Market Watcher 👀 || Community Analyst @cryptoquant_com 🏆 || Quoted by CNBC, Bloomberg 📰

How to get URL link on X (Twitter) App

@cryptoquant_com @saylor 1. Weekly purchases are shrinking 📉

@cryptoquant_com @saylor 1. Weekly purchases are shrinking 📉

2/ The Long-Term Holder distribution is also reflected in Coin Days Destroyed. ⛏

2/ The Long-Term Holder distribution is also reflected in Coin Days Destroyed. ⛏

And this...

And this...https://twitter.com/Mtrl_Scientist/status/1648810722418208770

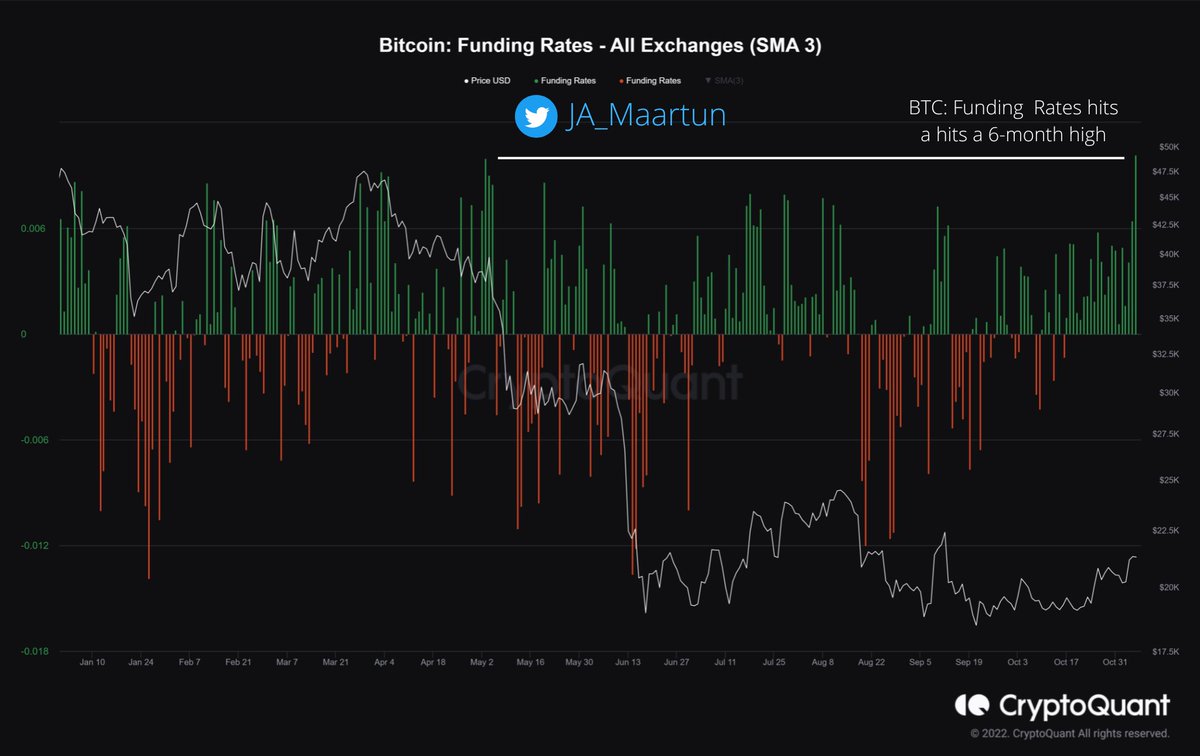

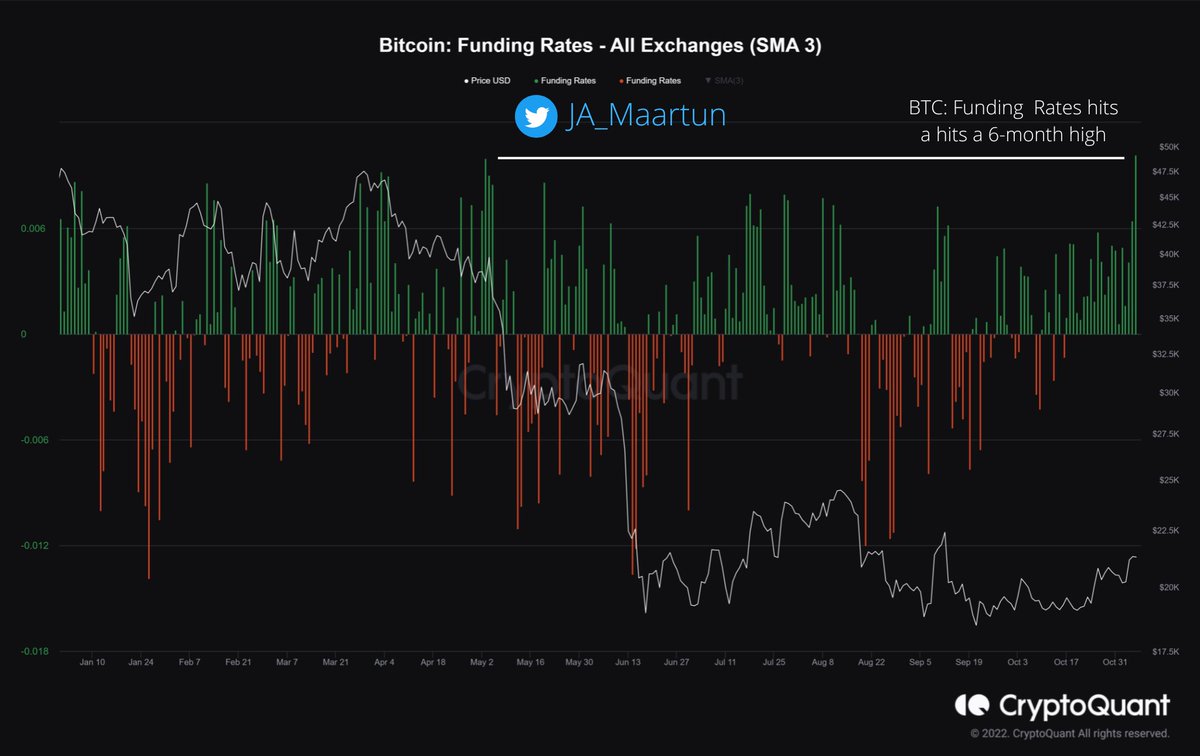

Funding Rates for Bitcoin hits a 6-months high. Funding Rates is the amount paid by traders in a long-position to traders who are in a short-position.

Funding Rates for Bitcoin hits a 6-months high. Funding Rates is the amount paid by traders in a long-position to traders who are in a short-position.

In the last 10 months, the price of Bitcoin decreased with 70%. On the other side; hashrate, and thereby the difficulty, has grown. This means it's harder to mine new Bitcoin, and those Bitcoins will give less revenue.

In the last 10 months, the price of Bitcoin decreased with 70%. On the other side; hashrate, and thereby the difficulty, has grown. This means it's harder to mine new Bitcoin, and those Bitcoins will give less revenue.

ETHUSDLONGS, a chart on tradingview which displays the total amount of open Long positions on Ethereum at Bitfinex. This metric has a major change in the recent data which is very important to be aware off.

ETHUSDLONGS, a chart on tradingview which displays the total amount of open Long positions on Ethereum at Bitfinex. This metric has a major change in the recent data which is very important to be aware off.