Whale closed 300.000 Long positions on Bitfinex😱

Let's find out WHY this is important and WHAT it could mean for the market 👇

#Bitcoin #Ethereum #Crypto #Bitfinex #Futures

Let's find out WHY this is important and WHAT it could mean for the market 👇

#Bitcoin #Ethereum #Crypto #Bitfinex #Futures

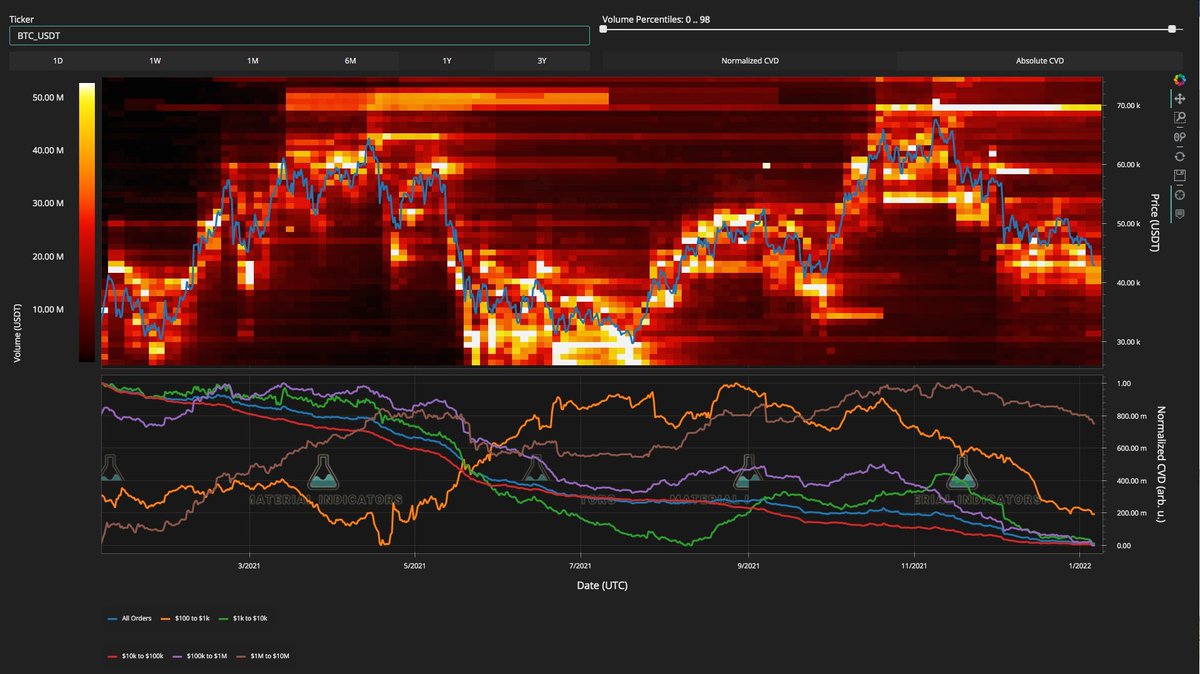

ETHUSDLONGS, a chart on tradingview which displays the total amount of open Long positions on Ethereum at Bitfinex. This metric has a major change in the recent data which is very important to be aware off.

The amount of ETHUSD Longs has been reduced with ± 300.000 (!!). That is a massive change on it's own, but it becomes more important when we take a look at historical data.

Let's give an overview 👇

July '21: Top was formed directly after closing. A pullback of 24% took place.

Nov '21: Top formed immediately. Price pulled back 50%.

March '22: 18 days before local top. Afterwards a 71% pullback happend.

July '21: Top was formed directly after closing. A pullback of 24% took place.

Nov '21: Top formed immediately. Price pulled back 50%.

March '22: 18 days before local top. Afterwards a 71% pullback happend.

Aug'22: 6 days so far. Will it mark a (local) top again?

Only time can give an answer to that question, but from a historical perspective, I am (and remain) conservative.

Only time can give an answer to that question, but from a historical perspective, I am (and remain) conservative.

Want to read more analysis on the cryptomarket?

Make sure to follow my account @JA_Maartun. Thanks 💪

Make sure to follow my account @JA_Maartun. Thanks 💪

• • •

Missing some Tweet in this thread? You can try to

force a refresh