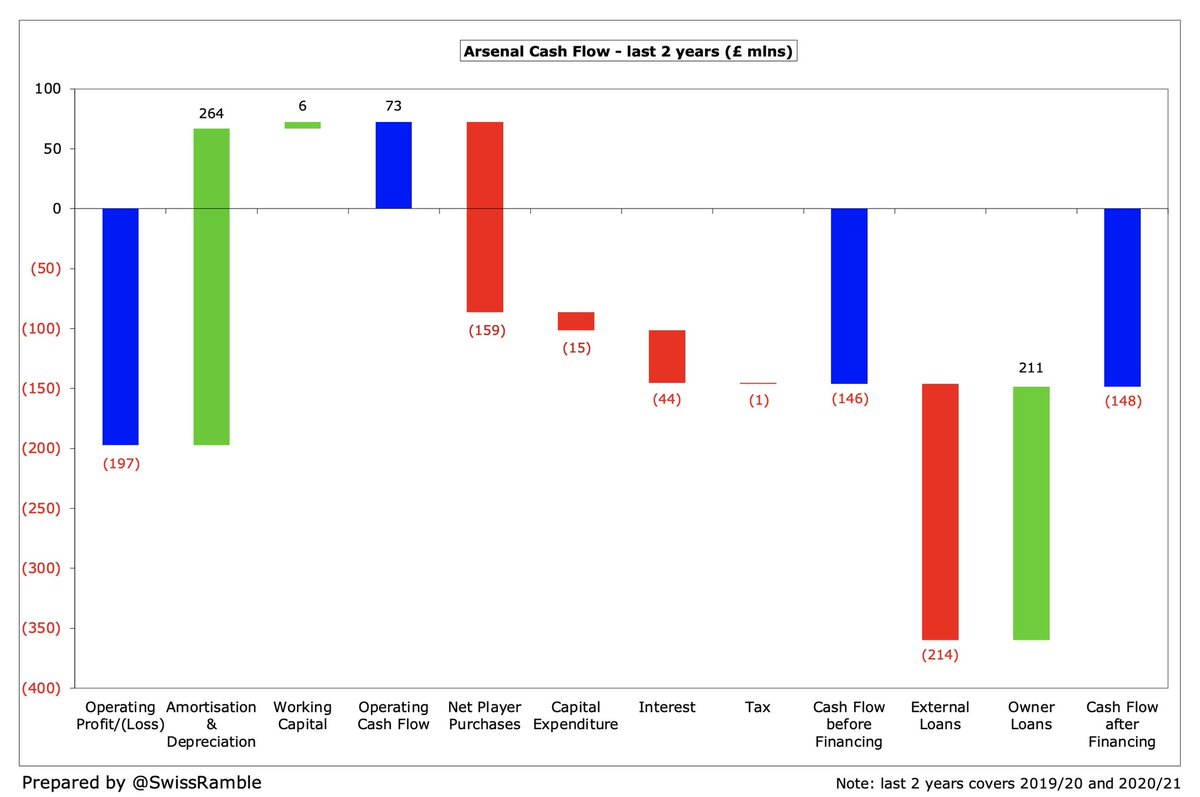

#AFC posted a huge £181m pre-tax loss, though this was inflated by interest payable including a once-off £32m refinancing fee, as around £200m external bonds were redeemed and replaced by a loan from Stan Kroenke. Net cash outflow of £148m was funded by reduction in cash balance.

#CFC enormous £294m operating loss was partially offset by £171m profit from player sales, but they still made £120m pre-tax loss. However, net cash outflow was restricted to £20m, mainly due to relatively low net player purchases plus £50m share capital from Roman Abramovich.

#LFC £114m operating loss was largely offset by £66m profit from player sales, so their pre-tax loss was “only” £51m. After spending £145m on net player purchases and £41m on infrastructure (training ground), the cash loss was mainly funded by £77m external loans.

#MCFC significant £218m operating loss was partially offset by £108m profit from player sales, but they still made £120m pre-tax loss. Even after £23m capital injection from the owners, the net cash outflow was still £85m. Funded by reduction in cash balance from £130m to £45m.

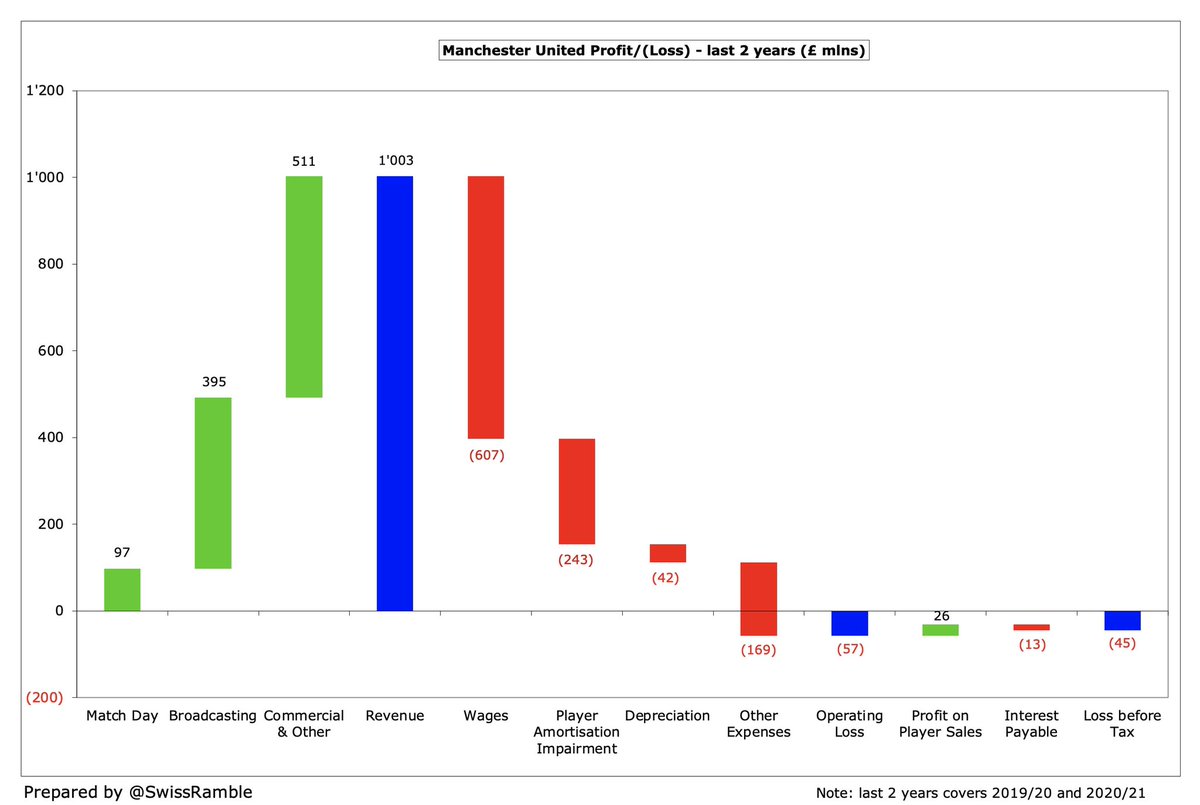

#MUFC £45m pre-tax loss was smallest of Big Six, mainly due to low operating loss of just £57m. Highest cash loss of £203m, mainly due to £285m net player purchases, but still paid £34m dividends and £21m share buyback. Funded by big fall in cash balance plus £56m external loans.

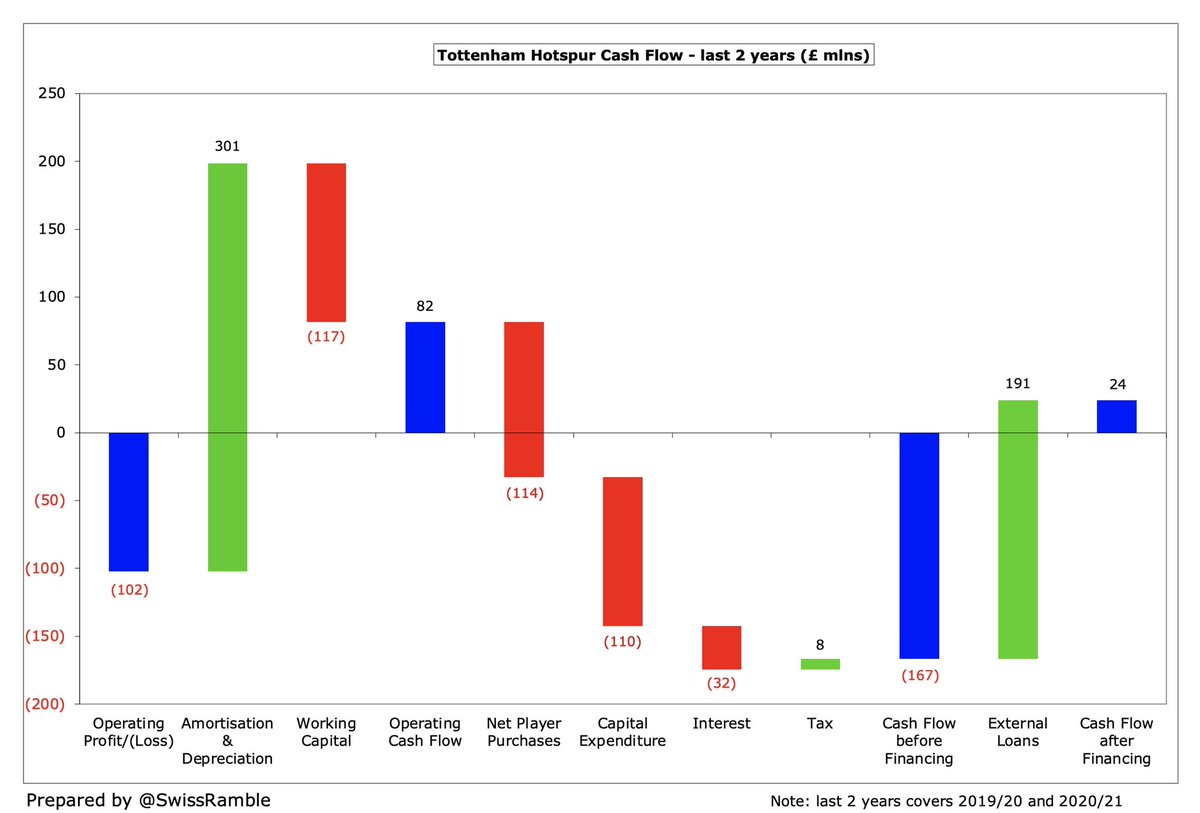

#THFC £148m pre-tax loss included £80m interest payable on loans for building their new stadium. This project also led to £110m capital expenditure (albeit much lower than the £474m outlay in preceding 2 years). Funded by £191m external loans, taking gross debt to £854m.

Although the Big Six appear to have coped relatively comfortably with the effects of the pandemic, other clubs have been less fortunate and have required significant additional financing, though some of this is linked to the usual ambitions (and not just driven by COVID).

To illustrate the differing requirements, I have looked at a few other clubs in the Premier League. This is not an exhaustive list by any means, but should be sufficient to make the point (plus I don’t have unlimited time 🙂).

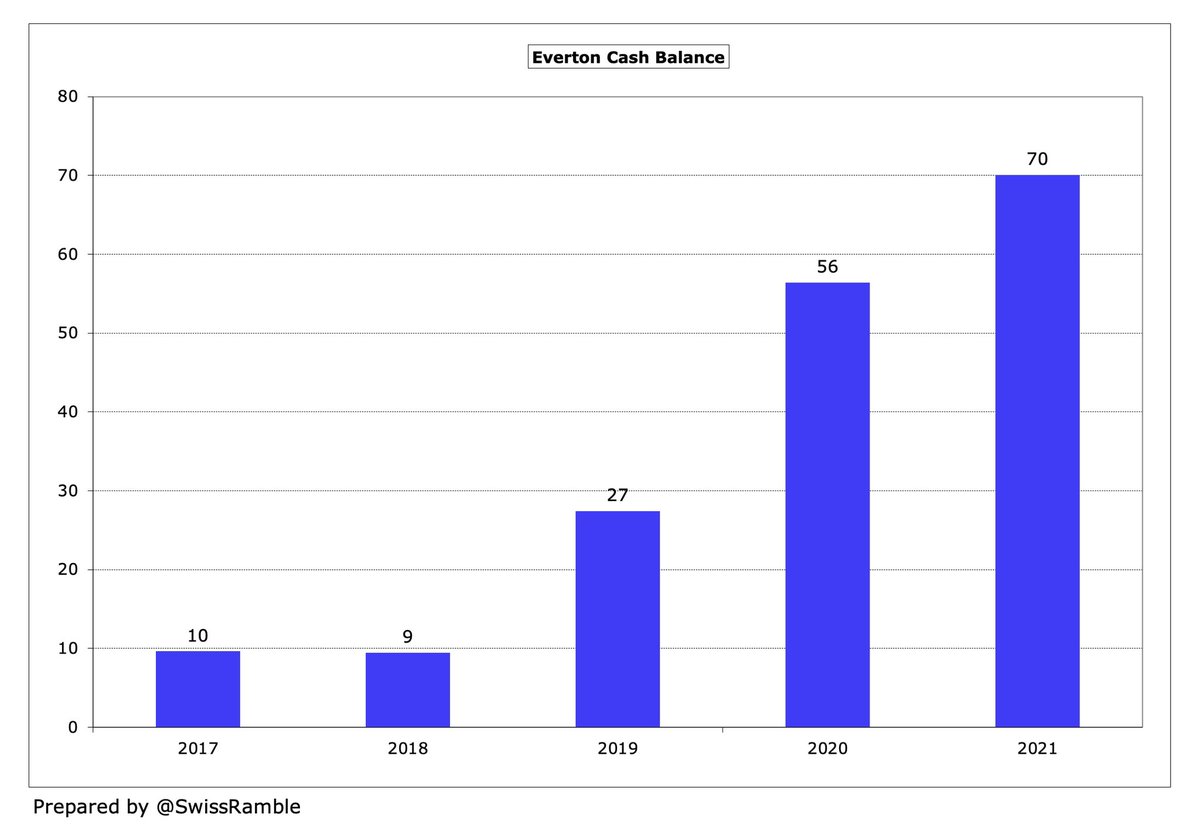

#EFC £261m pre-tax loss in the past 2 years was the highest in the top flight, as their £347m wages accounted for 92% of revenue. In cash terms their loss was £200m, which they funded with £150m from owners (£100m share capital and £50m loans) plus £93m bank loans.

#LCFC £188m operating loss was partially offset by £107m profit from player sales (mainly Harry Maguire to #MUFC). Their £134m cash loss was largely down to £110m capital expenditure (new training ground), which was funded by £162m loans from the owners, King Power.

#WHUFC £121m operating loss was partially offset by £43m profit from player sales, but £14m interest payable meant a £92m pre-tax loss. The £53m cash loss was covered by £30m share capital from a rights issue (mainly Sullivan and Gold) plus £31m external loans.

#AVFC £137m pre-tax loss was almost identical to the operating loss, as they only made £1m from player trading (though next accounts will include Grealish sale to #MCFC). Very high £194m net player purchases funded by £191m share capital from owners Nassef Sawiris and Wes Edens.

Although elite clubs have not required much additional financing in the last 2 years, other smaller clubs have not been so fortunate, having to rely on the generosity of their owners or the banks – even though their COVID losses were smaller (due to lower pre-pandemic revenue).

That said, it does look like much of the money provided has simply been used for “normal” activities, i.e. to finance expenditure on players, either in the form of transfers or wages. In other words, business as usual for most clubs.

• • •

Missing some Tweet in this thread? You can try to

force a refresh