For your attention 🧵with key updates for #Ukraine #Dairy Market during the #War

@topagrar_PL @PolskaIzbaMleka @DINtoday @HighGroundDairy @freshagenda2013 @Eucolait @AnttiJSaari1 @juliajones110 @StoneX_EUDairy @SaschaSiegel_ @dairylando

1/10

@topagrar_PL @PolskaIzbaMleka @DINtoday @HighGroundDairy @freshagenda2013 @Eucolait @AnttiJSaari1 @juliajones110 @StoneX_EUDairy @SaschaSiegel_ @dairylando

1/10

https://twitter.com/MaksDairyInfa/status/1509474155514765316?s=20&t=VOskolhk-eNv3cYQ3fIJDA

@topagrar_PL @PolskaIzbaMleka @DINtoday @HighGroundDairy @freshagenda2013 @Eucolait @AnttiJSaari1 @juliajones110 @StoneX_EUDairy @SaschaSiegel_ @dairylando As we have predicted since March, despite huge reduction of #milk production and processing, UA internal dairy use/consumption slumped due to war, migration, and deterioration of population wealth.

2/10

2/10

https://twitter.com/MaksDairyInfa/status/1514533749995802630?s=20&t=VOskolhk-o

In July we’ve observed crush of UA internal #grains and oil seeds prices due to port’s blockade by aggressor and the eve of new crops harvesting season. Compound #feed index downed to last year’s minimal (incl. sunflower meal traded 0,05 EUR/kg).

3/10

3/10

That’s why farmers tried to redirect flows of grains and oil seeds from trade to animal’s feeding. Unusual situation for UA when stockbreeding becomes more profitable than plant breeding. According to this, #Milk production #margin reached such high levels previous month.

4/10

4/10

As result of yields increasing, raw #milk production improving in #Ukraine. Official data matches our assesses and for Q2 and Q3 we see dairy market self-sufficient rate at the levels of 113-114 which means more volumes absorbing by #export.

5/10

5/10

https://twitter.com/MaksDairyInfa/status/1552978252045684737?s=20&t=VOskolhk-eNv3cYQ3fIJDA

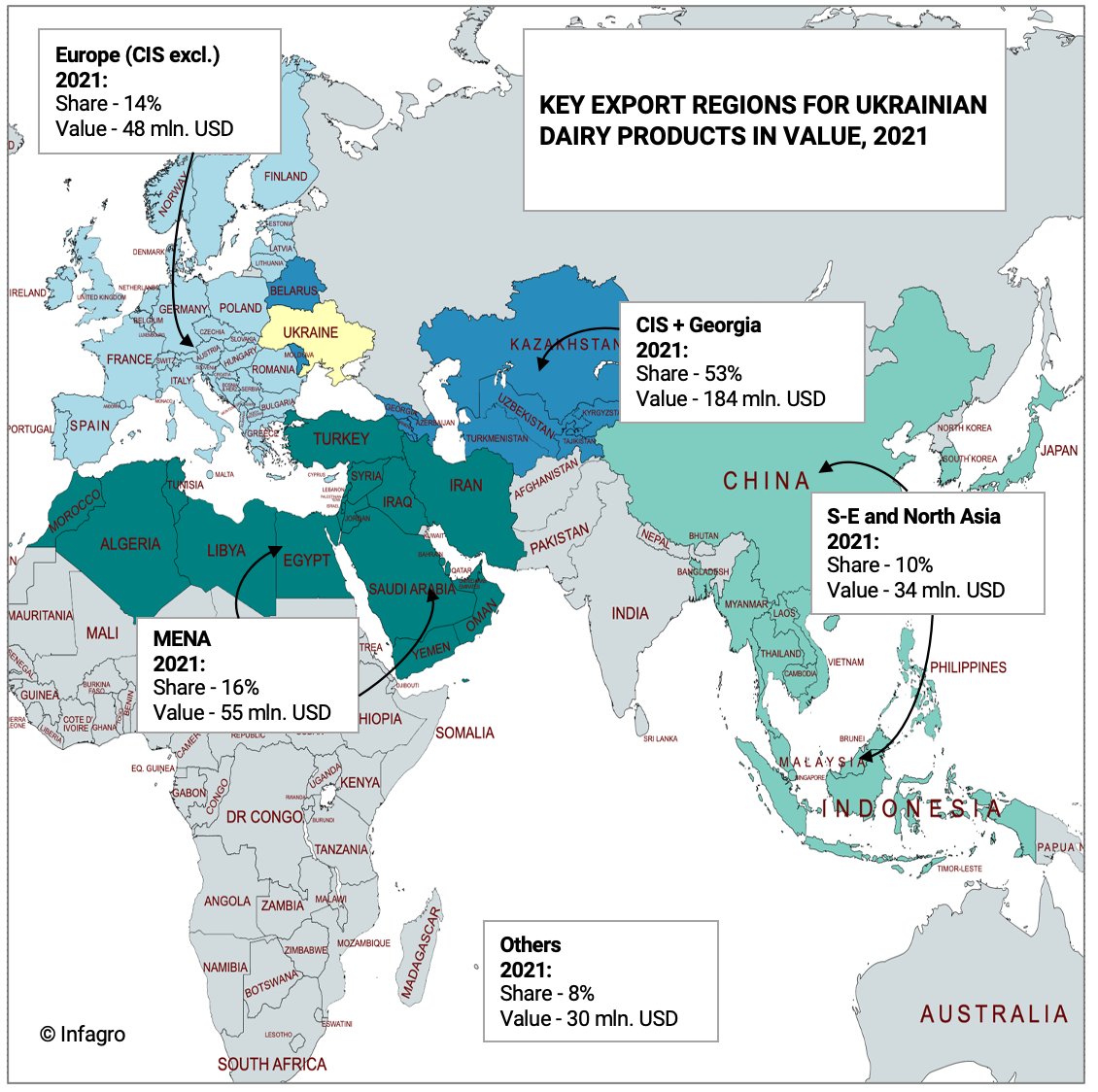

Trade data, especially for export, also confirms our calculations. Despite of port’s blocked, UA dairy had found ways for external sales mostly via #Poland and #Romania transit.

6/10

6/10

https://twitter.com/MaksDairyInfa/status/1534830803527643138?s=20&t=VOskolhk-eNv3cYQ3fIJDA

Net export monthly figures risen, it’s share to milk production was quite stable during the war. July projections show another increase, example: UA Jul #Butter monthly export vol at the highest level since Jun 2019.

7/10

7/10

UAH inflation makes export more attractive for UA dairies even despite global downward trend. UA dairy export volumes are not impacting on world trade but could help to avoid #recession/collapse of internal #dairy market.

8/10

8/10

https://twitter.com/MaksDairyInfa/status/1551862357407813635?s=20&t=VOskolhk-eNv3cYQ3fIJDA

Hope last good news of first cargo with UA #grain passes Black Sea from blocked Odessa port could be start of prices balancing in region as well as help to fix global food supply security. And could improve #dairy logistics and costs of freight.

9/10

9/10

https://twitter.com/YorukIsik/status/1554558666946363394?s=20&t=77Bt8SSBULH7BVKaVT8QLw

With my colleagues we continue to monitor situation of UA dairy market from inside the country with contact on to all market participators. So don’t hesitate to ask any questions here or via mail: maks.fasteyev@infagro.com.ua

Believe in victory and #StandWithUkraine ✌️🇺🇦

10/end

Believe in victory and #StandWithUkraine ✌️🇺🇦

10/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh