After Manchester United’s awful start to the season, the focus has once again turned to the Glazers. This thread will look at some of the reasons why the club’s fans might be unhappy with their owners – from a financial perspective #MUFC

#MUFC are the only Premier League club to pay dividends to their shareholders, mainly the Glazers. Since 2016 they have paid a hefty £166m, averaging £22m a year. Note: the high £33m payment in 2021/22 included including £11m delayed from 2020/21.

Although it has fallen from its (sizeable) peak, #MUFC £21m interest payment in 2020/21 was still the highest in the Premier League. United have now paid a staggering three-quarters of a billion pounds (£743m) in interest since the Glazers’ leveraged buy-out in 2005.

Focusing on the last 12 years, #MUFC £517m interest payment is nearly three times as much as the next highest club, namely #AFC with £174m. Looked at another way, it is almost as much as the rest of the Premier League combined (£536m).

#MUFC have also had to pay £147m on net loan repayments since 2010, which would have been even higher without £97m new debt since COVID struck. Only #AFC have paid more (to fund the Emirates stadium), exacerbated by replacing £202m external bonds with an owner loan in 2021.

Even after all the refinancings, #MUFC £592m gross debt is virtually unchanged since the Glazers’ arrival. United’s debt was 3rd highest in the PL in 2020/21, but #CFC £1.5 bln was provided interest-free by their owner (now written-off), while #THFC £854m funded a new stadium.

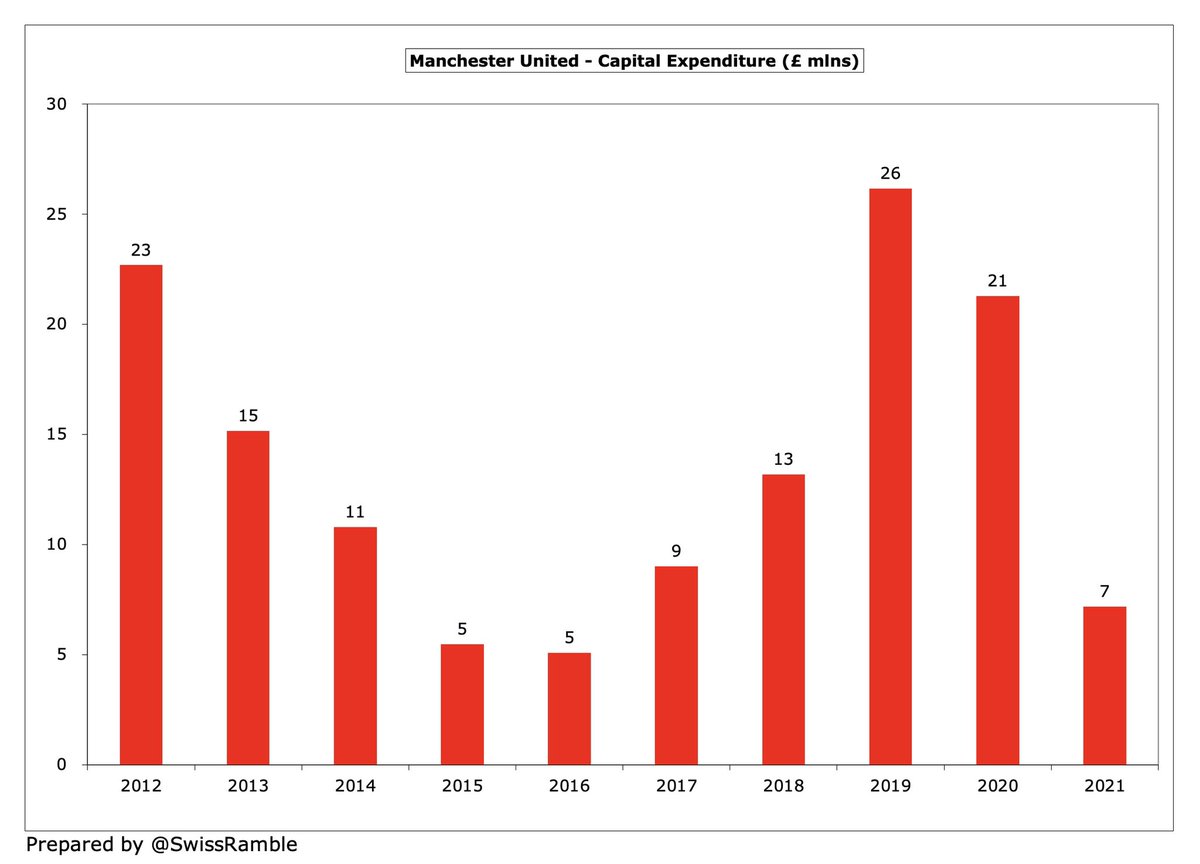

Regular visitors to Old Trafford will know that the venerable old stadium has seen better days, which is unsurprising given the Glazers’ lack of investment in infrastructure. #MUFC £136m capex over the last 10 years is less than #FFC and #LCFC, but is dwarfed by #THFC £1.4 bln.

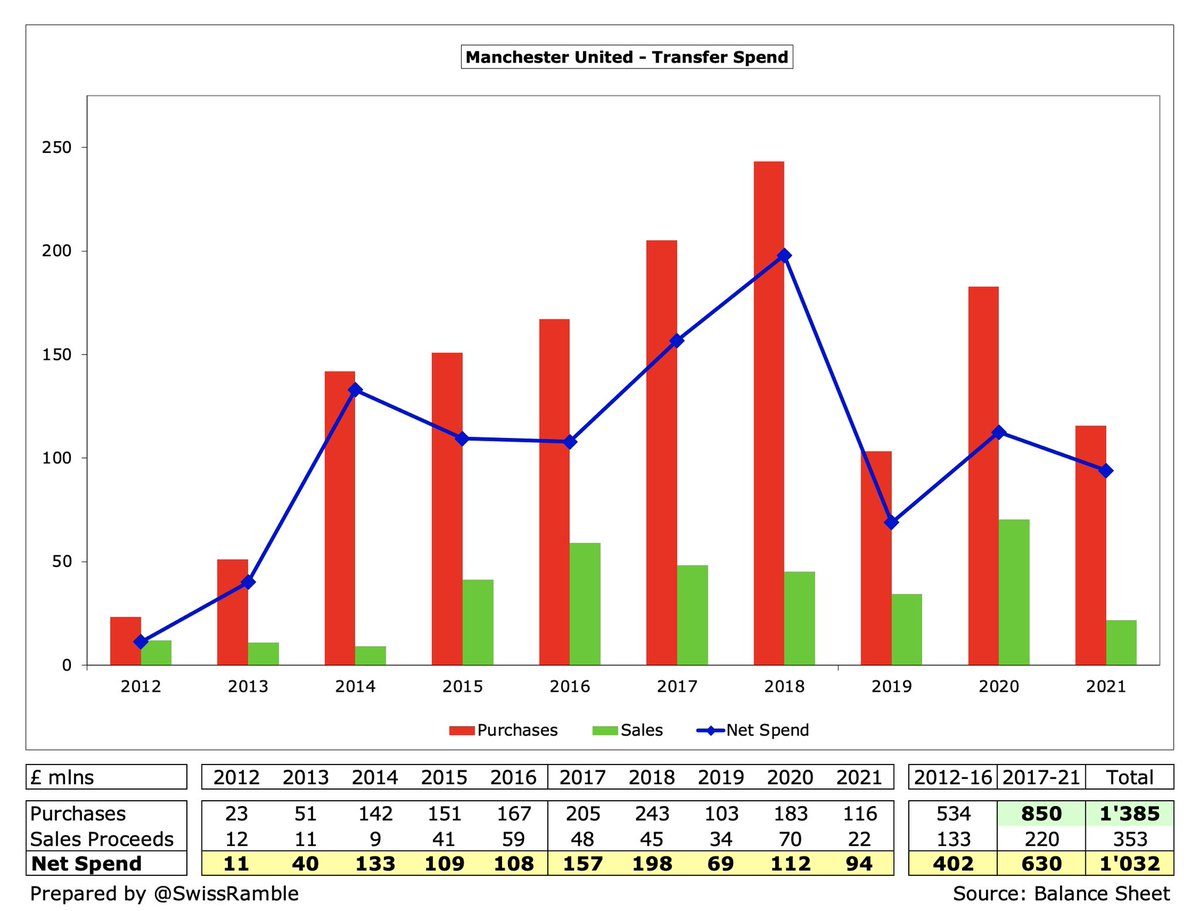

Glazers apologists will point to #MUFC massive transfer spend, which is a meaty £1.4 bln since 2012. Furthermore, £850m in last 5 years was only surpassed by #MCFC & #CFC (both £992m), but the point here is that this is money the club has generated, not provided by the owners.

In fact, in the last 10 years, no owners in the Premier League have taken out more money than the Glazers have done at #MUFC with £154m (dividends £133m, share buyback £21m). In stark contrast, some owners have put in significant funds: #MCFC £684m, #CFC £516m and #AVFC £506m.

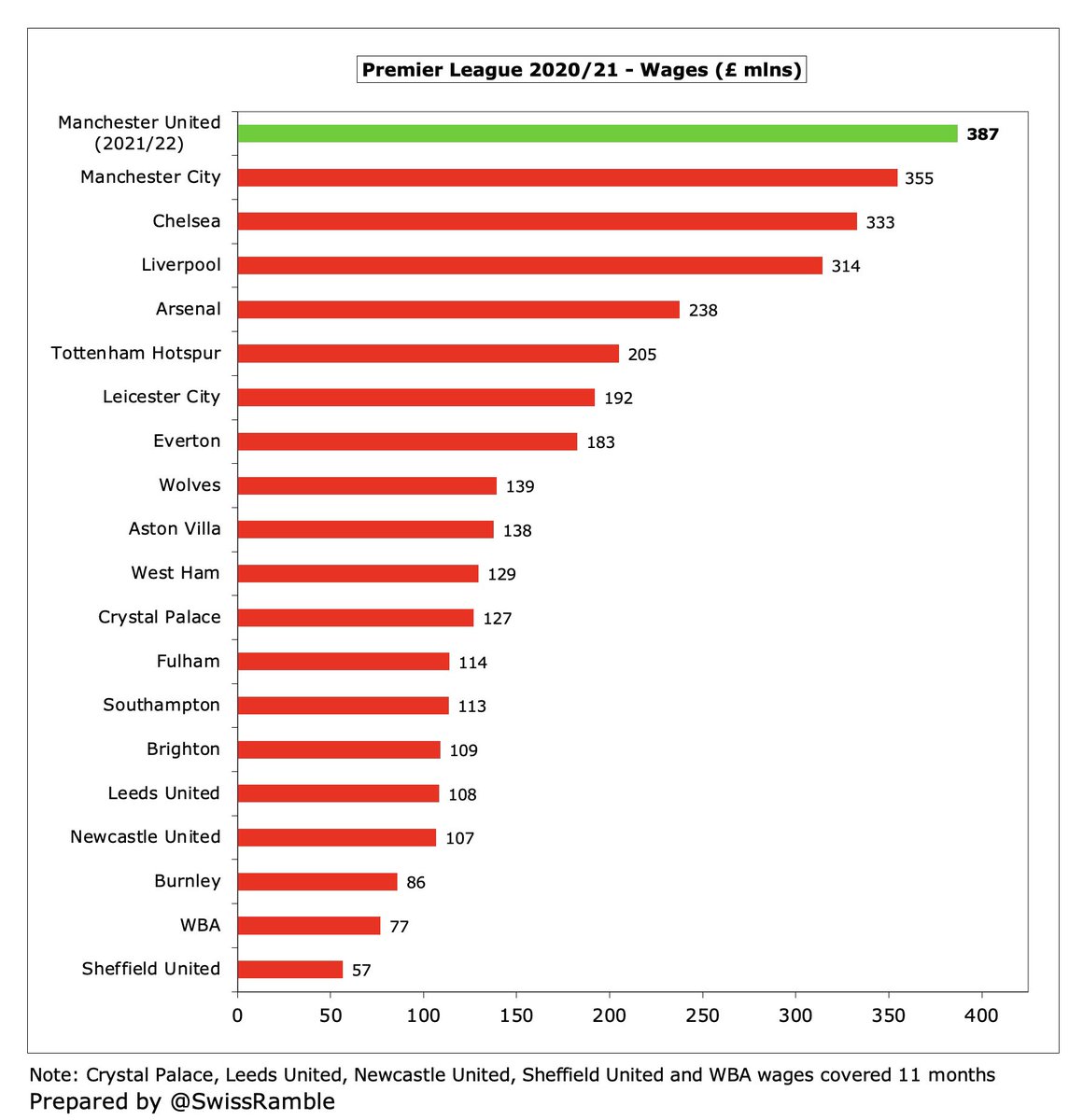

#MUFC lack of success, despite the huge player spend, is also a damning indictment of the club’s recruitment skills. The amount of money wasted since Sir Alex Ferguson’s retirement is shocking. This is also the case with wages, especially in the last couple of years.

#MUFC wages for first 9 months of 2021/22 shot up to £288m, due to signing Ronaldo, Varane and Sancho, which works out to £384m on an annualised basis. This is in line with the club’s estimate of a 20% year-on-year increase to £387m, which would be the highest ever in England.

#MUFC cash balance of £111m as at 30th June 2021 was pretty good and the second highest in England. However, it is worth noting that this is significantly lower than the club’s £308m peak a couple of years ago, partly due to covering losses caused by the COVID pandemic.

#MUFC have also been particularly poor at making money from player sales with their £81m profit from this activity in the last 5 years being firmly in the bottom half of the Premier League. For some context, #CFC £413m is more than five times as much.

Supporters of the Glazers will point to their commercial acumen, in the belief that #MUFC revenue growth has somehow justified the fact that the club has (to date) had to shell out well over a billion quid to finance the takeover, but is this really the case?

It is certainly true that #MUFC revenue has nearly tripled under the Glazers, rising from £173m to a COVID-impacted £494m in 2021, but it is worth noting that their revenue has dropped by £87m (15%) since 2017, one of the worst performances in the Big Six.

In particular, #MUFC have been significantly outpaced by #LFC and #MCFC recently in terms of revenue growth, so that their £494m has been overtaken by their “noisy neighbours” #MCFC £570m, while #LFC have very nearly closed the gap to United with £487m.

#MUFC commercial income fell £from £279m to £232m in 2021, due to no pre-season tour and other COVID factors. That said, United’s commercial engine has essentially stalled (revenue flat for 5 years before 2021 decrease), while there has been substantial growth at their rivals.

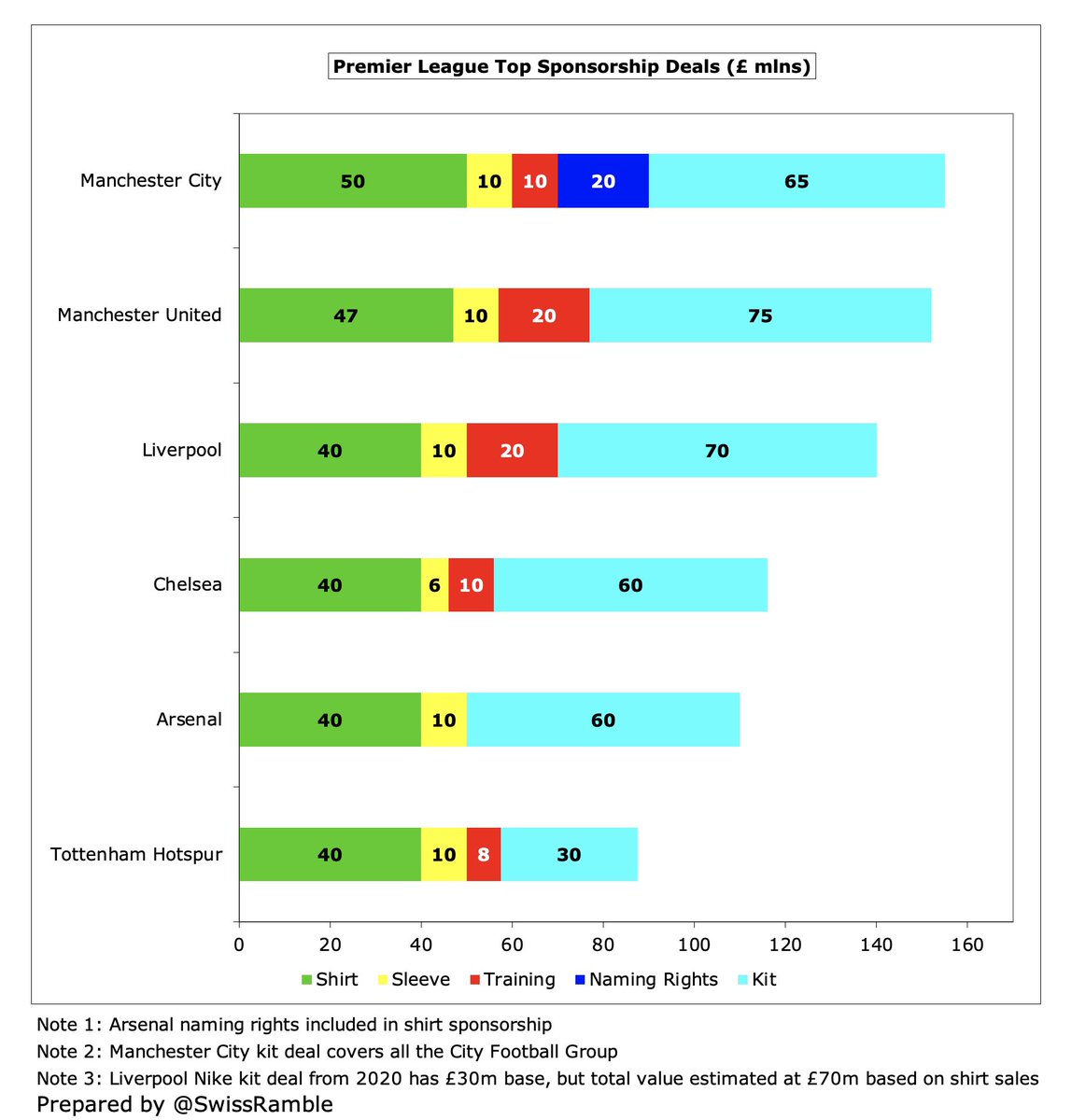

Furthermore, #MUFC new £47m TeamViewer shirt sponsorship is much lower than Chevrolet £64m. Tezos has been announced as training kit sponsor for £20m, though there was a season hiatus after the previous Aon deal ended. The impressive £75m Adidas kit deal runs to 2025.

#MUFC have only qualified for this season’s Europa League, which will hurt them financially, as the Champions League is far more lucrative. Their relatively poor performance in Europe is highlighted by money in last 5 years with United earning €150m less than #MCFC and #LFC.

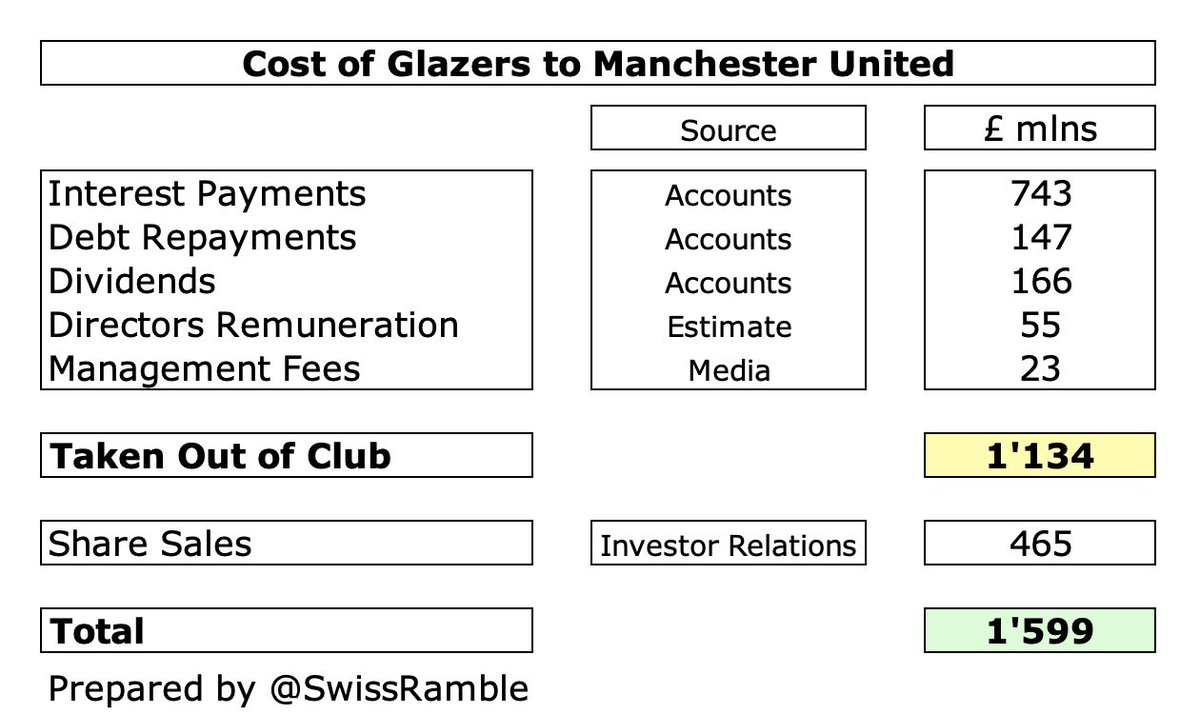

It is possible that the Glazers have also been quietly picking up directors’ fees, though this is not explicitly divulged in the accounts. There are 6 Glazers on the Manchester United PLC board of 12 directors, so we could assume 50% of the total paid, i.e. £55m since 2010.

Before 2010 #MUFC also paid the Glazers various management fees under a consultancy agreement, which added up to £23m (according to the prospectus for the MUFC Finance PLC borrowing).

Finally, the Glazers have made a fortune by selling some Class A shares in #MUFC, which works out to at least £465m (potentially £514m if underwriters took up the option to buy more shares). The club did “not receive any proceeds from the sale”, so only the owners benefited.

Putting these elements together, I estimate that the Glazers have taken out £1.1 bln from #MUFC (interest £743m, debt repayments £147m, dividends £166m, directors remuneration £55m & management fees £23m). Total cost to United rises to £1.6 bln if £465m share sales are included.

This additional money would have helped #MUFC if it had been invested in the squad or the stadium, though some observers might argue that the executive management would simply have wasted these funds, as they have done recently with the club’s big money signings.

While #MUFC under-performance on the pitch will have been painfully evident to United fans, they would be justified in being unhappy with the lack of financial progress in recent years, when they have also been eclipsed off the pitch by their rivals.

Although Ed Woodward once argued, “Playing performance doesn’t really have a meaningful impact on what we can do on the commercial side of the business”, we have seen that this isn’t really the case.

#MUFC remain in a relatively strong financial position compared to most other clubs, but fans are increasingly angry that their club continues to pay huge sums merely for the privilege of having the Glazers as owners.

• • •

Missing some Tweet in this thread? You can try to

force a refresh