#VIP Industries

#Q1FY23: Results, Concall, Investor Ppt, Stock Price

YOY: Net sales:⬆️179%; PAT:⬆️2280%

QoQ: Net sales:⬆️64%; PAT:⬆️813%

EPS: ₹4.88 vs ₹0.18 YoY vs ₹0.88 QoQ

Coming of a low base, still a good qtr

Highest revenue qtr ever

+5% growth over Q1 FY20

(Cont'd)

#Q1FY23: Results, Concall, Investor Ppt, Stock Price

YOY: Net sales:⬆️179%; PAT:⬆️2280%

QoQ: Net sales:⬆️64%; PAT:⬆️813%

EPS: ₹4.88 vs ₹0.18 YoY vs ₹0.88 QoQ

Coming of a low base, still a good qtr

Highest revenue qtr ever

+5% growth over Q1 FY20

(Cont'd)

- New launches: 38 in Luggage & 127 in Backpacks

- Entered 68 new towns; added 21 & signed 23 more stores

- The Wedding Collection (Vaani Kapoor), Change The World (Varun Dhawan) campaigns +ve

- EBITDA: 18.3%; Cost controlled; PBT: ₹100cr

- Hard Luggage: 46% of Revenue

(Cont'd)

- Entered 68 new towns; added 21 & signed 23 more stores

- The Wedding Collection (Vaani Kapoor), Change The World (Varun Dhawan) campaigns +ve

- EBITDA: 18.3%; Cost controlled; PBT: ₹100cr

- Hard Luggage: 46% of Revenue

(Cont'd)

- Own & control manufacturing: 79%

- Volume growth: 8% on FY20 base

- Q1 Headwinds: 24% inflation, 90% of loss of biz from Future Group store closure, impacting 15% revenues

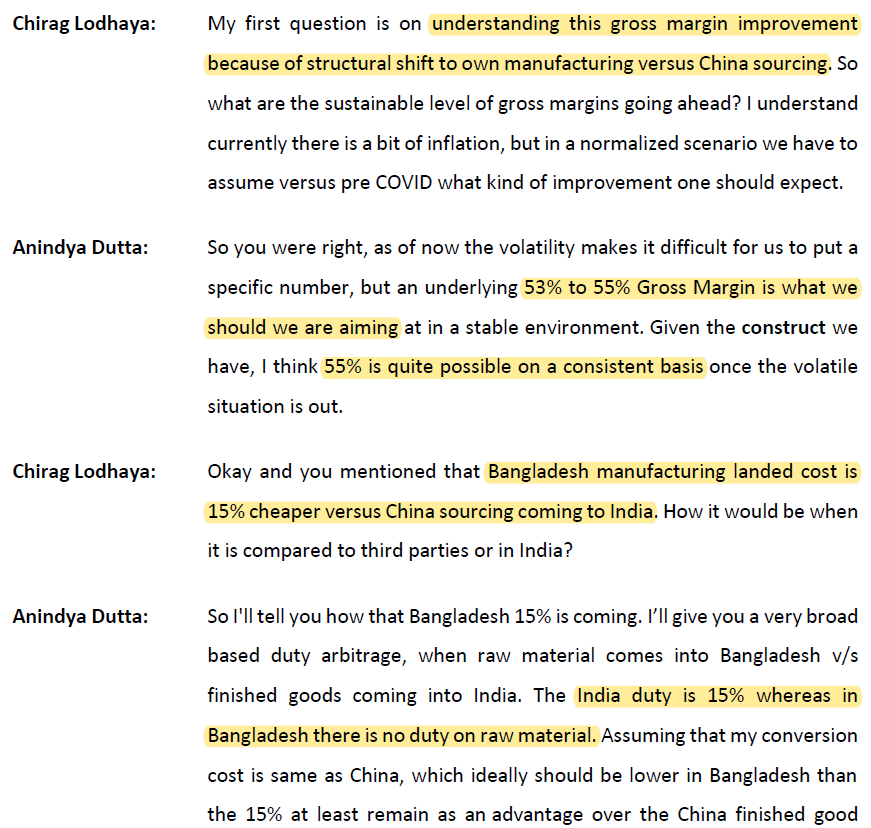

- Gross Margin: 49.9% vs 53.3% (Q4FY23) due to 4.9% higher raw material costs, but price⬆️ 2.1%

(Cont'd)

- Volume growth: 8% on FY20 base

- Q1 Headwinds: 24% inflation, 90% of loss of biz from Future Group store closure, impacting 15% revenues

- Gross Margin: 49.9% vs 53.3% (Q4FY23) due to 4.9% higher raw material costs, but price⬆️ 2.1%

(Cont'd)

- Covid resulted in higher tailwind in value segment

- unorganized market yielding into organized

- New capacity in hard luggage (polypropylene)

- Exports at 5% of Revenue

- FY23 Capex plan of ~₹50 cr; payback in 18-24 mths

- EBITDA Margin expectation (FY23): 18-20%

(Cont'd)

- unorganized market yielding into organized

- New capacity in hard luggage (polypropylene)

- Exports at 5% of Revenue

- FY23 Capex plan of ~₹50 cr; payback in 18-24 mths

- EBITDA Margin expectation (FY23): 18-20%

(Cont'd)

Management Comments:

- Market share at lower 40's; possibly improving

- Competition intensified

- Industry profitability will stabilize

- Demand to sustain; inflation to taper

- Value segment growing faster

- Acuteness of seasonality over time reduced

(Cont'd)

#FMCG #Investment

- Market share at lower 40's; possibly improving

- Competition intensified

- Industry profitability will stabilize

- Demand to sustain; inflation to taper

- Value segment growing faster

- Acuteness of seasonality over time reduced

(Cont'd)

#FMCG #Investment

Stock Price notes:

Stock down:

: 9.7% since result

: 14.7% from next day (after result) high of ₹685

: 24.6% in FY23 from high of ₹774.6

: CMP: ₹585.6, back at 6th Jul level; negated pre-results gain

: P/BV: 13.4; PE: 62; Mkt Cap: ₹8287cr

The End 🙏

#investing #stocks

Stock down:

: 9.7% since result

: 14.7% from next day (after result) high of ₹685

: 24.6% in FY23 from high of ₹774.6

: CMP: ₹585.6, back at 6th Jul level; negated pre-results gain

: P/BV: 13.4; PE: 62; Mkt Cap: ₹8287cr

The End 🙏

#investing #stocks

Standalone Results:

YOY: Net sales:⬆️179%; PAT:⬆️2280%

QoQ: Net sales:⬆️64%; PAT:⬆️813%

EPS: ₹5.85 vs ₹0.25 YoY vs ₹0.64 QoQ

Consolidated Results:

YOY: Net sales:⬆️186.41%; PAT:⬆️2631.23%

QoQ: Net sales:⬆️65.95%; PAT:⬆️457.71%

EPS: ₹4.88 vs ₹0.18 YoY vs ₹0.88 QoQ

YOY: Net sales:⬆️179%; PAT:⬆️2280%

QoQ: Net sales:⬆️64%; PAT:⬆️813%

EPS: ₹5.85 vs ₹0.25 YoY vs ₹0.64 QoQ

Consolidated Results:

YOY: Net sales:⬆️186.41%; PAT:⬆️2631.23%

QoQ: Net sales:⬆️65.95%; PAT:⬆️457.71%

EPS: ₹4.88 vs ₹0.18 YoY vs ₹0.88 QoQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh