Ex-Fund Manager & Principal Officer at FYERS Asset Management |

Previously with @fyers1 @SiemensGamesa, @Thermaxglobal|

Views - Personal

2 subscribers

How to get URL link on X (Twitter) App

- New launches: 38 in Luggage & 127 in Backpacks

- New launches: 38 in Luggage & 127 in Backpacks

Financials:

Financials:

https://twitter.com/gvkreddi/status/1310856340420485122), of all the sectors that performed well over the last 29 yrs, broken down in to three decades, there were some interesting insights.

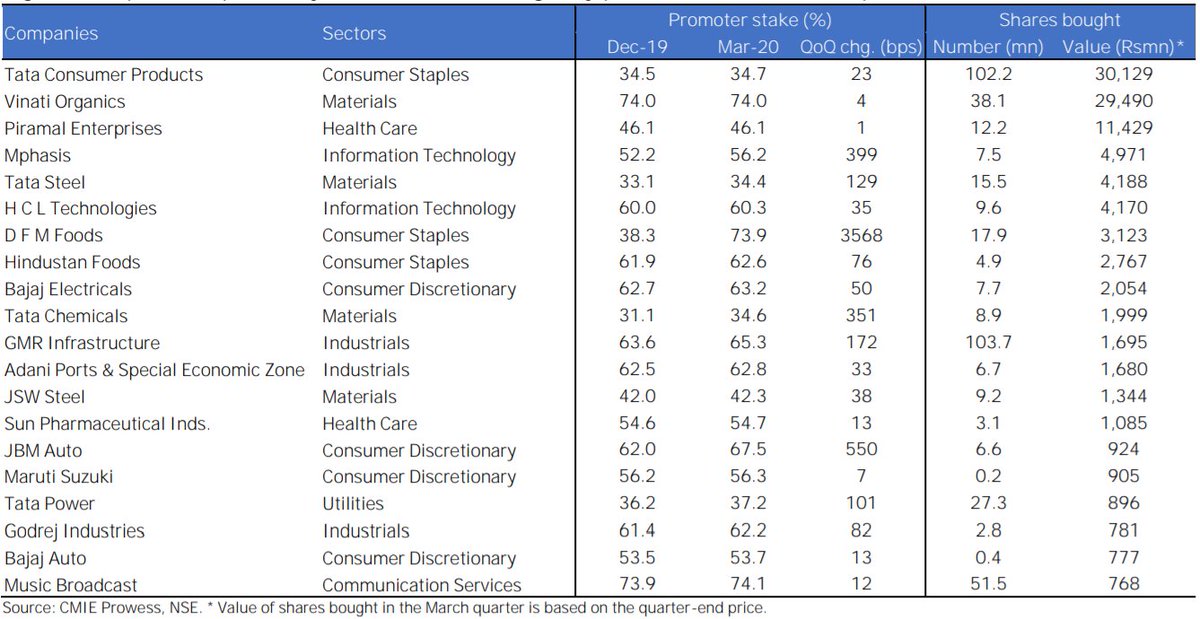

(2/n) Top 20 companies by value of shares bought by promoters in the March quarter.

(2/n) Top 20 companies by value of shares bought by promoters in the March quarter.