Did you know - 1 lakh invested in Asian Paints, Bajaj Finance & HDFC Bank in 2009 would've been close to 13 Cr today. 💰

They have been consistently compounding.

Compounding is when money makes money & thus, makes more money!

They have been consistently compounding.

Compounding is when money makes money & thus, makes more money!

1⃣. Return on capital employed > Cost of equity

The excess of ROCE over COE means how much more profits a firm is generating than expected.

Look at companies generating ROCE > 10-15%

The excess of ROCE over COE means how much more profits a firm is generating than expected.

Look at companies generating ROCE > 10-15%

2⃣. High Revenue Growth

Revenue growth of more than 9-10% yearly for the past decade is a good indicator of a stable compounder.

Revenue growth of more than 9-10% yearly for the past decade is a good indicator of a stable compounder.

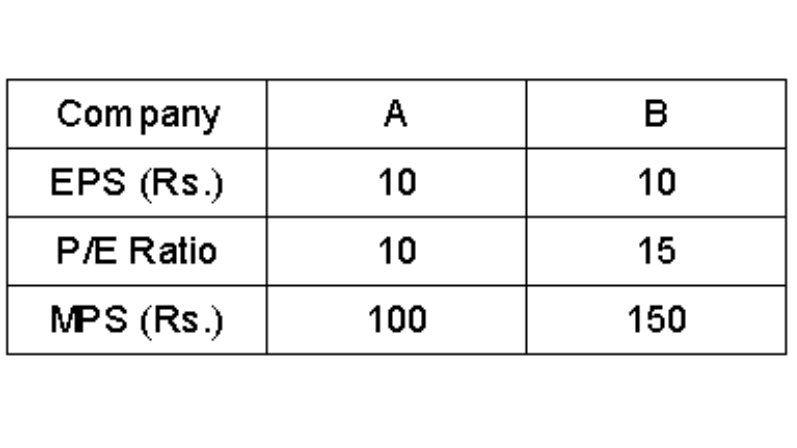

3⃣. Pricing Power

If a company's nearest peer's price cut affects the company, they might not be an ideal consistent compounder.

If a company's nearest peer's price cut affects the company, they might not be an ideal consistent compounder.

4⃣. Business Model

Analysis of the business model is of prime importance. Consistent compounders should have a tech-savvy, expansionary & consumer-centric model.

Analysis of the business model is of prime importance. Consistent compounders should have a tech-savvy, expansionary & consumer-centric model.

What's your way of finding stocks that can make you rich? Do comment below⤵️

Also, we have a detailed course on Value Investing which helps in stock picking - bit.ly/quest-value-in…

Also, we have a detailed course on Value Investing which helps in stock picking - bit.ly/quest-value-in…

• • •

Missing some Tweet in this thread? You can try to

force a refresh