1/ US Dollar is still king. 👑

Whole market currently at the mercy of the king.

DXY in parabolic uptrend. Once it breakes, #Bitcoin, #Gold and risk assets will rally, but it could squezze to 120 first for max pain.

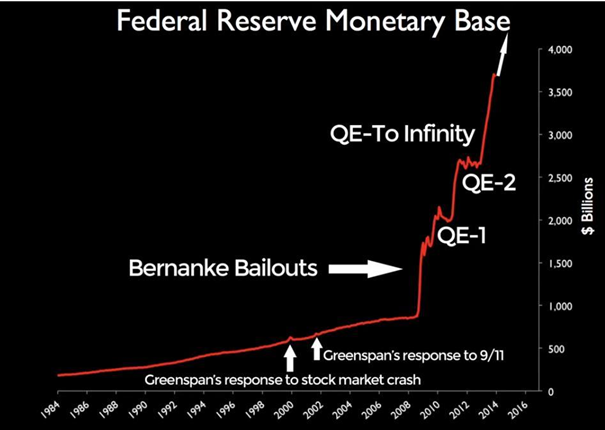

The FED might just go for it.

Whole market currently at the mercy of the king.

DXY in parabolic uptrend. Once it breakes, #Bitcoin, #Gold and risk assets will rally, but it could squezze to 120 first for max pain.

The FED might just go for it.

2/ In the short term DXY might dip to range low at around 107 before going higher. But not even sure if we get so low, next couple of days will clear it.

As long as we are above 104, it remains a trader market.

Be patient if you are looking for longterm entries.

As long as we are above 104, it remains a trader market.

Be patient if you are looking for longterm entries.

3/ US Yields have been ripping higher. As long as yields keep going up, all other asset classes will have a hard time.

US30Y sub 3% will be key, next resistance at 4%. If it goes higher, get ready for a lot of pain and stress in the financial system.

Wait for a clear reversal.

US30Y sub 3% will be key, next resistance at 4%. If it goes higher, get ready for a lot of pain and stress in the financial system.

Wait for a clear reversal.

4/ In stocks we have seen a very orderly sell off so far. No panic at all, just casualy grinding lower.

Critical point here. If we break down, I am pretty sure we will see new lows.

If we hold, the bottom might be in.

Leaning towards break down but I will follow price action.

Critical point here. If we break down, I am pretty sure we will see new lows.

If we hold, the bottom might be in.

Leaning towards break down but I will follow price action.

5/ SPX vs DXY and US30Y inverted.

As DXY and US30Y keep going higher, SPX will have a hard time.

But as mentioned before, its make or break now. Time to pay close attention to markets.

As DXY and US30Y keep going higher, SPX will have a hard time.

But as mentioned before, its make or break now. Time to pay close attention to markets.

6/ Max pain scenario for everyone might acutally be a dip in the dollar, a short lived run in risk assets to get everyone bullish and then rug the market.

Doubtful the market got so much power, but something to keep in mind.

Doubtful the market got so much power, but something to keep in mind.

https://twitter.com/WifeyAlpha/status/1568181871212695553

7/ #Bitcoin got pushed down by a strong dollar as well. Nothing to see here.

#Bitcoin might be in accumulation but be ready for another low if DXY keeps running. DXY at 120 = #Bitcoin at 10k or lower.

Whenn DXY eventuall reverses (and it will), #Bitcoin will fly.

#Bitcoin might be in accumulation but be ready for another low if DXY keeps running. DXY at 120 = #Bitcoin at 10k or lower.

Whenn DXY eventuall reverses (and it will), #Bitcoin will fly.

10/ To sum it up: all eyes on the dollar.

Currently it is a traders market. If you are looking to deploy some cash for longterm entries, keep track of the Dollar and the US30Y.

As long as they keep going up, be patient and wait for the right time to get greedy.

Currently it is a traders market. If you are looking to deploy some cash for longterm entries, keep track of the Dollar and the US30Y.

As long as they keep going up, be patient and wait for the right time to get greedy.

11/ Lets see what happens at next week FOMC meeting. Will send the Dollar either higher or in consolidation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh