1/ Maker's mission is to create an Unbiased World Currency.

How?

MakerDAO has an Endgame Plan for it 🧵

How?

MakerDAO has an Endgame Plan for it 🧵

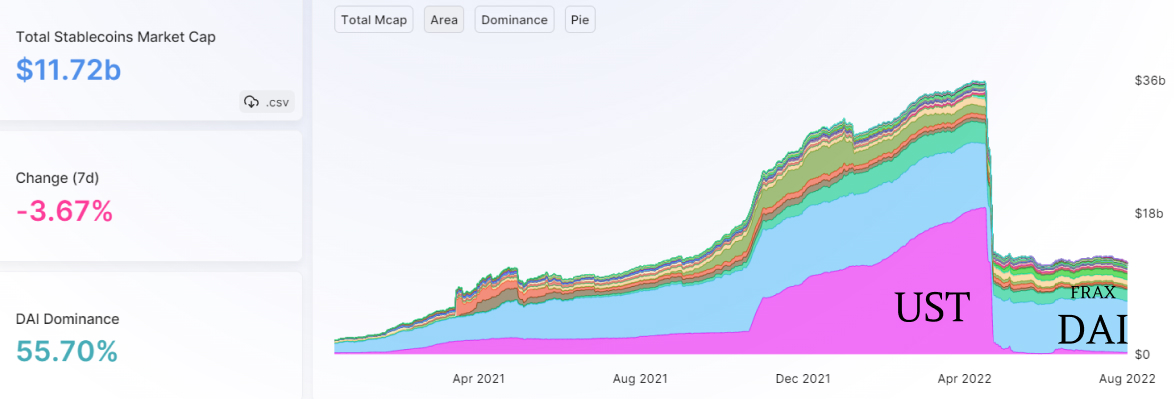

2/ Maker's DAI is the largest #DeFi stablecoin by the market cap and 13th largest token overall.

Yet $DAI's $6.5B MC pales in comparison to $USDT's $67.5B.

So, how can it scale and eventually overtake centralized stablecoins?

Yet $DAI's $6.5B MC pales in comparison to $USDT's $67.5B.

So, how can it scale and eventually overtake centralized stablecoins?

3/ Currently DAI is >50% backed by $USDC which poses centralization risks.

But @RuneKek's Endgame Plan attempts to make $Dai as #bitcoin-like as possible:

• Decentralized

• Intrinsically resilient and,

• Where the scope and complexity of the core system stops changing.

But @RuneKek's Endgame Plan attempts to make $Dai as #bitcoin-like as possible:

• Decentralized

• Intrinsically resilient and,

• Where the scope and complexity of the core system stops changing.

4/ First, Maker needs to reduce the complexity of how it is governed by creating self-sustainable DAOs called MetaDAOs.

One can think of Maker Core as L1 Ethereum: slow and expensive, but secure.

While MetaDAOs are L2 solutions: fast & nimble, that get security from the L1.

One can think of Maker Core as L1 Ethereum: slow and expensive, but secure.

While MetaDAOs are L2 solutions: fast & nimble, that get security from the L1.

5/ Each MetaDAO has a specific task at hand.

For example, Real World Asset DAO can develop specialized governance dynamics to allow them to overcome barriers that Maker got stuck in.

It's like Google's Alphabet, where Maker Core is Google and MetaDAOs are the “Alpha Bets”

For example, Real World Asset DAO can develop specialized governance dynamics to allow them to overcome barriers that Maker got stuck in.

It's like Google's Alphabet, where Maker Core is Google and MetaDAOs are the “Alpha Bets”

6/ Each MetaDAO will have a token (MDAO) launched via yield farming.

2B MDAO tokens will be farmed in 10 years with declining issuance rate:

• 20% to DAI holders

• 40% to delegated MKR holders, increasing vote participation

• 40% to synthetic $ETH (ETHD) vault debt holders

2B MDAO tokens will be farmed in 10 years with declining issuance rate:

• 20% to DAI holders

• 40% to delegated MKR holders, increasing vote participation

• 40% to synthetic $ETH (ETHD) vault debt holders

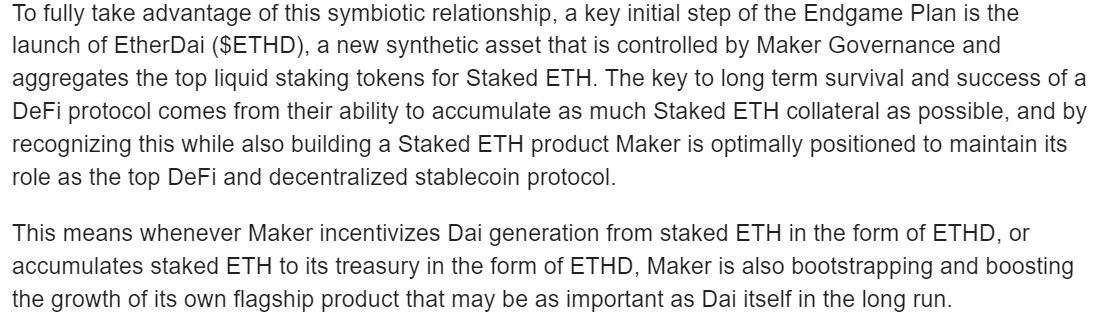

7/ EtherDai $ETHD is backed by liquid staking tokens, such as Lido's $stETH, and will be used as collateral for DAI.

Why $ETH?

It's 'one of the only pieces of global financial infrastructure that can survive large scale global instability and economic crisis.'

#ETH 🚀

Why $ETH?

It's 'one of the only pieces of global financial infrastructure that can survive large scale global instability and economic crisis.'

#ETH 🚀

8/ To become the Unbiased World Currency, Maker is willing to drop $DAI's dollar peg.

Yep, this means, $DAI will free float away from 1:1 USD by gradually changing its price over time according to the Target Rate.

Yep, this means, $DAI will free float away from 1:1 USD by gradually changing its price over time according to the Target Rate.

9/ The positive TR increases demand for Dai and reduces supply of Dai.

While a negative TR has the opposite effect: It reduces demand for Dai, and increases supply.

This should make DAI stable without the need of a 1:1 dollar peg.

While a negative TR has the opposite effect: It reduces demand for Dai, and increases supply.

This should make DAI stable without the need of a 1:1 dollar peg.

10/ Why?

The Endgame Plan assumes eventual regulatory crackdown on RWA collateral, which includes $USDC.

So it prioritizes resilience against physical attacks over maintaining the 1:1 USD peg.

The Endgame Plan assumes eventual regulatory crackdown on RWA collateral, which includes $USDC.

So it prioritizes resilience against physical attacks over maintaining the 1:1 USD peg.

11/ $DAI is currently used as a decentralized alternative to $USDC or $USDT.

Thus here is a real possibility, @RuneKek assumes, that as many as 50% of the protocol users will leave in a short period of time after free floating is first activated.

Thus here is a real possibility, @RuneKek assumes, that as many as 50% of the protocol users will leave in a short period of time after free floating is first activated.

12/ Rune also proposes a Protocol Owned Vault mechanism, similar to $FEI's Protocol Control Value.

The POV is a Maker Vault only usable by Maker Governance that holds ETHD and potentially other decentralized assets as collateral, and then uses it to generate & stabilize Dai.

The POV is a Maker Vault only usable by Maker Governance that holds ETHD and potentially other decentralized assets as collateral, and then uses it to generate & stabilize Dai.

13/ The Endgame Plan also aims to diversify collateral that includes:

• Decentralizes assets: $ETH, $UNI, $MKR etc.

• RWA: centralized stablecoins, renewable energy projects, cross-chain bridge tokens or Physically Resilient RWA...

• Decentralizes assets: $ETH, $UNI, $MKR etc.

• RWA: centralized stablecoins, renewable energy projects, cross-chain bridge tokens or Physically Resilient RWA...

14/ For example, a Physically Resilient RWAs are like renewable powered drone ships that can be disabled and re-enabled through on-chain governance and operate long term in international waters😎

15/ The Endgame Plan assumes a possibility that there will be a significant deterioration of regulatory security alongside a global economic and social decline.

To adapt, survive and recover Maker will have 3 'stances'.

To adapt, survive and recover Maker will have 3 'stances'.

16/ Pigeon Stance where there is no limit to RWA exposure and Dai remains pegged 1:1 with USD.

As Pigeons are not afraid of humans, Maker can tolerate minimal regulatory threats to generate as much income from RWAs as possible.

Pigeon Stance lasts 2.5 years.

As Pigeons are not afraid of humans, Maker can tolerate minimal regulatory threats to generate as much income from RWAs as possible.

Pigeon Stance lasts 2.5 years.

17/ Eagle Stance - Dai becomes free floating with a negative Target Rate.

Stance guarantees that Maker’s exposure to seizable RWA is limited to 25%.

To achieve this Dai can be unpegged from the dollar if necessary.

Stance guarantees that Maker’s exposure to seizable RWA is limited to 25%.

To achieve this Dai can be unpegged from the dollar if necessary.

18/ Phoenix Stance where Dai no longer allows any RWA other than Physically Resilient RWAs.

It's the maximum resilience form, where Maker no longer allows easily seizable RWA as collateral.

It's the maximum resilience form, where Maker no longer allows easily seizable RWA as collateral.

19/ The Endgame Plan roadmap is broken into 4 major phases.

Pregame will launch within 12 months to build ETHD, launch 6 MetaDAOs, starts liquidity mining etc.

Yet the Endgame will not launch until 2030 or later.

Pregame will launch within 12 months to build ETHD, launch 6 MetaDAOs, starts liquidity mining etc.

Yet the Endgame will not launch until 2030 or later.

20/ If you want to learn more, check @RuneKek posts on Maker Forum.

forum.makerdao.com/t/endgame-plan…

forum.makerdao.com/t/endgame-plan…

There's so much more to add here, so I wonder what important points I might have missed

@DooWanNam @GArentoft @Mariandipietra @SebVentures @ChrisBlec @joce_chang

@DooWanNam @GArentoft @Mariandipietra @SebVentures @ChrisBlec @joce_chang

• • •

Missing some Tweet in this thread? You can try to

force a refresh