Chelsea have been spending big in this summer’s transfer window with their outlay likely to be well over £200m by deadline day. This thread will look at the financial implications and explain how #CFC can still be in line with Financial Fair Play (FFP) regulations.

#CFC new owner Todd Boehly is well aware of the challenge: “FFP is starting to get some teeth and that will limit the ability to acquire players at any price. That could mean financial penalties and disqualification from sporting competitions.”

#CFC spending ability is limited by the Premier League Profitability and Sustainability (P&S) rules. These allow a £5m loss a year, which can be boosted by £30m equity injection, giving allowable losses of £35m a year. This works out to £105m over the 3-year monitoring period.

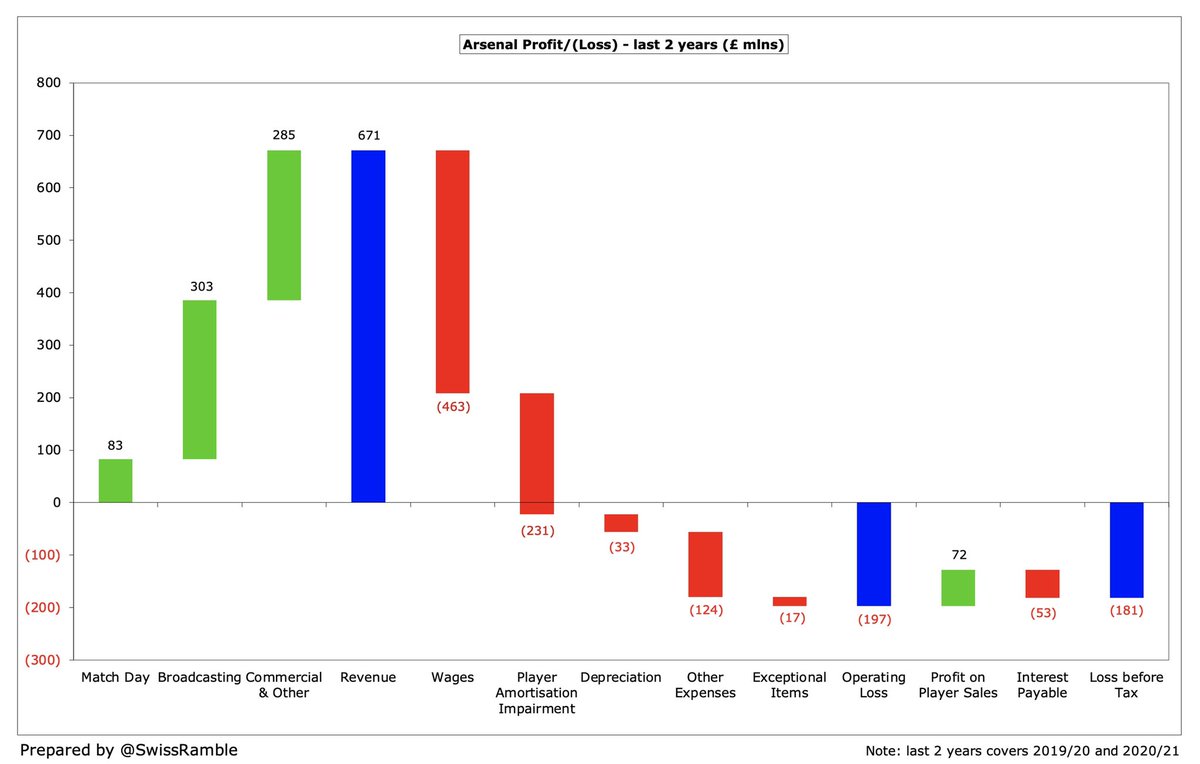

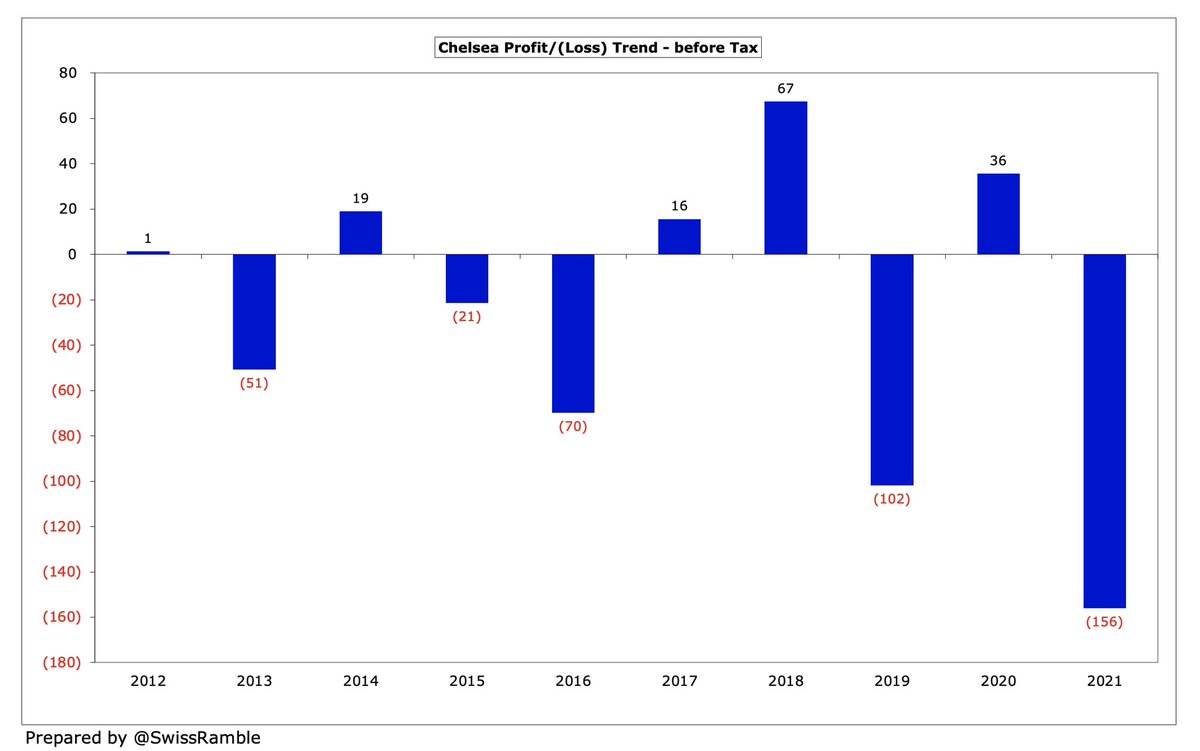

On the face of it, things don’t look too good for #CFC, as their pre-tax loss in the last 3 years was a hefty £222m, including £156m in 2020/21 and £102m in 2018/19. This was obviously adversely impacted by COVID, but was the 2nd highest loss in the Premier League in this period.

However, the Premier League has relaxed the regulations to neutralise the adverse impact of COVID, so the 2022 monitoring period assessed the seasons 2019/20 and 2020/21 as a single (average) period.

This is important, as it allowed #CFC to include £67m profit from 2017/18. On this basis, #CFC pre-tax loss over the adjusted 3-year monitoring period up to 2020/21 (the last published accounts) was “only” £94m, which was £11m better than the P&S maximum allowable loss of £105m.

In addition, #CFC can make an £85m adjustment for “healthy” expenditure (depreciation £29m, non-player amortisation £6m, youth development £30m, women’s football £14m and community £6m), giving a P&S loss of £10m, i.e. £95m better than he £105m allowable loss.

#CFC can also adjust for the adverse COVID impact. Not disclosed by the club, but I have estimated £128m revenue reduction (match day £76m, commercial £36m and broadcasting £16m), partly offset by £58m cost savings, giving a net £70m (averaged as £35m over the last 2 years).

Therefore, #CFC £94m pre-tax loss over the 3-year monitoring period was improved by £85m allowable deductions and £35m COVID impact to give £25m adjusted P&S profit. In other words, Chelsea were £130m better than the £105m permitted loss, a comfortable difference.

However, as the great ABC once sang, “That was then, this is now”, so we need to consider the impact of #CFC expenditure since the 2020/21 accounts closed on 30th June 2021, i.e. covering the last 3 transfer windows: Summer 2021, January 2022 and Summer 2022.

There is a sizeable caveat here, as amounts spent on transfer fees and wages are not public record in England. This means that the numbers used in this analysis will not be 100% correct, but they should be sufficiently accurate to illustrate the financial impact of the changes.

#CFC have spent £160m to date this summer to bring in Marc Cucurella, Raheem Sterling, Kalidou Koulibaly, Carney Chukwuemeka and Gabriel Slonina, while 2021/22 included the purchase of Romelu Lukaku for nearly £100m. Club also impacted by player loans (arrivals and returns).

Just for a bit of fun, let’s also assume that #CFC are successful in their pursuit of De Jong, Fofana and Aubameyang. That would be another £180m spend, bringing the total this summer to a massive £340m, which would mean £437m splashed out on transfer fees in the last 2 years.

The impact on #CFC profit and loss account will be driven by two factors: (a) wages of the new purchases, which I have estimated at £119m for the last 2 years; (b) player amortisation, the annual cost of writing-off transfer fees, which is £90m. This adds up to annual £209m cost.

Against that, #CFC have sold players for £181m in last 2 years, including Tammy Abraham, Kurt Zouma, Fikayo Tomori, Timo Werner, Marc Guéhi and Eden Hazard (add-on) plus £12m loan fees. Has produced significant £164m profit, as most leaving players were fully amortised.

In addition, #CFC benefit from reducing wage bill and player amortisation for those exits, even when no transfer fee received, e.g. Antonio Rüdiger, Andreas Christensen & Danny Drinkwater. Estimated annual savings are £77m wages and £19m player amortisation, so £96m in total.

At this point, I should probably explain how player trading is reported in a club’s accounts. The key point here is that when a player is purchased the cost is spread over a few years, but any profit made from selling a player is immediately booked to the accounts.

Transfer fees are not fully expensed when a player is purchased, but are written-off evenly over the length of the contract via player amortisation. So if a player is purchased for £30m on a 5-year contract, the annual amortisation would be £6m, i.e. £30m divided by 5 years.

However, if the player bought for £30m were to be sold for £50m after 3 years, the accounting profit would actually be £38m, i.e. £50m sales proceeds less £12m value (after reducing £30m cost by £18m amortisation). As the late, great Sid Waddell said, “Magic darts!”

So the net result of #CFC transfer activity in last 2 years is £113m cost increase in accounts, with player purchases growing the cost base by £209m, mitigated by £96m reduction from sales. This will be more than offset by £164m profit on player sales (including loan fees).

Big spending is nothing new for #CFC, who have splashed out nearly a billion on gross transfers in the 5 years up to 2020/21 (including signing-on and agent fees), which is joint highest in the Premier League with #MCFC, far ahead of #MUFC £850m, #AFC £676m and #LFC £660m.

As it stands, #CFC £162m player amortisation in 2020/21 is the highest in the Premier League, far above #MCFC £146m and #MUFC £120m, reflecting the club’s substantial transfer expenditure. There was also £12m player impairment, which will reduce amortisation going forward.

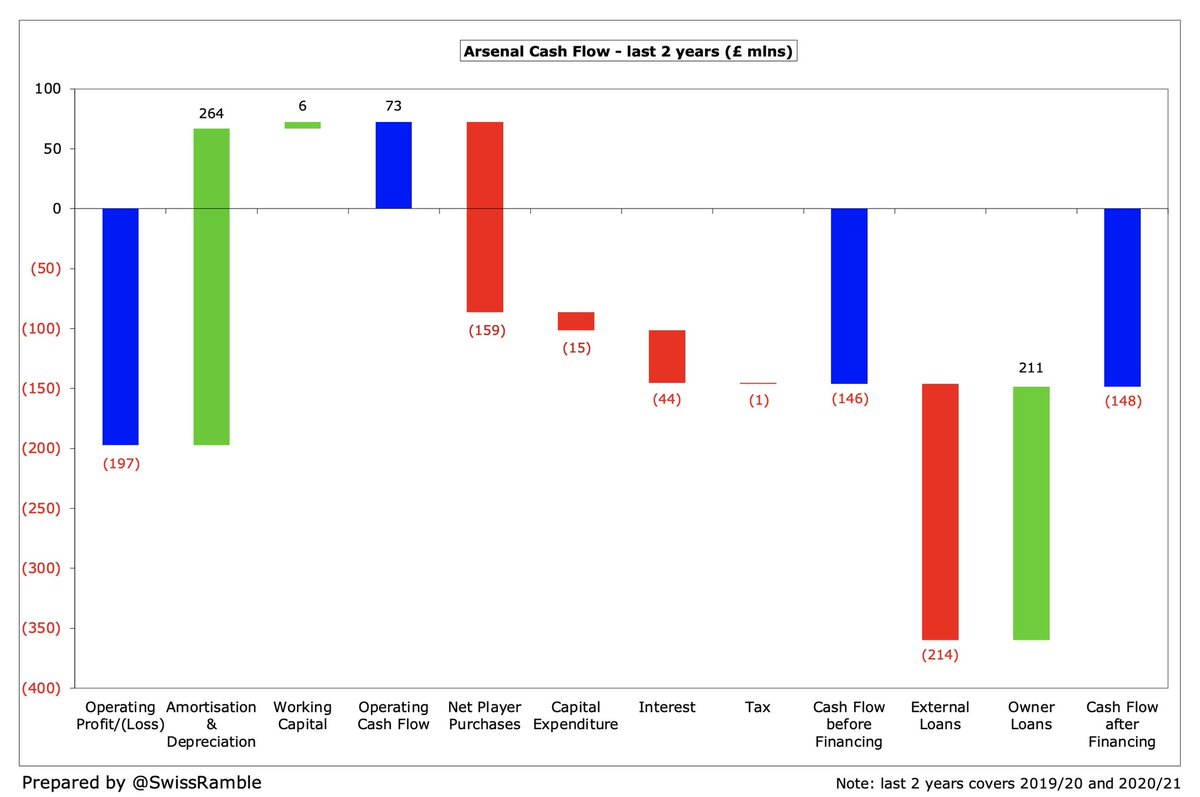

#CFC business model has essentially been to offset large operating losses with profits from player sales. As a result, they made £406m operating losses in the last 3 years (excluding exceptional items), while their £159m deficit in 2021 was easily the worst in the Premier League.

In stark contrast, #CFC have generated an impressive £413m profit from player sales in the last 5 years, including good money (pure profit) from Academy products. This is the highest in the top flight, significantly more than rivals, e.g. the next highest is #LFC with £274m.

The #CFC revenue story is less exciting. Like other clubs, it fell during the pandemic, but more importantly the growth since 2012 (when they had 2nd highest revenue in England) is much lower than #MCFC & #LFC. As a result, they are now only 4th best with a big gap to the top 3.

Although it’s a bit of a mug’s game, let’s now try to estimate #CFC profit and loss account for the next two years, so we can see whether their recent transfer spending is likely to cause any issues from a financial fair play perspective. The usual health warnings apply.

Based on the average £2.4m a game that #CFC earned in the 2019/20 season (for games played with fans), we can estimate £69m match day revenue for 2021/22, i.e. 29 games x £2.4m. We will assume fewer home games in 2022/23, so £64m income.

#CFC broadcasting income shot up to £274m in 2021, but this was inflated by two factors: (a) revenue for games played after the 2019/20 accounting close was deferred to the 2020/21 accounts; (b) more prize money due to Chelsea’s victory in the Champions League.

Because of the extended 2019/20 season (COVID delays), #CFC played 7 Premier League games after their 30th June accounting close, which meant £25m revenue deferred into 2020/21 accounts. Similarly, £8m was deferred for the Champions League, meaning 2021/22 will be £33m lower.

#CFC earned £105m (€120m) for winning the Champions League in 2002/21, but I estimate that this dropped by £25m to £80m (€90m) in 2021/22, when they were eliminated by Real Madrid in the quarter-finals.

Reducing the 2020/21 broadcasting income for deferred revenue and less progress in the Champions League, but adding money for better Premier League finish £2m plus winning the UEFA Super Cup £4m and FIFA World Cup £4m gives an estimate of £226m for 2021/22.

Assuming a similar performance in 2022/23, but adding £22m for the new Premier League TV deal, which is up by 14% (domestic deals flat, but overseas deals up 33%), would give £247m broadcasting revenue.

#CFC commercial growth in the last 10 years has been one of the lowest of the Big Six, so their £154m is now far behind the top 3, especially #MCFC £272m, and only just ahead of #THFC £152m. This will surely be an area of focus for Chelsea’s new owners.

#CFC have 15-year kit deal with Nike £60m, but Three UK £40m shirt sponsorship expires in June 2023, so scope for an increase there. New Trivago £10m training kit deal added in 2021/22. For forecast purposes, assume commercial income is back up to £180m pre-pandemic level.

#CFC also included £13m in other operating income in 2020/21, comprising recharged costs £10.6m (no details provided), research & development tax credit £1.1m and insurance claim £0.8m. I have assumed that there is no repeat of this once-off income in 2021/22.

#CFC £333m wage bill was 2nd highest in the Premier League in 2020/21, only surpassed by #MCFC £355m. I have incorporated the modelled £8m increase for transfer ins/outs, increased for contract extensions, but reduced for 2021 Champions League win bonus, giving net £311m.

Finally, 2020/21 included £24m exceptional charges for unspecified legal fees. Although #CFC have often booked “exceptional items” (£211m since 2005), I have assumed that these will be zero in 2021/22.

Putting all these estimates together would give a £42m pre-tax profit for #CFC in 2021/22, largely driven by the massive £160m profit from player sales. This would actually be the highest ever player trading profit in England, beating Chelsea’s own £143m in 2019/20.

That would imply a P&S adjusted profit of £3m over the 3-year monitoring period, so £108m better than the allowed £105m loss. The 2017/18 £95m P&S profit will be dropped, replaced by the estimated 2021/22 £73m profit, so not too much damage done.

The assumed transfer spend this summer implies a £185m loss for #CFC in 2022/23, though this could be mitigated by player sales before the end of the window, as this is currently only £5m (including loan fees). In fact, Timo Werner was sold for a small £4m accounting loss.

Even with the huge loss for 2022/23, #CFC would still be fine under the Premier League’s P&S rules, though their margin of safety would fall to £26m. Cleary, these are only modeled figures, but it does highlight that leading clubs have more room to maoeuvre than people think.

That said, UEFA’s FFP rules are stricter than the Premier League with the allowable losses (“acceptable deviation”) over 3 years being only €30m (including €25m equity contribution), though this will increase to €90m from 2024 (i.e. including 2022/23 as the 3rd year).

UEFA have also introduced squad cost control via a new ratio of player wages, transfers & agent fees that is limited to 70% of revenue & profit on player sales, though there will be a gradual implementation over 3 seasons (90% in 2023/24, 80% in 2024/25 and 70% from 2025/26).

Roman Abramovich put £1.5 bln into #CFC, resulting in the highest debt in the PL, though it was reported that the former owner wrote-off this balance as part of the club sale. That said, Boehly’s consortium has since raised £800m (loan £500m, revolving credit facility £300m).

It might be a little surprising that #CFC new owners are spending at the same rate as Abramovich, but the magnitude of the investment into the squad demonstrates their ambitions, while they look to grow the club’s revenue streams.

Boehly said, “We think the global footprint of this sport is really undeveloped. There are 4 billion fans of European football. There are 170 million fans of NFL. Global club football is a fraction of the NFL media money.” In order to benefit, #CFC must remain at the top table.

#CFC will clearly have to be conscious of financial fair play, but their big spending does not automatically mean that they will fall foul of the regulations, especially if they maintain their profitable player trading model (assisted by the accounting treatment of transfers).

• • •

Missing some Tweet in this thread? You can try to

force a refresh