1 // #Bitcoin Bottom Signals 🚀🔥

In just a few months, #Bitcoin traded $70000 all the way down to $20000. A historical drawdawn, the right time to look at potential bottom signals

I'll move over several datapoints. The more you'll see, the more bottom-ish. Let's go 👇

In just a few months, #Bitcoin traded $70000 all the way down to $20000. A historical drawdawn, the right time to look at potential bottom signals

I'll move over several datapoints. The more you'll see, the more bottom-ish. Let's go 👇

1 // Exchange Reserve. Reserves are trending down 🟢

Less #Bitcoin on exchanges = Less potential selling pressure

Chart:

cryptoquant.com/asset/btc/char…

Less #Bitcoin on exchanges = Less potential selling pressure

Chart:

cryptoquant.com/asset/btc/char…

2 // Drawndown from ATH 🟠

Previous Bear Markets: at least 80%

Current Bear Market: 70%

Chart:

studio.glassnode.com/metrics?a=BTC&…

Previous Bear Markets: at least 80%

Current Bear Market: 70%

Chart:

studio.glassnode.com/metrics?a=BTC&…

3 // Net Unrealized Loss (NUL) 🟢

Unrealized Losses equal as COVID-19 Crash. Not as high as previous bear markets 😉

cryptoquant.com/asset/btc/char…

Unrealized Losses equal as COVID-19 Crash. Not as high as previous bear markets 😉

cryptoquant.com/asset/btc/char…

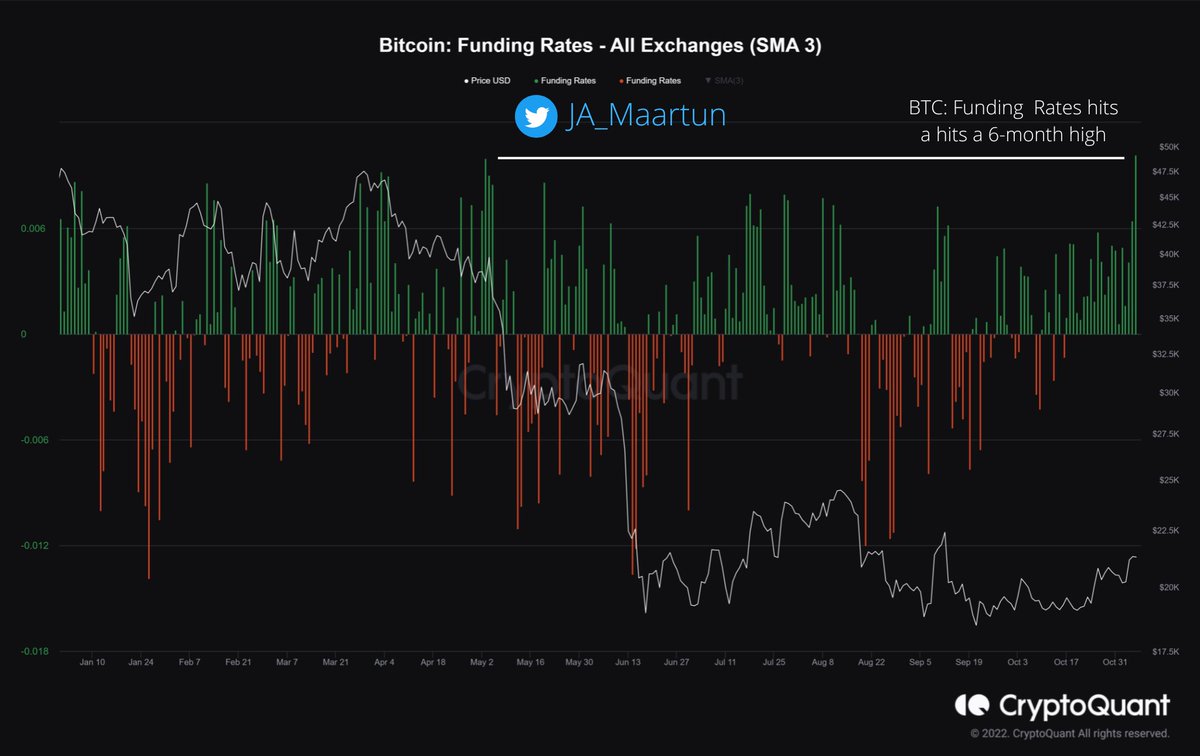

4 // Negative Funding Rates 🟢

Bitcoin likes to bottom on negative funding rates

Chart:

cryptoquant.com/asset/btc/char…

Bitcoin likes to bottom on negative funding rates

Chart:

cryptoquant.com/asset/btc/char…

5 // Net Unrealized Profit/Loss (NUPL) 🟢

Blue color (🔵) = Capitulation

Chart:

cryptoquant.com/asset/btc/char…

Blue color (🔵) = Capitulation

Chart:

cryptoquant.com/asset/btc/char…

6 // Bitcoin: UTXOs in Loss 🟢

Above previous bear market levels

Chart:

cryptoquant.com/asset/btc/char…

Above previous bear market levels

Chart:

cryptoquant.com/asset/btc/char…

7 // #Bitcoin MVRV Ratio is below 1 🟢

MVRV Ratio = Market Cap / Realized Cap

By comparing two valuation methods, the MVRV ratio can tell us to get a sense of whether the price is fair or not, which means it is useful to get market tops and bottoms.

MVRV Ratio = Market Cap / Realized Cap

By comparing two valuation methods, the MVRV ratio can tell us to get a sense of whether the price is fair or not, which means it is useful to get market tops and bottoms.

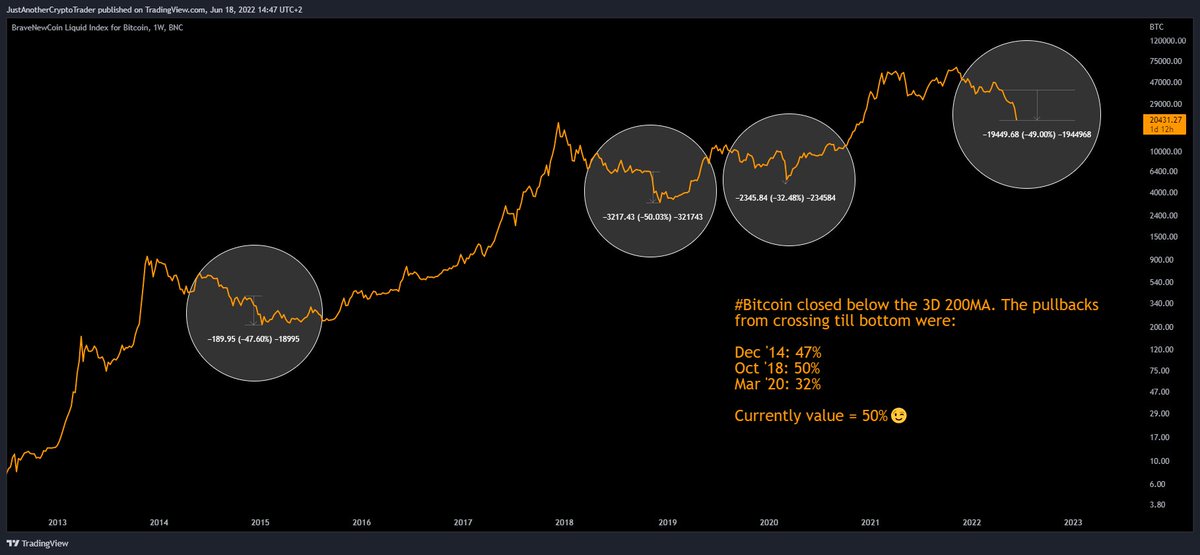

8 // Pullback from 3D 200MA 🟢

#Bitcoin closed below the 3D 200MA. The pullbacks

from crossing till bottom were:

Dec '14: 47%

Oct '18: 50%

Mar '20: 32%

Currently value = 50%😉

#Bitcoin closed below the 3D 200MA. The pullbacks

from crossing till bottom were:

Dec '14: 47%

Oct '18: 50%

Mar '20: 32%

Currently value = 50%😉

9 // 200 Weekly Moving Average 🟢

Historically, #Bitcoin hasn't spent much time below 200 WMA. Currently trading below it😉

Historically, #Bitcoin hasn't spent much time below 200 WMA. Currently trading below it😉

X / / And plenty more, but I had the feeling I should release this thread soon. It's not complete, but don't want to hold this information by meself. Make sure to use it!

15 // Bitcoin: Exchange Inflow (Mean, MA7)

1. $BTC drops hard over -30%

2. All Exchange Inflow Mean (MA7) spikes over 2.5 BTC

3. The indicator cools down

4. ALL-IN $BTC

cryptoquant.com/asset/btc/char…

1. $BTC drops hard over -30%

2. All Exchange Inflow Mean (MA7) spikes over 2.5 BTC

3. The indicator cools down

4. ALL-IN $BTC

cryptoquant.com/asset/btc/char…

16 // Thick white support clusters below price. #FireCharts could help

https://twitter.com/MI_Algos/status/1566232094598201348

17 // DonAlt buying 🫢

https://twitter.com/CryptoDonAlt/status/1592943507018113024?t=sMu5cqiJ4KtRkSxeddyMeg&s=19

18 // Time duration from ATH ⏰

https://twitter.com/JA_Maartun/status/1600060264430256128?t=UUqg1i-iBMkLxcmCI1NOTA&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh