There is a lot of talking around #Footprint #charts in #cryptotwitter lately. Many people smash them on their templates without even knowing the basics of #DOM reading, making many mistakes when interpreting them. This thread will get you covered 🧵👇

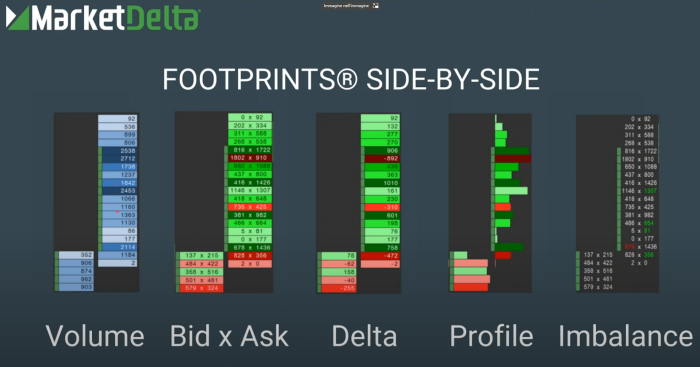

#Footprint candlesticks were first introduced to the public by Market Delta back in 2003. The most famous one is the Bid x Ask split view and most traders' first approach with Footprints is with this kind of visualisation, which is helpful on thick, liquid markets, like bonds.

One of the most common mistakes that inexperienced traders make is comparing orders that hit the Bid (left side) with those that lift the offer (right side) horizontally.

The interaction among market participants always happens diagonally from the Bid to the Ask.

The interaction among market participants always happens diagonally from the Bid to the Ask.

When aggressive market participants -those who execute market orders- overcome passive participants -those who provide liquidity by placing limit orders- the traded instrument makes an uptick, or a downtick, according to which side prevails (Bid vs Ask)

Therefore the executed orders that we read on the Bid x Ask candlesticks must be read diagonally, following the pattern shown in the attached image, as we would do with the DOM shown on the upper post.

Without even using Footprints, The DOM can be used as a standalone tool for scalping. DOM trading is based on pattern recognition, but it requires fluidity and deep focus since there are no identical situations. For this reason, DOM learning must be standalone in the first phase.

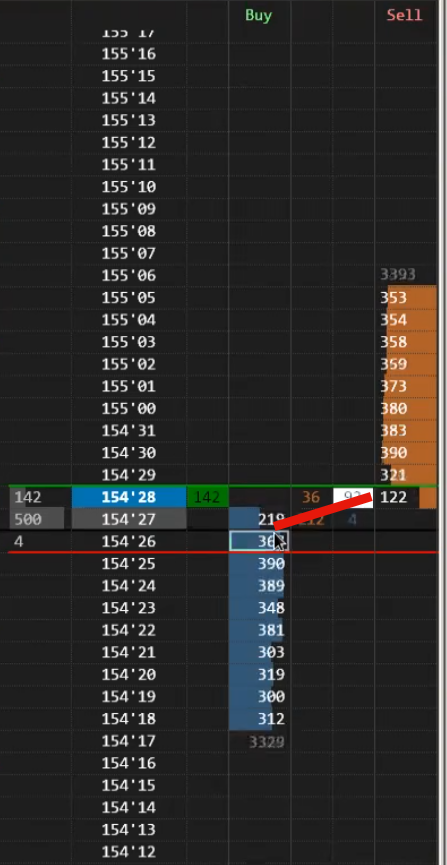

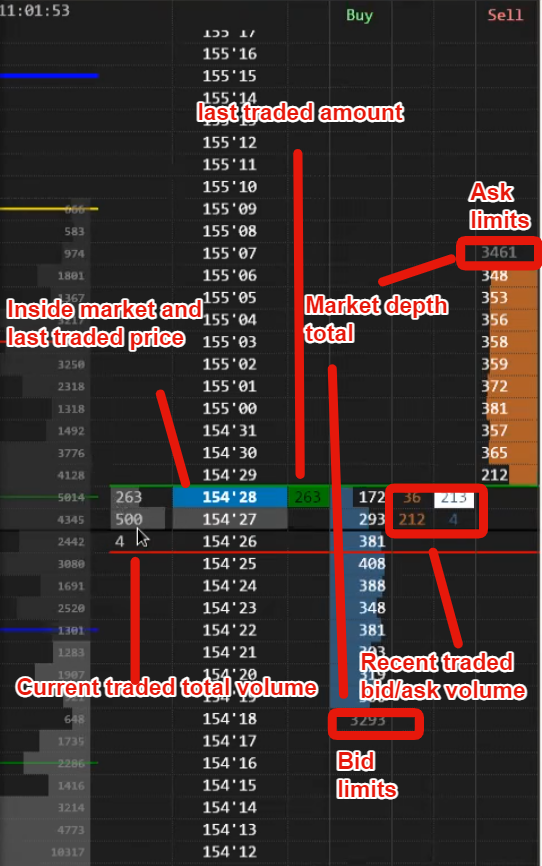

Let's see now some basic DOM terms:

Last traded price: Last executed trade at the bid OR the ask.

Full quoted price: The full current quote is the current bid, the current ask and the last traded price. It’s also called the “Inside market.”

Last traded price: Last executed trade at the bid OR the ask.

Full quoted price: The full current quote is the current bid, the current ask and the last traded price. It’s also called the “Inside market.”

Market depth total number: Total number of resting bid/ask at the displayed market depth.

Last traded amount: It shows the last traded number of contracts at the last traded price.

Last traded amount: It shows the last traded number of contracts at the last traded price.

Market depth total: total number of resting contracts in the visualised market depth. It tells how active a market is, and it can be used to gauge which is the dominant side. When the liquidity status of the market is good, it tends to have a constant value.

Recent traded bid/ask volume: market orders executed at the bid/ask. Their value reset each time the price revisits a certain price. These values build up the numbers you can see on a fully formed Bid x Ask split Footprint candlestick.

In case you missed it, I wrote a full-length article on my Medium page covering how to read and actively use Bid x Ask split Footprints: wire.insiderfinance.io/the-daytraders… thanks to @InsiderFinancex for publishing it!

But is the Bid x Ask split really the most useful way to use Footprints on illiquid markets like #crypto?

On this illustration by Market Delta, we can see that there are also the #Volume, #Delta and Profile Footprints. #Delta Footprints are particularly useful for spotting absorption events.

The original way to display #Delta Footprint was in a boxed style. Still, using a "Toothbrush" style view makes identifying absorption patterns -therefore resting liquidity- more straightforward.

This is particularly true on instruments like #BTC or the #NQ, where there is no need to use the Bid x Ask split, as you likely have to aggregate multiple price ticks to get a readable picture.

If you liked this #thread 🧵 and you'd like to see similar posts in the future, please consider retweeting the first post! And yes, there will soon be an article on Delta Footprints on my Medium Page. So, please consider following me there: medium.com/@L4z0r

Cool resources:

-DOM learning, Sierra Chart templates, FX and legacy Futures trading: @TicinoTrader

-Crypto education: @C2M_Killmex @Jeliaz_7 and the @KillmexTrading group; @tradingriot

-Prop funding: saviusllc.com/en/ref/29/?cam…

-DOM learning, Sierra Chart templates, FX and legacy Futures trading: @TicinoTrader

-Crypto education: @C2M_Killmex @Jeliaz_7 and the @KillmexTrading group; @tradingriot

-Prop funding: saviusllc.com/en/ref/29/?cam…

• • •

Missing some Tweet in this thread? You can try to

force a refresh