I’m buying silver, platinum, uranium, oil, and metals for the trades of the decade. I don’t live in Hawaii, just enjoy it immensely! Personal opinions only!

2 subscribers

How to get URL link on X (Twitter) App

Would be nice if they color coded the legend on the chart

Would be nice if they color coded the legend on the charthttps://twitter.com/StealthQE4/status/1638885695686148096Let me expound for the people who think we can hike our way out inflation, even if it means another Great Depression

Just crazy to me that in May 2022 with plenty of time to fix the mistakes before this election we didn’t

Just crazy to me that in May 2022 with plenty of time to fix the mistakes before this election we didn’t

People keep saying “Powell needs to a pull a Volcker to kill inflation”

People keep saying “Powell needs to a pull a Volcker to kill inflation”

Another 1% today, chippin away

Another 1% today, chippin away

https://twitter.com/ThHappyHawaiian/status/1540359184306380800#Silver (PSLV + Physical) 16.4%

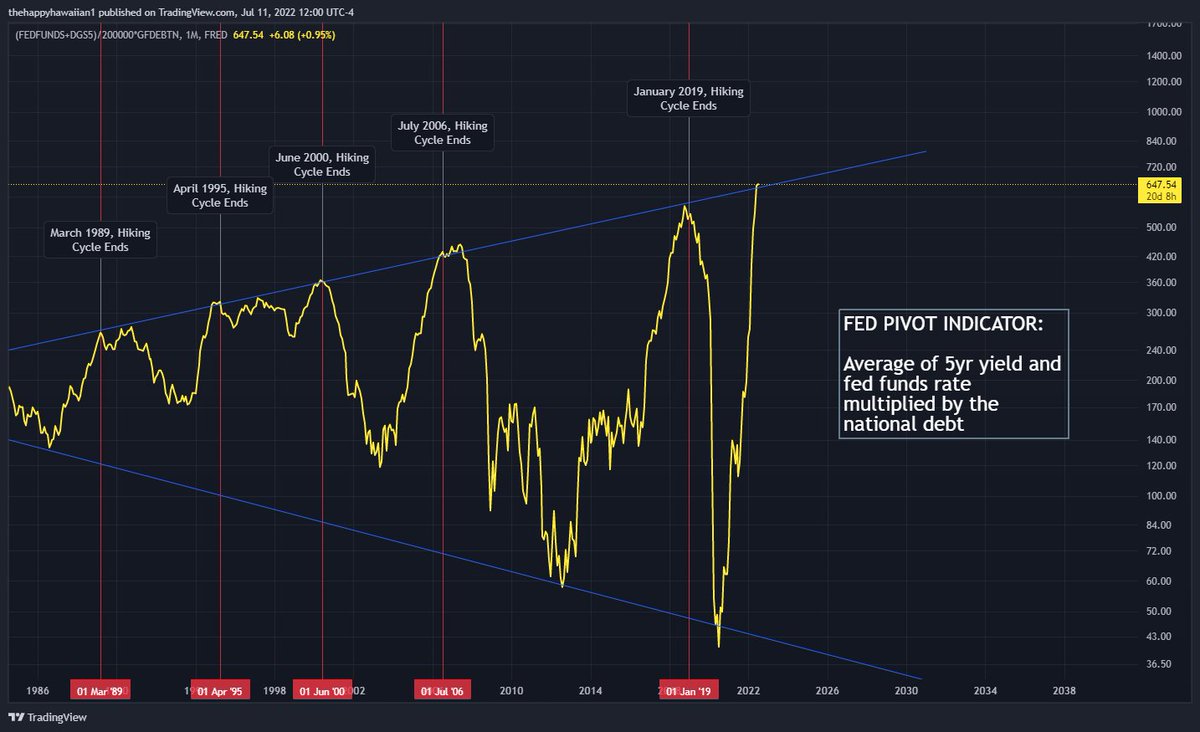

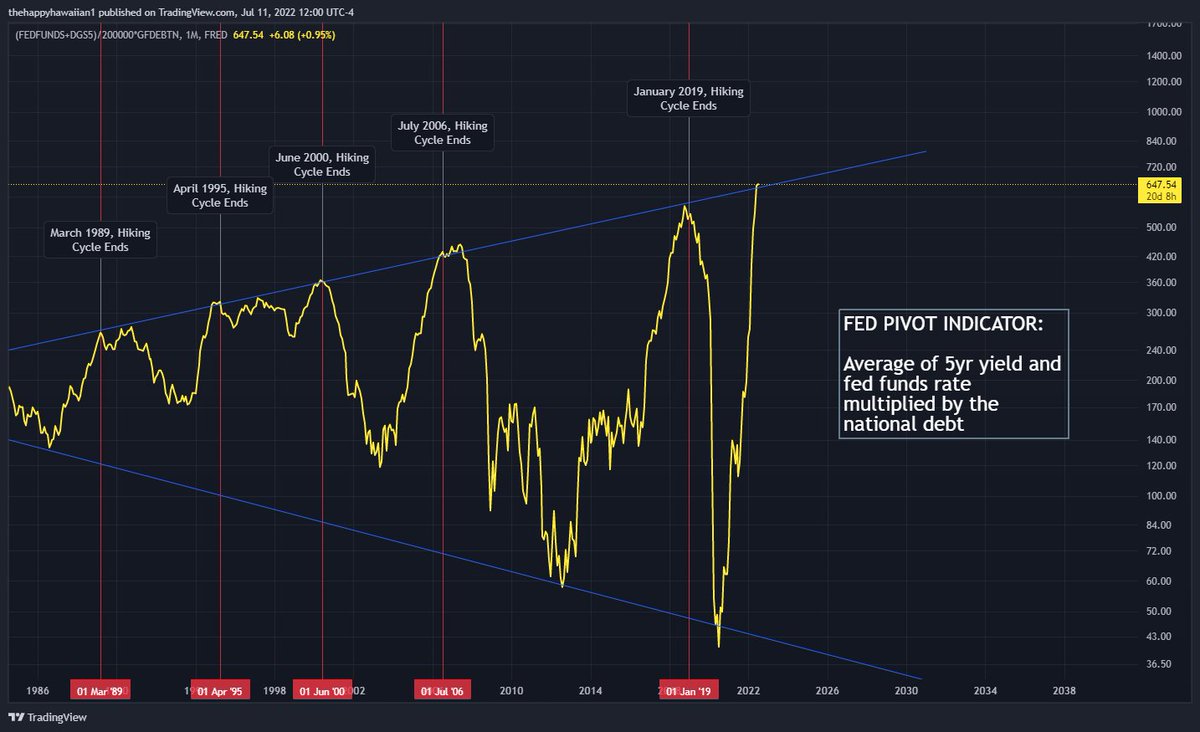

This chart is essentially proxy for the acceleration rate of interest expense for the US government, and has been a reliable indicator of fed pivot for 30+ years as the fed has ensured the US doesn't enter a debt death spiral

This chart is essentially proxy for the acceleration rate of interest expense for the US government, and has been a reliable indicator of fed pivot for 30+ years as the fed has ensured the US doesn't enter a debt death spiral

https://twitter.com/ThHappyHawaiian/status/1407746939576332292

As you can see it's been pretty flat, and has technically been flat since April 2020

As you can see it's been pretty flat, and has technically been flat since April 2020

Honestly let me know if there was something other than this, if there is I can't find it, but I'm open minded if I offended somehow @GlobalProTrader

Honestly let me know if there was something other than this, if there is I can't find it, but I'm open minded if I offended somehow @GlobalProTrader https://twitter.com/ThHappyHawaiian/status/1528715846545297410?s=20&t=Zt24qjqxBWRnyYo3gPLo6g

https://twitter.com/zerohedge/status/1540334846119141376

2nd one, new homes but using median prices, still up 15% from a year ago

2nd one, new homes but using median prices, still up 15% from a year ago

The mortgage payment index is comprised on 3 things: nominal home prices, interest rates, and inflation

The mortgage payment index is comprised on 3 things: nominal home prices, interest rates, and inflation

https://twitter.com/ThHappyHawaiian/status/1517598624032645127

We're in the zone currently that's kind of the "overflow" area that marked the previous 2 tops in the fed funds rate. You can see the fed funds rate in the chart above (the teal colored line)

We're in the zone currently that's kind of the "overflow" area that marked the previous 2 tops in the fed funds rate. You can see the fed funds rate in the chart above (the teal colored line)

This reading should give the fed some hope that inflation is dying down, but we've also heard that before, if I'm right with my call of 0.35% for April, the red line is where the trailing 6 month inflation would be

This reading should give the fed some hope that inflation is dying down, but we've also heard that before, if I'm right with my call of 0.35% for April, the red line is where the trailing 6 month inflation would be

https://twitter.com/JimForsythe5/status/1454074040906362881What about estate tax?!