I said I'd start doing this, and I'm still only on twitter and reddit, so here is as good of place as any

Just finished a rebalance exercise so it's a good time to add it all up

Current approximate allocation in my portfolios (including my self managed 401k):

Just finished a rebalance exercise so it's a good time to add it all up

Current approximate allocation in my portfolios (including my self managed 401k):

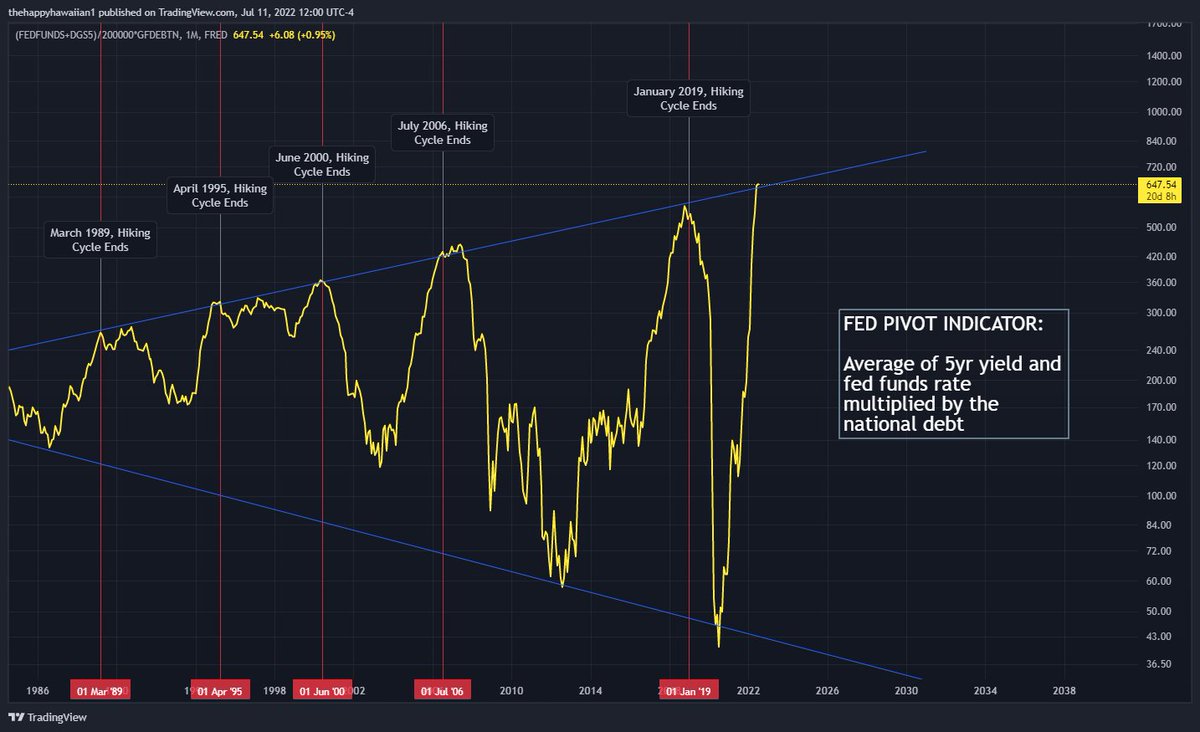

https://twitter.com/ThHappyHawaiian/status/1540359184306380800

#Silver (PSLV + Physical) 16.4%

#Platinum (PPLT + Physical) 14.5%

$LTPZ 14.4%

$SILJ 13.9%

$PICK 8.5%

$URNM 8.1%

$USO 6.9%

$GDXJ 4.7%

$CENX Jan Calls 2.4%

$SII Feb Calls 1.8%

$ANGPY 1.4%

$IMPUY 1.4%

$PLG 1.4%

$RJZ 1.4%

$LAND 1.4%

#Gold (PHYS + Physical) 0.7%

Cash/Other 0.8%

#Platinum (PPLT + Physical) 14.5%

$LTPZ 14.4%

$SILJ 13.9%

$PICK 8.5%

$URNM 8.1%

$USO 6.9%

$GDXJ 4.7%

$CENX Jan Calls 2.4%

$SII Feb Calls 1.8%

$ANGPY 1.4%

$IMPUY 1.4%

$PLG 1.4%

$RJZ 1.4%

$LAND 1.4%

#Gold (PHYS + Physical) 0.7%

Cash/Other 0.8%

Since the beginning of the year I've been expanding into many commodities and inflation plays and have been periodically rebalancing my weights based on market moves

This is probably a bit more diversified than some may have thought, also why I thought I should start sharing

This is probably a bit more diversified than some may have thought, also why I thought I should start sharing

What this doesn't include:

- The ibonds I bought recently

- my checking account (enough for 2-3 months expenses typically)

- my wife's biz checking account

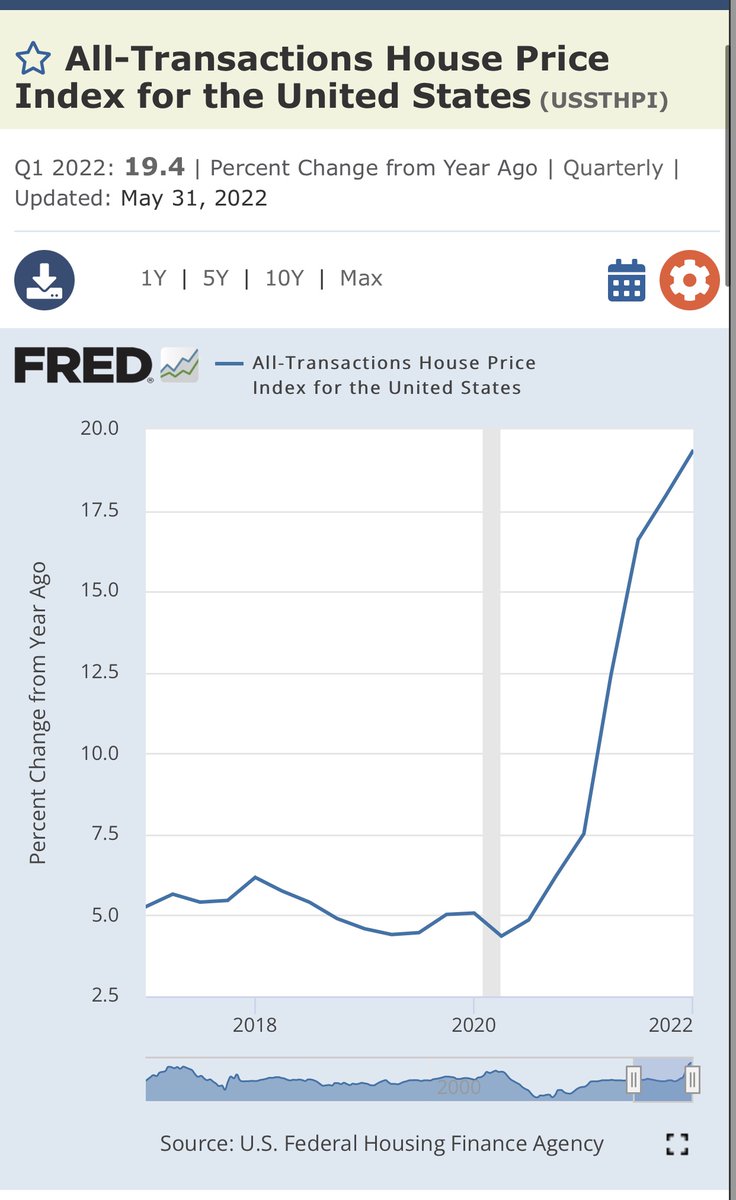

- value of real estate equity

- other property like cars and such

Feel free to like or critique all you want!

- The ibonds I bought recently

- my checking account (enough for 2-3 months expenses typically)

- my wife's biz checking account

- value of real estate equity

- other property like cars and such

Feel free to like or critique all you want!

• • •

Missing some Tweet in this thread? You can try to

force a refresh