Arsenal fans will be delighted with the team’s good start to the season, so are probably unconcerned about the financial implications of their player recruitment, but it is maybe worth looking at whether there will be any issues with Financial Fair Play (FFP) regulations #AFC

As it stands, #AFC have spent a hefty £270m gross on transfers in the last 2 seasons, only surpassed by #CFC £288m, but ahead of #MUFC £255m, #MCFC £231m, #THFC £194m and #LFC £156m (though both #CFC and #MUFC will probably spend more on new players before the window closes).

Even more incredibly, #AFC net transfer spend of £218m is the highest of the Big Six in the last 2 seasons, just ahead of #CFC £217m. That is a fairly remarkable statistic for a club that has not competed in the lucrative Champions League since 2017.

In fact, after many frugal years, #AFC have been big spenders for a while. In the 5 years to 2021 (most recent published accounts), they had £626m gross transfer spend, which was almost double the preceding 5-year period and 4th highest in the Premier League (ahead of #LFC).

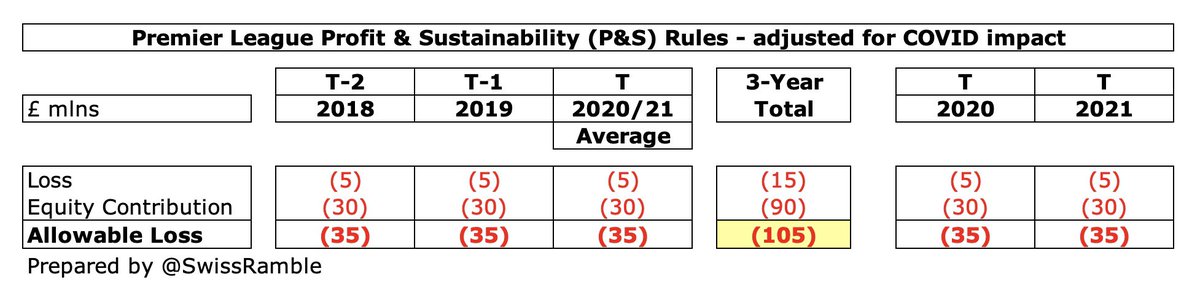

Like other clubs, #AFC spending is restricted by the Premier League Profitability and Sustainability (P&S) rules, which allow a £5m loss a year, boosted by £30m equity injection, giving allowable losses of £35m a year. That makes £105m over the 3-year monitoring period.

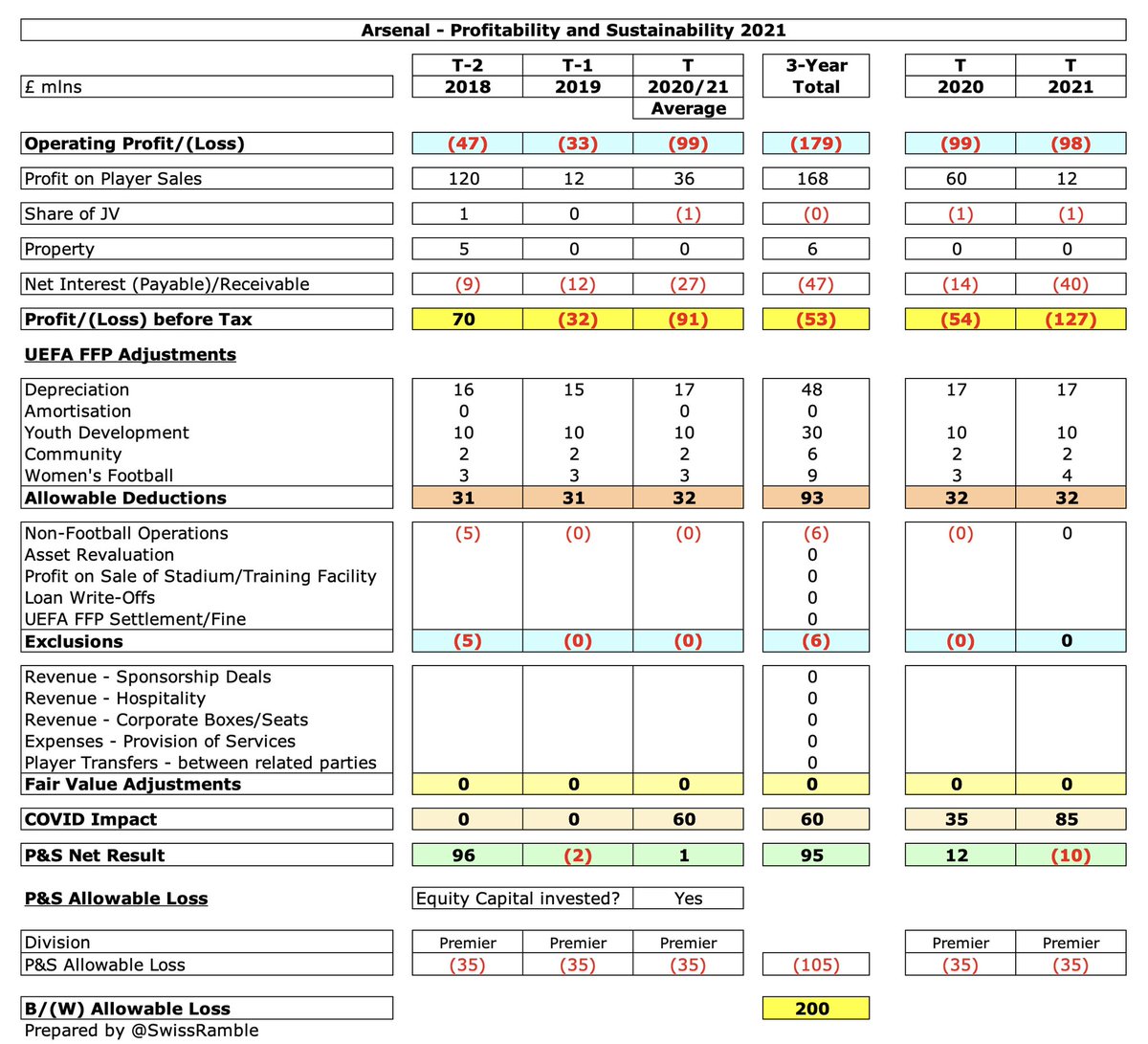

On the face of it, things don’t look too good for #AFC, as their pre-tax loss in the last 3 years was £213m, including a shocking £127m in 2020/21. This huge loss was obviously adversely impacted by COVID, but it was still the 3rd highest loss in the Premier League in this period

However, it is worth noting that the Premier League has relaxed the regulations to neutralise the adverse impact of COVID, so the 2022 monitoring period assessed the seasons 2019/20 and 2020/21 as a single (average) period.

This is important, as it allowed #AFC to include £70m profit from 2017/18. On this basis, #AFC pre-tax loss over the adjusted 3-year monitoring period up to 2020/21 (the last published accounts) was “only” £53m, which was £52m better than the P&S maximum allowable loss of £105m.

In addition, #AFC can make a £93m adjustment for “healthy” expenditure (depreciation £48m, youth development £30m, women’s football £9m and community £6m), giving a P&S profit of £41m, i.e. £146m better than the £105m allowable loss.

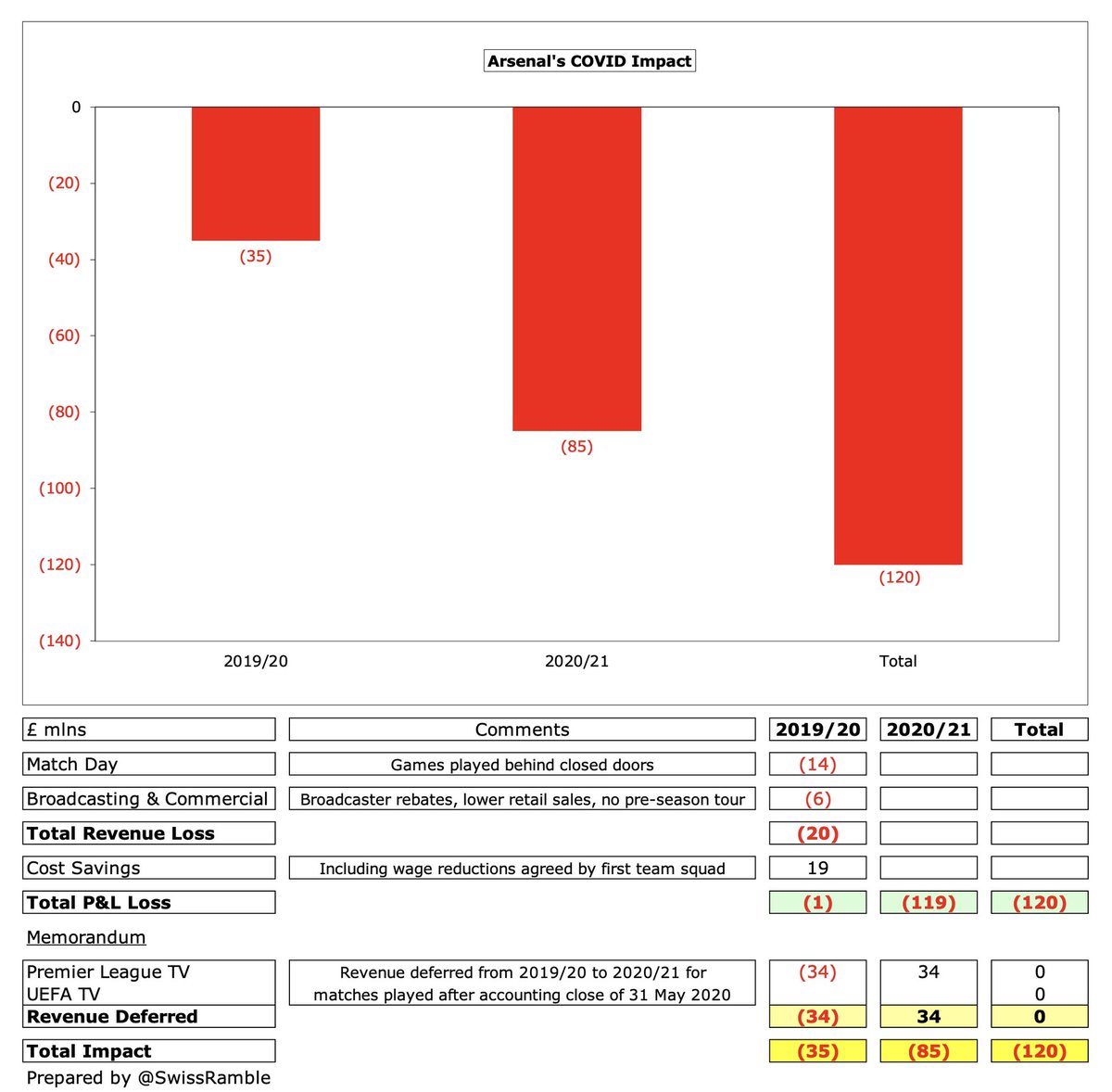

#AFC can also adjust for the adverse COVID impact. Per the accounts, this was £35m in 2019/20 and £85m in 2020/21, adding up to £120m (averaged as £60m over the last 2 years). Due to their high match day income, the Gunners were one of the clubs most severely hit by the pandemic.

Therefore, #AFC £53m pre-tax loss over the 3-year monitoring period was improved by £93m allowable deductions and £60m COVID impact (reduced by £6m property income) to give £95m adjusted P&S profit. This was £200m better than the £105m permitted loss, a comfortable buffer.

That’s all well and good, but that was obviously in the past, so we now need to consider the impact of #AFC expenditure since the 2020/21 accounts closed on 31st May 2021, i.e. covering the last 3 transfer windows: Summer 2021, January 2022 and Summer 2022 (to date).

There is a sizeable caveat here, as amounts spent on transfer fees and wages are not public record in England. This means that the numbers used in this analysis will not be 100% correct, but they should be sufficiently accurate to illustrate the financial impact of the changes.

Furthermore, as #AFC have a huge amount of player loan activity, I have kept the analysis simple, by only including these when a loan fee is received. To be clear, this is a high-level assessment of whether Arsenal are in line with FFP; it is not intended to be a perfect forecast

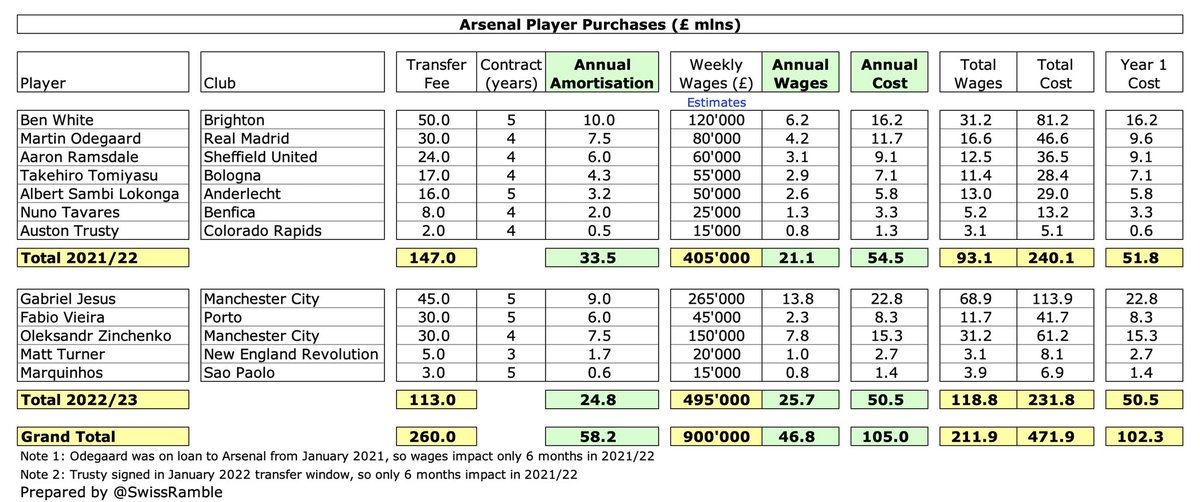

#AFC have spent £113m this summer to bring in Gabriel Jesus, Fabio Vieira, Oleksandr Zinchenko, Matt Turner and Marquinhos, while 2021/22 included £147m on Ben White, Martin Odegaard, Aaron Ramsdale, Takehiro Tomiyasu, Albert Sambi Lokonga, Nuno Tavares and Auston Trusty.

The impact on #AFC profit and loss account will be driven by two factors: (a) wages of the new purchases, which I have estimated at £47m for the last 2 years; (b) player amortisation, the annual cost of writing-off transfer fees, which is £58m. This adds up to annual £105m cost.

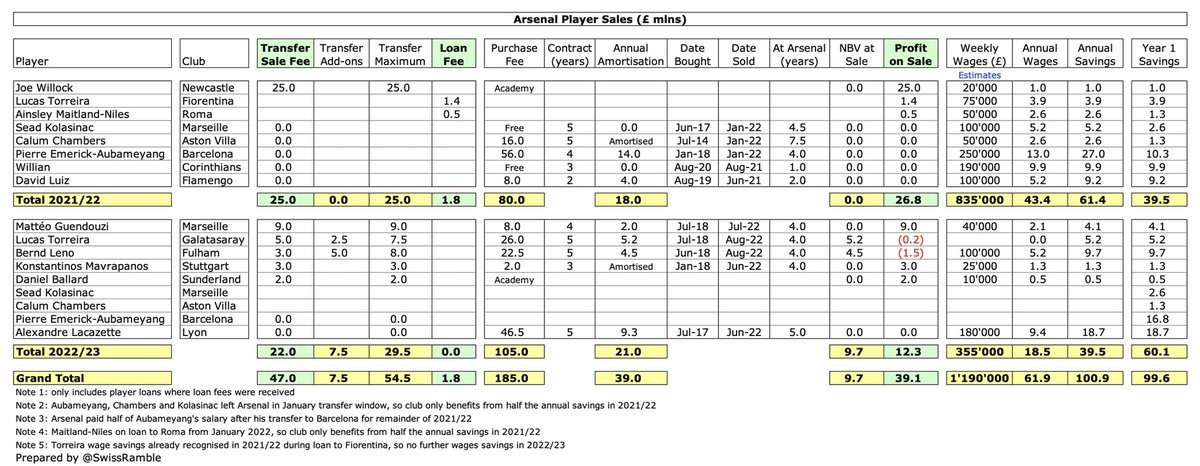

Against that, #AFC have sold players for £47m in last 2 years, including Joe Willock, Matteo Guendouzi, Lucas Torreira; Bernd Leno and Mavrapanos plus £2m loan fees. Has produced £39m profit, as most were fully amortised, though small accounting losses on Leno and Torreira.

In addition, #AFC benefit from reducing wage bill and player amortisation for those exits, even when no transfer fee received, e.g. Aubameyang, Lacazette, Willian, Kolasinac, Chambers & Luiz. Estimated annual savings are £62m wages and £39m player amortisation, so £101m in total.

Although it might be somewhat galling to see #AFC move on players for small transfer fees (or even on a free), the significant amount of money saved in wages and player amortisation is really important for the club, especially when considering FFP, which is assessed on the P&L.

At this point, I should probably explain how player trading is reported in a club’s accounts. The key point here is that when a player is purchased the cost is spread over a few years, but any profit made from selling a player is immediately booked to the accounts.

Transfer fees are not fully expensed when a player is purchased, but are written-off evenly over the length of the contract via player amortisation. So if a player is purchased for £30m on a 5-year contract, the annual amortisation would be £6m, i.e. £30m divided by 5 years.

However, if the player bought for £30m were sold for £50m after 3 years, the accounting profit would actually be £38m, i.e. £50m sales proceeds less £12m value (after reducing £30m cost by £18m amortisation). Some might think this is a form of cheating, but it’s just accounting.

As far as I can see, #AFC do not greatly benefit in the next two years from players in the current squad becoming fully amortised. As an example, Granit Xhaka was signed on a 5-year contract back in 2016, but his contract has been extended to 2024, so no immediate reduction.

So the net result of #AFC transfer activity in last 2 years is a small £3m cost increase in accounts, with player purchases growing the cost base by £103m, mitigated by £100m reduction from sales. This will be more than offset by £39m profit on player sales (including loan fees).

That said, #AFC need to manage their player trading well, as they now regularly post operating losses, as high as £91m in 2020/21. Although it is true that most football clubs lose money at an operating level, Arsenal’s loss was one of the worst in the top flight.

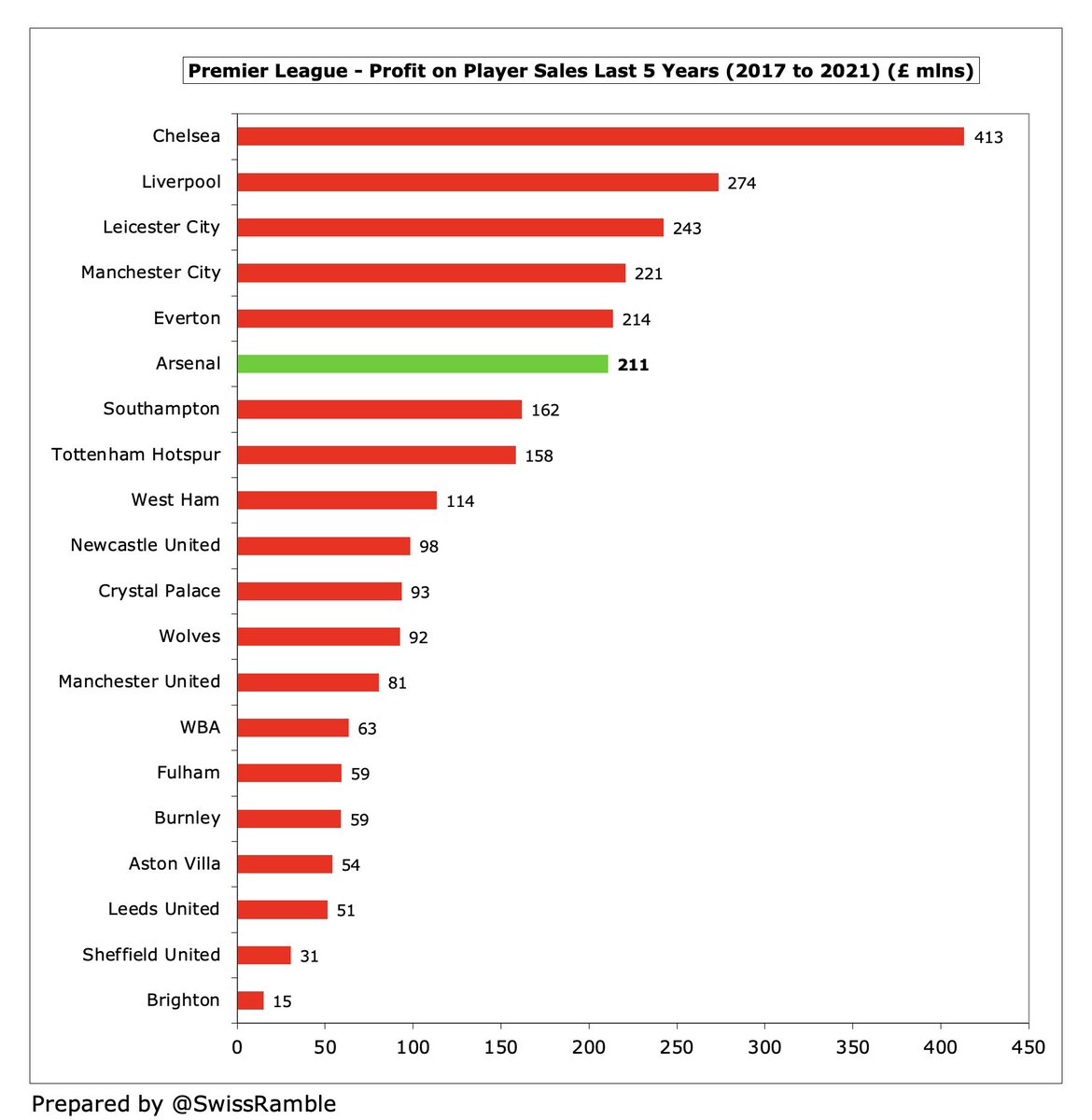

#AFC have partly offset operating losses with profits from player sales, amounting to £211m in the last 5 years. This is not too shabby, but only around half #CFC £413m. Also included 3 years of low profits, boosted by £120m in 2018 (Walcott, Giroud, Coquelin, Sanchez & The Ox).

#AFC revenue has fallen £95m (23%) from the £423m peak in 2017 to £328m in 2021, though this is almost entirely due to the COVID-driven £96m reduction in match day. In the same period, their rivals have powered ahead (except #MUFC), including being overtaken by #THFC.

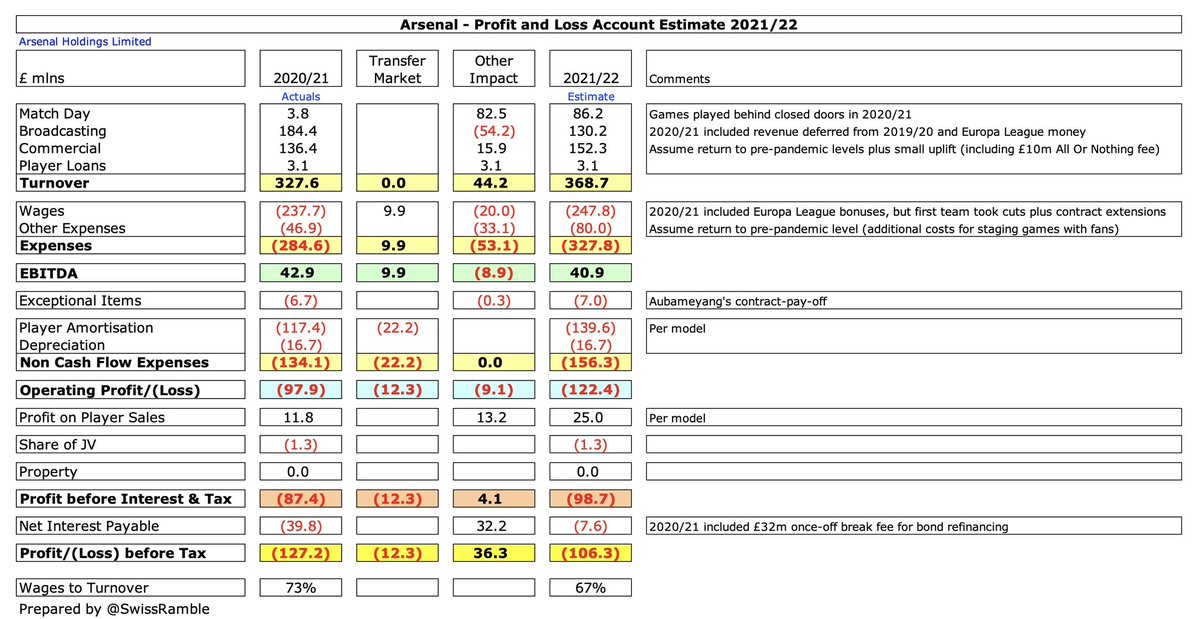

Although it’s a bit of a mug’s game, let’s now try to estimate #AFC profit and loss account for the next two years, so we can see whether their recent transfer spending is likely to cause any issues from a financial fair play perspective. The usual health warnings apply.

Based on the average £3.7m a game that #AFC earned in the 2019/20 season (for games played with fans), we can estimate £86m match day revenue for 2021/22, i.e. 23 games x £3.7m. The 2022/23 season will be boosted by return to Europe plus a 4% ticket price rise, so £109m income.

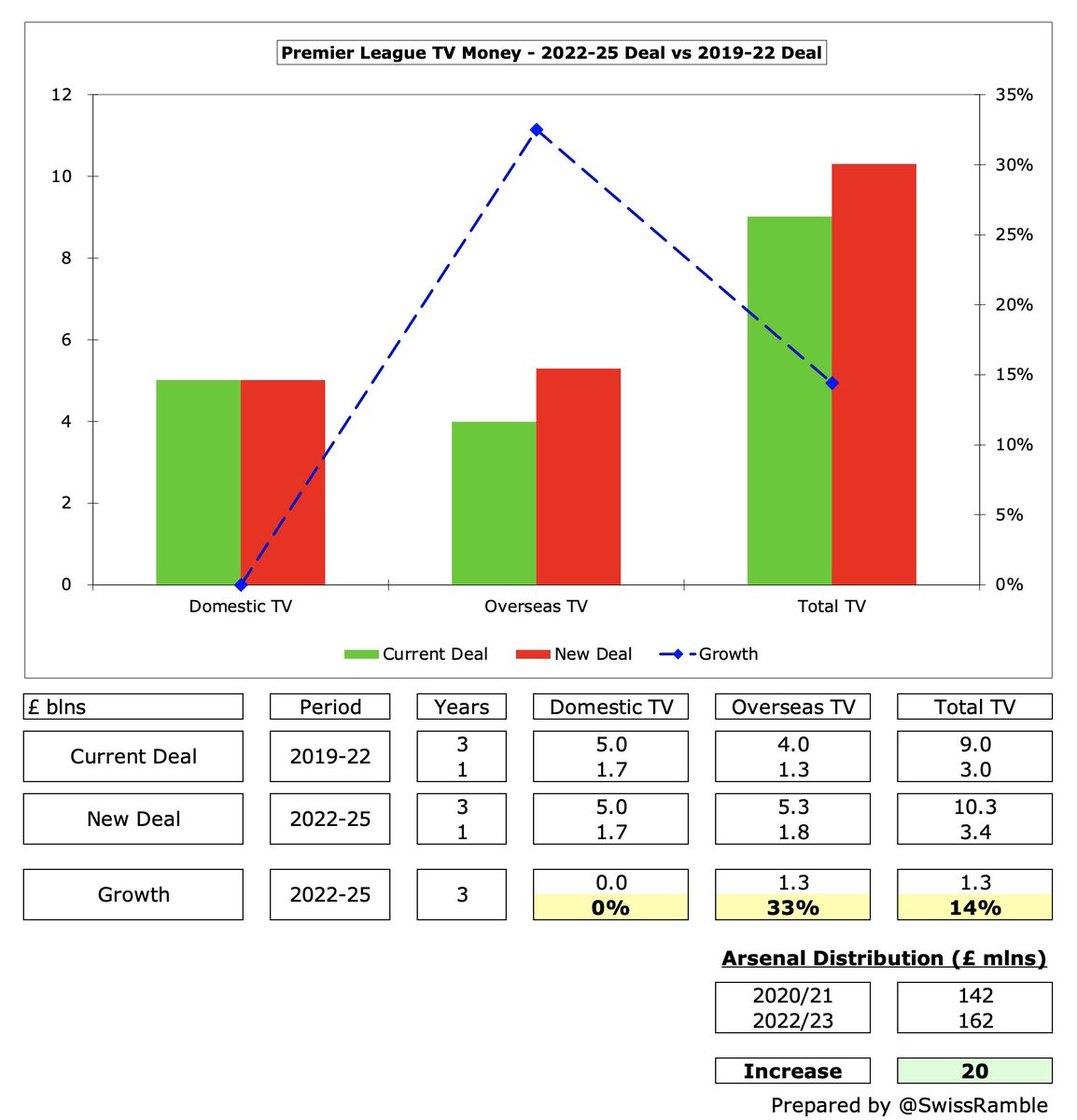

#AFC broadcasting income shot up to £184m in 2021, but this was inflated by two factors: (a) revenue for games played after the 2019/20 accounting close was deferred to the 2020/21 accounts; (b) prize money for reaching the Europa League semi-finals.

Because of the extended 2019/20 season (COVID delays), #AFC played 10 Premier League games after their 31st May accounting close, which meant £34m revenue deferred into 2020/21 accounts. This was one of the highest in the PL, as most other clubs have June or July year-ends.

#AFC earned £26m (€30m) for reaching the Europa League semi-finals in 2020/21, but they did not qualify for Europe in 2021/22. They are back in the Europa League this season, so we could estimate a similar sum of £27m.

Reducing the 2020/21 broadcasting income for £34m deferred revenue and no money from Europe, but adding £6m merit payment for better finish in the Premier League (5th vs. 8th) gives an estimate of £130m for 2021/22.

Assuming a similar performance in 2022/23, but adding £20m for the new Premier League TV deal, which is up by 14% (domestic deals flat, but overseas deals up 33%) plus an estimated £27m from the Europa League would give £177m broadcasting revenue.

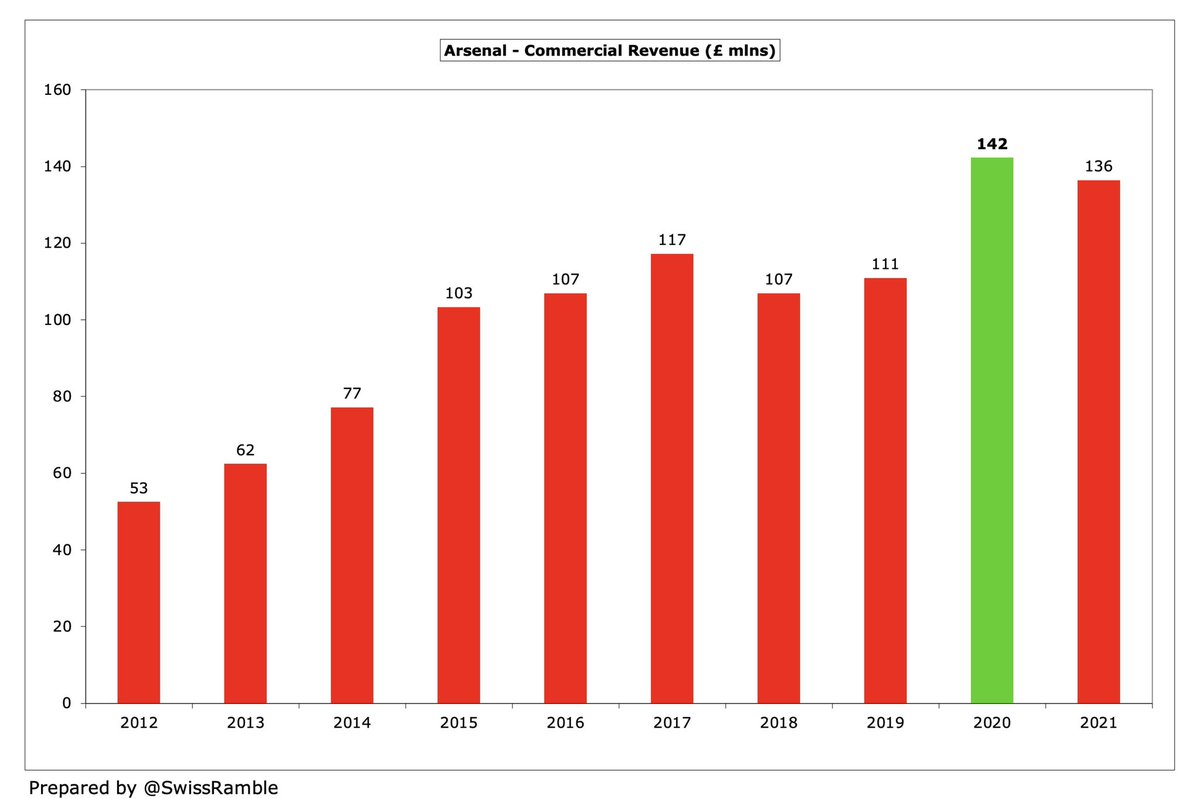

Despite rising by £84m since 2012, #AFC commercial growth in the last 10 years is the lowest of the Big Six, so their £136m in 2021 was far behind the top 3, especially #MCFC £272m, and is actually below #THFC £152m.

#AFC main commercial deals run to 2024: Adidas kit supplier £60m and Emirates shirt sponsorship £40m (including stadium naming rights). For the forecast, we have assumed commercial income returns to pre-pandemic level of £142m plus £10m for the “All Or Nothing” documentary.

#AFC wages have increased by £45m (24%) since 2015, but this growth is far smaller than their rivals, so they are now miles below the top four, despite Josh Kroenke observing that the club had “a Champions League wage bill on a Europa League budget”.

For the 2021/22 forecast I have incorporated the modelled £10m decrease for transfer ins/outs, exacerbated for no European qualification, but have included some growth, due to the first team squad taking cuts in 2020/21 for COVID plus contract improvements for younger players.

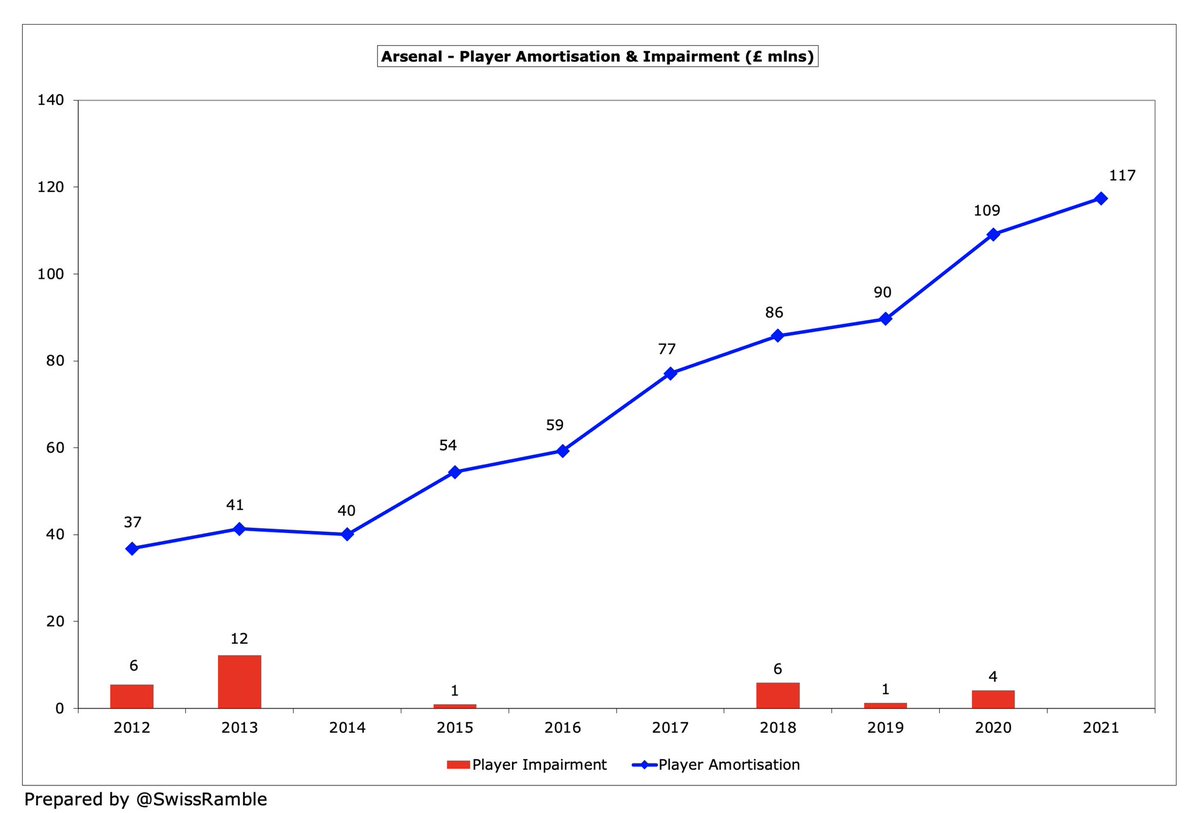

#AFC player amortisation has doubled in the last 5 years from £59m in 2016 to £117m in 2021 and is now 4th highest in the Premier League, though a long way below big-spending #CFC £162m. The forecast for 2021/22 is a £22m increase to £140m, though should slightly fall in 2022/23.

#AFC booked £7m exceptional items in 2020/21 for staff restructuring. I have assumed no repeat in 2021/22, though there was reportedly a £7m pay-off to Aubameyang to terminate his contract and facilitate his move to Barcelona.

#AFC £40m net interest payable in 2020/21 included a £32m break fee arising from debt refinancing, i.e. the early redemption of bonds, replaced by a loan from Kroenke. This was a once-off payment, which will reduce interest charges going forward.

Putting all these estimates together would give £106m pre-tax loss for #AFC in 2021/22, as higher revenue following the return of fans to the stadium is offset by higher expenses. The loss is however lower than 2020/21, due to more profit on player sales and much lower interest.

That would imply a P&S adjusted loss of £74m over the 3-year monitoring period, so £31m better than the allowed £105m loss. The 2017/18 P&S profit of £96m will be dropped, replaced by the estimated 2021/22 £74m loss, which would have a significant, but not fatal, impact on FFP.

The assumed transfer spend this summer, offset by player departures (especially Aubameyang and Lacazette), implies a smaller £55m loss for #AFC in 2022/23. Revenue will be boosted by return to Europe, new Premier League TV deal and 4% price increase on season tickets.

Even with the forecast losses, #AFC should just about be OK under the Premier League P&S rules, though the margin of safety would fall to only £10m. Arsenal clearly have to box clever to meet FFP targets, but it looks like they have managed to do so (based on these assumptions).

That said, UEFA’s FFP rules are stricter than the Premier League with the allowable losses (“acceptable deviation”) over 3 years being only €30m (including €25m equity contribution), though this will increase to €90m from 2024 (i.e. including 2022/23 as the 3rd year).

UEFA have also introduced squad cost control via a new ratio of player wages, transfers & agent fees that is limited to 70% of revenue & profit on player sales, though there will be a gradual implementation over 3 seasons (90% in 2023/24, 80% in 2024/25 and 70% from 2025/26).

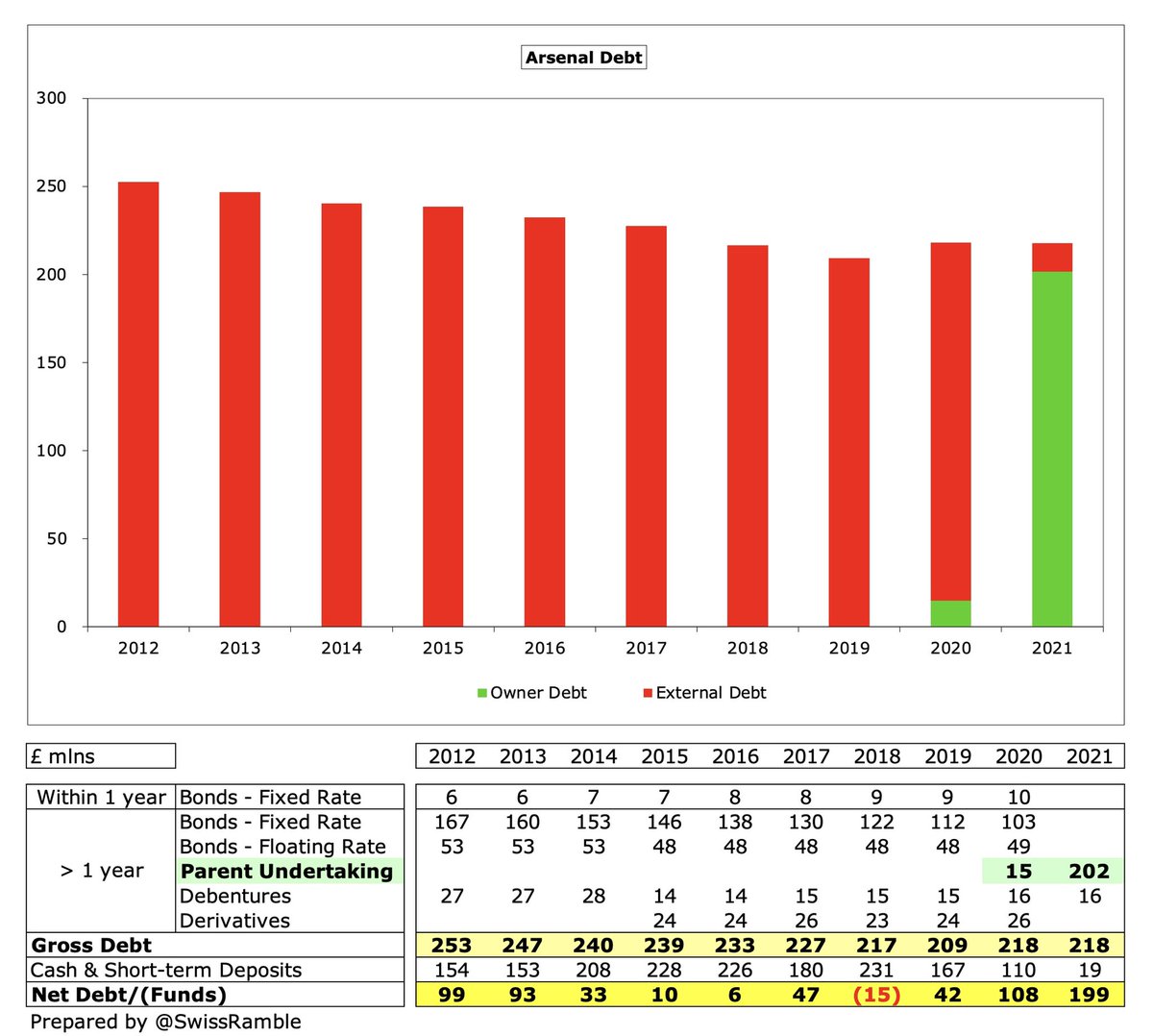

Even if #AFC are fine for FFP, the question remains how they have funded the player purchases, despite revenue falling due to the impact of COVID and not playing in Europe. The club has managed to do this in a number of ways, basically debt and using cash balance.

#AFC gross debt was unchanged in 2021 at £218m, though bonds were redeemed and replaced by a loan from Stan Kroenke, meaning lower interest payments and freeing up a £27m debt service reserve. Club also took out a cheap £120m COVID Bank of England loan, but this has been repaid.

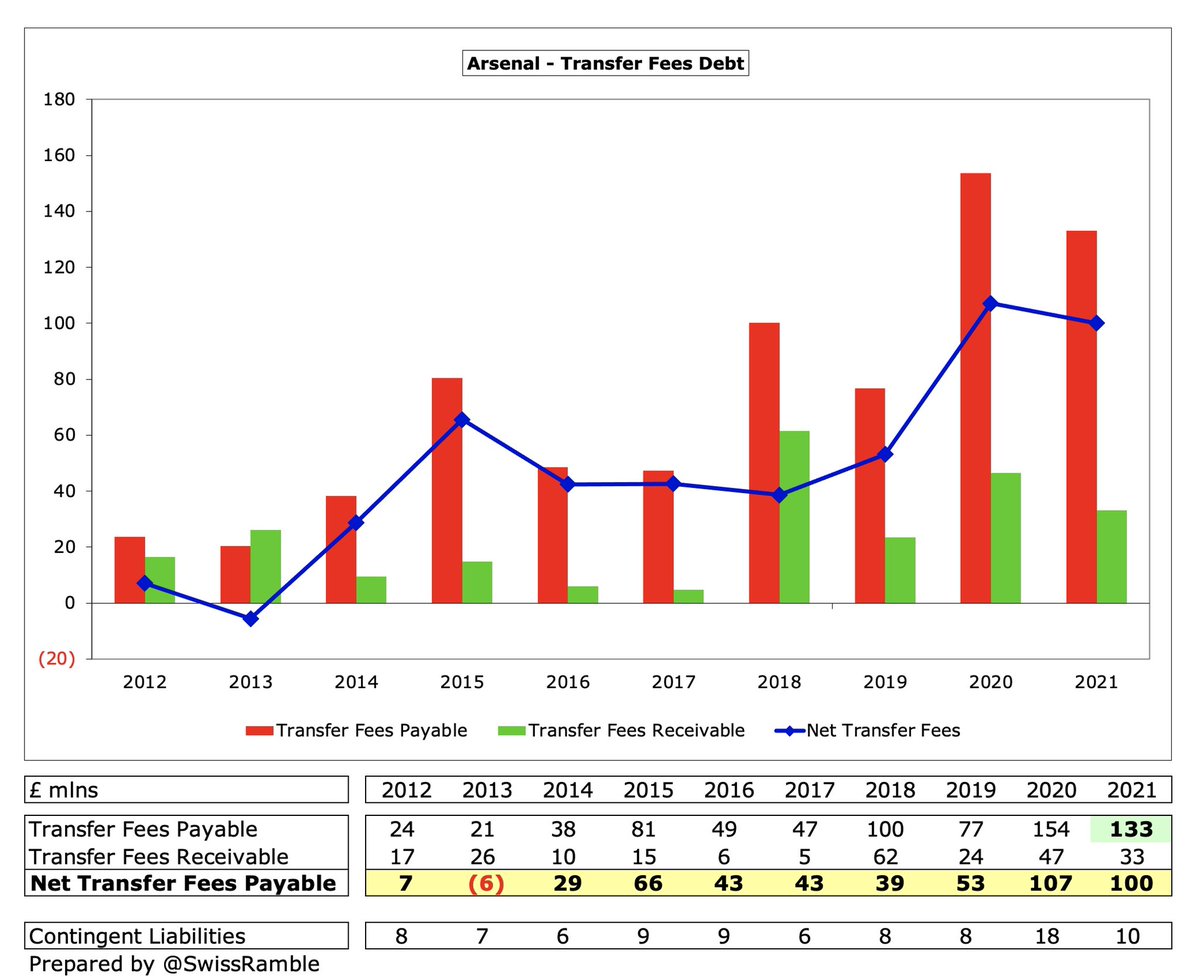

Like most clubs, #AFC also fund player purchases by higher transfer debt, as the fee is almost always paid in instalments. This reduced from £154m to £133m in 2020/21, but it would be no surprise to see an increase in the next accounts.

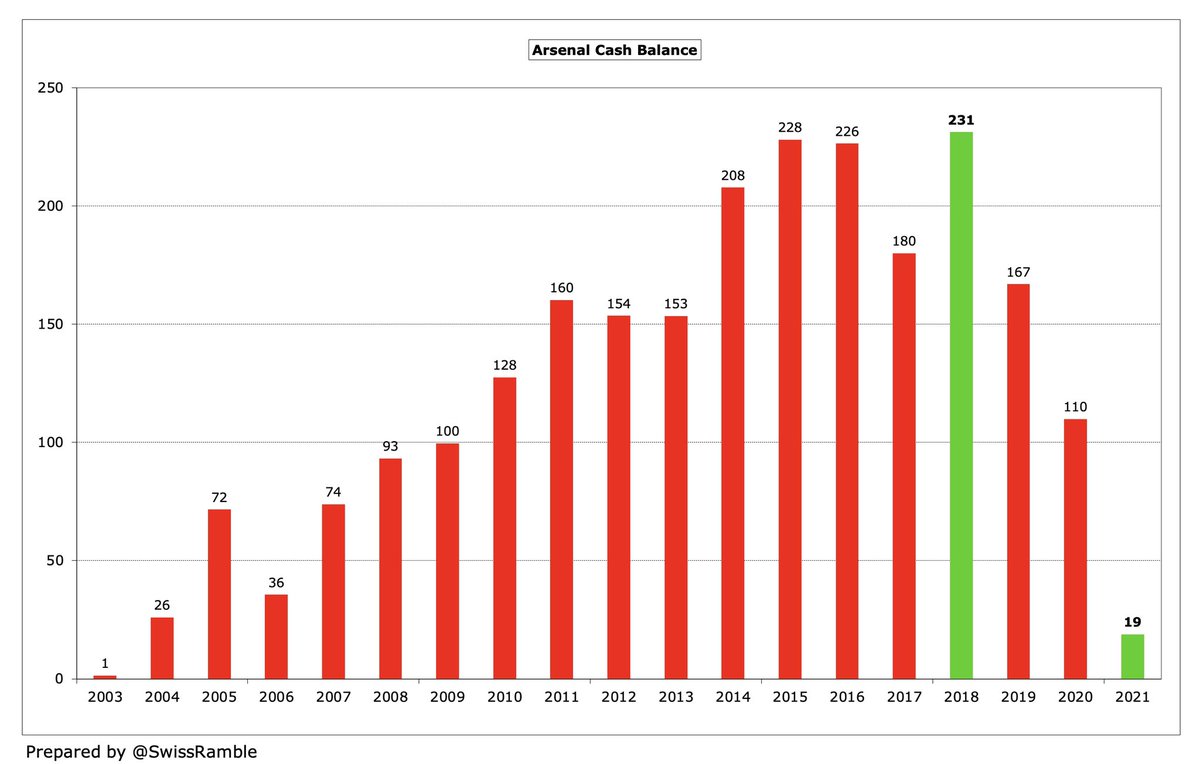

#AFC have also needed to eat into their cash balance, which has fallen significantly from the £231m peak in 2018 to only £19m in 2021, though this was impacted by COVID and delayed season ticket renewals. Now firmly in the bottom half of the Premier League.

#AFC have had to show some fancy footwork off the pitch to remain competitive during their extended Champions League absence, especially after being hit particularly hard by COVID, but they would appear to have just about managed to do so while still complying with FFP rules.

• • •

Missing some Tweet in this thread? You can try to

force a refresh